As we enter the new year, global markets are reflecting a mix of optimism and caution, with major indices like the S&P 500 closing out a strong year despite recent volatility. Economic indicators such as the Chicago PMI highlight challenges in manufacturing, while positive trends in employment offer some balance to broader market sentiment. In this environment, identifying stocks with untapped potential involves looking for companies that can navigate these mixed signals effectively and demonstrate resilience amidst fluctuating economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Formosa Laboratories (TWSE:4746)

Simply Wall St Value Rating: ★★★★★★

Overview: Formosa Laboratories, Inc. operates in the pharmaceutical industry by manufacturing and selling active pharmaceutical ingredients (APIs) and ultraviolet absorbers across various international markets, with a market capitalization of approximately NT$8.50 billion.

Operations: Formosa Laboratories generates revenue primarily from active pharmaceutical ingredients (APIs), contributing NT$4.48 billion. The company has a market capitalization of approximately NT$8.50 billion, reflecting its presence in various international markets.

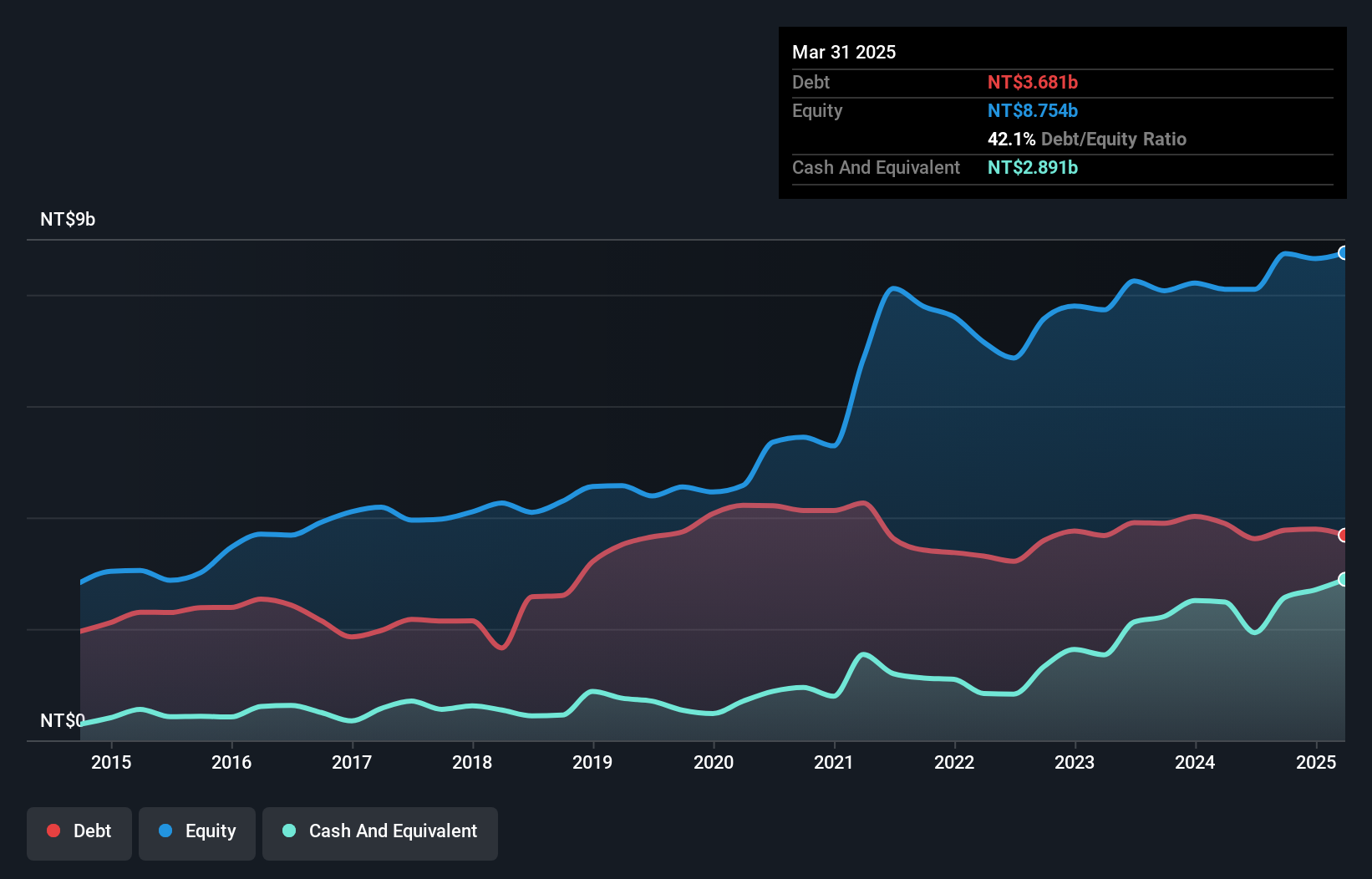

Formosa Labs, a nimble player in the pharmaceutical industry, is making waves with its robust financial health and growth trajectory. Earnings surged by 45.6% over the past year, outpacing the industry's 11.9%. The company trades at a significant discount of 61.5% below its fair value estimate, suggesting potential upside for investors. Despite a large one-off gain of NT$237M impacting recent results, Formosa's net debt to equity ratio stands at a satisfactory 13.8%, reflecting prudent financial management. Recent earnings showed improvement with TWD 210M net income for nine months ending September 2024 compared to last year's loss of TWD 56M.

- Delve into the full analysis health report here for a deeper understanding of Formosa Laboratories.

Gain insights into Formosa Laboratories' past trends and performance with our Past report.

FuSheng Precision (TWSE:6670)

Simply Wall St Value Rating: ★★★★★☆

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally, with a market capitalization of approximately NT$43.39 billion.

Operations: FuSheng Precision generates revenue primarily from its Golf Division, contributing NT$23.09 billion, and the Sports Assembly Division, adding NT$2.44 billion.

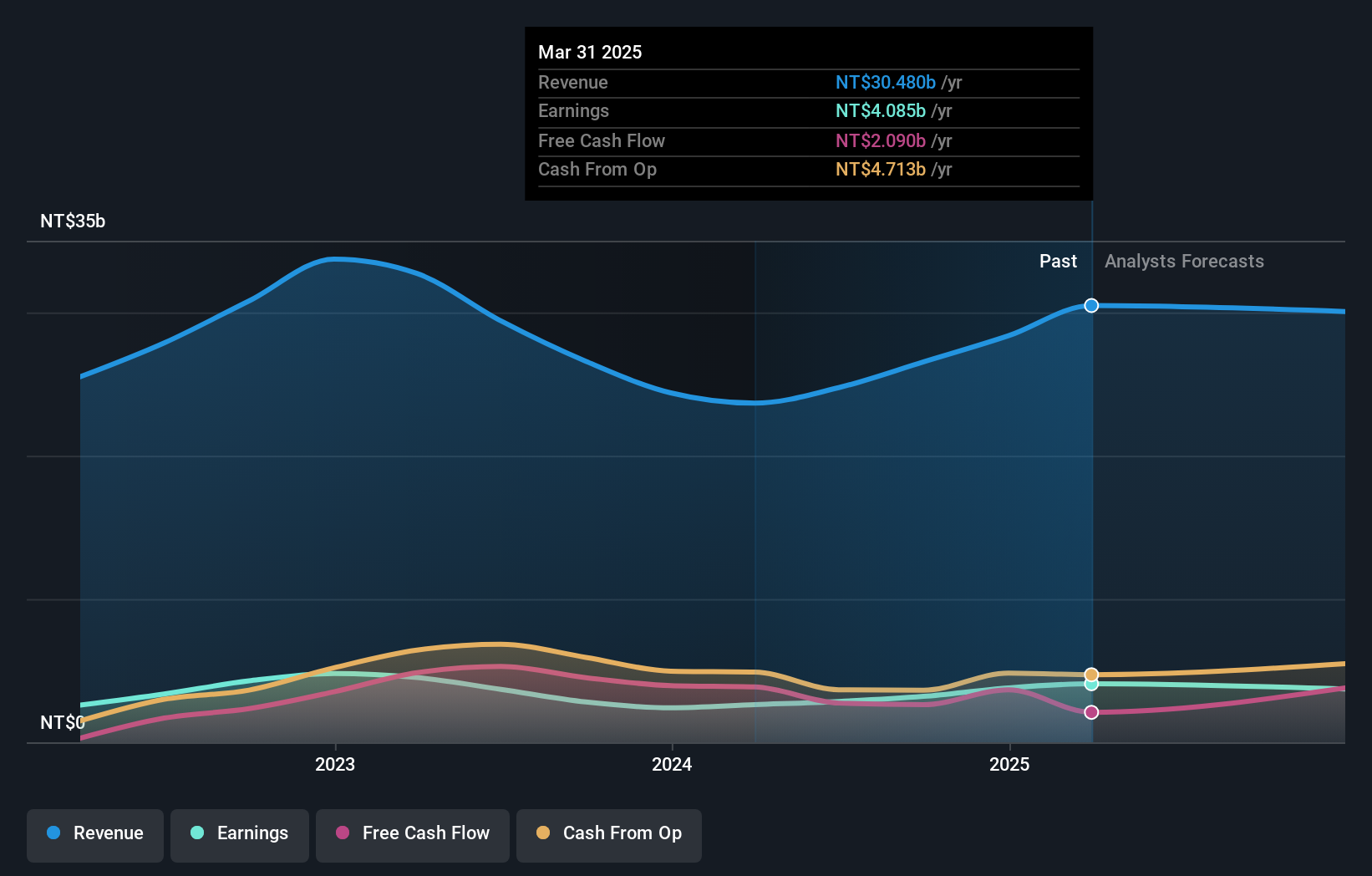

FuSheng Precision, a smaller player in its industry, recently showcased robust financial performance. For the third quarter of 2024, sales reached TWD 7.02 billion, up from TWD 5.23 billion the previous year. Net income also climbed to TWD 827 million compared to TWD 470 million a year prior, reflecting strong operational efficiency. Basic earnings per share improved to TWD 6.09 from last year's TWD 3.55, indicating enhanced shareholder value creation. The company's participation in investment forums suggests active engagement with investors and stakeholders as it continues on its growth trajectory within the market landscape.

CTCI (TWSE:9933)

Simply Wall St Value Rating: ★★★★☆☆

Overview: CTCI Corporation is involved in the design, surveying, construction, and inspection of engineering and construction plants, machinery and equipment, as well as environmental protection projects both domestically in Taiwan and internationally; it has a market cap of approximately NT$31.69 billion.

Operations: CTCI generates revenue primarily from its Construction Engineering Department, which contributes NT$119.09 billion, and the Environmental Resources Service, adding NT$8.65 billion. The General Sales Department and Other Operating Departments contribute NT$880.36 million and NT$490.55 million respectively to the total revenue stream.

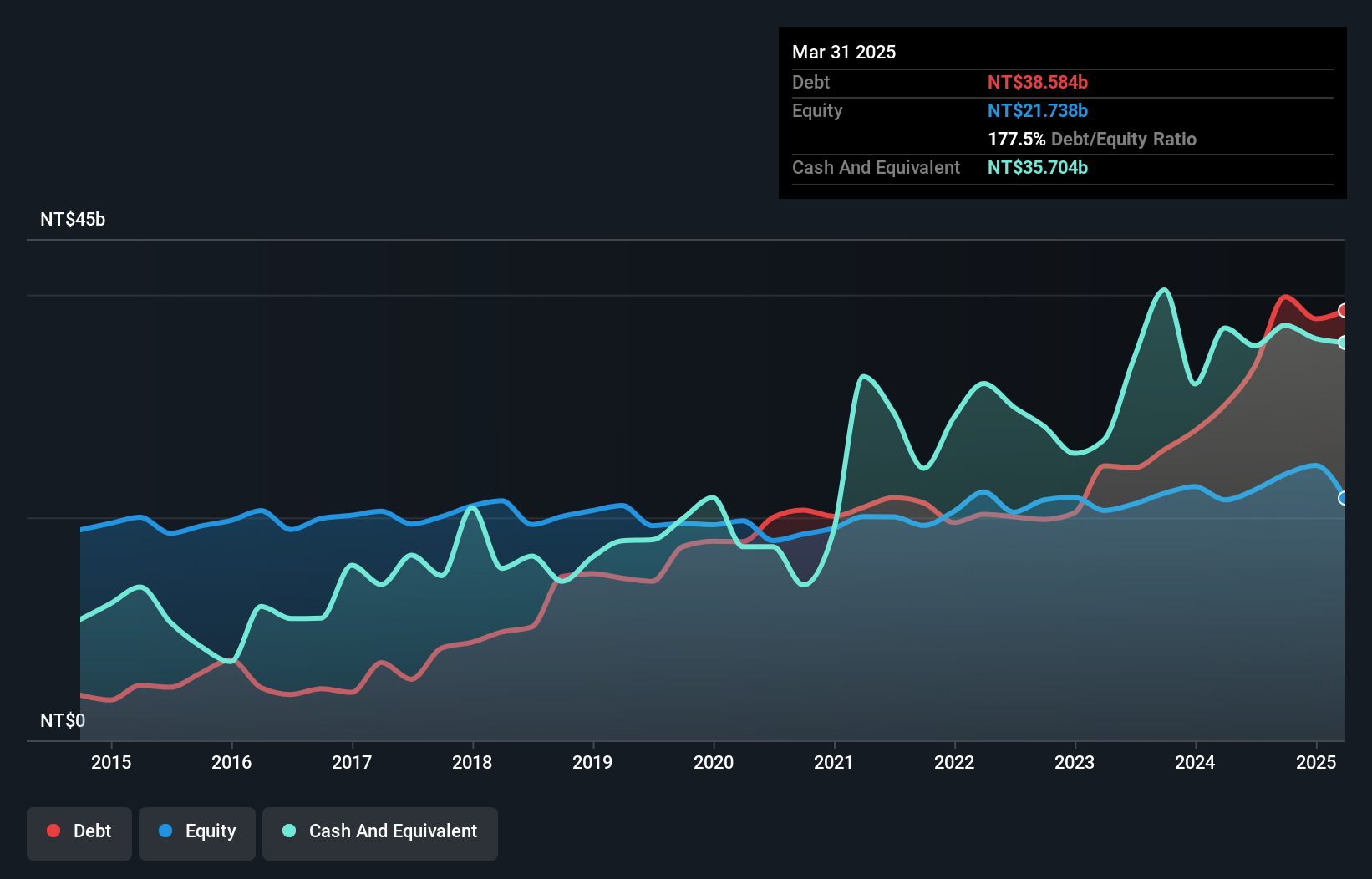

CTCI, a smaller player in the construction sector, has demonstrated notable growth with earnings rising 17.3% over the past year, outpacing the industry average of 9.3%. The company's price-to-earnings ratio of 15.8x suggests it trades at a favorable value compared to the broader TW market's 20.8x. Despite having high non-cash earnings, CTCI's free cash flow remains negative and its debt to equity ratio has increased significantly from 89.2% to 166.7% over five years, indicating potential leverage concerns. Recent quarterly results show sales climbing to TWD 28 billion but net income slipping slightly to TWD 379 million compared to last year’s third quarter figures.

- Click here and access our complete health analysis report to understand the dynamics of CTCI.

Review our historical performance report to gain insights into CTCI's's past performance.

Summing It All Up

- Click this link to deep-dive into the 4667 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4746

Formosa Laboratories

Manufactures and sells active pharmaceutical ingredients (APIs) and ultraviolet absorbers in India, the Netherlands, Japan, Germany, Taiwan, China, Switzerland, the United States, Canada, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives