- Taiwan

- /

- Semiconductors

- /

- TPEX:4923

Earnings Tell The Story For Force-MOS Technology Co., LTD. (GTSM:4923) As Its Stock Soars 27%

Despite an already strong run, Force-MOS Technology Co., LTD. (GTSM:4923) shares have been powering on, with a gain of 27% in the last thirty days. The last month tops off a massive increase of 184% in the last year.

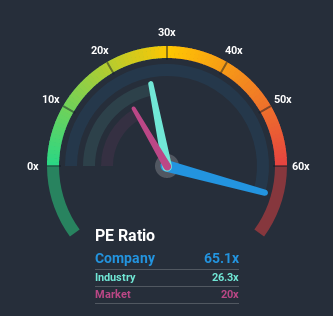

Following the firm bounce in price, Force-MOS Technology may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 65.1x, since almost half of all companies in Taiwan have P/E ratios under 19x and even P/E's lower than 14x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Force-MOS Technology has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Force-MOS Technology

Does Growth Match The High P/E?

In order to justify its P/E ratio, Force-MOS Technology would need to produce outstanding growth well in excess of the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 12% last year. Pleasingly, EPS has also lifted 355% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Force-MOS Technology's P/E sits above the majority of other companies. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Force-MOS Technology's P/E?

The strong share price surge has got Force-MOS Technology's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Force-MOS Technology maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Force-MOS Technology that you need to be mindful of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a P/E below 20x.

When trading Force-MOS Technology or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4923

Force MOS Technology

Engages in the design, development, and sale of MOSFETs and analog integrated circuits in Taiwan and Mainland China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives