3 Stocks Estimated To Be Trading Up To 41.3% Below Intrinsic Value

Reviewed by Simply Wall St

In a week marked by busy earnings reports and macroeconomic data, global markets saw mixed performances with major U.S. indexes finishing mostly lower, while European markets faced pressure from geopolitical concerns and economic forecasts. Amidst this volatility, investors are increasingly on the lookout for stocks that may be undervalued relative to their intrinsic value as they navigate cautious market conditions. Identifying such stocks involves assessing companies with strong fundamentals that may not yet be fully appreciated by the market, offering potential opportunities for growth as broader economic factors stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.85 | US$37.48 | 49.7% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥97.24 | CN¥194.47 | 50% |

| Arteche Lantegi Elkartea (BME:ART) | €6.10 | €12.20 | 50% |

| Elica (BIT:ELC) | €1.725 | €3.44 | 49.8% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 50% |

| Bangkok Genomics Innovation (SET:BKGI) | THB2.68 | THB5.35 | 49.9% |

| BayCurrent Consulting (TSE:6532) | ¥4902.00 | ¥9762.93 | 49.8% |

| Redcentric (AIM:RCN) | £1.20 | £2.39 | 49.8% |

| Beijing LeiKe Defense Technology (SZSE:002413) | CN¥4.72 | CN¥9.39 | 49.8% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$273.91 | US$546.14 | 49.8% |

Here's a peek at a few of the choices from the screener.

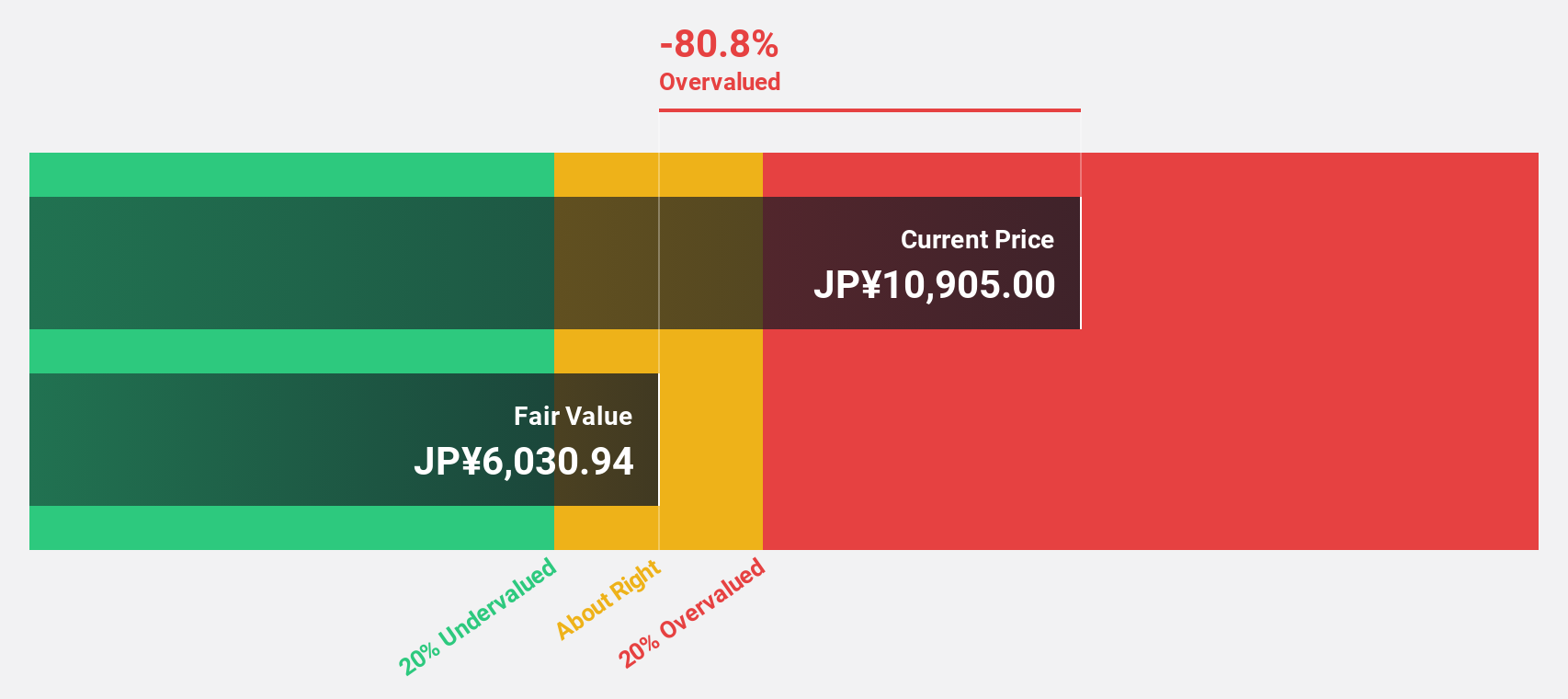

Kawasaki Heavy Industries (TSE:7012)

Overview: Kawasaki Heavy Industries, Ltd. operates in aerospace systems, energy solutions and marine engineering, precision machinery and robotics, rolling stock, and motorcycle and engine sectors both in Japan and internationally with a market cap of ¥959.11 billion.

Operations: The company's revenue segments include Aerospace Business at ¥435.40 billion, Power Sports & Engine at ¥594.38 billion, Energy Solutions & Marine at ¥388.09 billion, Precision Machinery / Robot at ¥249.35 billion, and Vehicle at ¥196.26 billion.

Estimated Discount To Fair Value: 25%

Kawasaki Heavy Industries appears undervalued, trading 25% below its estimated fair value of ¥7635.87. Despite a volatile share price recently, the company is expected to grow earnings significantly at 22.1% annually, outpacing the JP market's 8.9%. However, debt coverage by operating cash flow is weak and profit margins have declined from last year’s 3.2% to 1.7%, raising concerns about dividend sustainability and future return on equity projections.

- Our earnings growth report unveils the potential for significant increases in Kawasaki Heavy Industries' future results.

- Unlock comprehensive insights into our analysis of Kawasaki Heavy Industries stock in this financial health report.

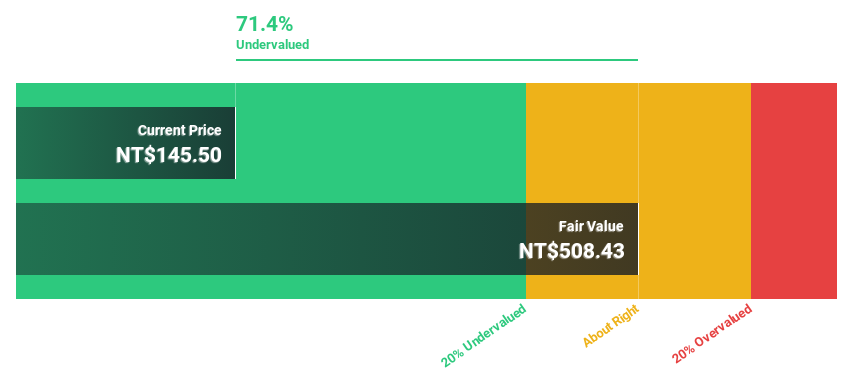

Johnson Health Tech .Co (TWSE:1736)

Overview: Johnson Health Tech. Co., Ltd. manufactures and sells sports and fitness equipment across the Americas, Europe, Asia, and other international markets with a market cap of NT$47.68 billion.

Operations: The company's revenue segments are comprised of NT$36.91 billion from Asia, NT$10.35 billion from Europe, and NT$20.94 billion from America.

Estimated Discount To Fair Value: 41.3%

Johnson Health Tech .Co. is trading at NT$157.5, significantly undervalued with an estimated fair value of NT$268.27, suggesting potential upside based on cash flows. Despite recent share price volatility and high debt levels, earnings are projected to grow 33.54% annually, surpassing the TW market's growth rate of 19.1%. Recent expansions in Vietnam could enhance revenue streams, although net income decreased in Q2 compared to last year despite higher sales figures.

- The growth report we've compiled suggests that Johnson Health Tech .Co's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Johnson Health Tech .Co's balance sheet health report.

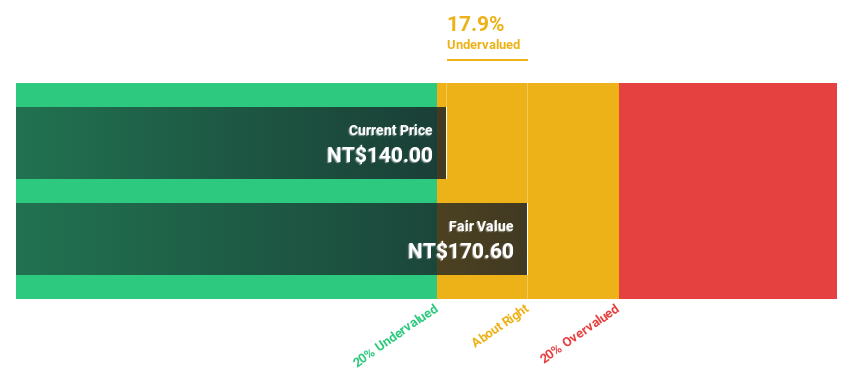

Sports Gear (TWSE:6768)

Overview: Sports Gear Co., Ltd. manufactures and sells OEM footwear products across the United States, Europe, Asia, China, Taiwan, and internationally with a market cap of NT$25.58 billion.

Operations: The company generates revenue of NT$15.93 billion from its Footwear Manufacturing Business.

Estimated Discount To Fair Value: 23.4%

Sports Gear Co., Ltd. is trading at NT$130.5, undervalued relative to its estimated fair value of NT$170.38, indicating potential based on cash flows. Despite a volatile share price and a dividend not well-covered by free cash flows, earnings are projected to grow 38.1% annually, outpacing the TW market's 19.1%. Recent revenue growth and a TWD 1 billion fixed-income offering could support future financial stability and expansion efforts.

- Our growth report here indicates Sports Gear may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Sports Gear.

Make It Happen

- Navigate through the entire inventory of 955 Undervalued Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1736

Johnson Health Tech .Co

Johnson Health Tech. Co., Ltd. engages in the manufacture and sale of sports and fitness equipment in the Americas, Europe, Asia, and internationally.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives