- Taiwan

- /

- Commercial Services

- /

- TWSE:6139

3 Reliable Dividend Stocks Yielding Up To 5.6%

Reviewed by Simply Wall St

In the midst of global market fluctuations driven by policy uncertainties and economic indicators, investors are keenly observing how these factors impact various sectors. With U.S. stocks experiencing volatility due to anticipated regulatory changes and interest rate expectations, dividend stocks continue to attract attention for their potential to provide steady income streams. In such an environment, identifying reliable dividend stocks becomes crucial as they can offer a buffer against market turbulence while contributing to portfolio stability through consistent payouts.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.61% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.84% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.76% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.55% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.37% | ★★★★★★ |

| Petrol d.d (LJSE:PETG) | 5.84% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.97% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.59% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.49% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Abu Dhabi Commercial Bank PJSC (ADX:ADCB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Abu Dhabi Commercial Bank PJSC, along with its subsidiaries, offers consumer banking, wholesale banking, and treasury and investment services in the United Arab Emirates and internationally, with a market capitalization of AED70.62 billion.

Operations: Abu Dhabi Commercial Bank PJSC generates revenue through its Retail Banking (AED4.69 billion), Property Management (AED745.08 million), Investments and Treasury (AED5.04 billion), and Corporate and Investment Banking (AED5.71 billion) segments.

Dividend Yield: 5.7%

Abu Dhabi Commercial Bank PJSC has shown growth in earnings, with a 17.5% annual increase over the past five years and recent net income improvement. However, its dividend history is volatile and unreliable, with a payout ratio of 46.9%, indicating dividends are covered by earnings but not consistently stable. The bank's low allowance for bad loans (99%) and high bad loan ratio (2.6%) could pose risks to future dividend reliability despite current coverage forecasts remaining favorable at 47.8%.

- Get an in-depth perspective on Abu Dhabi Commercial Bank PJSC's performance by reading our dividend report here.

- Our valuation report unveils the possibility Abu Dhabi Commercial Bank PJSC's shares may be trading at a premium.

Morito (TSE:9837)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Morito Co., Ltd. manufactures and sells apparel-related materials and household goods across Japan, Asia, Europe, and the United States with a market cap of ¥37.97 billion.

Operations: Morito Co., Ltd.'s revenue is derived from its operations in Japan (¥34.80 billion), Asia (¥12.03 billion), and Europe & the U.S. (¥7.14 billion).

Dividend Yield: 3.9%

Morito's dividend yield is in the top 25% of the JP market, with a payout ratio of 62.9%, indicating dividends are covered by earnings and cash flows (30.8%). Although dividend payments have increased over the past decade, they remain volatile and unreliable. Recently, Morito raised its dividend guidance to ¥29 per share for fiscal year ending November 2024 from ¥28 previously, while completing a share buyback worth ¥429.3 million representing 1.1% of shares.

- Unlock comprehensive insights into our analysis of Morito stock in this dividend report.

- Insights from our recent valuation report point to the potential overvaluation of Morito shares in the market.

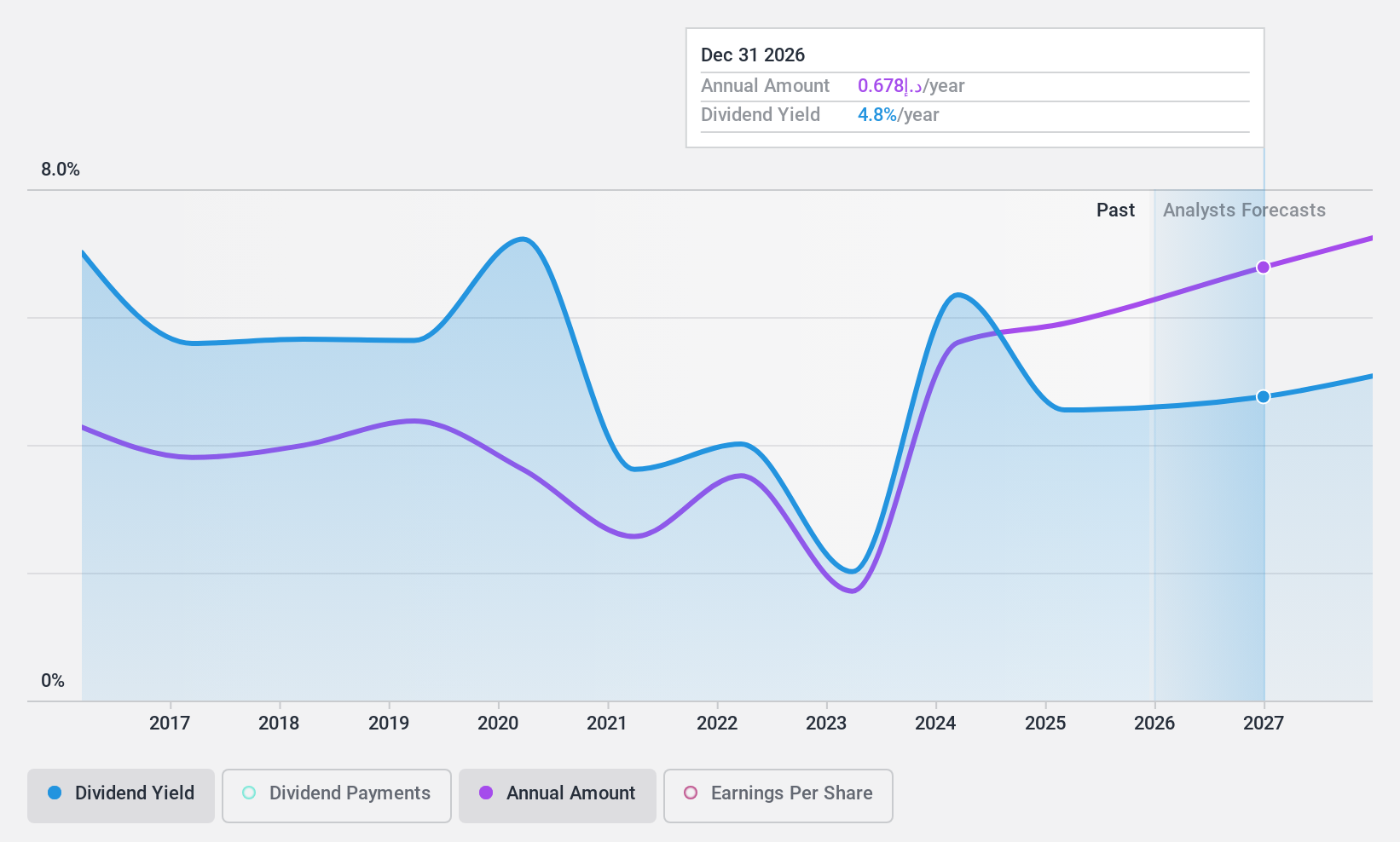

L&K Engineering (TWSE:6139)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: L&K Engineering Co., Ltd. offers turnkey engineering services in Taiwan, Hongkong, and internationally, with a market cap of NT$50.56 billion.

Operations: L&K Engineering Co., Ltd. generates revenue through its turnkey engineering services across Taiwan, Hongkong, and international markets.

Dividend Yield: 3.9%

L&K Engineering's dividend yield is 3.95%, below the top 25% of TW market payers, but with a sustainable payout ratio of 50% and cash coverage at 13.2%. Despite earnings growth and strong cash flow support, dividends have been volatile and unreliable over the past decade. Recent earnings showed increased sales to TWD 16.41 billion in Q3, while strategic expansion into Singapore could impact future revenue streams positively without immediate capital requirements.

- Click here to discover the nuances of L&K Engineering with our detailed analytical dividend report.

- The valuation report we've compiled suggests that L&K Engineering's current price could be quite moderate.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1980 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6139

L&K Engineering

Provides turnkey engineering services in Taiwan, Hongkong, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.