- South Korea

- /

- Electronic Equipment and Components

- /

- KOSDAQ:A108490

High Growth Tech Stocks in Asia for December 2025

Reviewed by Simply Wall St

As global markets experience a wave of optimism driven by dovish central bank signals and technology stocks rebounding from valuation concerns, Asian tech sectors are capturing investor attention with their potential for high growth. In this dynamic environment, identifying promising tech stocks involves assessing companies' ability to innovate and capitalize on emerging trends like artificial intelligence while navigating economic shifts that influence market sentiment.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 35.80% | 36.87% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Fositek | 37.48% | 49.53% | ★★★★★★ |

| Gold Circuit Electronics | 28.44% | 34.07% | ★★★★★★ |

| Knowmerce | 42.51% | 33.23% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

ROBOTIS (KOSDAQ:A108490)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ROBOTIS Co., Ltd. is a South Korean company that specializes in providing robotic solutions, with a market capitalization of ₩3.27 trillion.

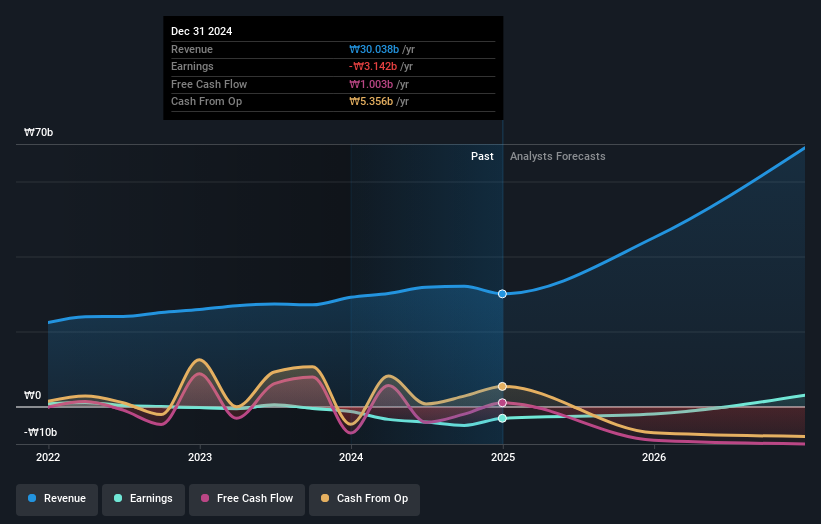

Operations: ROBOTIS Co., Ltd. focuses on developing, manufacturing, and selling personal robots, generating revenue of ₩34.11 billion.

ROBOTIS, a key contender in Asia's tech sector, recently showcased a robust turnaround with its third-quarter earnings revealing a shift from a net loss of ₩1.54 billion last year to a net income of ₩810.98 million this year. This performance is underpinned by an impressive annual revenue growth rate of 43.1% and even more striking annual earnings growth at 77.3%. The company's commitment to innovation is evident from its R&D expenses, which are strategically aligned to fuel future technologies, ensuring ROBOTIS remains at the forefront of the robotics and automation industry. Despite market volatility, these financial indicators combined with strategic follow-on equity offerings suggest ROBOTIS is positioning itself for sustained long-term growth in the high-stakes domain of high-tech industries in Asia.

- Take a closer look at ROBOTIS' potential here in our health report.

Evaluate ROBOTIS' historical performance by accessing our past performance report.

Shenzhen Aisidi (SZSE:002416)

Simply Wall St Growth Rating: ★★★★★☆

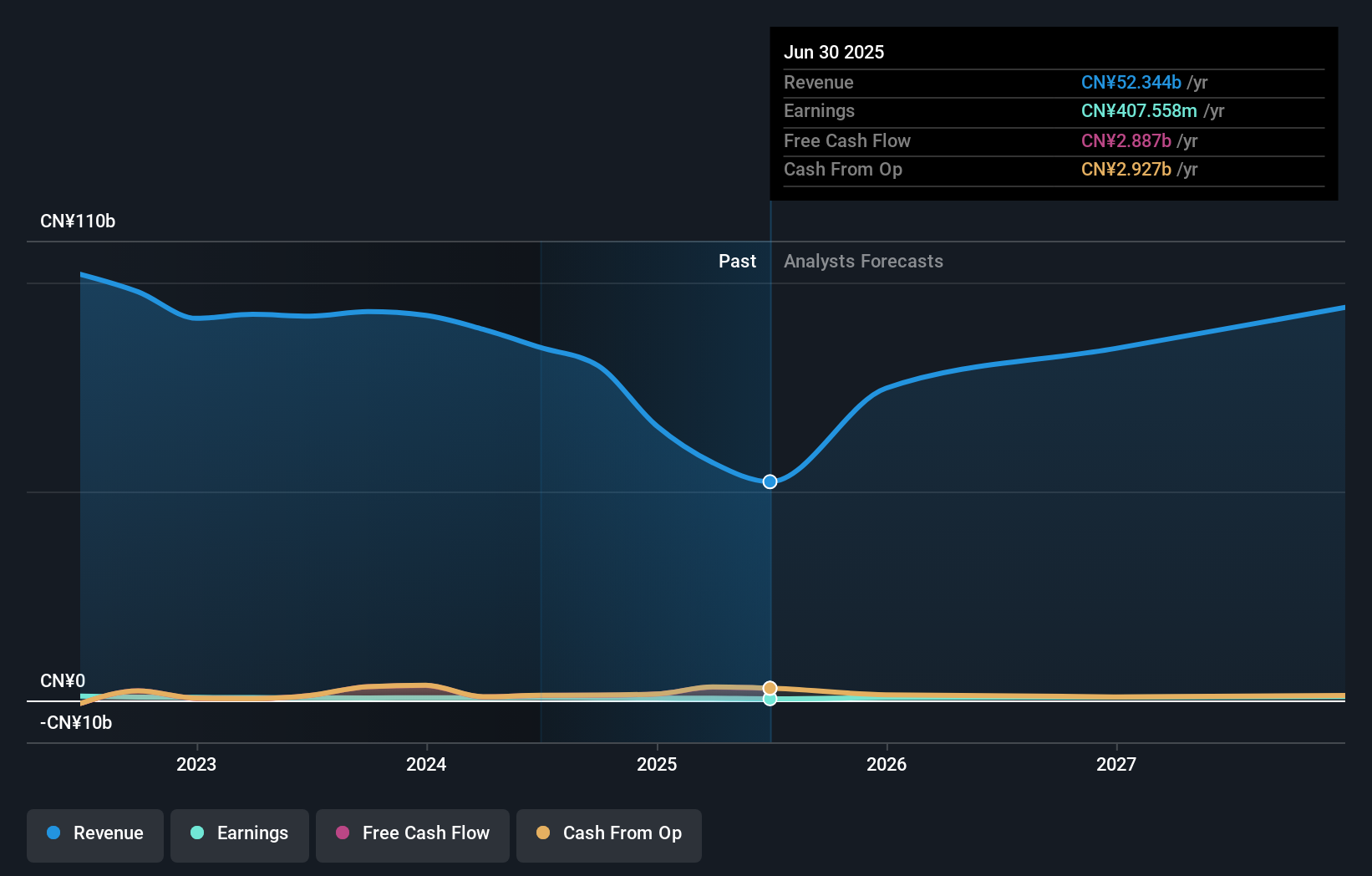

Overview: Shenzhen Aisidi Co., Ltd. engages in digital distribution and retail services both in China and internationally, with a market cap of CN¥15.11 billion.

Operations: The company operates in digital distribution and retail services, generating revenue from both domestic and international markets. With a significant market capitalization, it focuses on expanding its reach across various regions.

Shenzhen Aisidi, navigating through a challenging landscape, reported a significant downturn in its nine-month earnings with sales dropping to CNY 39.33 billion from CNY 57.38 billion the previous year, and net income decreasing to CNY 337.16 million from CNY 524.99 million. Despite these setbacks, the company's strategic amendments to its bylaws and proactive shareholder engagements indicate a restructuring aimed at resilience and growth in Asia's competitive tech sector. With an anticipated revenue growth rate of 22.5% per year and earnings expected to surge by 29.8% annually, Shenzhen Aisidi is poised to leverage its R&D investments effectively, ensuring it remains adaptive in evolving market conditions.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★★

Overview: PharmaEssentia Corporation is a biopharmaceutical company focused on developing treatments for human diseases, operating in Taiwan and internationally, with a market cap of NT$191.58 billion.

Operations: The company's primary revenue stream is from the research and development of new drugs, generating NT$13.82 billion.

PharmaEssentia is making notable strides in the biotech sector, particularly with its FDA-approved BESREMi® for polycythemia vera, a market that remains underserved. Recent presentations at the American Society of Hematology highlighted BESREMi®'s long-term efficacy, reinforcing its standing in a niche yet crucial therapeutic area. Financially, PharmaEssentia has demonstrated robust growth with third-quarter sales rising to TWD 3.89 billion from TWD 2.71 billion year-over-year and net income more than doubling to TWD 1.47 billion. This performance outpaces the industry's average, reflecting a compelling trajectory in revenue and earnings growth of 34.4% and 51.5% annually respectively—figures that underscore its potential amidst Asia's competitive high-tech landscape.

- Click here and access our complete health analysis report to understand the dynamics of PharmaEssentia.

Review our historical performance report to gain insights into PharmaEssentia's's past performance.

Key Takeaways

- Investigate our full lineup of 187 Asian High Growth Tech and AI Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A108490

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026