- Taiwan

- /

- Diversified Financial

- /

- TWSE:7722

Discovering November 2024's Undiscovered Gems on None Exchange

Reviewed by Simply Wall St

As global markets react to a "red sweep" in the U.S. elections, small-cap stocks have shown remarkable resilience, with the Russell 2000 Index leading gains despite remaining below its record highs. Amidst these dynamic market conditions, identifying undiscovered gems involves seeking companies that can capitalize on potential policy shifts and economic stimuli while maintaining strong fundamentals and growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 9.68% | 28.34% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Qifeng New Material (SZSE:002521)

Simply Wall St Value Rating: ★★★★★☆

Overview: Qifeng New Material Co., Ltd. is engaged in the research, development, manufacturing, and sale of decorative base papers, overlay papers, and non-woven wallpaper base papers in China with a market capitalization of CN¥5.06 billion.

Operations: Qifeng generates revenue primarily from the sale of decorative base papers, overlay papers, and non-woven wallpaper base papers. The company's net profit margin is a key financial metric to consider when analyzing its profitability.

Qifeng New Material, a smaller player in its sector, showcases mixed financial signals. Despite earnings growing at 4.6% annually over the past five years and trading at about 30.6% below estimated fair value, recent performance has been challenging. For the nine months ending September 2024, sales hit CNY 2.55 billion against last year's CNY 2.71 billion, while net income was CNY 106 million compared to CNY 157 million previously. The company's debt to equity ratio rose from 11% to nearly 16%, indicating increased leverage over five years, though it remains profitable with strong interest coverage capabilities and high-quality earnings.

- Navigate through the intricacies of Qifeng New Material with our comprehensive health report here.

Understand Qifeng New Material's track record by examining our Past report.

LINE Pay Taiwan (TPEX:7722)

Simply Wall St Value Rating: ★★★★★★

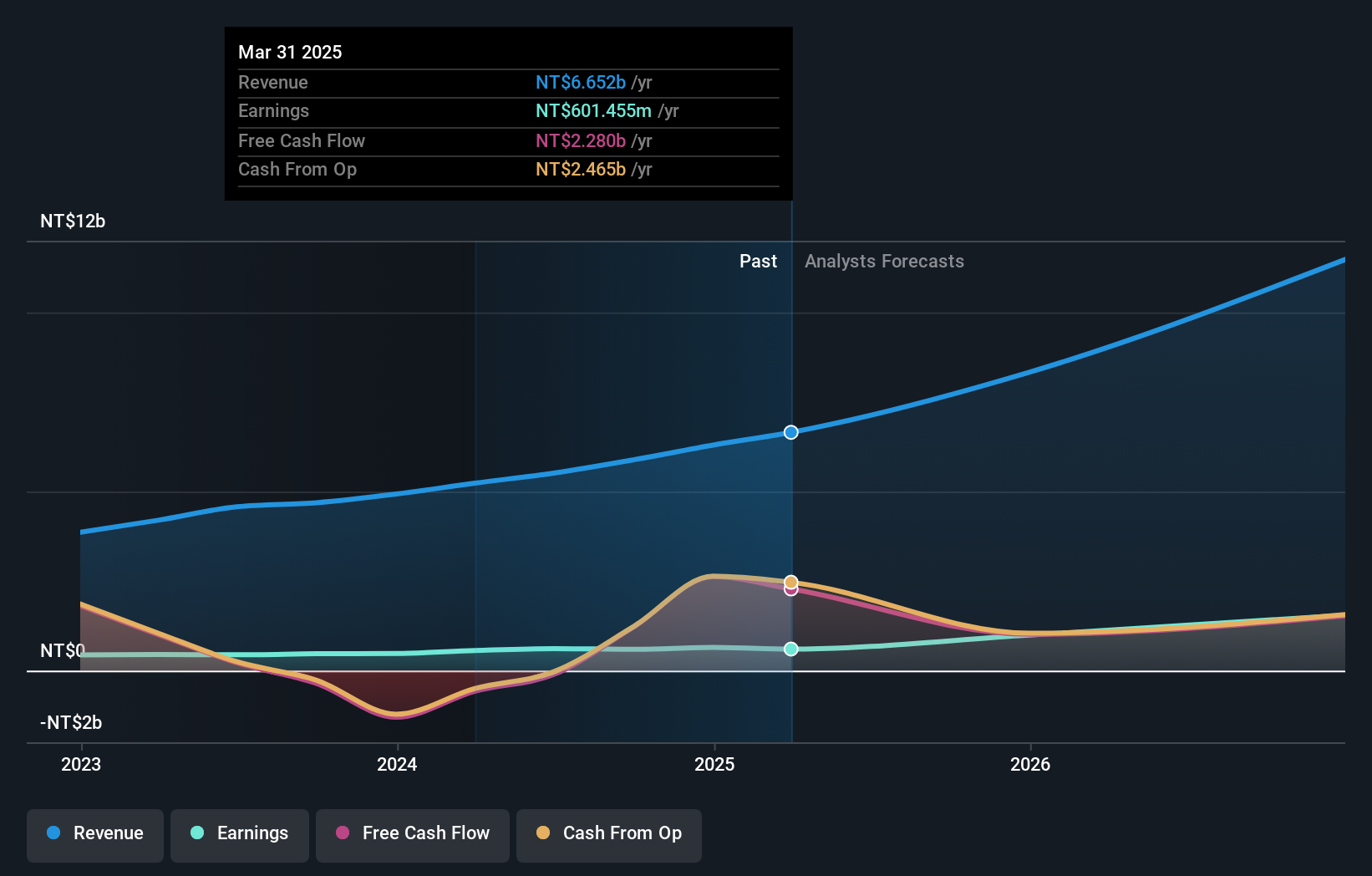

Overview: LINE Pay Taiwan Limited operates in the third-party payment sector within Taiwan and has a market capitalization of NT$39.78 billion.

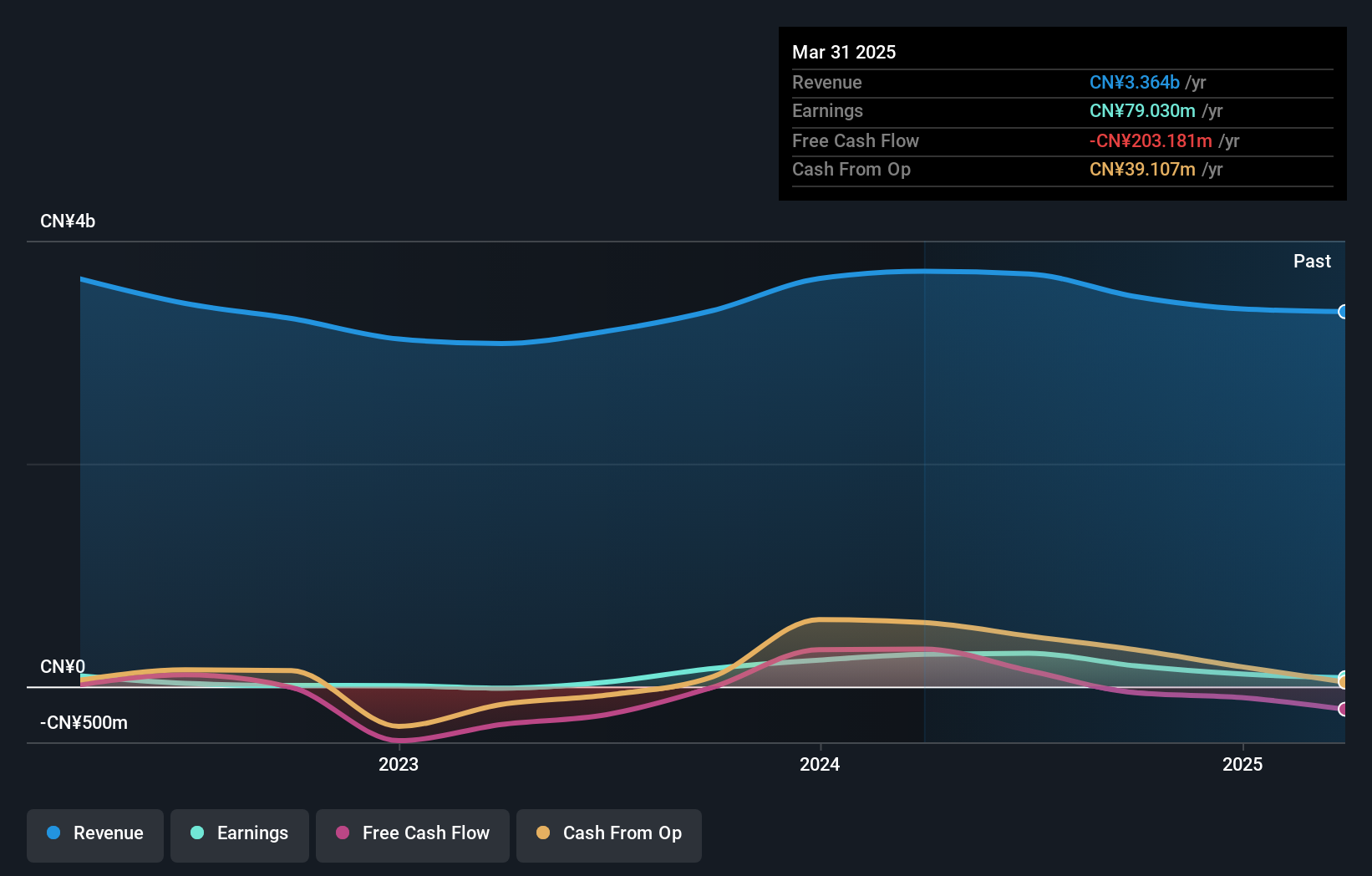

Operations: The company generates revenue primarily from data processing, amounting to NT$5.52 billion.

LINE Pay Taiwan, a dynamic player in the financial sector, has shown impressive growth with earnings soaring by 39.5% over the past year, outpacing its industry peers. The company boasts high-quality non-cash earnings and remains debt-free, eliminating concerns about interest coverage. Recent performance highlights include second-quarter sales of TWD 1.48 billion and net income reaching TWD 159 million, up from TWD 105 million last year. Basic earnings per share stood at TWD 2.65 compared to TWD 1.77 previously. Additionally, inclusion in the S&P Global BMI Index underscores its growing market presence and potential for future expansion.

Hyakujushi Bank (TSE:8386)

Simply Wall St Value Rating: ★★★★★☆

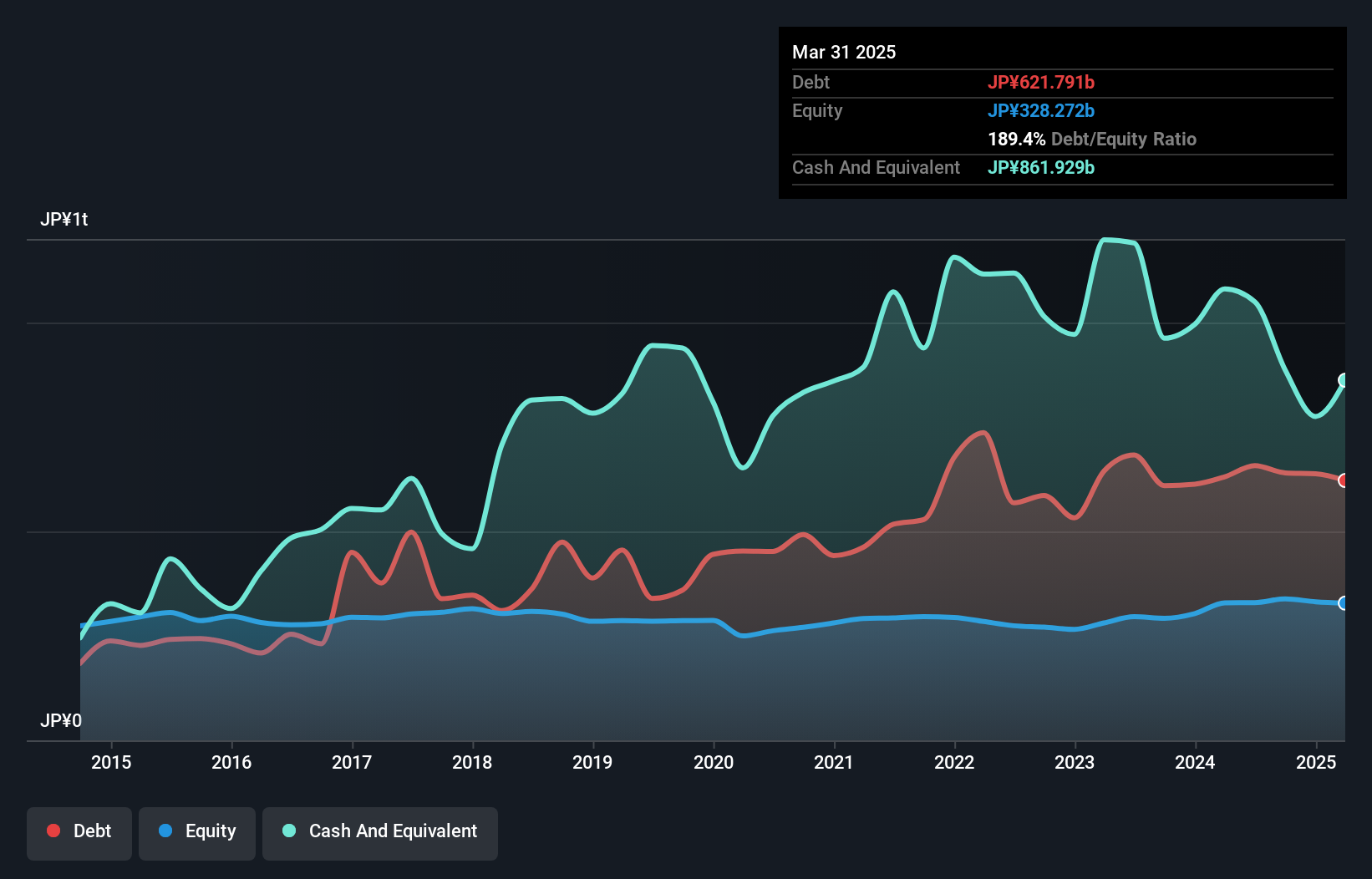

Overview: The Hyakujushi Bank, Ltd. primarily engages in banking activities in Japan and has a market capitalization of ¥79.87 billion.

Operations: Hyakujushi Bank generates revenue through its core banking operations in Japan. The bank's financial performance is characterized by its market capitalization of ¥79.87 billion, reflecting its position within the industry.

Hyakujushi Bank, a smaller player in the banking sector, shows a mixed financial landscape. With total assets of ¥5.78 trillion and equity at ¥338.5 billion, it presents a solid foundation but faces challenges with a low bad loan allowance of 33%. The bank's net interest margin stands at 0.7%, reflecting its cautious lending approach amidst primarily low-risk funding sources comprising 86% customer deposits. Notably, earnings growth over the past year outpaced industry averages by reaching 39%, suggesting underlying operational strength despite an insufficient allowance for bad loans at 1.4% of total loans. Recent share repurchases indicate strategic capital management efforts to enhance shareholder value.

- Delve into the full analysis health report here for a deeper understanding of Hyakujushi Bank.

Review our historical performance report to gain insights into Hyakujushi Bank's's past performance.

Key Takeaways

- Get an in-depth perspective on all 4664 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:7722

LINE Pay Taiwan

Engages in third-party payment-related business in Taiwan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives