- Taiwan

- /

- Tech Hardware

- /

- TWSE:2301

Three Prominent Dividend Stocks For January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are navigating a mixed landscape with U.S. stocks closing out a strong year despite recent volatility and European markets showing varied performance amid inflationary pressures. In this context, dividend stocks continue to attract attention for their potential to provide steady income streams, especially when market conditions present uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

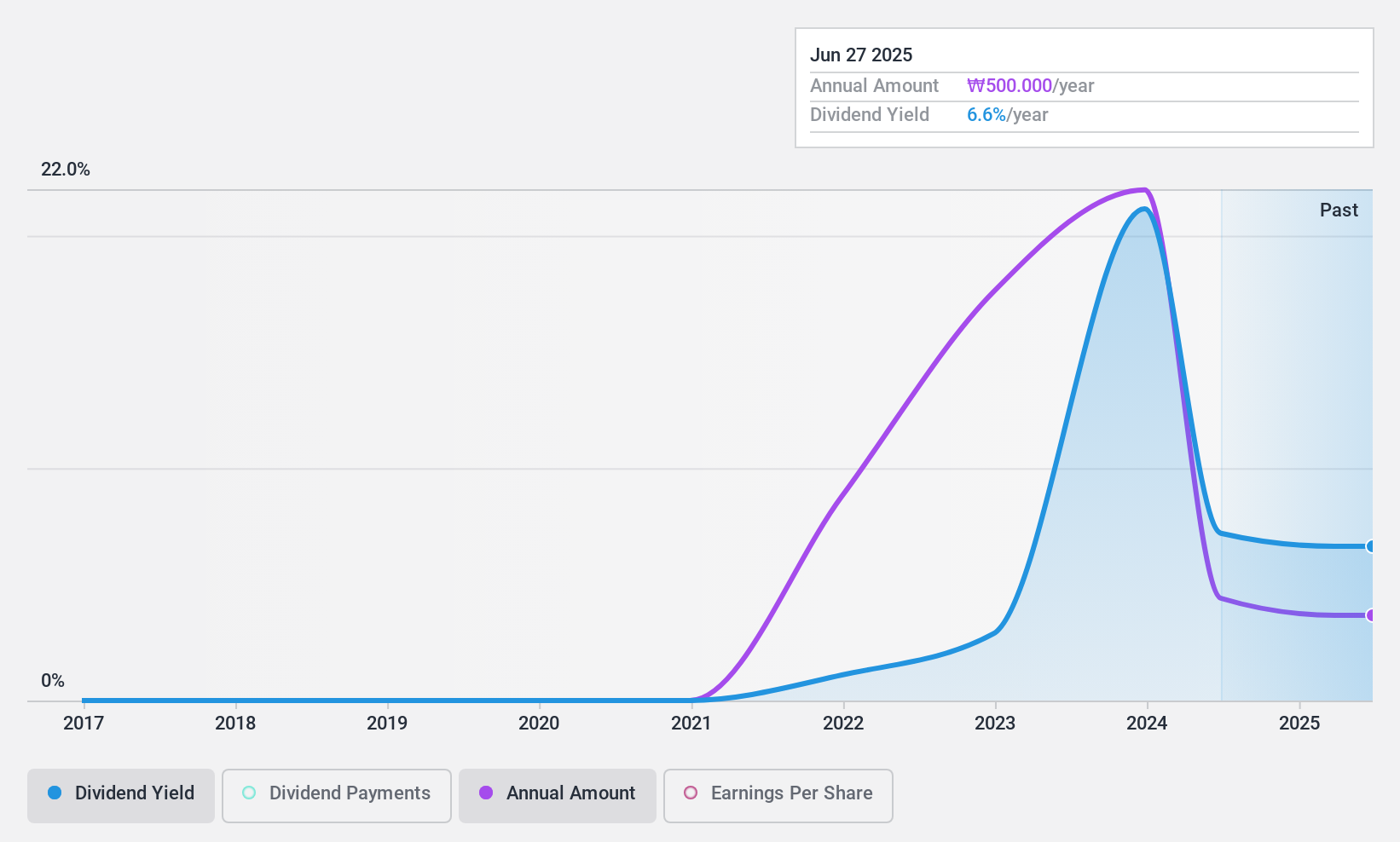

Dongkuk HoldingsLtd (KOSE:A001230)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dongkuk Holdings Co., Ltd. manufactures and sells steel products both in South Korea and internationally, with a market cap of ₩232.64 billion.

Operations: Dongkuk Holdings Co., Ltd.'s revenue is primarily derived from its Transit segment at ₩707.87 billion and Trade (including IT) segment at ₩766.77 billion, with additional contributions from its Steel segment totaling ₩412.85 billion.

Dividend Yield: 8%

Dongkuk Holdings Ltd. offers a dividend yield in the top 25% of the KR market, supported by a low payout ratio of 2.8% and cash payout ratio of 12.1%, indicating strong coverage by earnings and cash flows. However, its dividends have been volatile over the past four years, with payments decreasing since inception. Recent financials show improved profitability over nine months but highlight significant volatility in quarterly earnings, which may impact future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Dongkuk HoldingsLtd.

- Our expertly prepared valuation report Dongkuk HoldingsLtd implies its share price may be too high.

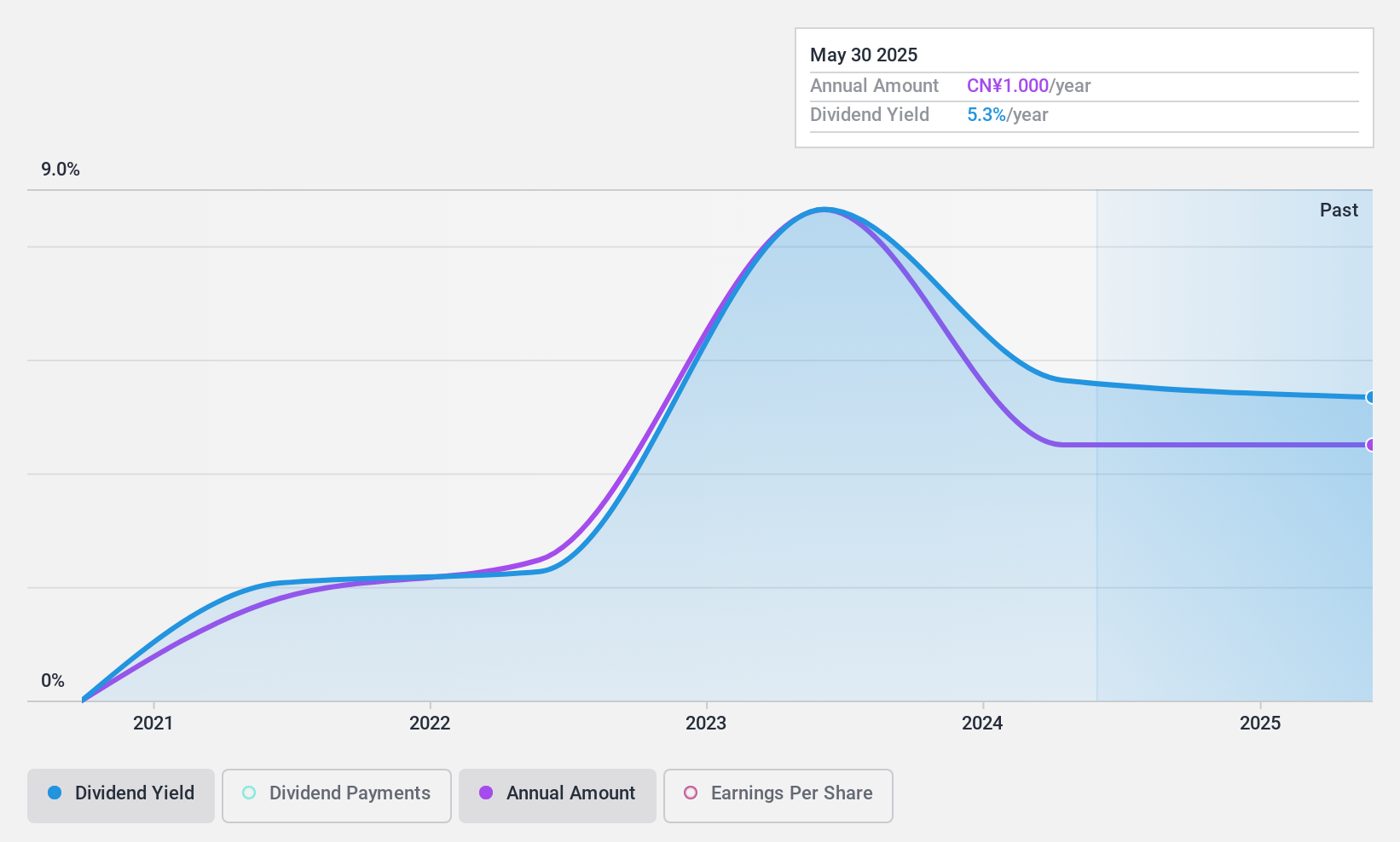

Zhejiang Jianye Chemical (SHSE:603948)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jianye Chemical Co., Ltd. is involved in the research, development, production, and sales of fine chemical products in China, with a market cap of CN¥3.05 billion.

Operations: Zhejiang Jianye Chemical Co., Ltd. generates revenue through its activities in the fine chemical sector within China.

Dividend Yield: 5.3%

Zhejiang Jianye Chemical's dividend yield ranks in the top 25% of the CN market, supported by a reasonable payout ratio of 66% and a cash payout ratio of 48.5%, indicating solid coverage by earnings and cash flows. However, its dividend history is unstable, with volatility over four years despite recent increases. Recent earnings show decreased revenue and net income for nine months ending September 2024, which could affect future dividend reliability.

- Click here to discover the nuances of Zhejiang Jianye Chemical with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Zhejiang Jianye Chemical's current price could be quite moderate.

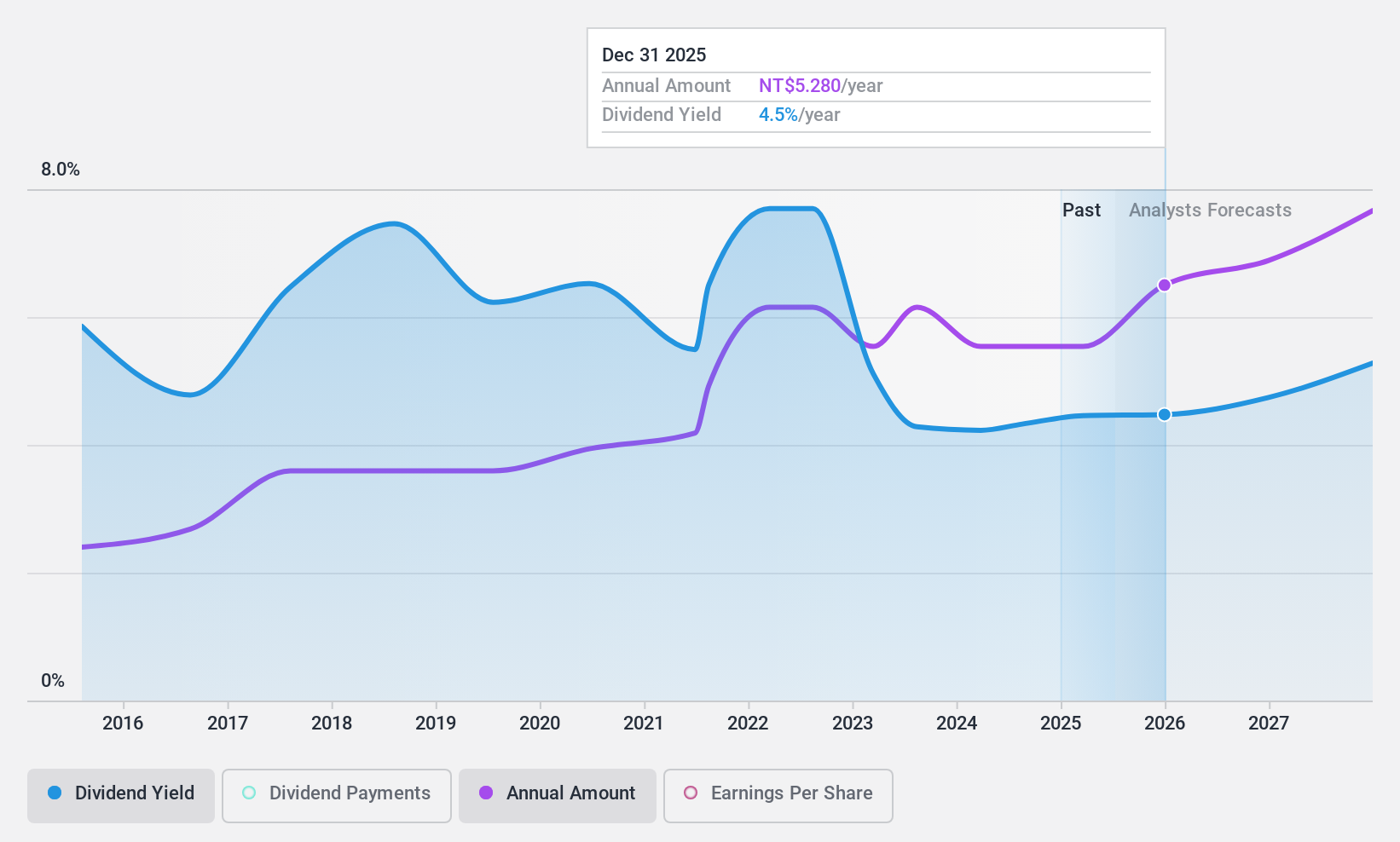

Lite-On Technology (TWSE:2301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lite-On Technology Corporation, with a market cap of NT$232.32 billion, is involved in the research, design, development, manufacture, and sale of modules and system solutions through its subsidiaries.

Operations: Lite-On Technology Corporation's revenue is primarily derived from the Information and Consumer Electronics Segment at NT$60.96 billion, followed by the Cloud and IoT Segment at NT$47.74 billion, and the Optoelectronic Department at NT$28.58 billion.

Dividend Yield: 4.4%

Lite-On Technology's dividend yield is slightly below the top 25% in Taiwan, with an 83.5% payout ratio indicating dividends are covered by earnings and cash flows. Despite a decade of increased payments, the dividend history remains volatile and unreliable. Recent earnings show a decline, which could impact future payouts. However, Lite-On's focus on AI and green computing innovations positions it competitively within high-performance computing sectors, potentially supporting long-term growth prospects.

- Click to explore a detailed breakdown of our findings in Lite-On Technology's dividend report.

- In light of our recent valuation report, it seems possible that Lite-On Technology is trading behind its estimated value.

Key Takeaways

- Investigate our full lineup of 1979 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2301

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion