- Taiwan

- /

- Tech Hardware

- /

- TPEX:5465

3 Reliable Dividend Stocks Offering Yields Up To 4.7%

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, U.S. stocks faced broad-based declines, with the S&P 500 experiencing its longest streak of more decliners than gainers since 1978. Amid these volatile market conditions, investors may find stability in dividend stocks, which offer consistent income streams and potential resilience against market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Universal Robina (PSE:URC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Universal Robina Corporation is a branded food product company with operations in the Philippines and internationally, and it has a market cap of ₱161.29 billion.

Operations: Universal Robina Corporation's revenue is primarily derived from its Branded Consumer Food segment, contributing ₱62.97 billion, and its Agro-Industrial and Commodity Food segment, which adds ₱133.22 billion.

Dividend Yield: 4.8%

Universal Robina's dividend yield of 4.78% is reliable and stable, though below the top quartile in the Philippines market. The company's dividends have grown over the past decade and are well-covered by earnings and cash flows, with payout ratios of 75.8% and 66.9%, respectively. Despite recent declines in net income, analysts expect a stock price increase of 35.7%. Recent corporate restructuring may impact future operations but hasn't affected dividend stability yet.

- Delve into the full analysis dividend report here for a deeper understanding of Universal Robina.

- Upon reviewing our latest valuation report, Universal Robina's share price might be too pessimistic.

Loyalty Founder EnterpriseLtd (TPEX:5465)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Loyalty Founder Enterprise Co., Ltd. manufactures, processes, and sells precision steel molds and stamping die products for computers and server chassis in Taiwan, the United States, and Mainland China, with a market cap of approximately NT$5.49 billion.

Operations: Loyalty Founder Enterprise Co., Ltd. generates its revenue primarily from Mainland China with NT$4.35 billion, followed by Taiwan at NT$849.06 million, and the United States contributing NT$38.35 million.

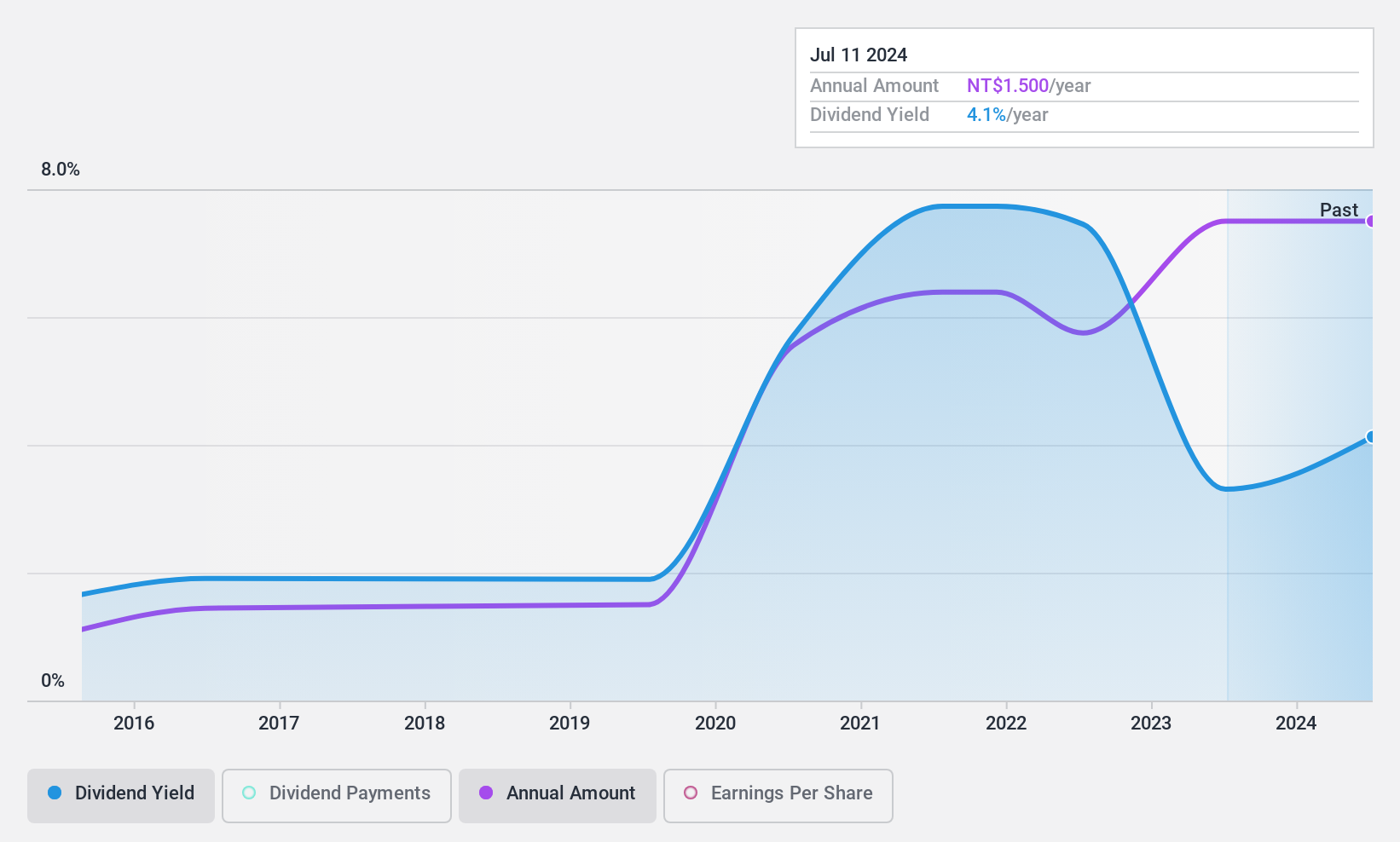

Dividend Yield: 3.8%

Loyalty Founder Enterprise's dividend yield of 3.76% is lower than the top tier in Taiwan, with a payout ratio of 86.9%, indicating dividends are covered by earnings and cash flows. However, the dividend history is marked by volatility and unreliability over the past decade. Recent financial results show a decline in revenue and net income, which may affect future payouts despite current coverage sustainability by cash flows at a 39.3% ratio.

- Navigate through the intricacies of Loyalty Founder EnterpriseLtd with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Loyalty Founder EnterpriseLtd is priced lower than what may be justified by its financials.

Sanoh Industrial (TSE:6584)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sanoh Industrial Co., Ltd. manufactures and sells automotive parts worldwide, with a market cap of ¥25.59 billion.

Operations: Sanoh Industrial Co., Ltd.'s revenue is derived from several regions, including ¥29.72 billion from Asia, ¥17.16 billion from China, ¥49.66 billion from Japan, ¥23.32 billion from Europe, and ¥66.40 billion from North and South America.

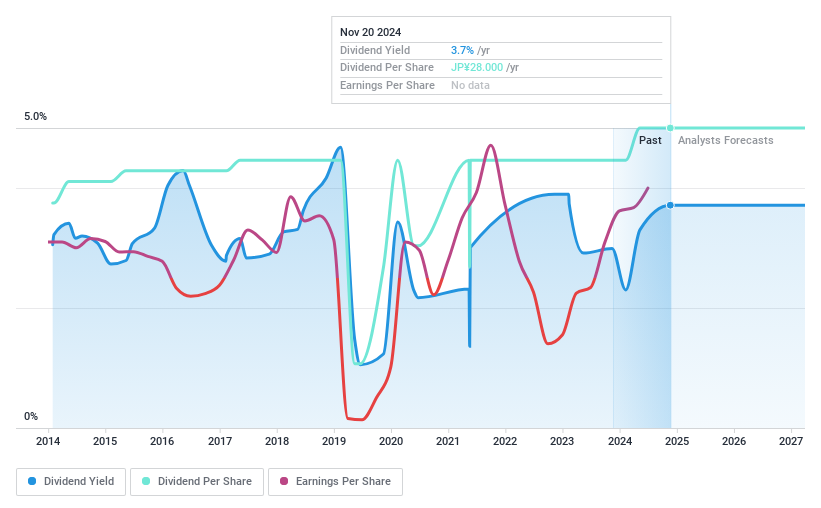

Dividend Yield: 3.8%

Sanoh Industrial's dividend payments are well covered by both earnings and cash flows, with low payout ratios of 24.8% and 18%, respectively. Despite an impressive earnings growth of 85.8% over the past year, the company's dividends have been volatile and unreliable over the last decade. Trading at a good value relative to peers, Sanoh's current dividend yield is slightly below Japan's top tier payers but remains sustainable given its financial coverage.

- Take a closer look at Sanoh Industrial's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sanoh Industrial shares in the market.

Key Takeaways

- Explore the 1937 names from our Top Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5465

Loyalty Founder EnterpriseLtd

Engages in the manufacture, processing, and sale of precision steel molds and stamping die products for computers and server chassis in Taiwan, the United States, and Mainland China.

Flawless balance sheet average dividend payer.