- China

- /

- Professional Services

- /

- SZSE:300938

Zhejiang Golden EagleLtd And 2 Other Undiscovered Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

In recent weeks, global markets have experienced broad-based gains, with smaller-cap indexes outperforming large-caps amid positive economic indicators such as falling U.S. jobless claims and improving home sales. This favorable environment for small-cap stocks presents an opportunity to explore lesser-known companies that could enhance a diversified portfolio. Identifying a promising stock often involves looking for strong fundamentals and growth potential, particularly in sectors poised to benefit from current economic trends and technological advancements.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Mobile Telecommunications | NA | 4.98% | 0.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Zhejiang Golden EagleLtd (SHSE:600232)

Simply Wall St Value Rating: ★★★★☆☆

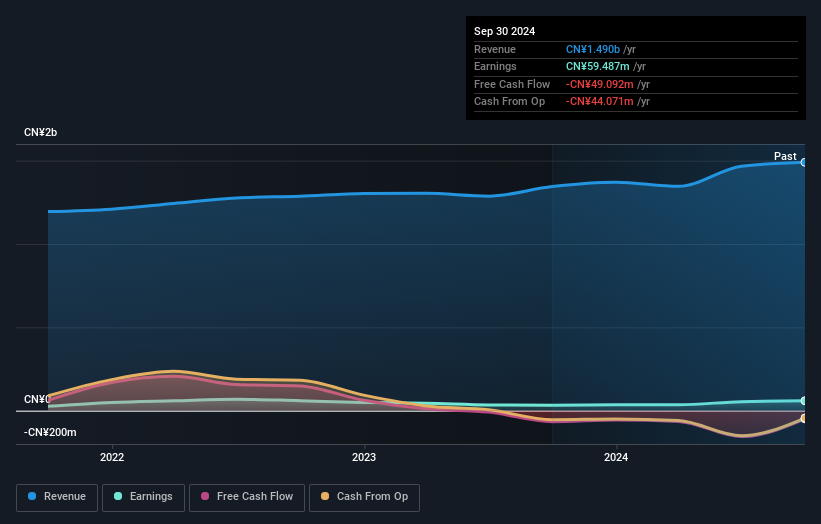

Overview: Zhejiang Golden Eagle Co., Ltd. is a company that manufactures and sells textile machinery for linen, silk, and wool in China with a market cap of CN¥2.08 billion.

Operations: Golden Eagle generates revenue primarily from the sale of textile machinery for linen, silk, and wool. The company's net profit margin is a key financial metric to monitor.

Zhejiang Golden Eagle, with its niche market presence, has shown impressive earnings growth of 86% over the past year, outpacing the luxury industry average. The company's net debt to equity ratio stands at a satisfactory 12.7%, indicating prudent financial management. Despite not being free cash flow positive, it boasts high-quality earnings and well-covered interest payments at 9.5 times EBIT coverage. Recent reports highlight sales reaching CNY 1.09 billion for the first nine months of 2024, up from CNY 969 million last year, with net income rising to CNY 53 million from CNY 29 million previously.

- Navigate through the intricacies of Zhejiang Golden EagleLtd with our comprehensive health report here.

Assess Zhejiang Golden EagleLtd's past performance with our detailed historical performance reports.

EMTEK (Shenzhen) (SZSE:300938)

Simply Wall St Value Rating: ★★★★★☆

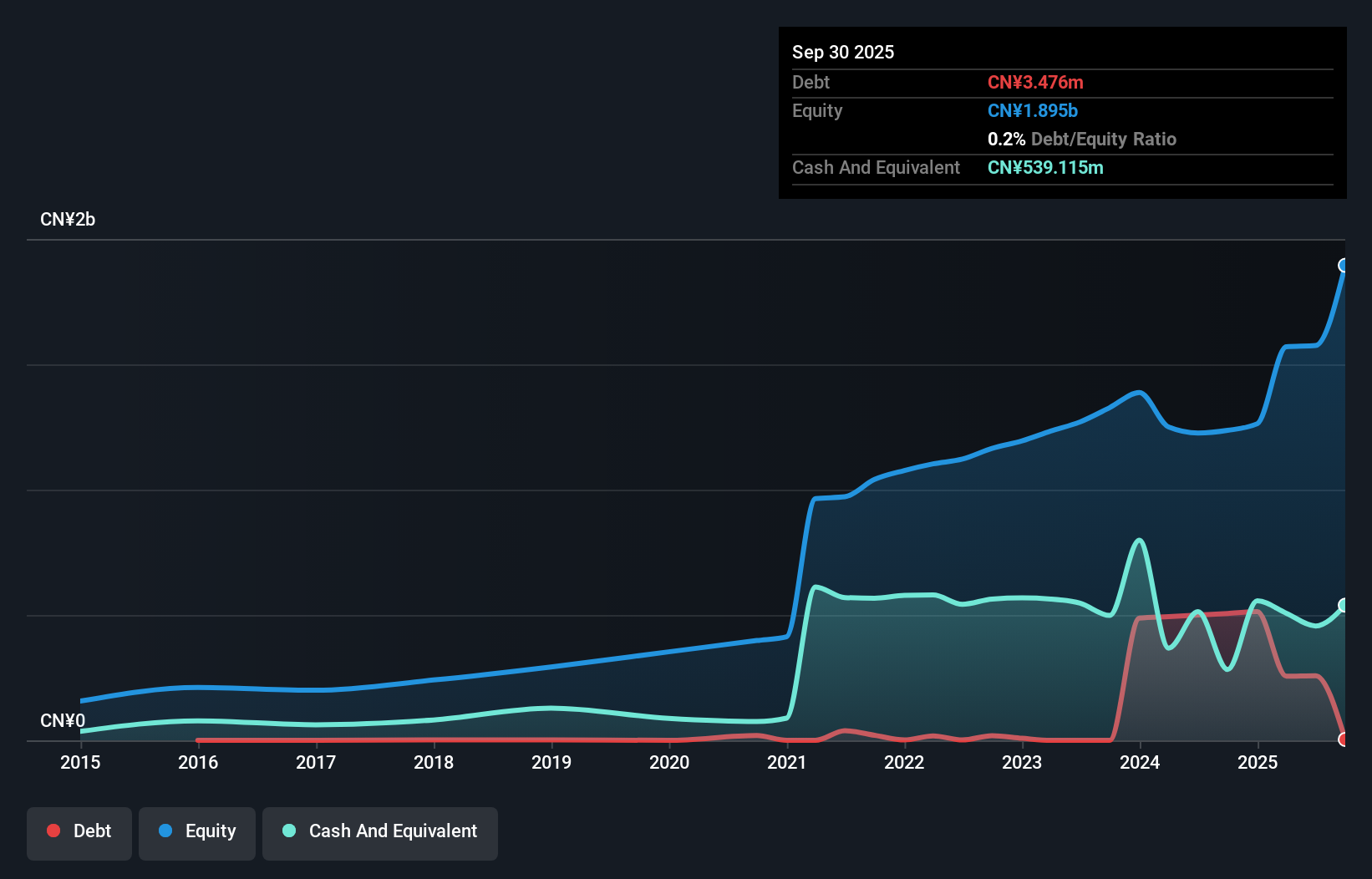

Overview: EMTEK (Shenzhen) Co., Ltd. operates as a third-party testing institution in China with a market capitalization of CN¥3.40 billion.

Operations: EMTEK (Shenzhen) generates revenue primarily from its research services, amounting to CN¥719.98 million. The company has a market capitalization of approximately CN¥3.40 billion.

EMTEK (Shenzhen) showcases a dynamic profile with recent earnings results highlighting a net income of CNY 143.07 million for the nine months ending September 2024, up from CNY 133.18 million the previous year. The company has demonstrated robust growth with its earnings increasing by 10.7% over the past year, surpassing industry averages and reflecting high-quality earnings. A satisfactory net debt to equity ratio of 18.1% indicates prudent financial management, while a price-to-earnings ratio of 19.6x suggests it is valued attractively compared to the broader CN market at 34.6x. Recent share buybacks totaling CNY 200 million underscore confidence in its long-term prospects.

- Get an in-depth perspective on EMTEK (Shenzhen)'s performance by reading our health report here.

Gain insights into EMTEK (Shenzhen)'s past trends and performance with our Past report.

First Copper Technology (TWSE:2009)

Simply Wall St Value Rating: ★★★★★★

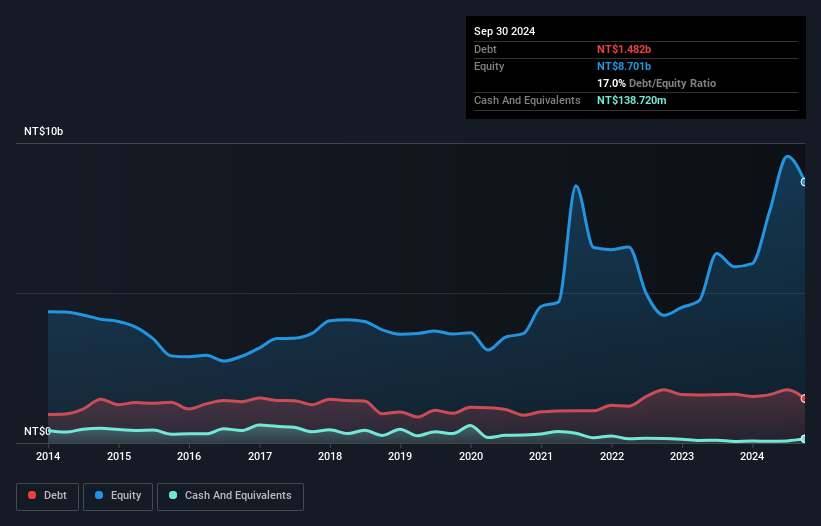

Overview: First Copper Technology Co., Ltd. is engaged in the production and sale of copper and copper alloy strips both in Taiwan and internationally, with a market capitalization of approximately NT$14.99 billion.

Operations: The primary revenue stream for First Copper Technology comes from the manufacture and sale of copper sheet products, generating NT$3.06 billion.

First Copper Technology has shown impressive growth, with earnings surging by 492% over the past year, far outpacing the industry average of 12%. The company's debt to equity ratio improved from 27.2% to 17% in five years, indicating stronger financial health. Recent earnings reports highlight a substantial increase in net income for Q3 2024 at TWD 216.56 million, up from TWD 74.35 million last year. Sales reached TWD 796.59 million compared to TWD 672.52 million previously, reflecting robust performance and positioning it as a promising player in its sector despite its smaller market cap stature.

Taking Advantage

- Discover the full array of 4636 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMTEK (Shenzhen) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300938

Excellent balance sheet with proven track record.