3 Companies With Estimated Value Discrepancies In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by fluctuating interest rates and competitive pressures in the AI sector, investors are keenly observing the movements of major indices, with tech stocks experiencing notable volatility. In this environment, identifying undervalued stocks can be particularly appealing for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhongji Innolight (SZSE:300308) | CN¥98.25 | CN¥195.56 | 49.8% |

| Reach Subsea (OB:REACH) | NOK8.06 | NOK16.12 | 50% |

| TF Bank (OM:TFBANK) | SEK376.00 | SEK750.28 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK82.94 | SEK165.72 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.97 | CA$11.89 | 49.8% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.23 | US$26.31 | 49.7% |

| Groupe Dynamite (TSX:GRGD) | CA$16.11 | CA$32.07 | 49.8% |

| WuXi XDC Cayman (SEHK:2268) | HK$28.25 | HK$56.12 | 49.7% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | US$37.70 | US$75.20 | 49.9% |

| Kyndryl Holdings (NYSE:KD) | US$43.45 | US$86.66 | 49.9% |

Let's dive into some prime choices out of the screener.

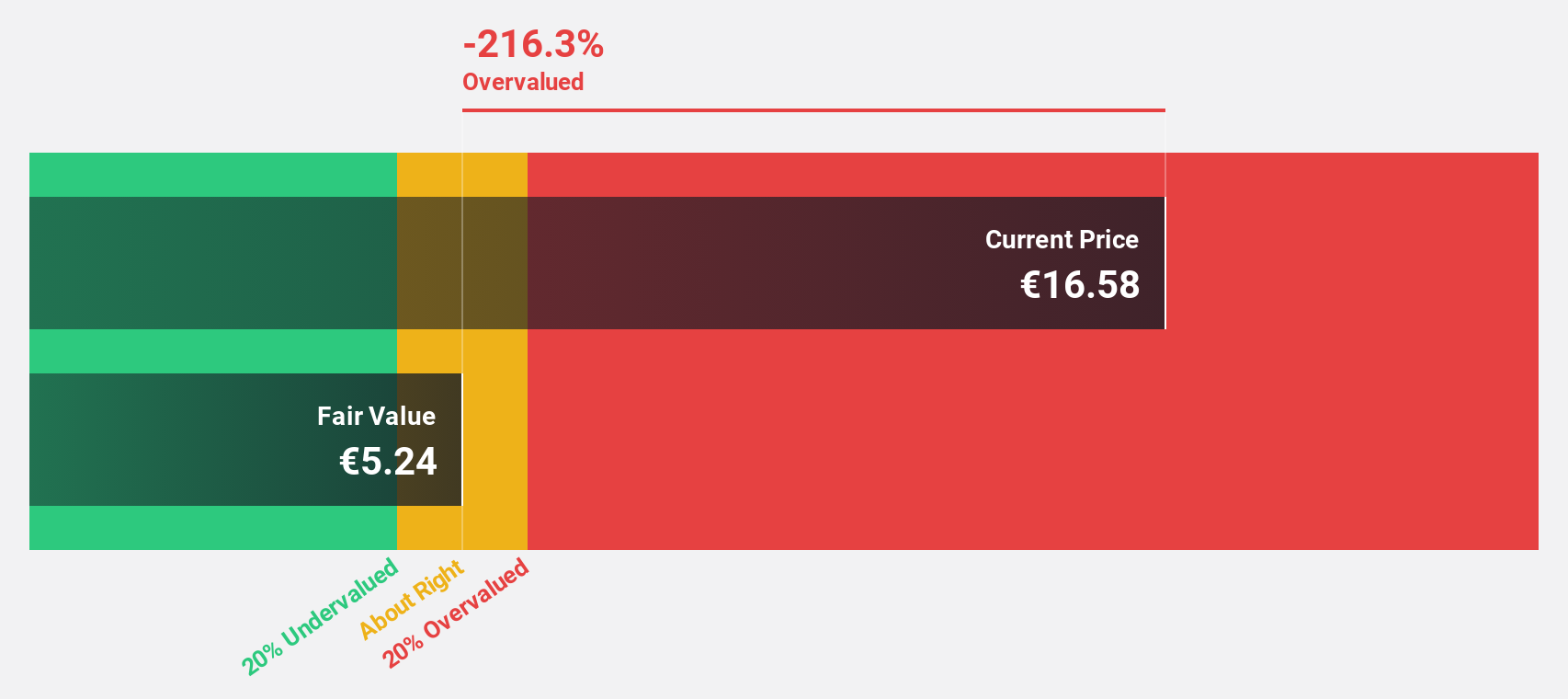

Fincantieri (BIT:FCT)

Overview: Fincantieri S.p.A. is a global player in the shipbuilding industry with a market capitalization of approximately €2.44 billion.

Operations: The company generates revenue primarily from its Shipbuilding segment (€5.90 billion), followed by Offshore and Specialized Vessels (€1.28 billion) and Equipment, Systems and Infrastructure (€1.35 billion).

Estimated Discount To Fair Value: 46%

Fincantieri is trading at €7.56, significantly below its estimated fair value of €14.01, indicating it may be undervalued based on discounted cash flow analysis. Despite recent shareholder dilution, earnings are forecast to grow 82.1% annually as the company is expected to become profitable within three years, outpacing average market growth. Strategic partnerships with Lloyds Engineering Works enhance its role in India's defense sector, potentially boosting future revenue streams and supporting long-term growth prospects.

- In light of our recent growth report, it seems possible that Fincantieri's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Fincantieri.

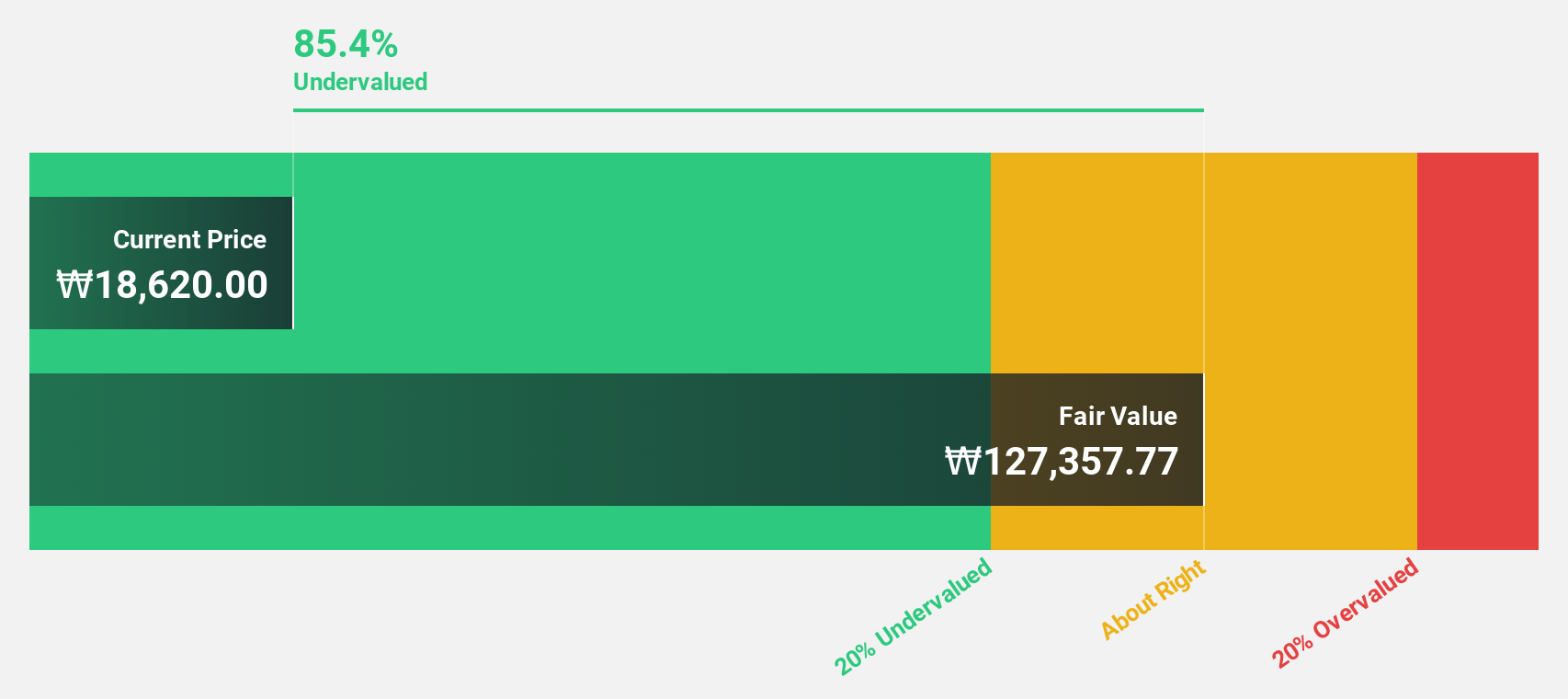

Vuno (KOSDAQ:A338220)

Overview: Vuno Inc. is a medical artificial intelligence solution development company with a market cap of ₩372.37 billion.

Operations: The company generates revenue from its artificial intelligence medical software production, amounting to ₩23.72 billion.

Estimated Discount To Fair Value: 20.7%

Vuno is trading at ₩26,650, below its estimated fair value of ₩33,591.97, suggesting it could be undervalued based on cash flow analysis. With revenue projected to grow 44.9% annually—surpassing the market's 8.8%—and expected profitability within three years, Vuno shows promising growth potential. Recent private placements totaling approximately ₩23.73 billion may provide strategic capital for expansion and innovation in smart healthcare technologies despite share price volatility.

- Insights from our recent growth report point to a promising forecast for Vuno's business outlook.

- Click here to discover the nuances of Vuno with our detailed financial health report.

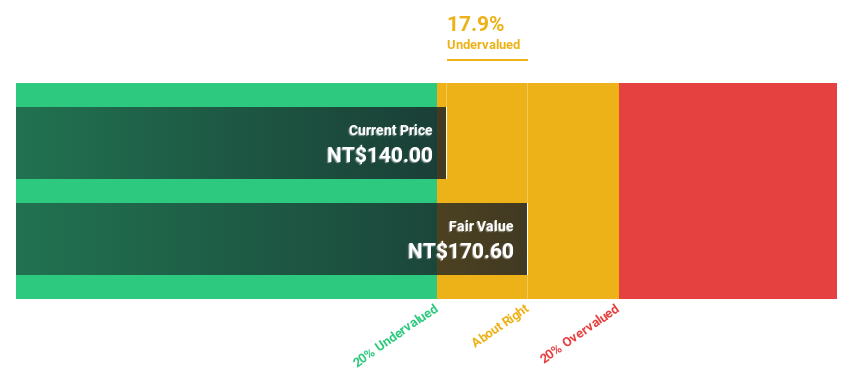

Sports Gear (TWSE:6768)

Overview: Sports Gear Co., Ltd. manufactures and sells OEM footwear products across the United States, Europe, Asia, China, Taiwan, and internationally with a market cap of NT$27.45 billion.

Operations: The company generates revenue of NT$17.27 billion from its footwear manufacturing business.

Estimated Discount To Fair Value: 17.8%

Sports Gear is trading at NT$140, below its estimated fair value of NT$170.31, indicating potential undervaluation based on cash flow analysis. The company reported a substantial earnings growth of 79.4% over the past year and forecasts suggest annual profit growth of 29%, outpacing the TW market's 17.5%. Despite recent share price volatility and a dividend not well-covered by free cash flows, revenue is expected to grow at 20.2% annually.

- According our earnings growth report, there's an indication that Sports Gear might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Sports Gear.

Make It Happen

- Click here to access our complete index of 925 Undervalued Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FCT

Undervalued with reasonable growth potential.

Market Insights

Community Narratives