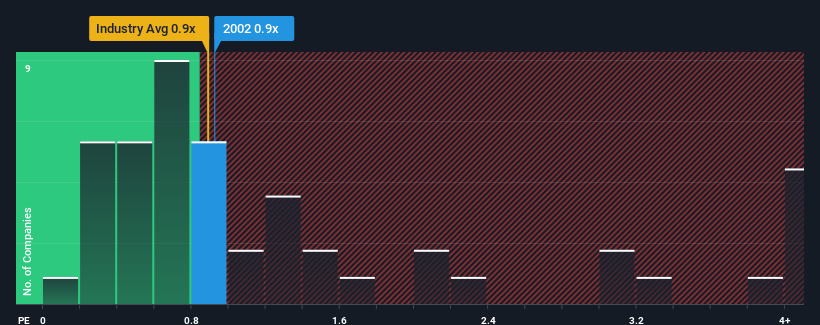

It's not a stretch to say that China Steel Corporation's (TWSE:2002) price-to-sales (or "P/S") ratio of 0.9x seems quite "middle-of-the-road" for Metals and Mining companies in Taiwan, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for China Steel

How Has China Steel Performed Recently?

While the industry has experienced revenue growth lately, China Steel's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think China Steel's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like China Steel's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 5.8% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 3.3% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 3.8% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.1%, which is not materially different.

With this in mind, it makes sense that China Steel's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does China Steel's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A China Steel's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Metals and Mining industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for China Steel that you should be aware of.

If these risks are making you reconsider your opinion on China Steel, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2002

China Steel

Manufactures and sells steel products in Taiwan, Vietnam, Malaysia, China, India, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives