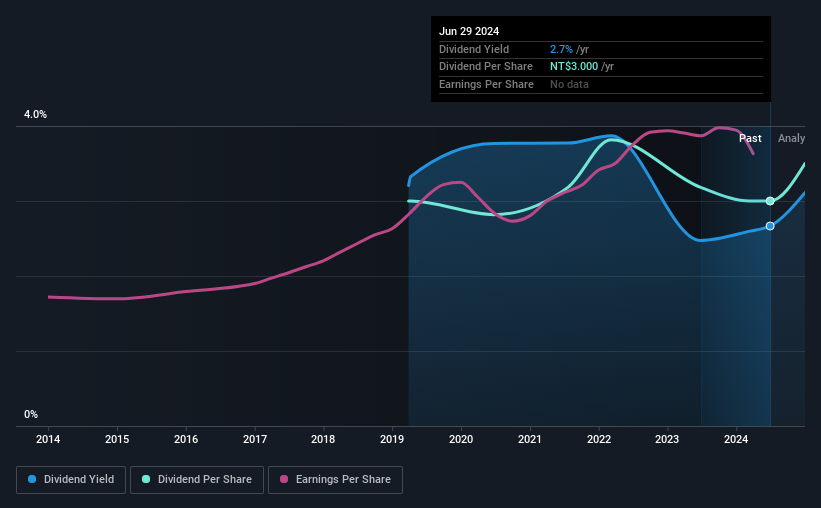

Hotai Finance Co., Ltd. (TWSE:6592) is reducing its dividend from last year's comparable payment to NT$3.00 on the 16th of August. The dividend yield of 2.7% is still a nice boost to shareholder returns, despite the cut.

View our latest analysis for Hotai Finance

Hotai Finance's Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, Hotai Finance was earning enough to cover the dividend, but it wasn't generating any free cash flows. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Looking forward, earnings per share is forecast to rise by 7.4% over the next year. Assuming the dividend continues along recent trends, we think the payout ratio could be 62% by next year, which is in a pretty sustainable range.

Hotai Finance Is Still Building Its Track Record

Hotai Finance's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The last annual payment of NT$3.00 was flat on the annual payment from5 years ago. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

Dividend Growth May Be Hard To Achieve

The company's investors will be pleased to have been receiving dividend income for some time. However, Hotai Finance's EPS was effectively flat over the past five years, which could stop the company from paying more every year. Growth of 1.8% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

An additional note is that the company has been raising capital by issuing stock equal to 18% of shares outstanding in the last 12 months. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

Our Thoughts On Hotai Finance's Dividend

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. While Hotai Finance is earning enough to cover the payments, the cash flows are lacking. We don't think Hotai Finance is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. To that end, Hotai Finance has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Hotai Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6592

Hotai Finance

Provides vehicle installment sales, and leasing of vehicles and equipment services in Taiwan and China.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives