We Think Orient EuroPharma (GTSM:4120) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Orient EuroPharma Co., Ltd. (GTSM:4120) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Orient EuroPharma

How Much Debt Does Orient EuroPharma Carry?

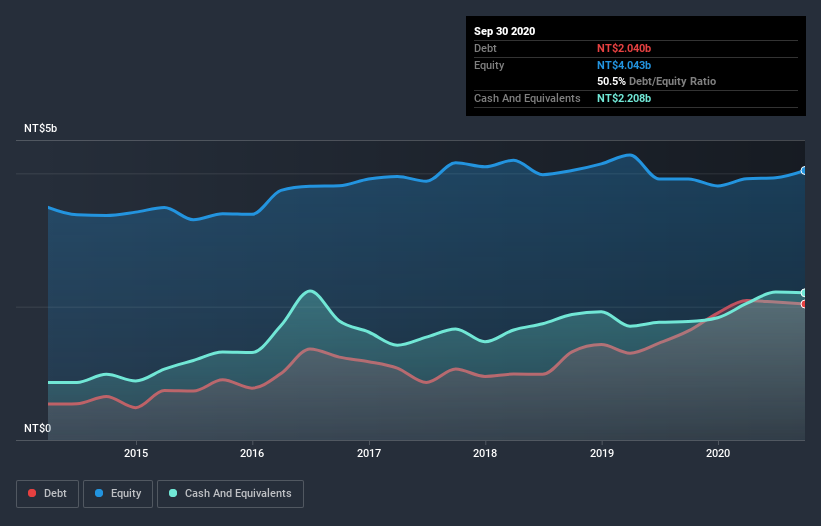

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Orient EuroPharma had NT$2.04b of debt, an increase on NT$1.64b, over one year. But it also has NT$2.21b in cash to offset that, meaning it has NT$168.0m net cash.

How Strong Is Orient EuroPharma's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Orient EuroPharma had liabilities of NT$2.19b due within 12 months and liabilities of NT$1.81b due beyond that. On the other hand, it had cash of NT$2.21b and NT$527.6m worth of receivables due within a year. So it has liabilities totalling NT$1.26b more than its cash and near-term receivables, combined.

Orient EuroPharma has a market capitalization of NT$4.17b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. While it does have liabilities worth noting, Orient EuroPharma also has more cash than debt, so we're pretty confident it can manage its debt safely.

On the other hand, Orient EuroPharma saw its EBIT drop by 7.1% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Orient EuroPharma will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Orient EuroPharma may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Orient EuroPharma's free cash flow amounted to 30% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Summing up

Although Orient EuroPharma's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of NT$168.0m. So we are not troubled with Orient EuroPharma's debt use. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Take risks, for example - Orient EuroPharma has 3 warning signs (and 2 which make us uncomfortable) we think you should know about.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Orient EuroPharma, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4120

Orient EuroPharma

A pharmaceutical company, develops and manufactures drugs worldwide.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives