In the midst of global market fluctuations, with U.S. stocks retreating from recent gains and European markets experiencing mixed results due to political and economic uncertainties, investors are seeking stability amidst volatility. As inflation concerns persist and interest rate expectations shift, dividend stocks can offer a reliable source of income through regular payouts. In such an environment, focusing on companies with strong fundamentals and consistent dividend histories can be a prudent strategy for those looking to navigate these uncertain times while maintaining steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.16% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.74% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.76% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.78% | ★★★★★☆ |

Click here to see the full list of 1964 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Shenzhen Fuanna Bedding and FurnishingLtd (SZSE:002327)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shenzhen Fuanna Bedding and Furnishing Co., Ltd operates in the research and development, design, production, and sales of textile home furnishings and living products both in China and internationally, with a market cap of CN¥7.24 billion.

Operations: Shenzhen Fuanna Bedding and Furnishing Co., Ltd generates revenue through the research, design, production, and sales of textile home furnishings and living products in both domestic and international markets.

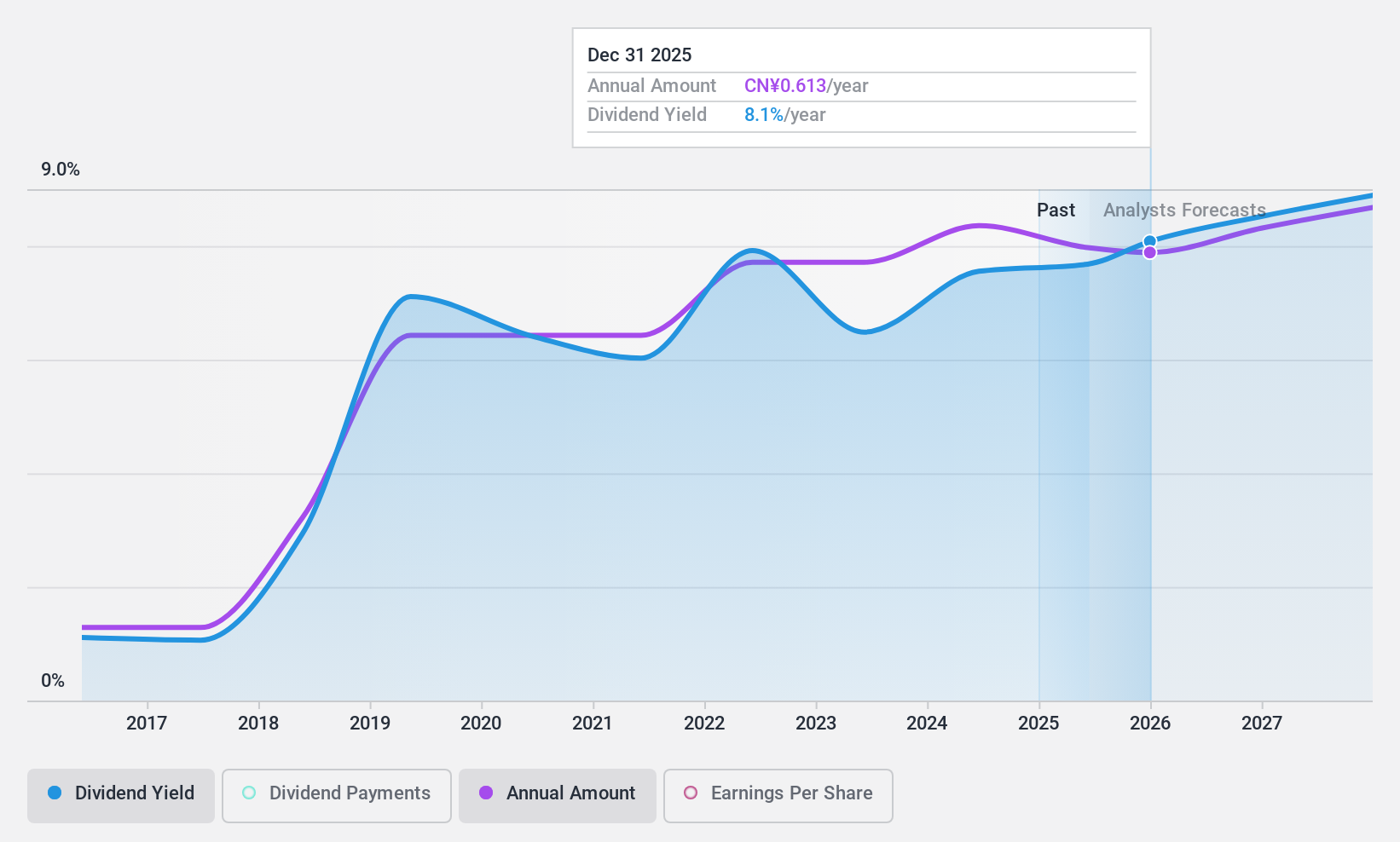

Dividend Yield: 7.3%

Shenzhen Fuanna Bedding and Furnishing Ltd. offers a dividend yield of 7.25%, placing it in the top 25% of dividend payers in China. However, the dividends are not well covered by earnings or free cash flow, with high payout ratios indicating potential sustainability issues. Despite this, the company has maintained stable and growing dividend payments over the past decade. Recent earnings show a slight decline in net income to CNY 293.19 million for nine months ended September 2024 compared to last year.

- Click to explore a detailed breakdown of our findings in Shenzhen Fuanna Bedding and FurnishingLtd's dividend report.

- Our valuation report here indicates Shenzhen Fuanna Bedding and FurnishingLtd may be undervalued.

KurimotoLtd (TSE:5602)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kurimoto Ltd. is engaged in the manufacturing and sale of ductile iron pipes, valves, industrial equipment and materials, and construction materials both in Japan and internationally, with a market cap of ¥49.54 billion.

Operations: Kurimoto Ltd.'s revenue segments include the manufacturing and sale of ductile iron pipes and accessories, valves, industrial equipment and materials, as well as construction materials.

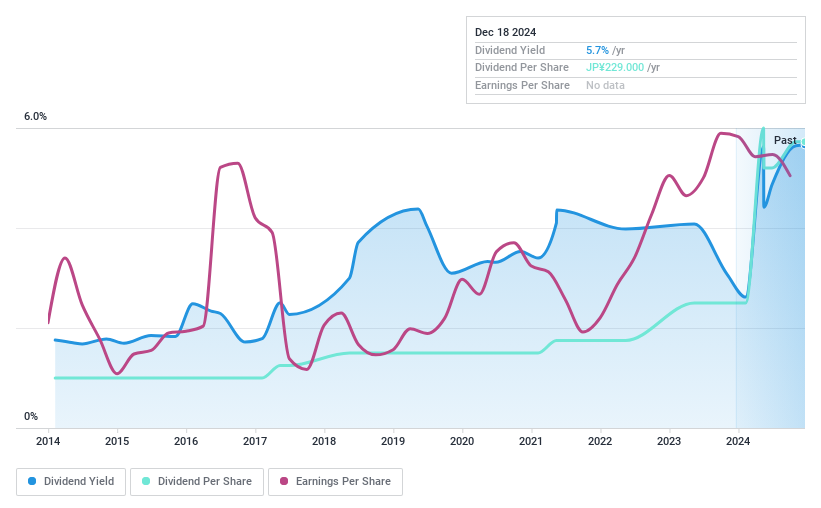

Dividend Yield: 5.5%

Kurimoto Ltd. offers a dividend yield of 5.51%, ranking it in the top 25% of dividend payers in Japan. The company's dividends have been reliable and stable over the past decade, with consistent growth and low volatility. However, despite a favorable payout ratio of 40.4%, indicating coverage by earnings, the dividends are not supported by free cash flows, raising sustainability concerns. Its price-to-earnings ratio is attractively below the market average at 9.9x.

- Click here and access our complete dividend analysis report to understand the dynamics of KurimotoLtd.

- Insights from our recent valuation report point to the potential overvaluation of KurimotoLtd shares in the market.

Taiwan Fertilizer (TWSE:1722)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Fertilizer Co., Ltd. manufactures and sells inorganic and organic fertilizers, along with other chemical products, operating in Taiwan, the Middle East, and internationally, with a market cap of NT$55.86 billion.

Operations: Taiwan Fertilizer Co., Ltd. generates revenue through the production and sale of both inorganic and organic fertilizers, as well as various chemical products, serving markets in Taiwan, the Middle East, and other international regions.

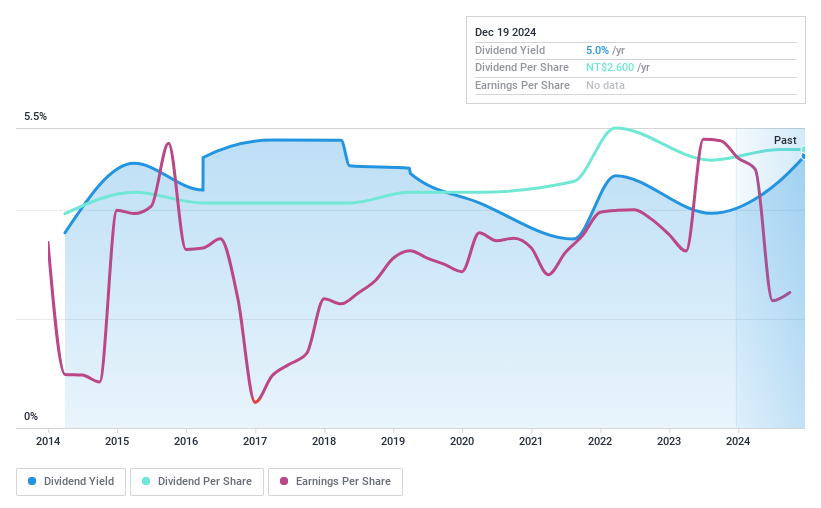

Dividend Yield: 4.5%

Taiwan Fertilizer's dividends have been stable and growing over the past decade, with a yield of 4.55% placing it among the top dividend payers in Taiwan. However, its high payout ratio of 148.3% indicates dividends are not well supported by earnings or cash flows, raising sustainability concerns. Recent earnings showed improved quarterly net income (TWD 737.93 million) but significant year-to-date declines, impacting long-term dividend coverage prospects amidst lower profit margins from last year.

- Navigate through the intricacies of Taiwan Fertilizer with our comprehensive dividend report here.

- Our valuation report unveils the possibility Taiwan Fertilizer's shares may be trading at a premium.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1964 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Fertilizer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1722

Taiwan Fertilizer

Manufactures and sells inorganic and organic fertilizers, and other chemical products in Taiwan, the Middle East, and internationally.

Excellent balance sheet average dividend payer.