Here's Why Orient EuroPharma (GTSM:4120) Has A Meaningful Debt Burden

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Orient EuroPharma Co., Ltd. (GTSM:4120) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Orient EuroPharma

How Much Debt Does Orient EuroPharma Carry?

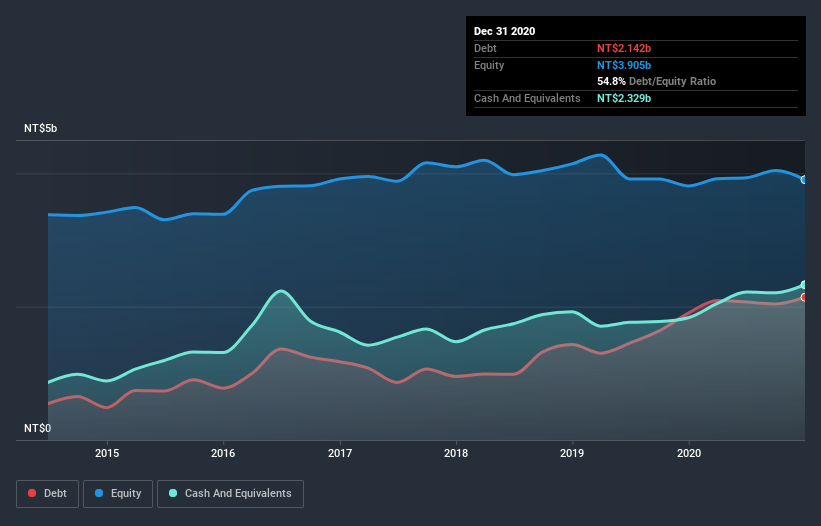

As you can see below, at the end of December 2020, Orient EuroPharma had NT$2.14b of debt, up from NT$1.90b a year ago. Click the image for more detail. However, it does have NT$2.33b in cash offsetting this, leading to net cash of NT$187.5m.

How Healthy Is Orient EuroPharma's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Orient EuroPharma had liabilities of NT$2.43b due within 12 months and liabilities of NT$1.83b due beyond that. Offsetting these obligations, it had cash of NT$2.33b as well as receivables valued at NT$542.2m due within 12 months. So its liabilities total NT$1.38b more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since Orient EuroPharma has a market capitalization of NT$3.99b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt. While it does have liabilities worth noting, Orient EuroPharma also has more cash than debt, so we're pretty confident it can manage its debt safely.

It is just as well that Orient EuroPharma's load is not too heavy, because its EBIT was down 65% over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Orient EuroPharma's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Orient EuroPharma may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the most recent three years, Orient EuroPharma recorded free cash flow worth 55% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Summing up

Although Orient EuroPharma's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of NT$187.5m. So while Orient EuroPharma does not have a great balance sheet, it's certainly not too bad. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Orient EuroPharma is showing 3 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading Orient EuroPharma or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4120

Orient EuroPharma

A pharmaceutical company, develops and manufactures drugs worldwide.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives