- Taiwan

- /

- Commercial Services

- /

- TWSE:6139

Asian Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China escalate, concerns about global economic growth have become a focal point for investors in Asia, with Chinese stock markets recording losses despite hopes for fresh stimulus measures from Beijing. In this uncertain environment, dividend stocks can offer a degree of stability and income potential, making them an attractive consideration for those looking to navigate the current market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.89% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.89% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.51% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.26% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.70% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.49% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.21% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.41% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.48% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

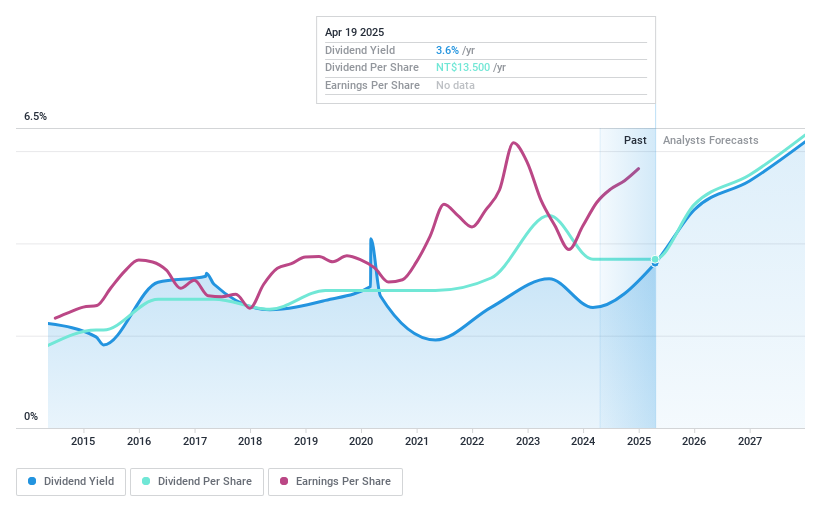

Eclat Textile (TWSE:1476)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eclat Textile Co., Ltd. is engaged in the design, manufacture, processing, trading, marketing, and sale of knitted fabrics, clothing, garments, and textile raw materials both in Taiwan and internationally with a market cap of NT$108.79 billion.

Operations: Eclat Textile Co., Ltd.'s revenue is derived from its Knitting Division, which generated NT$18.49 billion, and its Apparels Division, which contributed NT$28.89 billion.

Dividend Yield: 3.4%

Eclat Textile's dividend payments have increased over the past decade, though they have been volatile, indicating an unstable track record. Despite a reasonable payout ratio of 58.5% and a cash payout ratio of 87.7%, its dividend yield of 3.4% is low compared to the top quartile in Taiwan's market. Recent earnings showed growth with sales at TWD 36.83 billion and net income rising to TWD 6.64 billion for 2024, suggesting potential for future stability in dividends if trends continue positively.

- Click to explore a detailed breakdown of our findings in Eclat Textile's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Eclat Textile shares in the market.

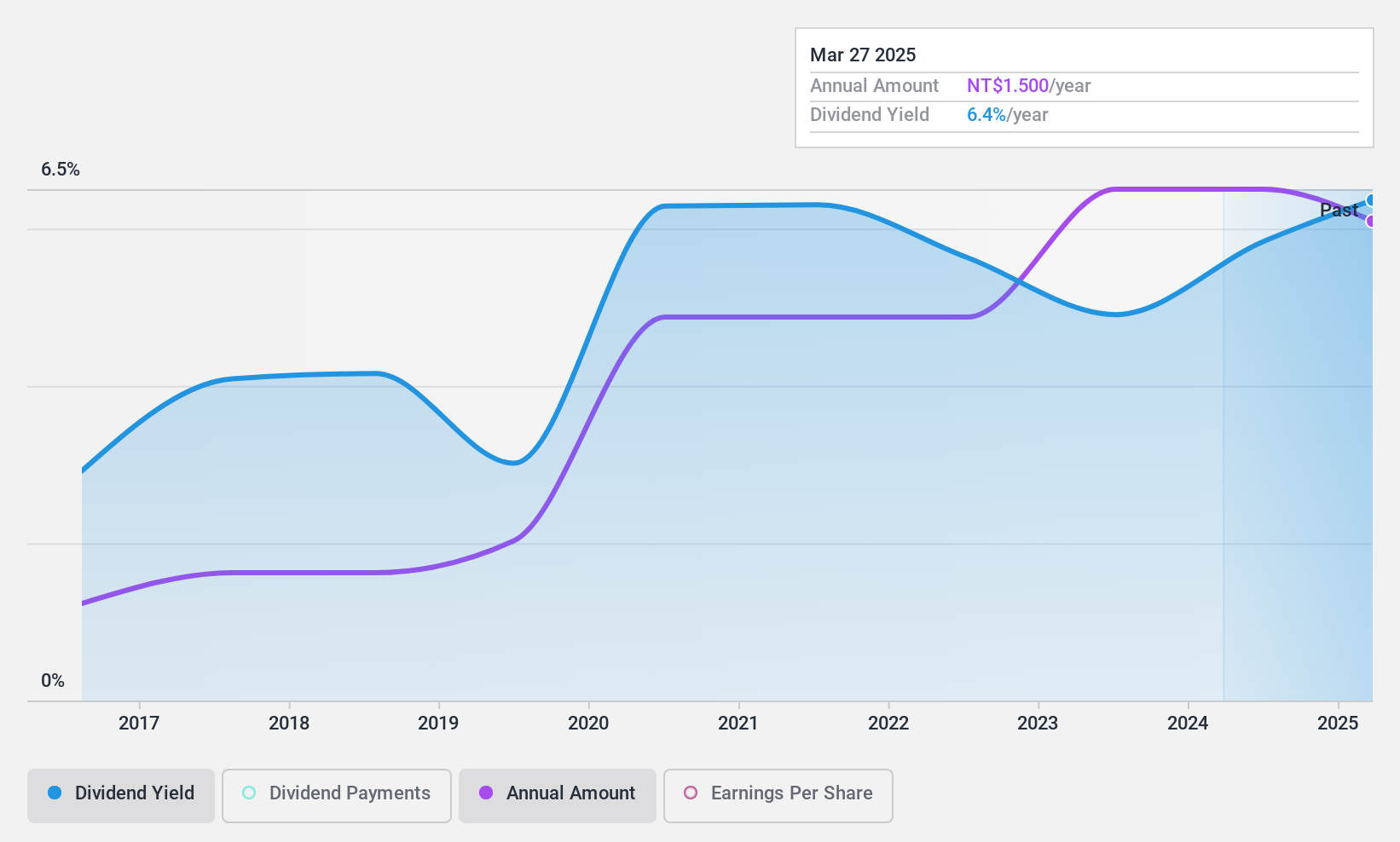

Emerging Display Technologies (TWSE:3038)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Emerging Display Technologies Corp. manufactures and markets capacitive touch panels and liquid crystal displays (LCD) across Taiwan, Europe, the United States, and other international markets with a market cap of NT$3.38 billion.

Operations: Emerging Display Technologies Corp.'s revenue is derived from the Americas Business Unit (NT$1.34 billion), Taiwan Regional Division (NT$3.48 billion), and Mainland District Business Unit (NT$410.11 million).

Dividend Yield: 6.6%

Emerging Display Technologies offers a high dividend yield of 6.59%, ranking in the top quartile of Taiwan's market, supported by a stable payout history over the past decade. The company's dividends are sustainable, with earnings and cash flow coverage at 68% and 59.2%, respectively. However, recent financials show declining sales (TWD 3.61 billion) and net income (TWD 327.9 million) for 2024, alongside a proposed dividend decrease to TWD 1.5 per share, indicating potential challenges ahead for maintaining dividend levels.

- Dive into the specifics of Emerging Display Technologies here with our thorough dividend report.

- Upon reviewing our latest valuation report, Emerging Display Technologies' share price might be too pessimistic.

L&K Engineering (TWSE:6139)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: L&K Engineering Co., Ltd. offers turnkey engineering services in Taiwan, Hong Kong, and internationally with a market cap of NT$50.33 billion.

Operations: L&K Engineering Co., Ltd. generates revenue from its L1 Company segment with NT$23.76 billion, L2 Company segment with NT$17.17 billion, and The Company segment with NT$26.15 billion.

Dividend Yield: 6.5%

L&K Engineering's recent earnings report shows strong growth, with sales reaching TWD 65.09 billion and net income at TWD 4.34 billion for 2024. The company proposed a cash dividend of TWD 14 per share, totaling TWD 3.27 billion distributed to shareholders. Despite a volatile dividend history over the past decade, current dividends are well-covered by both earnings (74.7% payout ratio) and cash flows (26.2% cash payout ratio), positioning it in the top quartile of Taiwan's market for yield at 6.48%.

- Unlock comprehensive insights into our analysis of L&K Engineering stock in this dividend report.

- In light of our recent valuation report, it seems possible that L&K Engineering is trading behind its estimated value.

Key Takeaways

- Click here to access our complete index of 1225 Top Asian Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade L&K Engineering, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6139

L&K Engineering

Provides turnkey engineering services in Taiwan, Hongkong, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives