As global markets navigate a tumultuous period marked by busy earnings seasons and mixed economic signals, investors are paying close attention to how these dynamics affect their portfolios. With major indices experiencing fluctuations, particularly in the technology sector, dividend stocks emerge as a potential stabilizing force for those seeking income amidst uncertainty. A good dividend stock often combines consistent payout history with financial resilience, making it an attractive consideration in today's volatile environment.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.85% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.72% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.06% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.45% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.20% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.62% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.18% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.63% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.83% | ★★★★★★ |

Click here to see the full list of 2017 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

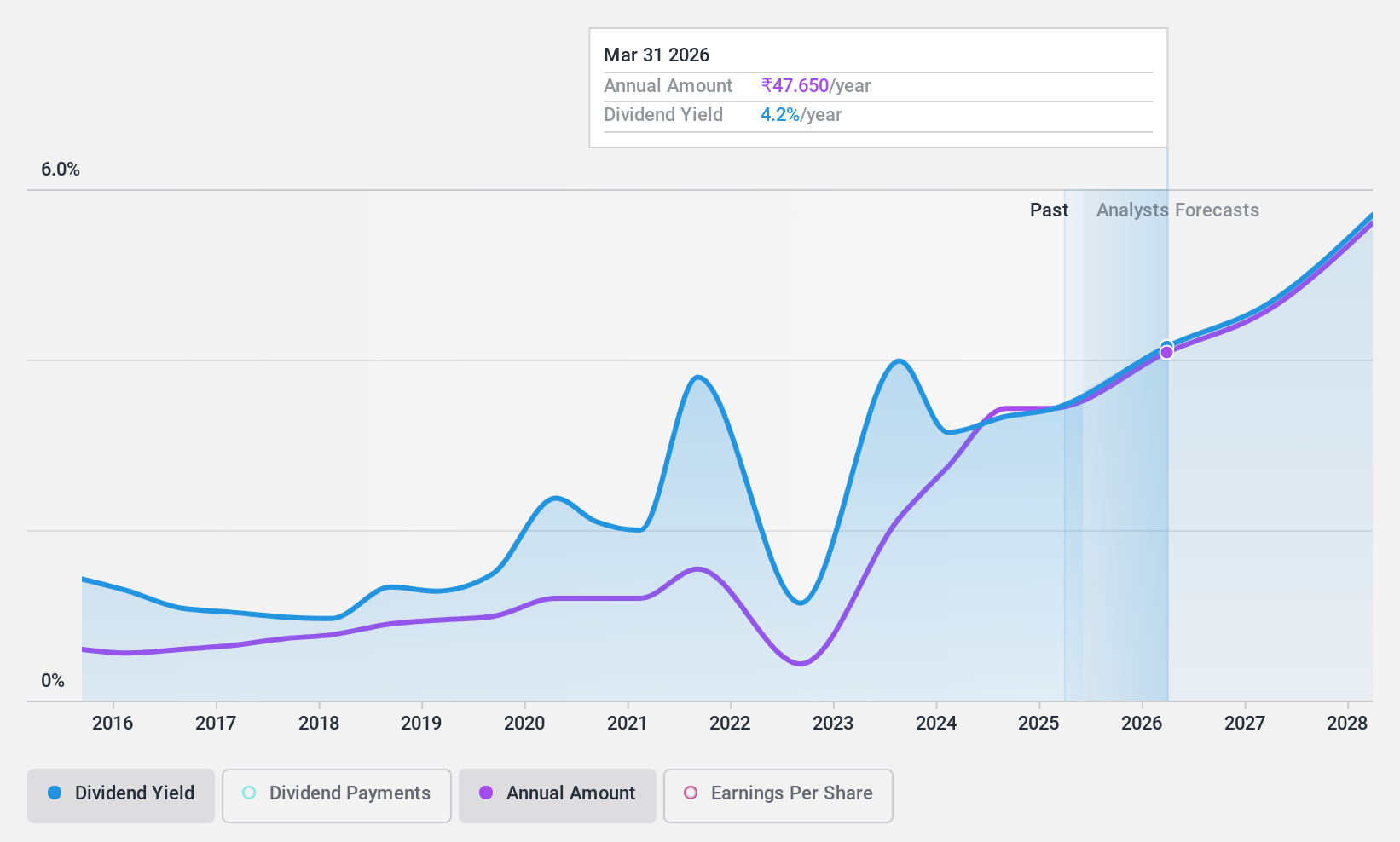

Gulf Oil Lubricants India (NSEI:GULFOILLUB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Gulf Oil Lubricants India Limited manufactures, markets, and trades lubricating oils, greases, and other derivatives for the automobile and industrial sectors in India with a market cap of ₹58.77 billion.

Operations: The company's revenue primarily comes from its lubricants segment, which generated ₹33.83 billion.

Dividend Yield: 3.4%

Gulf Oil Lubricants India presents a mixed picture for dividend investors. With a payout ratio of 57.4% and cash payout ratio of 62.8%, its dividends are well-covered by earnings and cash flows, though the dividend track record has been volatile over the past decade. Despite this instability, dividends have increased over time, placing it in the top 25% of Indian market payers with a yield of 3.35%. Recent strategic appointments may bolster growth prospects further.

- Navigate through the intricacies of Gulf Oil Lubricants India with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Gulf Oil Lubricants India is trading behind its estimated value.

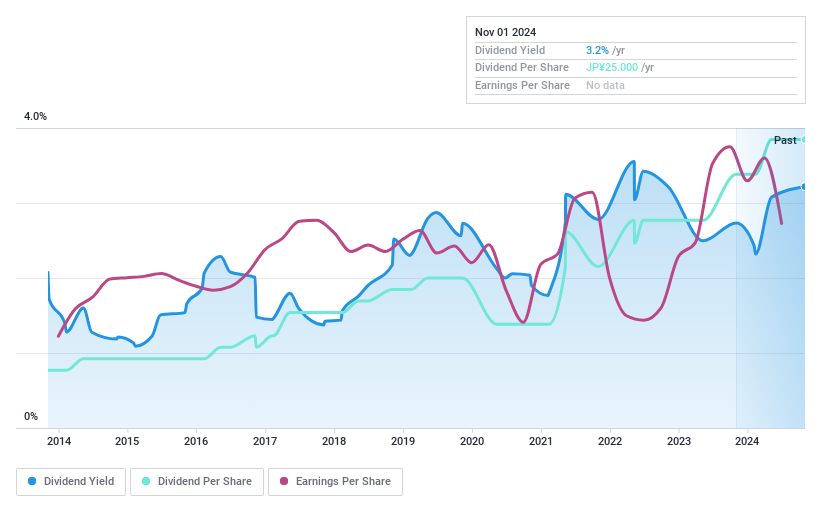

Parker (TSE:9845)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Parker Corporation engages in product development, manufacturing, sales, and technical services across various industries including automobiles, electrical machinery, chemicals, steel, electronics, and food with a market cap of ¥203.87 billion.

Operations: Parker Corporation's revenue segments include automobiles, electrical machinery, chemicals, steel, electronics, and food.

Dividend Yield: 3.1%

Parker's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 20.2% and a cash payout ratio of 15.8%. However, the dividends have been volatile over the past decade despite some growth. Currently trading at 70.8% below its estimated fair value, Parker's dividend yield of 3.07% is lower than the top quartile in Japan's market (3.82%). Profit margins have decreased from last year’s figures, potentially impacting future payouts.

- Dive into the specifics of Parker here with our thorough dividend report.

- The analysis detailed in our Parker valuation report hints at an deflated share price compared to its estimated value.

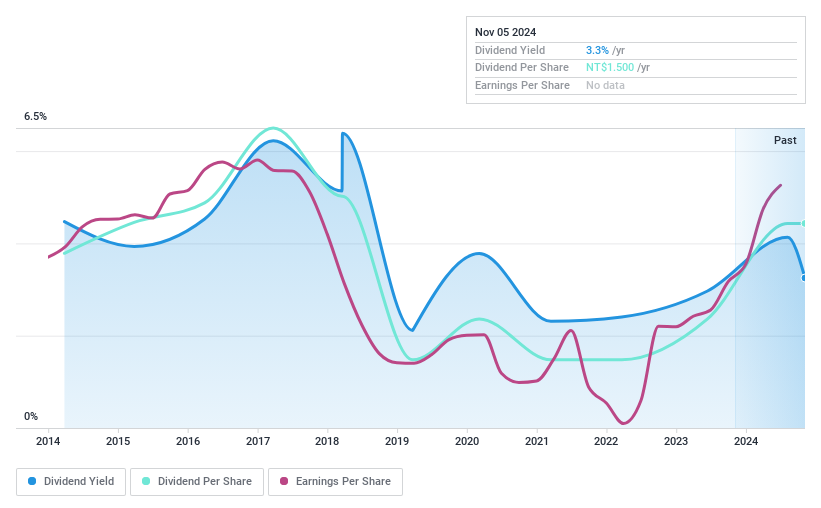

San Fang Chemical Industry (TWSE:1307)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: San Fang Chemical Industry Co., Ltd. is a company that manufactures and sells artificial leather, synthetic resin, and other materials across Taiwan, China, Hong Kong, Southeast Asia, and internationally with a market cap of NT$18.36 billion.

Operations: San Fang Chemical Industry Co., Ltd.'s revenue segments include GII at NT$1.08 billion, PTS at NT$2.44 billion, Sanfang Development Co., Ltd. at NT$1.75 billion, and SAN Fang Chemical Industry Co., Ltd. at NT$7.76 billion.

Dividend Yield: 3.3%

San Fang Chemical Industry's dividends are covered by earnings and cash flows, with payout ratios of 53% and 45.8%, respectively. However, the dividend history is unstable, showing volatility over the past decade. The current yield of 3.25% is below Taiwan's top quartile benchmark of 4.43%. Despite this, San Fang trades at a substantial discount to its estimated fair value and reported strong earnings growth recently, with net income rising significantly year-on-year.

- Click here and access our complete dividend analysis report to understand the dynamics of San Fang Chemical Industry.

- Insights from our recent valuation report point to the potential undervaluation of San Fang Chemical Industry shares in the market.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 2014 Top Dividend Stocks now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1307

San Fang Chemical Industry

Manufactures and sells artificial leather, synthetic resin, and other materials in Taiwan, China, Hong Kong, Southeast Asia, and internationally.

Flawless balance sheet, undervalued and pays a dividend.