Undiscovered Gems None And 2 Other Promising Small Caps With Solid Foundations

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by accelerating inflation and volatile interest rates, small-cap stocks have recently lagged behind their larger counterparts, with the Russell 2000 Index trailing the S&P 500 Index. However, this environment can present unique opportunities for discerning investors seeking "undiscovered gems" in the small-cap space—companies that boast solid foundations and potential for growth despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 9.72% | 4.93% | 6.51% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Standard Chartered Bank Kenya | 9.32% | 12.22% | 22.08% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Wuhan East Lake High Technology Group (SHSE:600133)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wuhan East Lake High Technology Group Co., Ltd. operates as a diversified company involved in various sectors, with a market capitalization of CN¥11.05 billion.

Operations: The company generates revenue through its diversified operations across multiple sectors. With a market capitalization of CN¥11.05 billion, it focuses on optimizing its cost structure to enhance profitability.

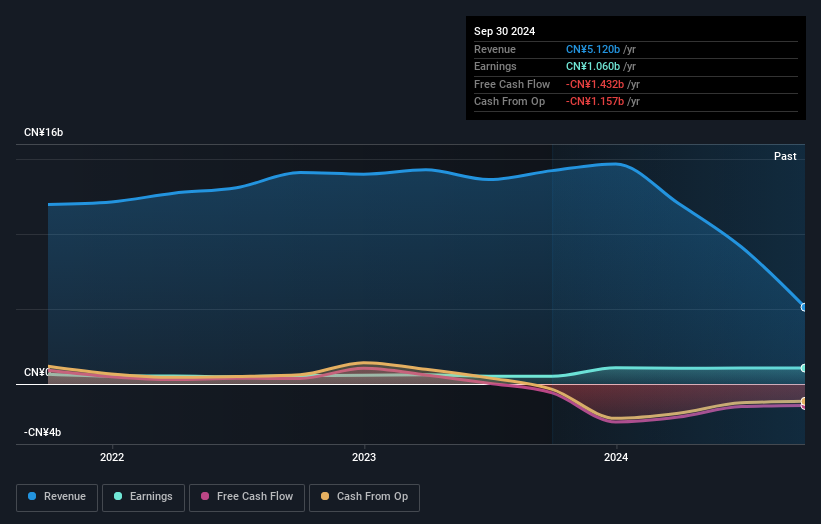

Wuhan East Lake High Technology Group has shown impressive earnings growth of 107% over the past year, outpacing the construction industry's -3.9%. Despite a high net debt to equity ratio of 40.6%, the company has significantly reduced this from 222.7% five years ago, reflecting improved financial management. With a price-to-earnings ratio of 10x, it offers good value compared to the broader CN market's 36x. The upcoming shareholders meeting on January 24, 2025, indicates active engagement with stakeholders and could provide insights into future strategic directions for this promising small-cap player in China's tech landscape.

- Take a closer look at Wuhan East Lake High Technology Group's potential here in our health report.

Learn about Wuhan East Lake High Technology Group's historical performance.

Fukushima GalileiLtd (TSE:6420)

Simply Wall St Value Rating: ★★★★★★

Overview: Fukushima Galilei Co. Ltd. is involved in the manufacturing, sales, and maintenance of commercial freezer refrigerators, refrigerated showcases, and other refrigeration devices both in Japan and internationally with a market cap of ¥109.06 billion.

Operations: Fukushima Galilei generates revenue primarily through the sale and maintenance of commercial refrigeration equipment. The company's financials reveal a focus on optimizing costs to enhance profitability, with particular attention to its net profit margin.

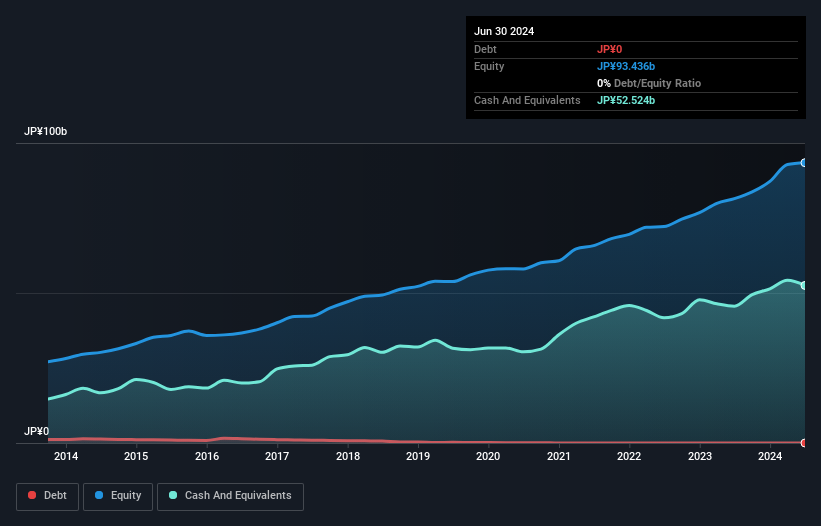

Fukushima Galilei, a niche player in the machinery sector, is trading at a compelling 66.2% below its estimated fair value and has demonstrated robust financial health with no debt on its books. The company's earnings grew by 5.5% over the past year, outpacing the industry average of 4%, highlighting its competitive edge. Recent guidance for the fiscal year ending March 2025 projects net sales of ¥119 billion (US$), with an operating profit of ¥13 billion (US$). A dividend forecast of ¥52.50 per share reflects confidence in ongoing profitability despite expected earnings declines averaging 0.9% annually over three years.

- Get an in-depth perspective on Fukushima GalileiLtd's performance by reading our health report here.

Chicony Power Technology (TWSE:6412)

Simply Wall St Value Rating: ★★★★★★

Overview: Chicony Power Technology Co., Ltd. is a Taiwanese company that develops, manufactures, and sells switching power supplies, electronic components and LED lighting modules, and smart building solutions with a market capitalization of NT$51.70 billion.

Operations: The company generates its revenue primarily from the Asian and domestic markets, with NT$31.32 billion and NT$35.12 billion respectively. The American market contributes NT$1.05 billion to its revenue stream.

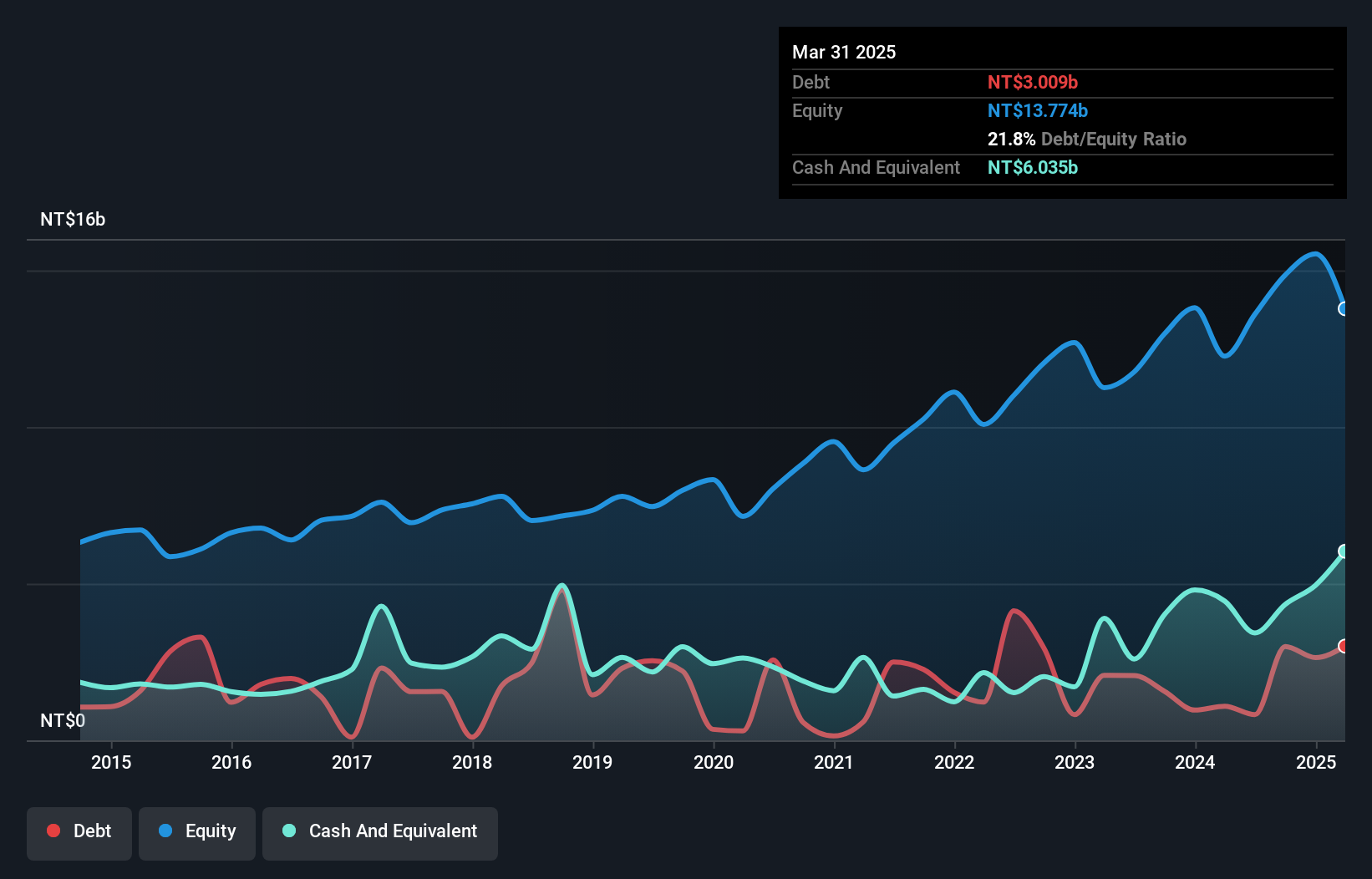

Chicony Power Technology, a player in the electrical industry, is showing promising signs with its earnings growth of 13% over the past year, outpacing the industry's 7.3%. The company has managed to reduce its debt-to-equity ratio from 27.7% to 20.2% over five years, indicating prudent financial management. Trading at a price-to-earnings ratio of 14.9x compared to the TW market's 21.6x suggests it offers good relative value for investors looking for potential upside in smaller companies. Recent participation in high-profile conferences like J.P. Morgan Taiwan CEO-CFO Conference highlights its proactive engagement with investors and stakeholders alike.

Turning Ideas Into Actions

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4730 more companies for you to explore.Click here to unveil our expertly curated list of 4733 Undiscovered Gems With Strong Fundamentals.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Galilei, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6420

Galilei

Through its subsidiaries, manufactures and sale of commercial refrigerators and freezers, plug-in type and remote type showcases, and other equipment in Japan and internationally.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives