In the midst of fluctuating global markets, with U.S. stocks experiencing a decline due to cautious Federal Reserve commentary and looming political uncertainties, investors are increasingly seeking stability in their portfolios. One strategy that has gained attention is focusing on growth companies with high insider ownership, as these firms often exhibit strong internal confidence and alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.9% | 37.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| CD Projekt (WSE:CDR) | 29.7% | 27% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Let's explore several standout options from the results in the screener.

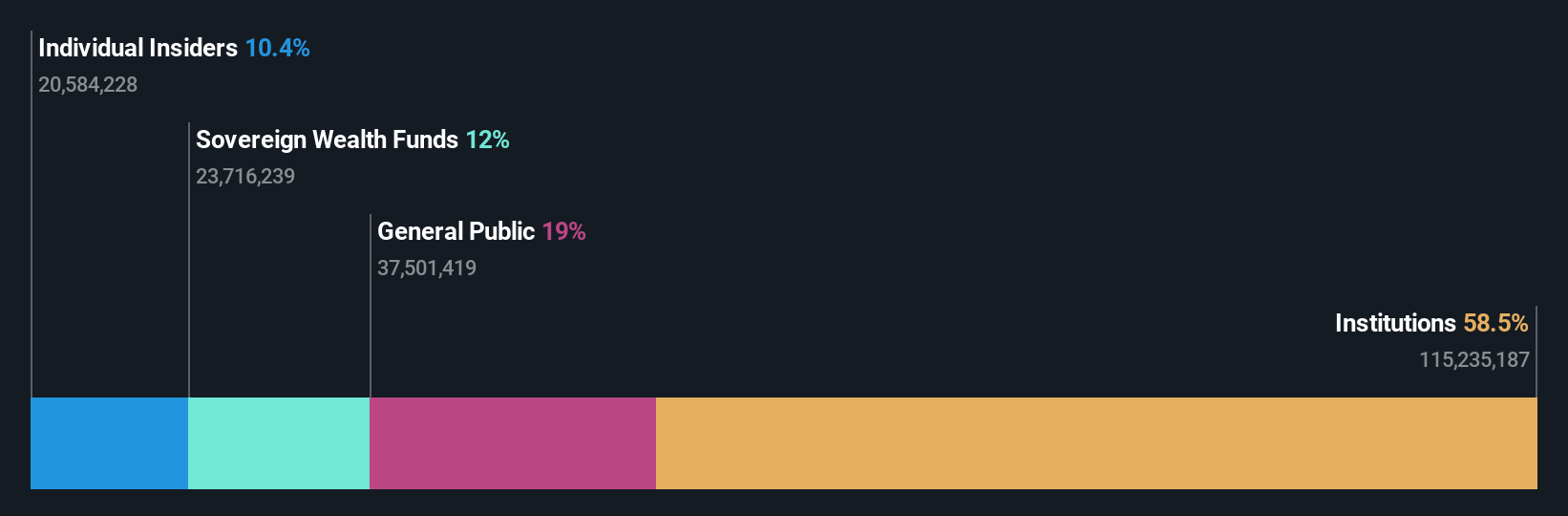

Nordic Semiconductor (OB:NOD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nordic Semiconductor ASA is a fabless semiconductor company that designs, sells, and delivers integrated circuits for short- and long-range wireless applications across Europe, the Americas, and the Asia Pacific, with a market cap of NOK19.05 billion.

Operations: The company's revenue segment is primarily derived from the design and sale of integrated circuits and related solutions, amounting to $469.41 million.

Insider Ownership: 10.7%

Earnings Growth Forecast: 70.3% p.a.

Nordic Semiconductor has seen substantial insider buying in the past three months, indicating confidence in its growth prospects. While its revenue is forecast to grow at 17.1% annually, outpacing the Norwegian market, it remains below a 20% benchmark for high growth. The company is expected to become profitable within three years, with earnings projected to increase by 70.3% annually. Recent Q3 results showed increased sales of US$158.77 million and net income of US$6.17 million compared to last year’s figures.

- Get an in-depth perspective on Nordic Semiconductor's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Nordic Semiconductor's share price might be on the expensive side.

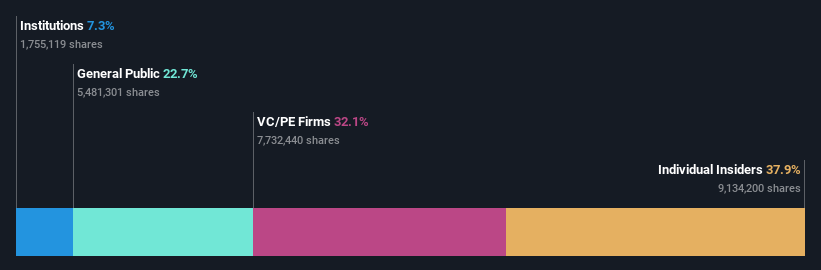

Weihai Guangtai Airport EquipmentLtd (SZSE:002111)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Weihai Guangtai Airport Equipment Co., Ltd manufactures and sells ground support and firefighting equipment in China and internationally, with a market cap of CN¥5.72 billion.

Operations: The company generates revenue primarily through the manufacture and sale of ground support equipment and firefighting equipment both domestically and internationally.

Insider Ownership: 16.9%

Earnings Growth Forecast: 42.9% p.a.

Weihai Guangtai Airport Equipment Ltd. demonstrates strong growth potential with expected annual earnings growth of 42.91%, significantly outpacing the Chinese market's average. Recent earnings results show a rise in net income to CNY 128.88 million, supported by revenue growth from CNY 1,608.34 million to CNY 2,073.75 million year-over-year. Despite a lower profit margin and an ROE forecast of 11.6%, its P/E ratio remains attractive compared to the market average, suggesting reasonable valuation for investors seeking growth opportunities with high insider ownership alignment.

- Dive into the specifics of Weihai Guangtai Airport EquipmentLtd here with our thorough growth forecast report.

- In light of our recent valuation report, it seems possible that Weihai Guangtai Airport EquipmentLtd is trading beyond its estimated value.

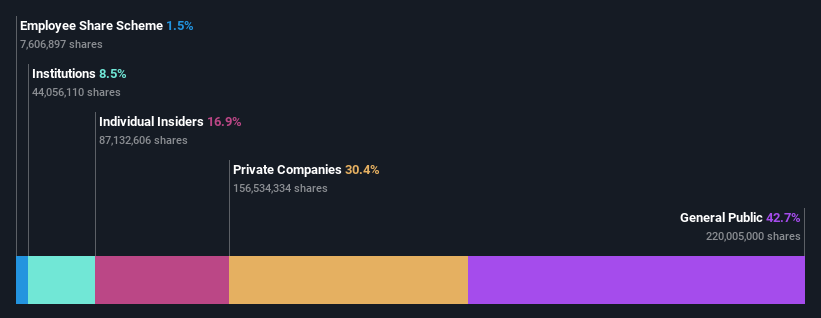

Japan Eyewear Holdings (TSE:5889)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Japan Eyewear Holdings Co., Ltd. operates in Japan through its subsidiaries, focusing on the planning, designing, manufacturing, wholesaling, and retailing of eyewear products with a market cap of ¥56.45 billion.

Operations: Revenue segments for the company include ¥5.60 billion from Four Nines and ¥10.34 billion from Kaneko Glasses.

Insider Ownership: 37.9%

Earnings Growth Forecast: 15.2% p.a.

Japan Eyewear Holdings shows potential for growth with earnings forecasted to rise 15.24% annually, surpassing the Japanese market average. Despite high debt levels and recent share price volatility, the company trades at a discount of 25.8% below its estimated fair value. Recent revisions in earnings guidance indicate robust performance driven by strong store sales and tourism demand, with revenue now expected at ¥16 billion for fiscal year ending January 2025.

- Unlock comprehensive insights into our analysis of Japan Eyewear Holdings stock in this growth report.

- Our valuation report unveils the possibility Japan Eyewear Holdings' shares may be trading at a discount.

Where To Now?

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1509 more companies for you to explore.Click here to unveil our expertly curated list of 1512 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Weihai Guangtai Airport EquipmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002111

Weihai Guangtai Airport EquipmentLtd

Engages in manufacture and sale of ground support equipment and fire-fighting equipment in China and internationally.

High growth potential with adequate balance sheet.