- Japan

- /

- Trade Distributors

- /

- TSE:8015

Global Dividend Stocks Highlighting Three Top Picks

Reviewed by Simply Wall St

As global markets experience a period of cautious optimism amid easing trade tensions and mixed economic indicators, investors are increasingly turning their attention to dividend stocks for stability and income. In the current market environment, characterized by fluctuating consumer sentiment and economic growth concerns, a good dividend stock typically offers consistent payouts and resilience against volatility, making it an attractive option for those seeking to balance risk with reliable returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.21% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.97% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.93% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.10% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.16% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.38% | ★★★★★★ |

Click here to see the full list of 1528 stocks from our Top Global Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

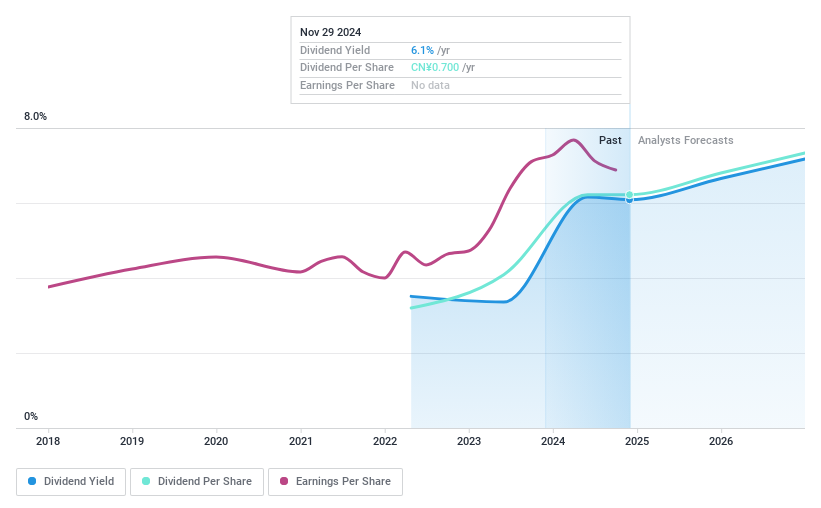

Beijing Caishikou Department StoreLtd (SHSE:605599)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Caishikou Department Store Co., Ltd. operates as a retail company with a market capitalization of CN¥10.52 billion, focusing on providing a variety of consumer goods and services.

Operations: The company's revenue is primarily derived from its Gold and Jewellery Sale segment, which generated CN¥19.53 billion.

Dividend Yield: 5%

Beijing Caishikou Department Store Ltd. offers a dividend yield of 5.03%, ranking in the top 25% among CN market payers, with dividends covered by earnings and cash flows at payout ratios of 81.4% and 61.6%, respectively. Despite only three years of payments, dividends have grown steadily without volatility. The stock trades at a slight discount to its fair value estimate, but the company's short dividend history may concern some investors seeking long-term stability.

- Get an in-depth perspective on Beijing Caishikou Department StoreLtd's performance by reading our dividend report here.

- Our expertly prepared valuation report Beijing Caishikou Department StoreLtd implies its share price may be lower than expected.

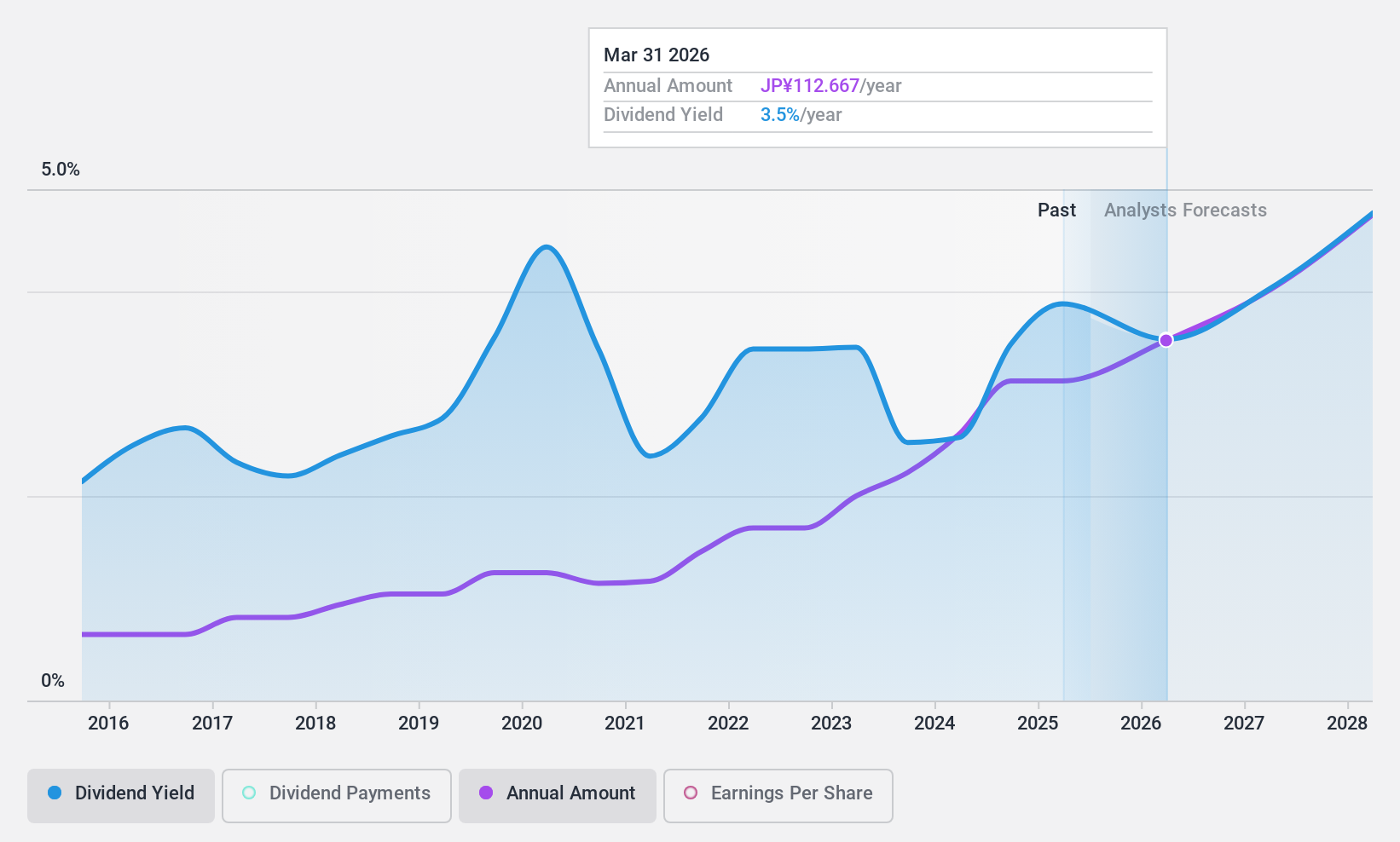

Toyota Tsusho (TSE:8015)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toyota Tsusho Corporation operates globally across sectors such as metals, parts and logistics, mobility, machinery, energy and projects, chemicals and electronics, and food and consumer services with a market cap of ¥2.81 trillion.

Operations: Toyota Tsusho Corporation's revenue segments include Metal (¥1.91 billion), Africa (¥1.65 billion), Mobility (¥1.02 billion), Lifestyle (¥547.09 million), Supply Chain (¥1.28 billion), Circular Economy (¥1.78 billion), Digital Solutions (¥1.35 billion), and Green Infrastructure (¥824.29 million).

Dividend Yield: 3.9%

Toyota Tsusho's dividend yield is in the top 25% of Japan's market. Despite a volatile dividend history over the past decade, current dividends are well covered by earnings and cash flows, with payout ratios of 30.6% and 37.1%, respectively. The stock trades at an attractive valuation, with a price-to-earnings ratio of 8.1x compared to the market average of 12.9x, indicating potential value for investors seeking dividend income alongside growth opportunities through recent quantum computing partnerships.

- Navigate through the intricacies of Toyota Tsusho with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Toyota Tsusho's share price might be too pessimistic.

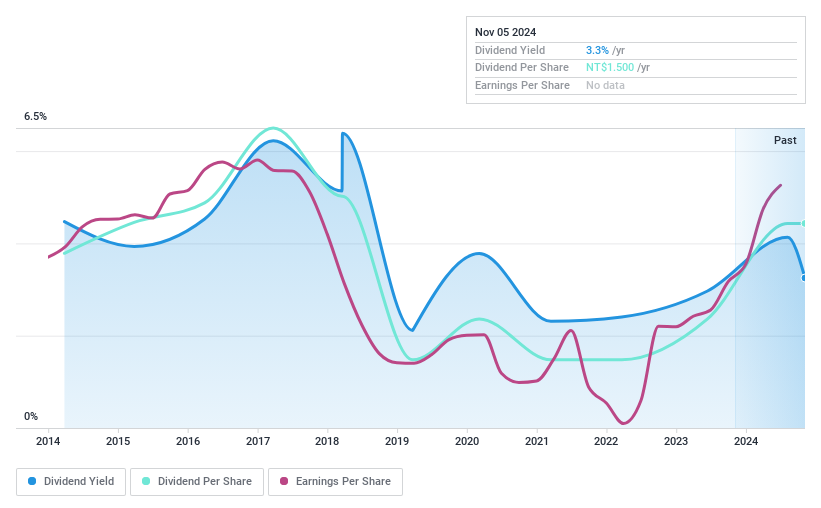

San Fang Chemical Industry (TWSE:1307)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: San Fang Chemical Industry Co., Ltd. is engaged in the manufacturing and sale of artificial leather, synthetic resin, and other materials across Taiwan, China, Hong Kong, Southeast Asia, and international markets with a market cap of NT$15.36 billion.

Operations: San Fang Chemical Industry Co., Ltd.'s revenue segments include NT$1.09 billion from GII, NT$2.65 billion from PTS, NT$1.80 billion from Sanfang Development Co., Ltd., and NT$8.24 billion from SAN Fang Chemical Industry Co., Ltd.

Dividend Yield: 6.9%

San Fang Chemical Industry's dividend yield ranks in the top 25% of Taiwan's market. Despite a history of volatility, recent earnings growth supports current dividends, with payout ratios of 72.6% from earnings and 77.3% from cash flows. The company recently increased its dividend to TWD 2.7 per share for 2024, distributing TWD 1.07 billion to shareholders, reflecting improved financial performance as net income nearly doubled year-over-year to TWD 1.48 billion.

- Unlock comprehensive insights into our analysis of San Fang Chemical Industry stock in this dividend report.

- In light of our recent valuation report, it seems possible that San Fang Chemical Industry is trading behind its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 1528 Top Global Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Tsusho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8015

Toyota Tsusho

Engages in the metals, parts and logistics, mobility, machinery, energy and project, chemicals and electronics, and food and consumer services businesses worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives