- Taiwan

- /

- Metals and Mining

- /

- TWSE:2029

3 Reliable Dividend Stocks With Yields Up To 6.6%

Reviewed by Simply Wall St

As global markets show resilience with major U.S. indexes approaching record highs and a strong labor market driving positive sentiment, investors are increasingly looking for stability amid geopolitical uncertainties and economic fluctuations. In this environment, dividend stocks can offer a reliable income stream; particularly appealing are those with substantial yields, as they provide potential returns even when market conditions remain unpredictable.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.51% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.33% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.67% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.49% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Al Waha Capital PJSC (ADX:WAHA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Waha Capital PJSC is a private equity firm that manages assets across sectors such as financial services, fintech, healthcare, energy, infrastructure, industrial real estate and capital markets, with a market cap of AED2.80 billion.

Operations: Al Waha Capital PJSC's revenue from its private investments, excluding Waha Land, amounts to AED149.88 million.

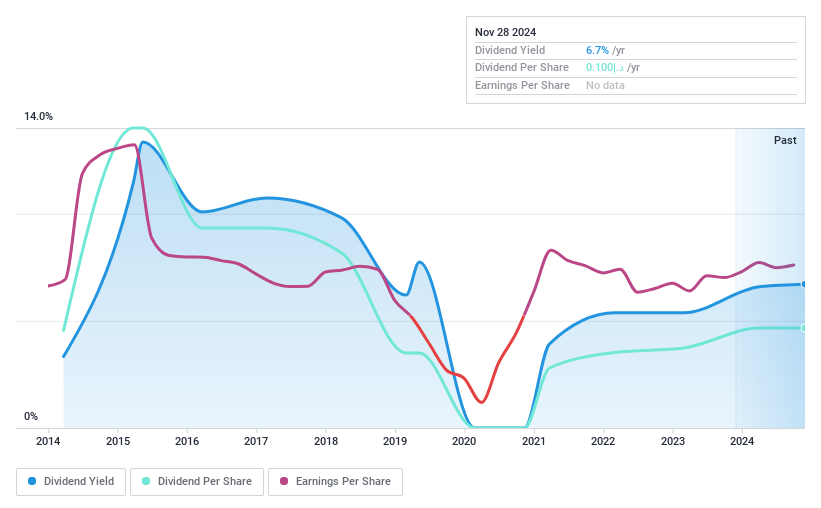

Dividend Yield: 6.7%

Al Waha Capital PJSC's dividend yield of 6.67% ranks it among the top 25% of dividend payers in the AE market. Despite a low payout ratio of 37.2%, indicating dividends are covered by earnings, the lack of free cash flow raises sustainability concerns. Earnings growth is strong, with a notable increase to AED 77.56 million for Q3 2024 from AED 53.63 million a year ago, yet past dividend payments have been volatile and unreliable over the last decade.

- Get an in-depth perspective on Al Waha Capital PJSC's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Al Waha Capital PJSC's share price might be too optimistic.

Sheng Yu Steel (TWSE:2029)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sheng Yu Steel Co., Ltd. manufactures, processes, and sells steel sheets across Taiwan, the rest of Asia, Europe, the United States, and internationally with a market cap of NT$8.13 billion.

Operations: Sheng Yu Steel Co., Ltd. generates revenue of NT$12.86 billion from its manufacturing, processing, and sales operations.

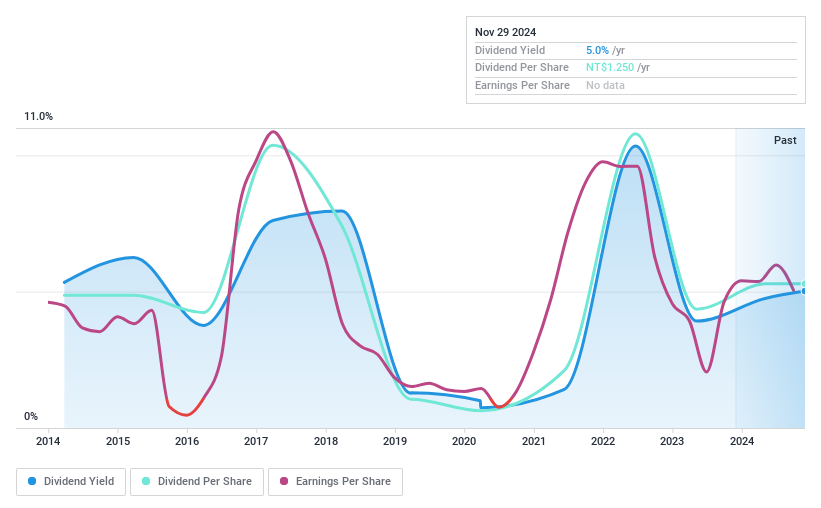

Dividend Yield: 4.9%

Sheng Yu Steel's dividend yield of 4.94% places it in the top 25% of TW market payers, with a sustainable payout ratio of 69.7%. However, dividends have been volatile over the past decade despite growth in earnings by 19.4% annually over five years. Recent earnings showed a decline, with Q3 net income at TWD 83.04 million compared to TWD 219.77 million last year, raising concerns about future dividend stability amidst attractive valuation metrics.

- Click here to discover the nuances of Sheng Yu Steel with our detailed analytical dividend report.

- Our valuation report here indicates Sheng Yu Steel may be undervalued.

Supreme Electronics (TWSE:8112)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Supreme Electronics Co., Ltd. operates as an import and export dealer of electronic products and components across Taiwan, Hong Kong, China, the United States, and internationally, with a market cap of NT$33.85 billion.

Operations: Supreme Electronics Co., Ltd. generates revenue of NT$235.52 billion from its computer peripherals and electronic components segment.

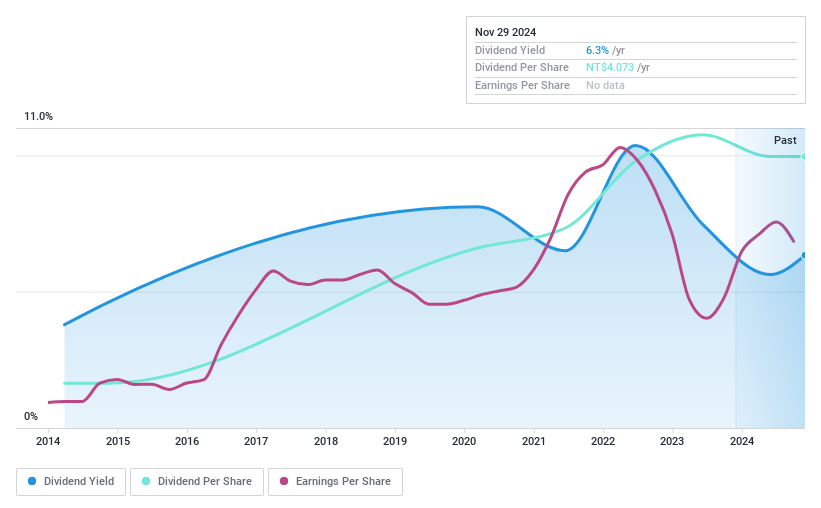

Dividend Yield: 6.3%

Supreme Electronics' dividend yield of 6.28% ranks it among the top 25% in Taiwan, but its sustainability is questionable due to insufficient free cash flow coverage. Despite a stable and growing dividend history over the past decade, recent financials show a decline in Q3 net income to TWD 523.79 million from TWD 684.43 million last year, while sales increased significantly. The current payout ratio of 81.8% covers earnings but not cash flows, posing potential risks for future dividends.

- Unlock comprehensive insights into our analysis of Supreme Electronics stock in this dividend report.

- The analysis detailed in our Supreme Electronics valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Click here to access our complete index of 1954 Top Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2029

Sheng Yu Steel

Manufactures, processes, and sells sheets in Taiwan, rest of Asia, Europe, the United States, and internationally.

Flawless balance sheet established dividend payer.