- China

- /

- Electrical

- /

- SZSE:000533

Spotlighting Undiscovered Gems With Potential In December 2024

Reviewed by Simply Wall St

In December 2024, global markets are navigating a complex landscape marked by the Federal Reserve's cautious approach to interest rate cuts and looming political uncertainties in the U.S., which have contributed to broad-based declines in major indices, particularly affecting smaller-cap stocks. Despite these challenges, the economic backdrop of strong consumer spending and robust job data presents opportunities for discerning investors seeking potential in lesser-known stocks. In this environment, identifying undiscovered gems involves looking beyond immediate market volatility to find companies with solid fundamentals that can thrive amidst broader economic trends and sector-specific dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Nikko | 33.49% | 5.29% | -7.39% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Mobvista (SEHK:1860)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mobvista Inc., along with its subsidiaries, offers advertising and marketing technology services essential for the development of the mobile internet ecosystem to a global customer base, with a market cap of HK$12.65 billion.

Operations: Mobvista generates revenue primarily through its advertising and marketing technology services. The company's net profit margin has shown varying trends over recent periods, reflecting changes in operational efficiency and cost management strategies.

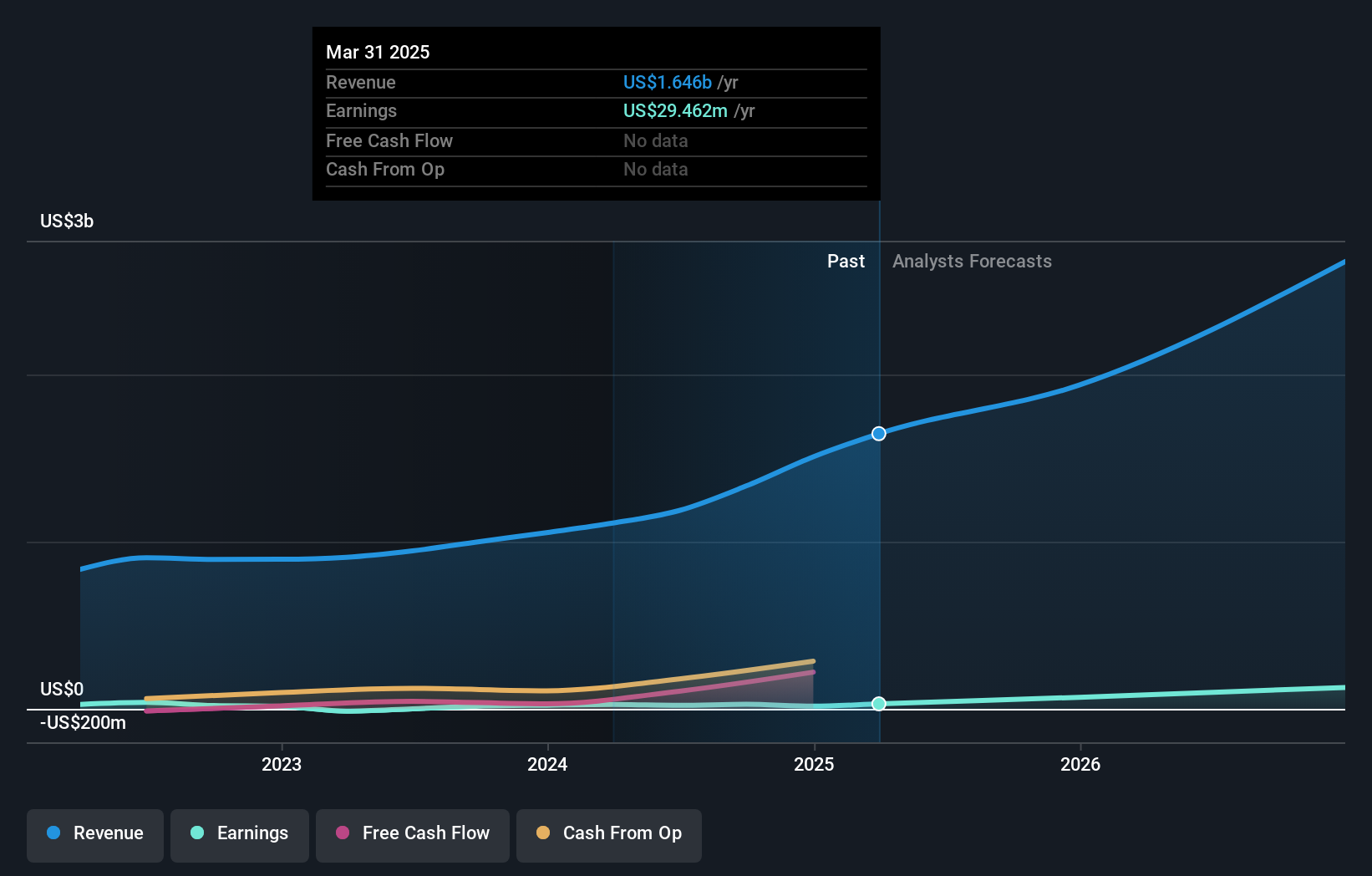

Mobvista, a dynamic player in the tech industry, has seen its earnings grow significantly by 64.6% over the past year, outpacing the media sector's -2.2%. The company's debt to equity ratio has risen from 20.9% to 59% over five years; however, interest payments are well covered with an EBIT coverage of 6.2x. Recent financial disclosures highlight robust sales growth in Q3 2024, with revenue jumping to US$416 million from US$269 million a year prior and net income increasing to US$9.9 million from US$3.78 million, showcasing substantial progress and potential for future expansion.

- Click to explore a detailed breakdown of our findings in Mobvista's health report.

Evaluate Mobvista's historical performance by accessing our past performance report.

Sri Trang Gloves (Thailand) (SET:STGT)

Simply Wall St Value Rating: ★★★★★★

Overview: Sri Trang Gloves (Thailand) Public Company Limited is involved in the manufacture and distribution of rubber gloves across various international markets, with a market capitalization of approximately THB28.37 billion.

Operations: Sri Trang Gloves generates revenue primarily from its gloves segment, amounting to THB23.30 billion. The company's financial performance is significantly influenced by this core segment, which represents the majority of its revenue stream.

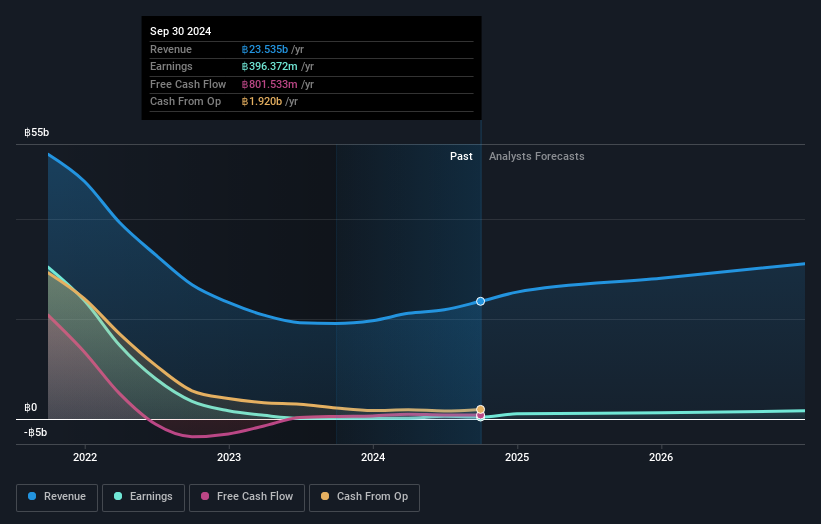

Sri Trang Gloves, a nimble player in the glove manufacturing space, has shown impressive earnings growth of 153% over the last year, outpacing its industry peers. Despite a recent net loss of THB 86.53 million for Q3 2024, it achieved THB 438.64 million net income over nine months, doubling from the previous year's THB 194.96 million. The company's debt to equity ratio improved significantly from 155% to just under 20% in five years, highlighting financial discipline and stability. While share price volatility persists, future earnings are projected to grow by over half annually, suggesting potential upside amidst challenges.

Guangdong Shunna Electric (SZSE:000533)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong Shunna Electric Co., Ltd. specializes in providing power transmission and distribution equipment in China, with a market capitalization of CN¥3.14 billion.

Operations: Guangdong Shunna Electric generates revenue primarily from the sale of power transmission and distribution equipment. The company's financial performance shows a focus on optimizing its cost structure to enhance profitability. Its net profit margin has shown notable fluctuations, reflecting varying levels of operational efficiency over time.

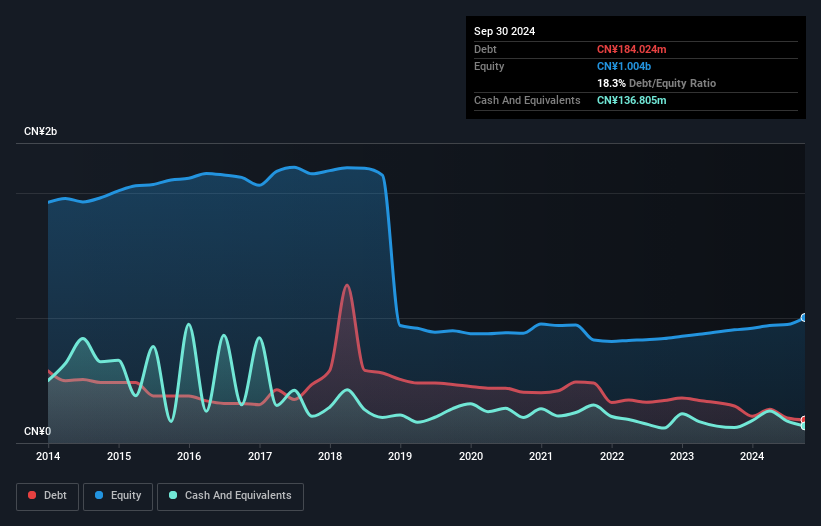

Guangdong Shunna Electric, a promising player in the electrical industry, has demonstrated robust earnings growth of 43.9% over the past year, outpacing the industry's 1.1%. Trading at 30.8% below its estimated fair value suggests potential undervaluation. The company's debt management appears strong with a reduction in its debt to equity ratio from 52.1% to 18.3% over five years and an adequate net debt to equity ratio of 4.7%. Recent earnings reports show sales rising to CNY 1.70 billion from CNY 1.53 billion last year, with net income increasing from CNY 48 million to CNY 71 million.

- Click here and access our complete health analysis report to understand the dynamics of Guangdong Shunna Electric.

Understand Guangdong Shunna Electric's track record by examining our Past report.

Next Steps

- Investigate our full lineup of 4628 Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000533

Guangdong Shunna Electric

Provides power transmission and distribution equipment in China.

Flawless balance sheet with proven track record.