3 Global Stocks Estimated To Be Up To 37.4% Below Intrinsic Value

Reviewed by Simply Wall St

In a global market landscape marked by declining consumer confidence and persistent inflation, investors are navigating through a period of uncertainty, with major indices showing mixed performances. Amid these conditions, identifying undervalued stocks can be an effective strategy for those looking to capitalize on potential growth opportunities, as such stocks may offer significant upside when the broader economic environment stabilizes.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhou International Group Holdings (SEHK:2313) | HK$57.10 | HK$114.14 | 50% |

| Vimi Fasteners (BIT:VIM) | €0.96 | €1.91 | 49.8% |

| Power Wind Health Industry (TWSE:8462) | NT$117.00 | NT$231.90 | 49.5% |

| Akatsuki (TSE:3932) | ¥3140.00 | ¥6229.71 | 49.6% |

| CD Projekt (WSE:CDR) | PLN221.00 | PLN441.00 | 49.9% |

| Bide Pharmatech (SHSE:688073) | CN¥53.80 | CN¥106.91 | 49.7% |

| Nanjing King-Friend Biochemical PharmaceuticalLtd (SHSE:603707) | CN¥12.53 | CN¥24.90 | 49.7% |

| Canatu Oyj (HLSE:CANATU) | €12.40 | €24.73 | 49.9% |

| Sunny Optical Technology (Group) (SEHK:2382) | HK$84.65 | HK$168.45 | 49.7% |

| Delixi New Energy Technology (SHSE:603032) | CN¥16.73 | CN¥33.28 | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

XCMG Construction Machinery (SZSE:000425)

Overview: XCMG Construction Machinery Co., Ltd. manufactures and sells construction machinery in China, with a market cap of CN¥104.20 billion.

Operations: The company generates revenue primarily from its Construction Machinery Industry segment, amounting to CN¥89.90 billion.

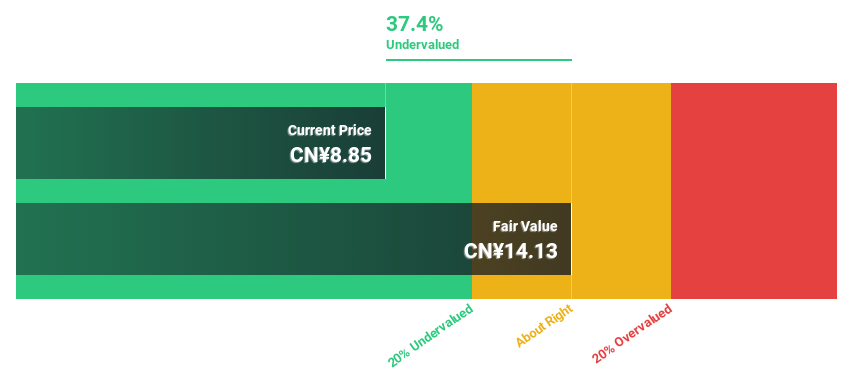

Estimated Discount To Fair Value: 37.4%

XCMG Construction Machinery appears undervalued, trading at CN¥8.85, significantly below its estimated fair value of CN¥14.13. Despite a low return on equity forecast and debt concerns relative to operating cash flow, the company is positioned for robust earnings growth of 25.79% annually over the next three years, outpacing the Chinese market average. Recent strategic initiatives like launching a certified used equipment brand enhance its competitive edge and commitment to sustainability in construction machinery markets.

- Our comprehensive growth report raises the possibility that XCMG Construction Machinery is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of XCMG Construction Machinery.

PAL GROUP Holdings (TSE:2726)

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of approximately ¥273.06 billion.

Operations: The company's revenue segments comprise ¥123.51 billion from the clothing business and ¥78.71 billion from the miscellaneous goods business.

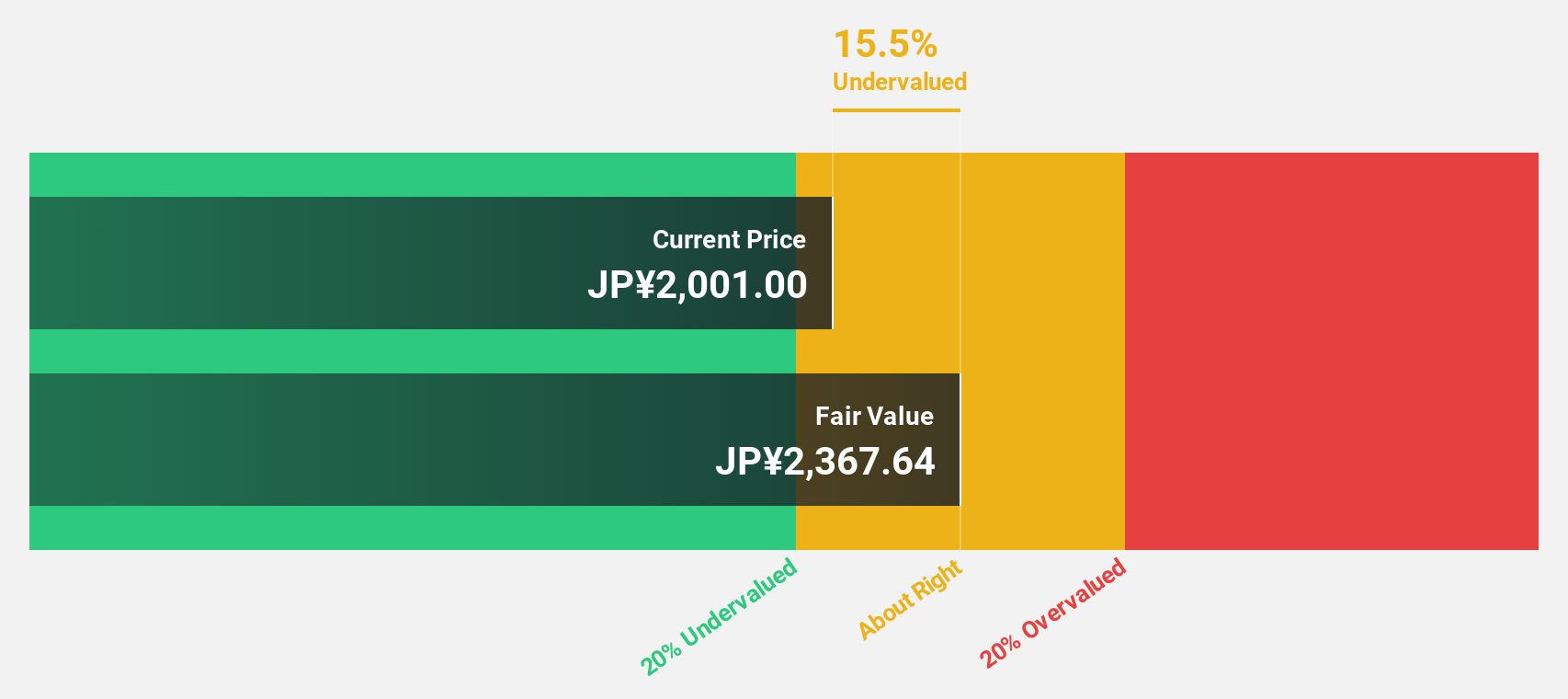

Estimated Discount To Fair Value: 21.3%

PAL GROUP Holdings is trading at ¥3245, notably below its estimated fair value of ¥4122.44, suggesting it is undervalued based on cash flows. The company's earnings are projected to grow significantly at 20.6% annually over the next three years, outpacing the Japanese market average of 8%. Although revenue growth is slower than desired at 8.6%, it still surpasses the market's 4.2%. Recent dividend guidance increases to JPY 60 per share indicate financial confidence.

- The growth report we've compiled suggests that PAL GROUP Holdings' future prospects could be on the up.

- Take a closer look at PAL GROUP Holdings' balance sheet health here in our report.

Advanced Energy Solution Holding (TWSE:6781)

Overview: Advanced Energy Solution Holding Co., Ltd. operates in the energy sector and has a market capitalization of NT$80.98 billion.

Operations: The company generates revenue primarily from its Batteries / Battery Systems segment, amounting to NT$9.33 billion.

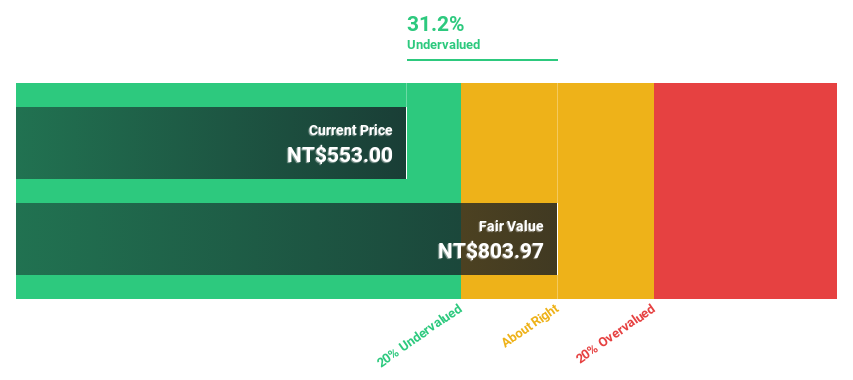

Estimated Discount To Fair Value: 11.6%

Advanced Energy Solution Holding is trading at NT$972, slightly below its estimated fair value of NT$1099.62, indicating undervaluation based on cash flows. Forecasts suggest robust revenue growth of 29.6% annually and earnings growth of 36.8%, both exceeding market averages in Taiwan. Despite recent share price volatility, analysts expect a potential price rise of 27.6%. The company's return on equity is anticipated to reach a high level of 23.1% within three years.

- Our earnings growth report unveils the potential for significant increases in Advanced Energy Solution Holding's future results.

- Delve into the full analysis health report here for a deeper understanding of Advanced Energy Solution Holding.

Seize The Opportunity

- Get an in-depth perspective on all 515 Undervalued Global Stocks Based On Cash Flows by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000425

XCMG Construction Machinery

Engages in the manufacture and sale of construction machinery in China.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives