Undiscovered Gems And 2 Other Small Caps with Promising Potential

Reviewed by Simply Wall St

In a week marked by volatility, U.S. stocks saw mixed results as AI competition fears and ongoing corporate earnings reports influenced market sentiment. Meanwhile, the Fed's decision to hold interest rates steady amidst solid economic activity and persistent inflation has left investors contemplating the potential impacts on small-cap stocks like those in the S&P 600 Index. In this environment, identifying promising small-cap companies requires a keen eye for innovation and resilience amid shifting economic landscapes and competitive pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cresco | 6.62% | 8.15% | 9.94% | ★★★★★★ |

| DoshishaLtd | NA | 2.43% | 2.36% | ★★★★★★ |

| NOROO PAINT & COATINGS | 12.38% | 4.96% | 8.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ITOCHU-SHOKUHIN | NA | 0.74% | 13.97% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wan Hwa Enterprise | NA | -7.43% | -7.24% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| New Asia Construction & Development | 65.89% | 5.34% | 12.05% | ★★★★★☆ |

| Nippon Sharyo | 59.09% | -1.22% | -12.92% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Ganzhou Tengyuan Cobalt New Material (SZSE:301219)

Simply Wall St Value Rating: ★★★★★★

Overview: Ganzhou Tengyuan Cobalt New Material Co., Ltd. operates in the cobalt materials industry and has a market cap of CN¥13.56 billion.

Operations: Ganzhou Tengyuan Cobalt New Material generates revenue primarily from its operations in the cobalt materials industry. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

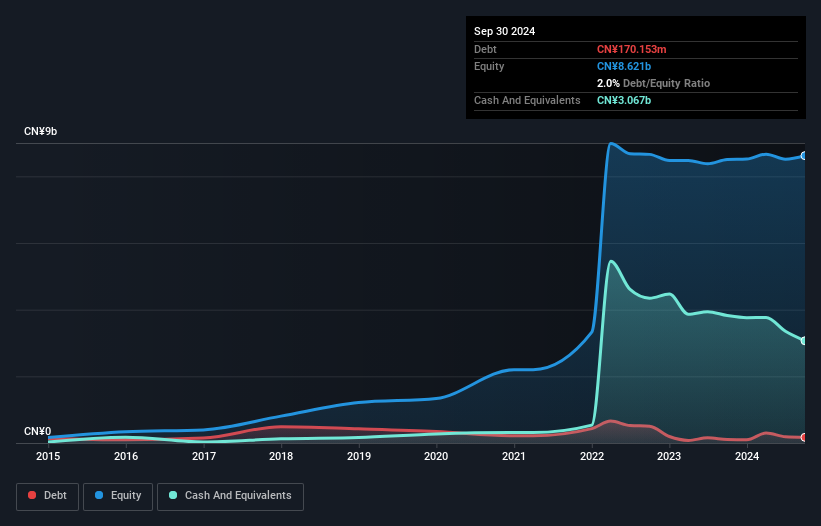

Tengyuan Cobalt, a nimble player in the materials sector, has demonstrated impressive earnings growth of 708% over the past year, outpacing its industry peers. The company's debt-to-equity ratio has significantly decreased from 28% to just 2% in five years, indicating prudent financial management. Despite a notable one-off gain of CN¥165.7M impacting recent results, Tengyuan's price-to-earnings ratio stands at an attractive 18x compared to the broader CN market's 34.9x. Looking ahead, earnings are projected to grow by approximately 24% annually, suggesting potential for continued value creation in this competitive space.

Suruga Bank (TSE:8358)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Suruga Bank Ltd. offers a range of banking and financial services to both individual and corporate clients in Japan, with a market capitalization of ¥235.25 billion.

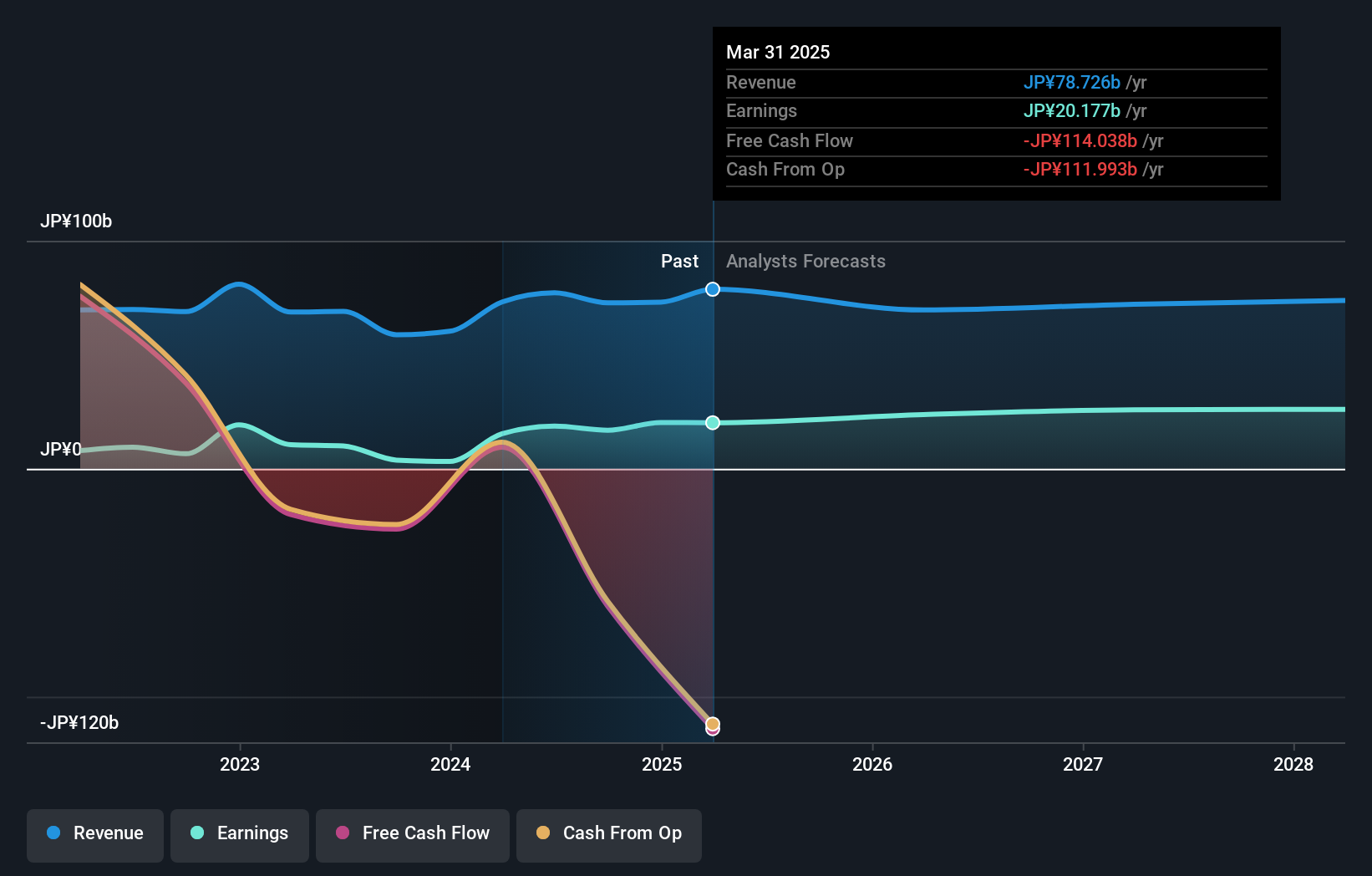

Operations: Suruga Bank generates revenue primarily from its banking segment, amounting to ¥82.04 billion. The net profit margin is a key indicator of its profitability.

Suruga Bank, with assets totaling ¥3,444.1 billion and equity of ¥297.2 billion, is navigating a challenging landscape with its high bad loan ratio of 8.9%. Despite this hurdle, the bank's earnings surged by 347% last year, outpacing the industry average of 21%. Total deposits stand at ¥3,129.8 billion against loans of ¥2,120.7 billion. The bank plans to repurchase shares worth ¥6 billion to boost shareholder returns by April 2025. While its funding relies heavily on low-risk customer deposits (99%), insufficient allowance for bad loans remains a concern at just 54% coverage.

- Take a closer look at Suruga Bank's potential here in our health report.

Evaluate Suruga Bank's historical performance by accessing our past performance report.

San Fang Chemical Industry (TWSE:1307)

Simply Wall St Value Rating: ★★★★★★

Overview: San Fang Chemical Industry Co., Ltd. is a company that manufactures and sells artificial leather, synthetic resin, and other materials across Taiwan, China, Hong Kong, Southeast Asia, and internationally with a market cap of NT$16.83 billion.

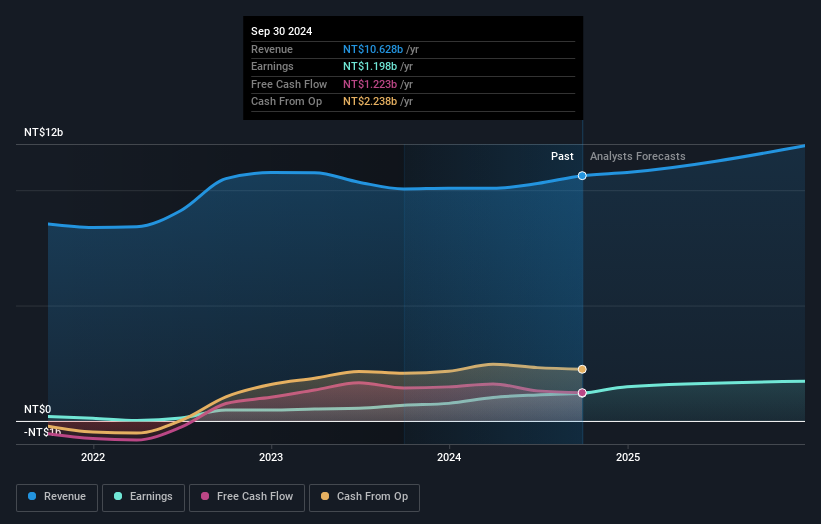

Operations: San Fang Chemical Industry generates revenue primarily from its artificial leather and synthetic resin segments, with significant contributions of NT$8.03 billion and NT$2.55 billion respectively. The company also reports a notable input from Sanfang Development Co., Ltd., adding NT$1.78 billion to its total revenue stream.

San Fang Chemical is catching attention with a robust 76.4% earnings growth over the past year, outpacing the industry average of 13.7%. The company seems to be trading at a compelling value, reportedly 53.3% below its estimated fair value, which could attract keen investors. Its debt-to-equity ratio has improved from 49.2% to 42.4% in five years, suggesting prudent financial management and likely contributing to its positive free cash flow status. Recent quarterly results showed sales of TWD 3,110 million and net income of TWD 386 million, reflecting solid performance compared to last year's figures.

- Click to explore a detailed breakdown of our findings in San Fang Chemical Industry's health report.

Learn about San Fang Chemical Industry's historical performance.

Key Takeaways

- Discover the full array of 4724 Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301219

Ganzhou Tengyuan Cobalt New Material

Ganzhou Tengyuan Cobalt New Material Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives