It's A Story Of Risk Vs Reward With Cathay Financial Holding Co., Ltd. (TWSE:2882)

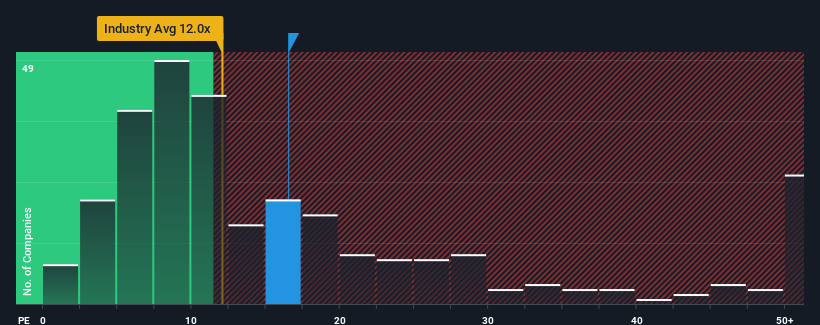

With a price-to-earnings (or "P/E") ratio of 16.5x Cathay Financial Holding Co., Ltd. (TWSE:2882) may be sending bullish signals at the moment, given that almost half of all companies in Taiwan have P/E ratios greater than 22x and even P/E's higher than 38x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Cathay Financial Holding as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Cathay Financial Holding

Is There Any Growth For Cathay Financial Holding?

In order to justify its P/E ratio, Cathay Financial Holding would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 47%. The last three years don't look nice either as the company has shrunk EPS by 51% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the ten analysts covering the company suggest earnings should grow by 67% over the next year. That's shaping up to be materially higher than the 22% growth forecast for the broader market.

In light of this, it's peculiar that Cathay Financial Holding's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Cathay Financial Holding's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Cathay Financial Holding currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Cathay Financial Holding has 2 warning signs we think you should be aware of.

You might be able to find a better investment than Cathay Financial Holding. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade Cathay Financial Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2882

Cathay Financial Holding

Through its subsidiaries, provides various financial products and services in Taiwan, rest of Asia, and internationally.

Good value with proven track record.