- Taiwan

- /

- Semiconductors

- /

- TWSE:2388

Undiscovered Gems None And 2 More Promising Small Cap Stocks

Reviewed by Simply Wall St

As global markets grapple with cautious Federal Reserve commentary and political uncertainties, smaller-cap indexes have been particularly hard hit, reflecting broader investor sentiment. Despite these challenges, the U.S. economy shows resilience with stronger-than-expected growth and consumer spending data, suggesting potential opportunities for discerning investors in the small-cap space. In this environment, identifying promising small-cap stocks involves looking for companies that demonstrate robust fundamentals and adaptability to navigate economic fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| Mildef Crete | NA | 0.93% | 9.96% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Forest Packaging GroupLtd | 17.72% | 2.87% | -6.03% | ★★★★★★ |

| Nofoth Food Products | NA | 14.41% | 31.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Power HF (SHSE:605100)

Simply Wall St Value Rating: ★★★★★★

Overview: Power HF Co., Ltd. is engaged in the research, development, manufacturing, and sale of diesel engines both in China and internationally, with a market cap of CN¥2.32 billion.

Operations: Power HF Co., Ltd. generates revenue primarily through the sale of diesel engines, with a market capitalization of CN¥2.32 billion.

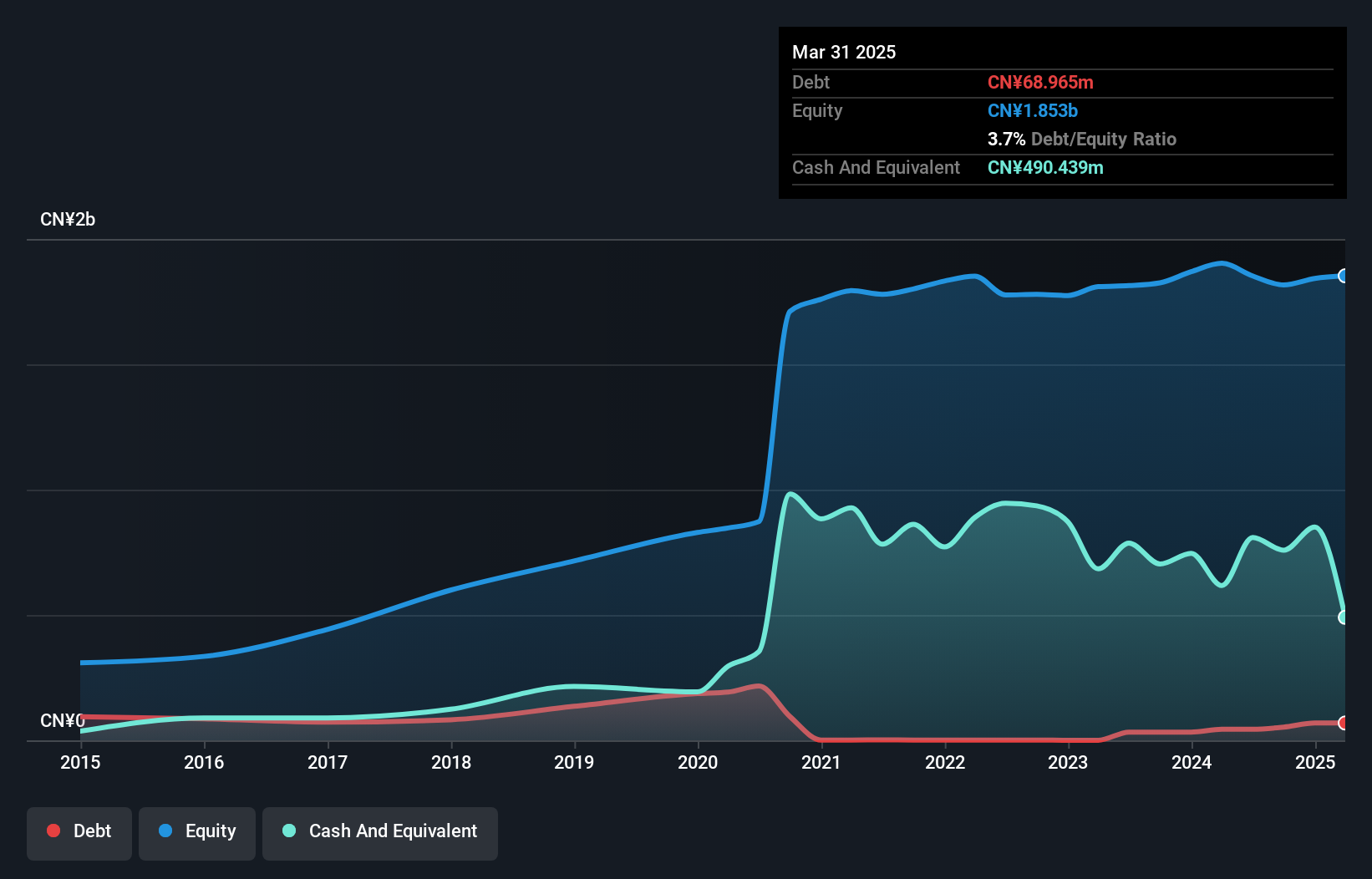

Power HF has demonstrated notable earnings growth of 70.8% over the past year, outpacing the Machinery industry's -0.06% performance. Despite a challenging five-year period with annual earnings dropping by 22.1%, recent improvements suggest resilience. The company boasts high-quality earnings and a favorable debt-to-equity ratio, reducing from 21.7% to 2.9% in five years, indicating effective debt management. However, sales for the first nine months of 2024 decreased to CNY728 million from CNY1 billion last year, with net income slightly down at CNY52 million compared to CNY59 million previously, reflecting some ongoing challenges in revenue generation.

- Click here and access our complete health analysis report to understand the dynamics of Power HF.

Gain insights into Power HF's historical performance by reviewing our past performance report.

Jiangxi Guoke Defence GroupLtd (SHSE:688543)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Guoke Defence Group Co., Ltd. engages in the research, development, production, and sale of military products both in China and internationally, with a market capitalization of CN¥8.18 billion.

Operations: Jiangxi Guoke Defence Group generates revenue primarily from its Aerospace & Defense segment, amounting to CN¥1.13 billion. The company's financial performance is highlighted by its gross profit margin trend, which has shown variability over recent periods.

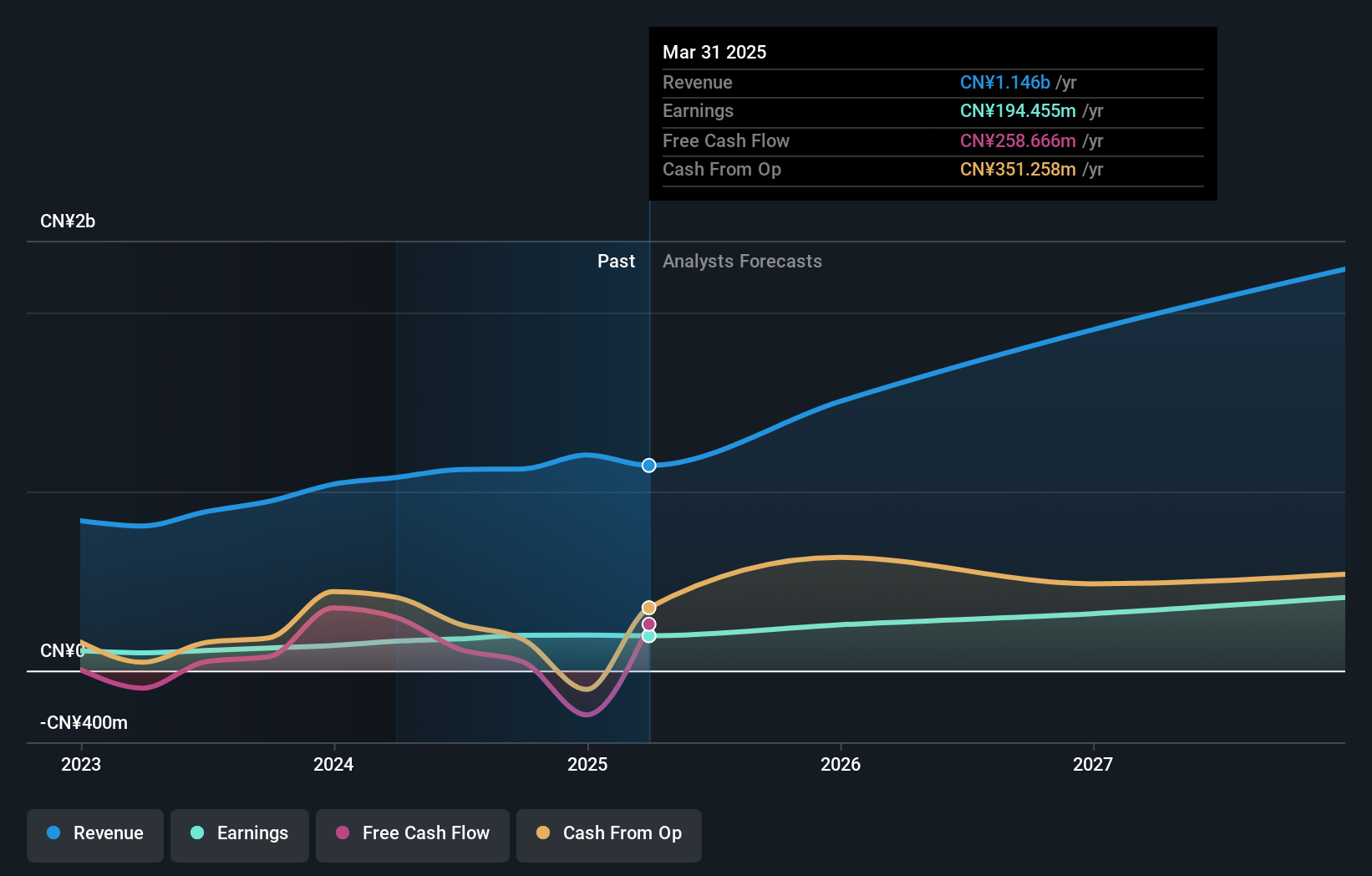

Jiangxi Guoke Defence Group, a player in the Aerospace & Defense sector, presents an intriguing opportunity with its price-to-earnings ratio of 42.8x, notably below the industry average of 62.8x. Over the past year, earnings have surged by 56.1%, outpacing the industry's -13.4% performance dip. The company has successfully reduced its debt-to-equity ratio from 91.7% to a mere 2.7% over five years, indicating prudent financial management and more cash than total debt suggests robust liquidity healthiness too . Recent financials for nine months ending September show sales at CNY 763 million and net income hitting CNY 149 million compared to last year's figures of CNY 678 million and CNY93 million respectively . Despite high share price volatility recently , Jiangxi Guoke remains profitable with positive free cash flow trends evident in Q3 reports where they repurchased shares worth approximately CNY76 million since February's buyback announcement earlier this year .

VIA Technologies (TWSE:2388)

Simply Wall St Value Rating: ★★★★★★

Overview: VIA Technologies, Inc. is involved in the programming, designing, manufacturing, and sale of semiconductors and PC chip sets with a market capitalization of NT$56.08 billion.

Operations: The primary revenue stream for VIA Technologies comes from the design, manufacturing, and trading of computer integrated circuit (IC) products, generating NT$14.62 billion.

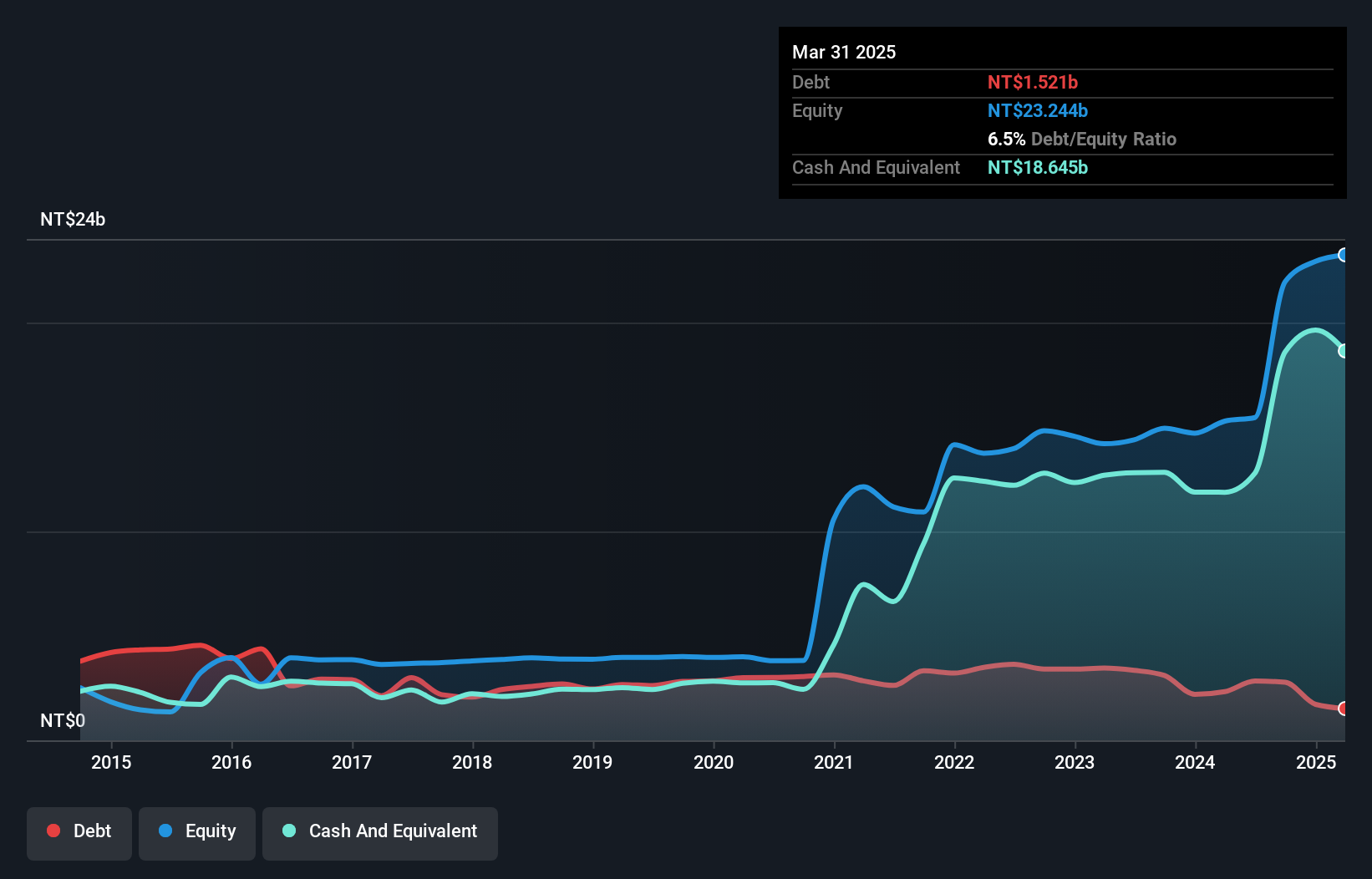

VIA Technologies has shown remarkable earnings growth, with a 533.9% increase over the past year, surpassing the semiconductor industry's 5.9%. The company's debt-to-equity ratio has significantly improved from 70.3% to 12.7% in five years, indicating effective financial management. Despite this progress, earnings have declined by an average of 15.3% annually over the past five years, suggesting some volatility in performance. Recent reports highlight strong sales growth for Q3 at TWD 5,293 million compared to TWD 3,239 million last year and net income rising to TWD 295 million from TWD 92 million previously—showcasing potential for continued improvement amidst market fluctuations.

- Dive into the specifics of VIA Technologies here with our thorough health report.

Examine VIA Technologies' past performance report to understand how it has performed in the past.

Seize The Opportunity

- Click here to access our complete index of 4632 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2388

VIA Technologies

VIA Technologies, Inc. engage in the programming, designing, manufacturing, and sale of semiconductors and PC chip sets.

Flawless balance sheet with acceptable track record.