- Taiwan

- /

- Semiconductors

- /

- TWSE:8261

Undiscovered Gems And 2 Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

In the current global market landscape, small-cap stocks have faced heightened volatility, with indexes like the S&P 600 experiencing significant declines amid cautious Federal Reserve commentary and looming political uncertainties. Despite these challenges, economic indicators such as robust consumer spending and positive job data suggest underlying resilience that could bode well for discerning investors seeking opportunities in lesser-known equities. In this environment, identifying promising small-cap stocks involves looking for companies with strong fundamentals and growth potential that can weather broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Invest Bank | 135.69% | 11.07% | 18.67% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

We'll examine a selection from our screener results.

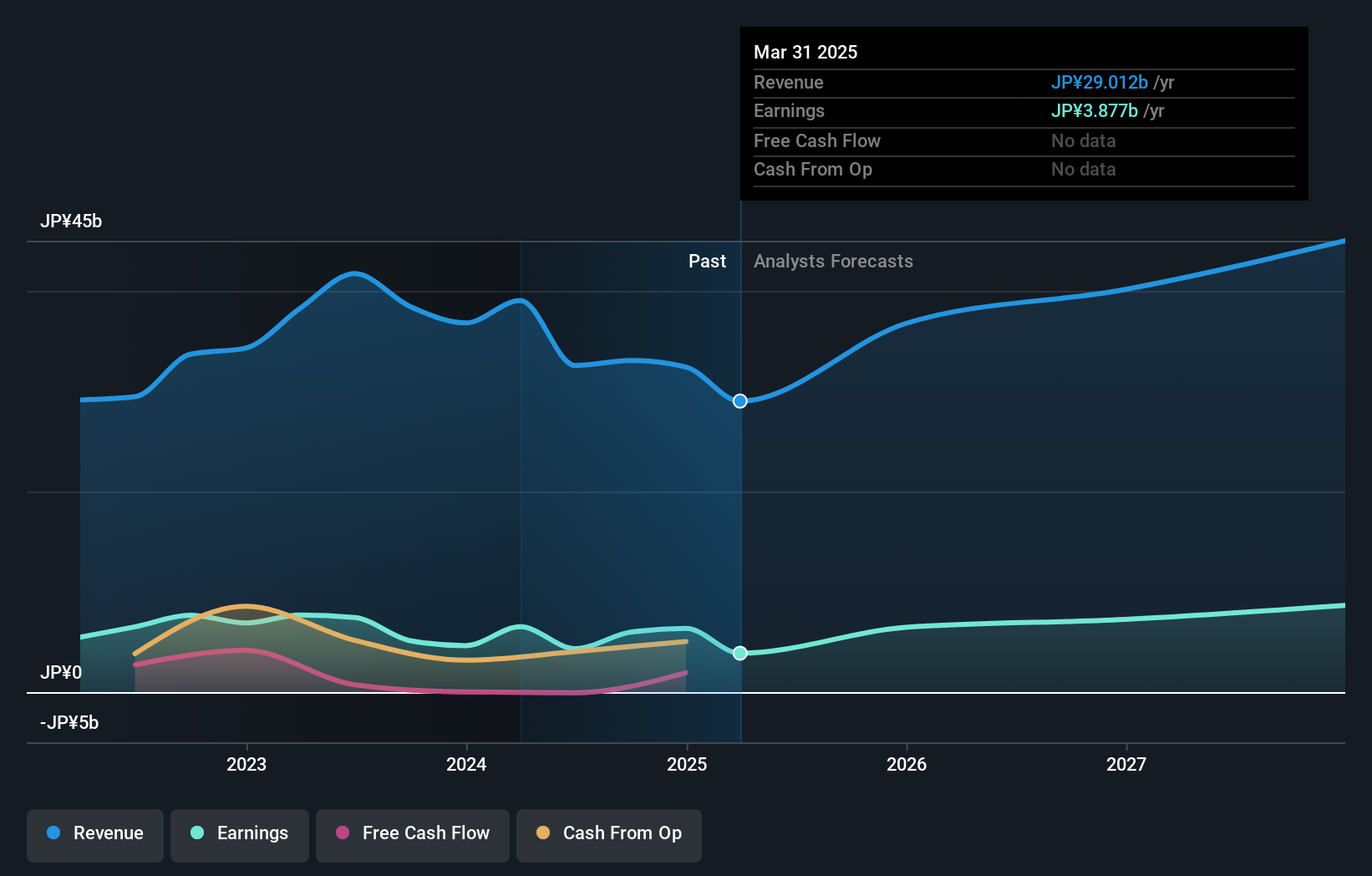

OptorunLtd (TSE:6235)

Simply Wall St Value Rating: ★★★★★★

Overview: Optorun Co., Ltd. specializes in the manufacture, distribution, and import/export of vacuum coating machines and related equipment in Japan, with a market cap of ¥83.85 billion.

Operations: Optorun generates revenue primarily from its Film Deposition Equipment Business, which reported ¥33.06 billion.

Optorun Ltd., a small player in the semiconductor industry, has shown impressive earnings growth of 16.5% over the past year, surpassing the industry's average of 6.7%. Despite a large one-off gain of ¥2.7 billion impacting recent financial results, it remains profitable with no concerns about its cash runway. The company's debt to equity ratio has decreased significantly from 2% to 0.7% over five years, indicating prudent financial management and more cash than total debt. Looking ahead, earnings are forecasted to grow at an annual rate of 16.85%, suggesting potential for continued robust performance in its sector.

- Click here to discover the nuances of OptorunLtd with our detailed analytical health report.

Examine OptorunLtd's past performance report to understand how it has performed in the past.

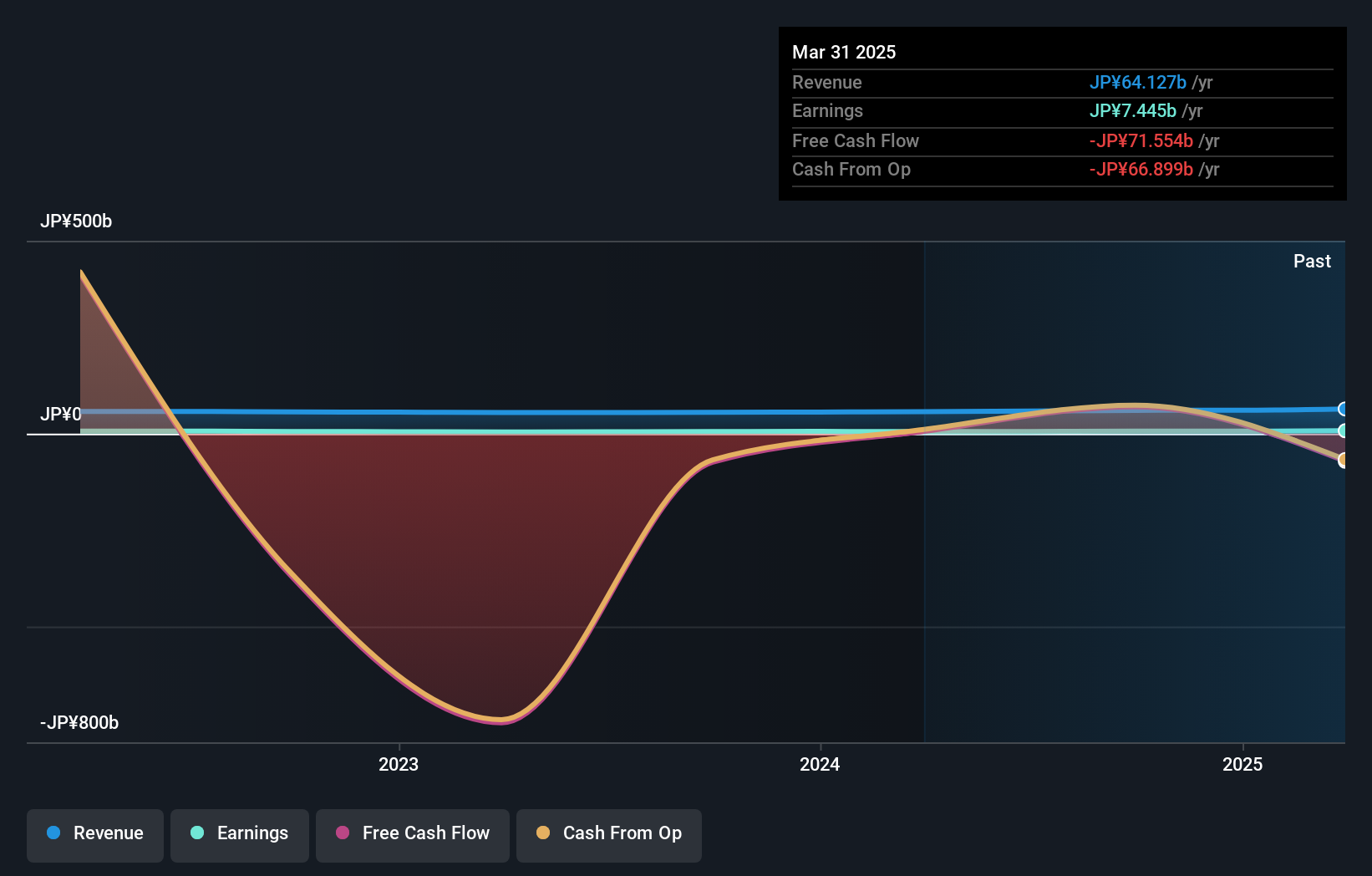

Toho Bank (TSE:8346)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Toho Bank, Ltd. offers a range of banking products and services in Japan and has a market capitalization of ¥73.41 billion.

Operations: Toho Bank's primary revenue stream is derived from its banking operations, which generated ¥52.69 billion. The leasing segment contributed ¥7.88 billion, followed by credit guarantees at ¥1.81 billion and securities at ¥0.92 billion.

With total assets of ¥6,590.9 billion and equity at ¥207.3 billion, Toho Bank operates on a solid foundation with 97% of its liabilities funded through low-risk customer deposits. Total deposits stand at ¥6,169.1 billion against loans of ¥3,756.7 billion, showcasing a strategic balance in operations despite a net interest margin of just 0.6%. Earnings growth outpaced the industry with a 23% rise over the past year while trading at 13.8% below fair value suggests potential upside for investors seeking undervalued opportunities in financial sectors with high-quality earnings and appropriate non-performing loan levels at 1.4%.

- Take a closer look at Toho Bank's potential here in our health report.

Understand Toho Bank's track record by examining our Past report.

Advanced Power Electronics (TWSE:8261)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Power Electronics Co., Ltd. specializes in providing power discrete products in Taiwan and has a market capitalization of approximately NT$10.99 billion.

Operations: The company generates revenue primarily from its Electronic Components & Parts segment, amounting to NT$2.82 billion.

Advanced Power Electronics, a promising entity in the semiconductor sector, showcases robust financial health with earnings up 28.5% over the past year, surpassing industry growth of 5.9%. The company is debt-free now, a significant improvement from five years ago when its debt-to-equity ratio was 23.3%. With a price-to-earnings ratio of 24.7x below the industry average of 29.2x, it presents an attractive valuation proposition. Recent results highlight net income for Q3 at TWD 155 million compared to TWD 136 million last year and basic EPS rising to TWD 1.31 from TWD 1.16, indicating solid performance momentum.

Make It Happen

- Gain an insight into the universe of 4624 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:8261

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives