Here's Why It's Unlikely That Zig Sheng Industrial Co., Ltd.'s (TWSE:1455) CEO Will See A Pay Rise This Year

Key Insights

- Zig Sheng Industrial's Annual General Meeting to take place on 6th of June

- Total pay for CEO Pat-Huang Su includes NT$3.05m salary

- The total compensation is similar to the average for the industry

- Over the past three years, Zig Sheng Industrial's EPS fell by 105% and over the past three years, the total loss to shareholders 46%

Shareholders will probably not be too impressed with the underwhelming results at Zig Sheng Industrial Co., Ltd. (TWSE:1455) recently. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 6th of June. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Zig Sheng Industrial

How Does Total Compensation For Pat-Huang Su Compare With Other Companies In The Industry?

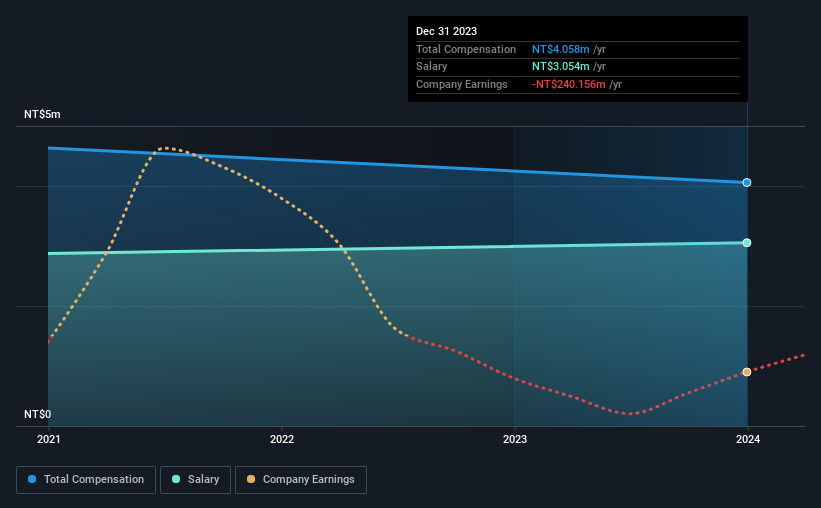

At the time of writing, our data shows that Zig Sheng Industrial Co., Ltd. has a market capitalization of NT$7.4b, and reported total annual CEO compensation of NT$4.1m for the year to December 2023. There was no change in the compensation compared to last year. Notably, the salary which is NT$3.05m, represents most of the total compensation being paid.

On comparing similar companies from the Taiwanese Luxury industry with market caps ranging from NT$3.2b to NT$13b, we found that the median CEO total compensation was NT$4.5m. So it looks like Zig Sheng Industrial compensates Pat-Huang Su in line with the median for the industry.

| Component | 2023 | 2023 | Proportion (2023) |

| Salary | NT$3.1m | NT$3.1m | 75% |

| Other | NT$1.0m | NT$1.0m | 25% |

| Total Compensation | NT$4.1m | NT$4.1m | 100% |

Talking in terms of the industry, salary represented approximately 95% of total compensation out of all the companies we analyzed, while other remuneration made up 5% of the pie. In Zig Sheng Industrial's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Zig Sheng Industrial Co., Ltd.'s Growth

Zig Sheng Industrial Co., Ltd. has reduced its earnings per share by 105% a year over the last three years. It saw its revenue drop 1.2% over the last year.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Zig Sheng Industrial Co., Ltd. Been A Good Investment?

Few Zig Sheng Industrial Co., Ltd. shareholders would feel satisfied with the return of -46% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

If you think CEO compensation levels are interesting you will probably really like this free visualization of insider trading at Zig Sheng Industrial.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking to trade Zig Sheng Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zig Sheng Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1455

Zig Sheng Industrial

Engages in the spinning, weaving, dyeing, finishing, printing, buying, and selling of fibers, synthetic cotton, and nylon yarn in Taiwan.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives