- Taiwan

- /

- Construction

- /

- TWSE:5515

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a landscape marked by accelerating inflation and rising indices, investors are increasingly seeking stability amid economic uncertainties. In such an environment, dividend stocks can offer a reliable income stream and potential for portfolio enhancement.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.95% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.41% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.42% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1992 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Dubai Islamic Bank P.J.S.C (DFM:DIB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Islamic Bank P.J.S.C. operates in corporate, retail, and investment banking both in the United Arab Emirates and internationally, with a market cap of approximately AED55.87 billion.

Operations: Dubai Islamic Bank P.J.S.C.'s revenue segments include Consumer Banking (AED4.38 billion), Corporate Banking (AED3.40 billion), Treasury (AED2.55 billion), and Real Estate Development (AED645 million).

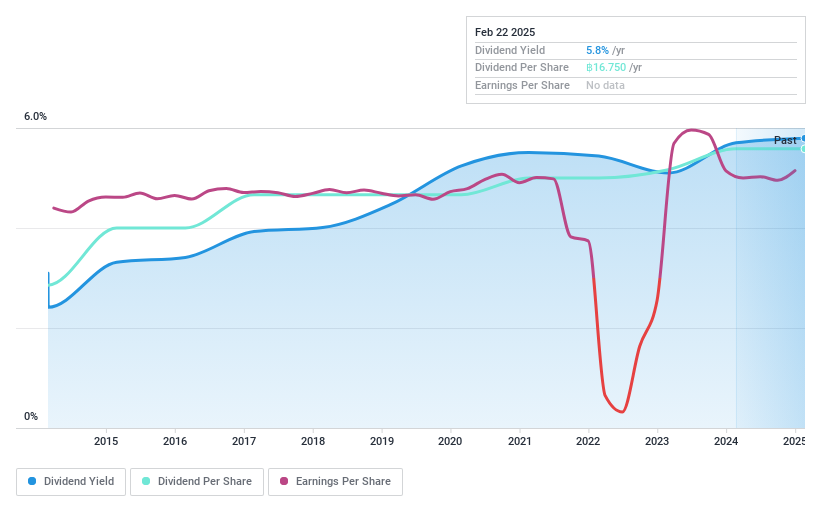

Dividend Yield: 5.8%

Dubai Islamic Bank P.J.S.C. offers a dividend yield of 5.82%, slightly below the top quartile in the AE market, and maintains a reasonable payout ratio of 43.3%. Despite recent earnings growth and a recommended AED 0.45 per share dividend for 2024, its dividends have been volatile over the past decade. The bank faces challenges with high bad loans (3.8%), impacting financial stability, yet trades attractively with a P/E ratio of 7.4x against the market's 13.3x average.

- Navigate through the intricacies of Dubai Islamic Bank P.J.S.C with our comprehensive dividend report here.

- According our valuation report, there's an indication that Dubai Islamic Bank P.J.S.C's share price might be on the cheaper side.

BKI Holdings (SET:BKIH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BKI Holdings Public Company Limited operates in Thailand, providing non-life insurance services, and has a market cap of THB30.17 billion.

Operations: BKI Holdings generates revenue from various segments, including Fire (THB1.74 billion), Motor (THB12.38 billion), Miscellaneous (THB6.50 billion), and Marine and Transportation (THB411.56 million).

Dividend Yield: 5.8%

BKI Holdings' dividend yield of 5.78% is lower than the top 25% in the TH market, and its high payout ratio of 119% suggests dividends are not well covered by earnings. However, cash flows cover the current cash payout ratio of 76.3%. Despite stable and reliable dividend payments over the past decade, profit margins have declined from last year. The stock trades at a discount, being 22.6% below its estimated fair value.

- Click here and access our complete dividend analysis report to understand the dynamics of BKI Holdings.

- Our comprehensive valuation report raises the possibility that BKI Holdings is priced higher than what may be justified by its financials.

Chien Kuo Construction (TWSE:5515)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chien Kuo Construction Co., Ltd. operates in the construction industry within Taiwan and China, with a market capitalization of approximately NT$5.54 billion.

Operations: Chien Kuo Construction Co., Ltd. generates its revenue primarily from its construction activities, amounting to NT$5.21 billion.

Dividend Yield: 4.5%

Chien Kuo Construction offers a dividend yield of 4.55%, placing it in the top 25% of dividend payers in Taiwan. Despite this, dividends have been volatile over the past decade with no growth. The payout ratio is sustainable at 51.4%, supported by strong cash flow coverage at 29.1%. However, large one-off items have impacted earnings quality, and the stock trades significantly below its estimated fair value by approximately 73.2%.

- Unlock comprehensive insights into our analysis of Chien Kuo Construction stock in this dividend report.

- Our valuation report here indicates Chien Kuo Construction may be undervalued.

Taking Advantage

- Navigate through the entire inventory of 1992 Top Dividend Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5515

Chien Kuo Construction

Engages in the construction business in Taiwan and China.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives