- Japan

- /

- Hospitality

- /

- TSE:6412

Undiscovered Gems In Asia To Explore This March 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by inflationary pressures and trade uncertainties, Asian equities present intriguing opportunities for investors seeking diversification. In this environment, identifying stocks with solid fundamentals and resilience to economic fluctuations becomes crucial, particularly as we explore potential undiscovered gems in the region's dynamic market.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 2.33% | -2.02% | ★★★★★★ |

| Otec | 8.17% | 3.43% | 1.06% | ★★★★★★ |

| BBK Test Systems | NA | 8.57% | 12.90% | ★★★★★★ |

| Pan Asian Microvent Tech (Jiangsu) | 20.39% | 14.25% | 10.66% | ★★★★★★ |

| Tait Marketing & Distribution | NA | 7.56% | 15.53% | ★★★★★★ |

| Donpon Precision | 35.22% | -2.30% | 36.96% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| Jiangsu Longda Superalloy | 17.07% | 19.16% | 11.40% | ★★★★★☆ |

| Alltek Technology | 166.36% | 7.57% | 13.88% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Pamica Technology (SZSE:001359)

Simply Wall St Value Rating: ★★★★★☆

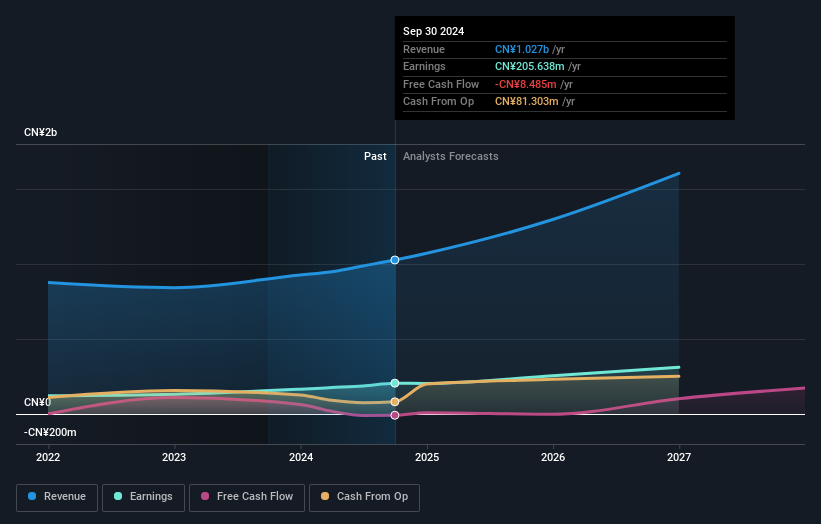

Overview: Pamica Technology Corporation focuses on the research and development, production, and sale of mica insulation materials, glass fiber cloth, and new energy insulation materials with a market capitalization of CN¥5.53 billion.

Operations: Pamica Technology generates revenue primarily from the sale of mica insulation materials, glass fiber cloth, and new energy insulation materials. The company's financial performance is highlighted by a net profit margin that provides insight into its profitability.

Pamica Technology, a promising player in Asia's tech landscape, showcases an attractive profile with its earnings growth of 30.7% over the past year, outpacing the Electrical industry’s 1.3%. The company seems to manage its finances prudently as it has more cash than total debt and maintains a price-to-earnings ratio of 26.9x, which is below the CN market average of 37x. Despite not being free cash flow positive recently, Pamica continues to exhibit high-quality earnings and is projected to grow at a rate of 20.06% annually. An upcoming shareholders meeting on January 8, 2025 might provide further insights into its strategic direction.

- Delve into the full analysis health report here for a deeper understanding of Pamica Technology.

Explore historical data to track Pamica Technology's performance over time in our Past section.

Kemflo International (TPEX:7818)

Simply Wall St Value Rating: ★★★★★☆

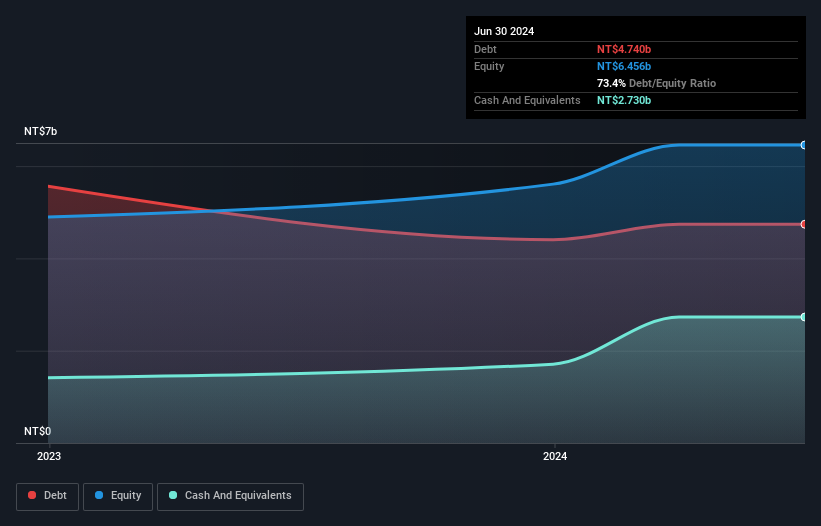

Overview: Kemflo International Co., Ltd. specializes in the manufacturing and sale of water purification and filtration products both in Taiwan and globally, with a market cap of NT$23.39 billion.

Operations: Kemflo International generates revenue primarily through its Water Resources Department, contributing NT$7.97 billion, and the Metal Segment, adding NT$5.75 billion. The Industrial Water Department adds NT$1.25 billion to the total revenue stream.

Kemflo International, a smaller player in the market, is trading at 37.8% below its estimated fair value, suggesting potential undervaluation. The company's earnings have surged by 78.2% over the past year, outpacing the Consumer Durables industry growth of 12.5%, highlighting its robust performance. With an EBIT that covers interest payments 10.8 times over and a net debt to equity ratio of 31.1%, Kemflo demonstrates strong financial health and satisfactory leverage levels. Despite illiquid shares, it remains free cash flow positive with high-quality earnings, positioning it well for future opportunities in its sector.

- Dive into the specifics of Kemflo International here with our thorough health report.

Understand Kemflo International's track record by examining our Past report.

Heiwa (TSE:6412)

Simply Wall St Value Rating: ★★★★★☆

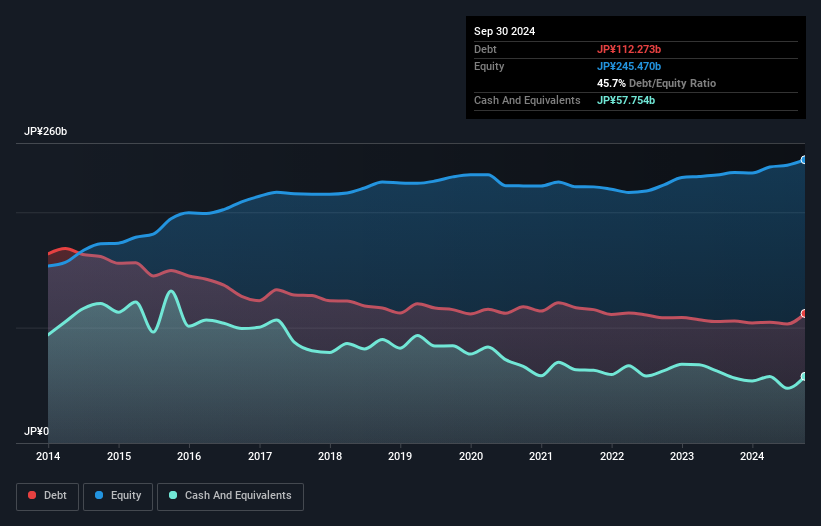

Overview: Heiwa Corporation is a Japanese company that develops, manufactures, and sells pachinko and pachislot machines, with a market cap of ¥233.16 billion.

Operations: Heiwa generates revenue primarily from its Pachislot and Pachinko Machine Business, which contributes ¥53.05 billion, and its Golf Business, adding ¥99.32 billion. The company's market cap stands at ¥233.16 billion.

Heiwa, a notable player in the hospitality sector, has seen its earnings soar by 117% over the past year, significantly outpacing the industry's 24.2%. The company trades at a price-to-earnings ratio of 9.1x, which is favorable compared to Japan's market average of 13x. Heiwa's debt situation appears manageable with a net debt to equity ratio of 18.5%, deemed satisfactory under industry standards. Recent corporate guidance projects net sales of ¥145.4 billion and operating income of ¥26.7 billion for fiscal year ending March 2025, indicating potential for continued robust performance in the coming period.

- Click here and access our complete health analysis report to understand the dynamics of Heiwa.

Assess Heiwa's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Explore the 2574 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heiwa might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6412

Heiwa

Develops, manufactures, and sells pachinko and pachislot machines in Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives