- Taiwan

- /

- Trade Distributors

- /

- TWSE:6192

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism following the Fed's recent rate cuts and ongoing political uncertainties, investors are keenly observing how these factors impact stock performance. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, especially in volatile market conditions. A good dividend stock typically offers a reliable payout history and financial stability, making it an appealing option for those looking to balance growth with income in today's economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.30% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.28% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.78% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.56% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.53% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.05% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.74% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

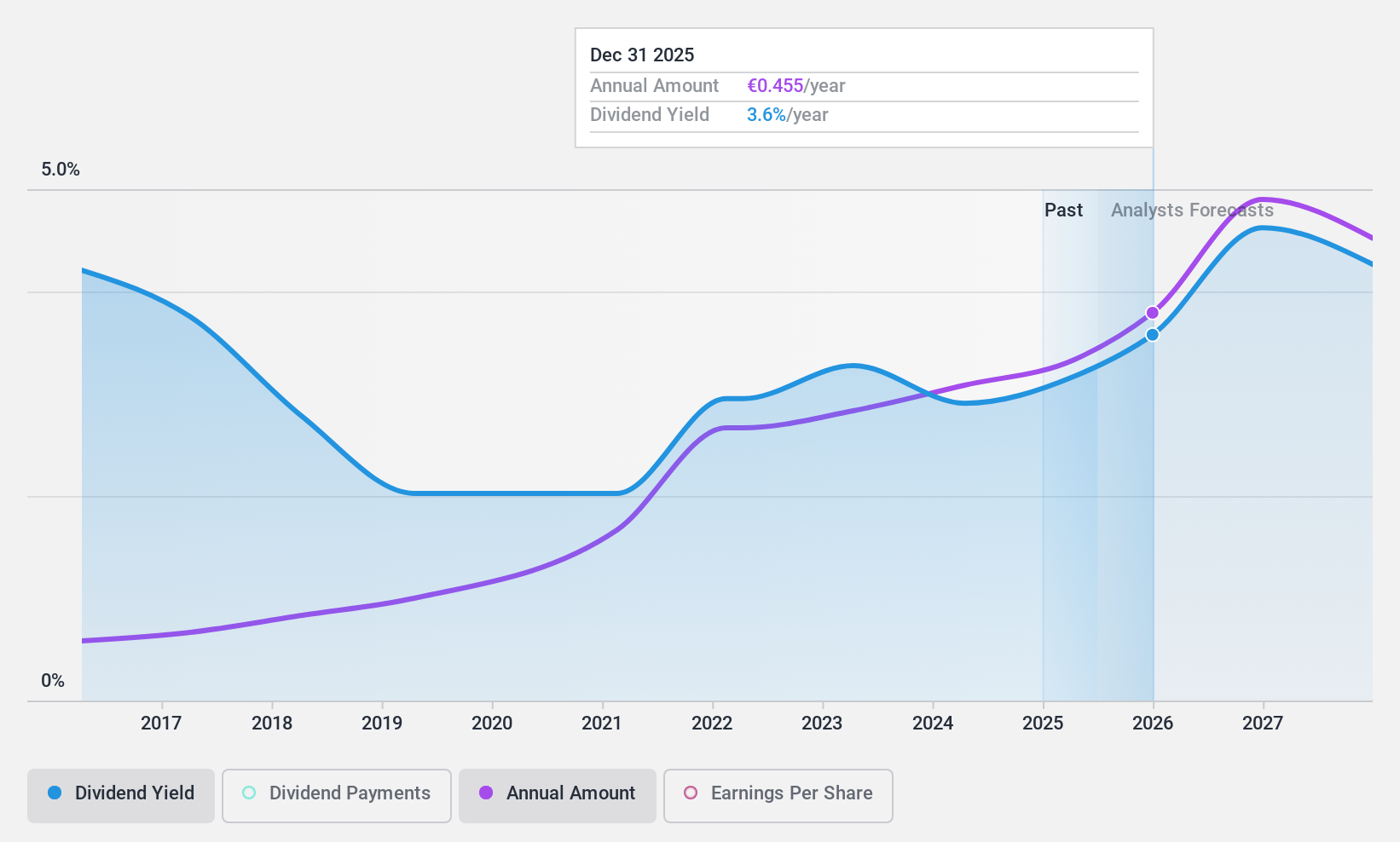

Marimekko Oyj (HLSE:MEKKO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marimekko Oyj is a lifestyle design company that designs, manufactures, and sells clothing, bags and accessories, and interior decoration products globally, with a market cap of €490.91 million.

Operations: Marimekko Oyj generates its revenue from the Marimekko Business segment, which amounted to €179.21 million.

Dividend Yield: 3.1%

Marimekko Oyj offers a stable dividend with consistent growth over the past decade, supported by a reasonable payout ratio of 64.9% and a cash payout ratio of 45.3%, ensuring coverage by both earnings and cash flows. Although its dividend yield of 3.06% is lower than the Finnish market's top quartile, it remains reliable and stable. Recent earnings showed slight declines in net income but overall sales growth for the nine months ended September 2024, aligning with positive future guidance.

- Click here to discover the nuances of Marimekko Oyj with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Marimekko Oyj is priced lower than what may be justified by its financials.

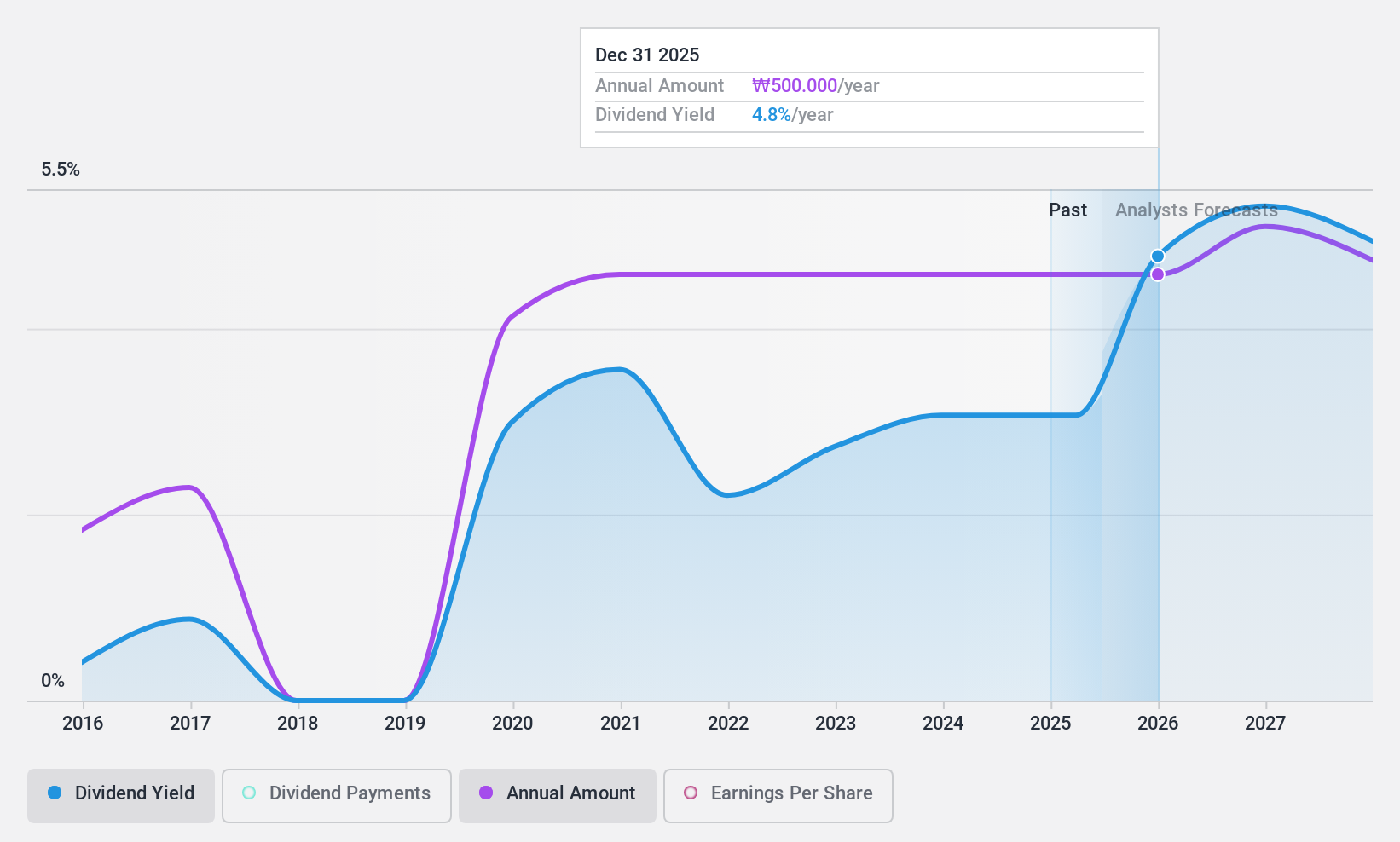

Hansae (KOSE:A105630)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hansae Co., Ltd. manufactures and sells finished clothing products across Vietnam, Indonesia, Nicaragua, Guatemala, Myanmar, and Haiti with a market cap of approximately ₩570.26 billion.

Operations: Hansae Co., Ltd. generates its revenue primarily from clothing manufacturing, with this segment contributing approximately ₩1.75 billion.

Dividend Yield: 3.5%

Hansae's dividend stability over the past decade is notable, though its 3.45% yield lags behind top Korean market payers. Despite a low payout ratio of 20.8%, dividends aren't well-supported by cash flows, indicated by a high cash payout ratio of 263.7%. Recent earnings reveal increased sales but declining net income for the third quarter and nine months ended September 2024, impacting dividend sustainability due to insufficient earnings coverage.

- Click here and access our complete dividend analysis report to understand the dynamics of Hansae.

- Our expertly prepared valuation report Hansae implies its share price may be lower than expected.

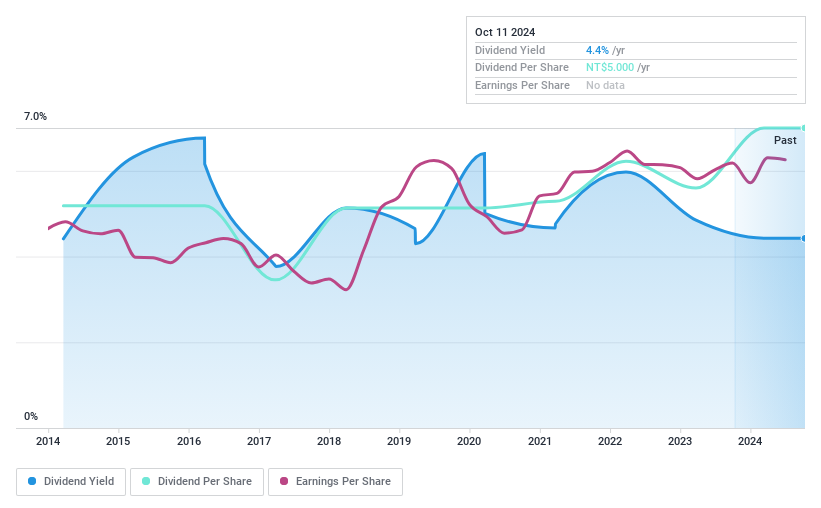

Lumax International (TWSE:6192)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lumax International Corp., Ltd. operates in Taiwan and China, supplying electronic components and program-controlled instruments, with a market cap of NT$10.58 billion.

Operations: Lumax International Corp., Ltd.'s revenue is primarily derived from Program-Controlled Instrument (NT$2.81 billion), Other Program Control Business (NT$1.76 billion), Program-Controlled System (NT$1.92 billion), Electronics Component (NT$555.50 million), and Communication and Linear Transmission System (NT$563.41 million).

Dividend Yield: 4.5%

Lumax International's dividend history is marked by volatility, with payments not consistently growing. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 57.2% and 60%, respectively. Trading significantly below its estimated fair value suggests potential for capital appreciation. Recent financials show increased sales but a slight drop in net income for Q3 2024 compared to the previous year, which may affect future dividend reliability.

- Click to explore a detailed breakdown of our findings in Lumax International's dividend report.

- According our valuation report, there's an indication that Lumax International's share price might be on the cheaper side.

Where To Now?

- Gain an insight into the universe of 1956 Top Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6192

Lumax International

Provides electronic components and program-controlled instruments in Taiwan and China.

Flawless balance sheet, good value and pays a dividend.