Is Formosa Taffeta Co., Ltd.'s (TPE:1434) Stock On A Downtrend As A Result Of Its Poor Financials?

Formosa Taffeta (TPE:1434) has had a rough week with its share price down 3.9%. Given that stock prices are usually driven by a company’s fundamentals over the long term, which in this case look pretty weak, we decided to study the company's key financial indicators. Specifically, we decided to study Formosa Taffeta's ROE in this article.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

View our latest analysis for Formosa Taffeta

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Formosa Taffeta is:

6.8% = NT$3.6b ÷ NT$53b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. Another way to think of that is that for every NT$1 worth of equity, the company was able to earn NT$0.07 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Formosa Taffeta's Earnings Growth And 6.8% ROE

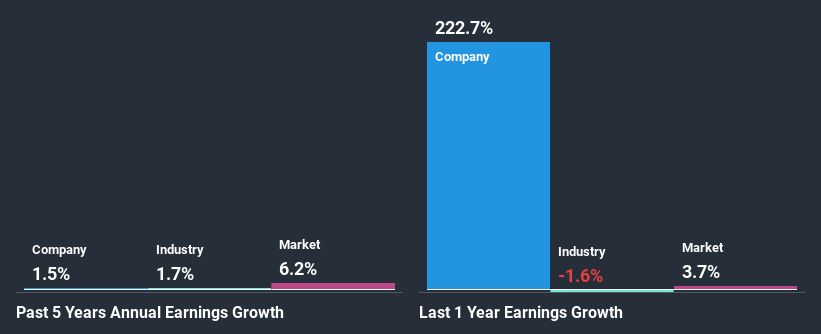

On the face of it, Formosa Taffeta's ROE is not much to talk about. Yet, a closer study shows that the company's ROE is similar to the industry average of 8.2%. Still, Formosa Taffeta has seen a flat net income growth over the past five years. Bear in mind, the company's ROE is not very high. Hence, this provides some context to the flat earnings growth seen by the company.

Next, on comparing Formosa Taffeta's net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 1.7% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. Has the market priced in the future outlook for 1434? You can find out in our latest intrinsic value infographic research report

Is Formosa Taffeta Using Its Retained Earnings Effectively?

Formosa Taffeta has a three-year median payout ratio as high as 106% meaning that the company is paying a dividend which is beyond its means. The absence in growth is therefore not surprising. Paying a dividend beyond their means is usually not viable over the long term. That's a huge risk in our books.

Additionally, Formosa Taffeta has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Summary

Overall, we would be extremely cautious before making any decision on Formosa Taffeta. While the company has posted decent earnings growth, the company is retaining little to no profits and is reinvesting those profits at a low rate of return. This makes us doubtful if that growth could continue, especially if by any chance the business is faced with any sort of risk. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Formosa Taffeta's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you decide to trade Formosa Taffeta, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:1434

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives