Investors more bullish on All Cosmos Bio-Tech Holding (TWSE:4148) this week as stock jumps 12%, despite earnings trending downwards over past three years

You can receive the average market return by buying a low-cost index fund. But if you pick the right individual stocks, you could make more than that. For example, the All Cosmos Bio-Tech Holding Corporation (TWSE:4148) share price is up 35% in the last three years, slightly above the market return. It's nice to see the stock price has more recent momentum, too, with a rise of 27% in the last year.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for All Cosmos Bio-Tech Holding

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, All Cosmos Bio-Tech Holding failed to grow earnings per share, which fell 11% (annualized).

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

Languishing at just 2.0%, we doubt the dividend is doing much to prop up the share price. It may well be that All Cosmos Bio-Tech Holding revenue growth rate of 8.2% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

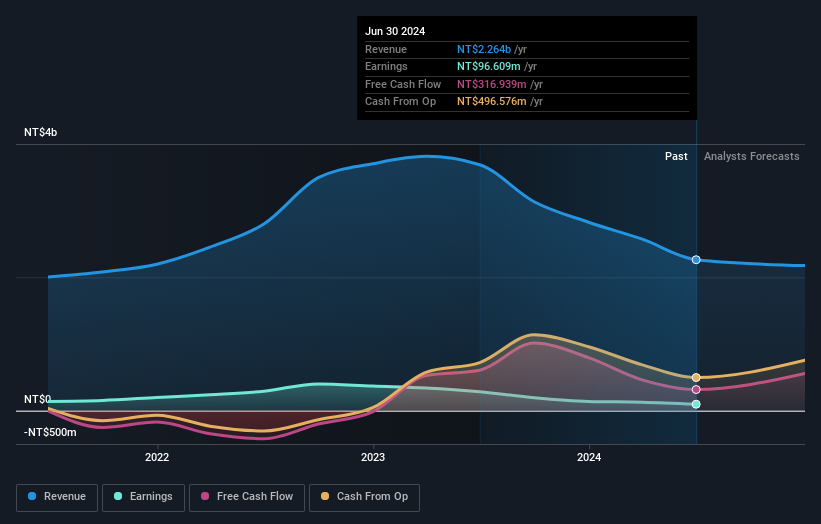

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, All Cosmos Bio-Tech Holding's TSR for the last 3 years was 48%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

All Cosmos Bio-Tech Holding provided a TSR of 30% over the last twelve months. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 7% per year over five year. This suggests the company might be improving over time. It's always interesting to track share price performance over the longer term. But to understand All Cosmos Bio-Tech Holding better, we need to consider many other factors. To that end, you should be aware of the 2 warning signs we've spotted with All Cosmos Bio-Tech Holding .

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:4148

All Cosmos Bio-Tech Holding

Through its subsidiaries, manufactures and sells bio-organic and bio-chemical compound fertilizers in Malaysia and internationally.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives