As global markets navigate a mixed economic landscape, characterized by fluctuating consumer confidence and evolving trade tensions, investors continue to seek stability and income amidst uncertainty. In such an environment, dividend stocks can offer a reliable source of returns, providing both income and potential for growth as they distribute profits back to shareholders.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1952 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Chow Sang Sang Holdings International (SEHK:116)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chow Sang Sang Holdings International Limited is an investment holding company that manufactures and retails jewellery, with a market cap of HK$4.29 billion.

Operations: Chow Sang Sang Holdings International Limited generates revenue primarily from the retail of jewellery and watches (HK$22.65 billion), wholesale of precious metals (HK$1.14 billion), and trading of LGD (HK$9.33 million).

Dividend Yield: 8.5%

Chow Sang Sang Holdings International's dividend payments are covered by earnings and cash flows, with a payout ratio of 50.8% and a cash payout ratio of 19.8%. However, dividends have been volatile and unreliable over the past decade, experiencing significant drops. Despite this instability, the stock trades at good value compared to peers and offers a top-tier dividend yield in the Hong Kong market.

- Dive into the specifics of Chow Sang Sang Holdings International here with our thorough dividend report.

- Upon reviewing our latest valuation report, Chow Sang Sang Holdings International's share price might be too pessimistic.

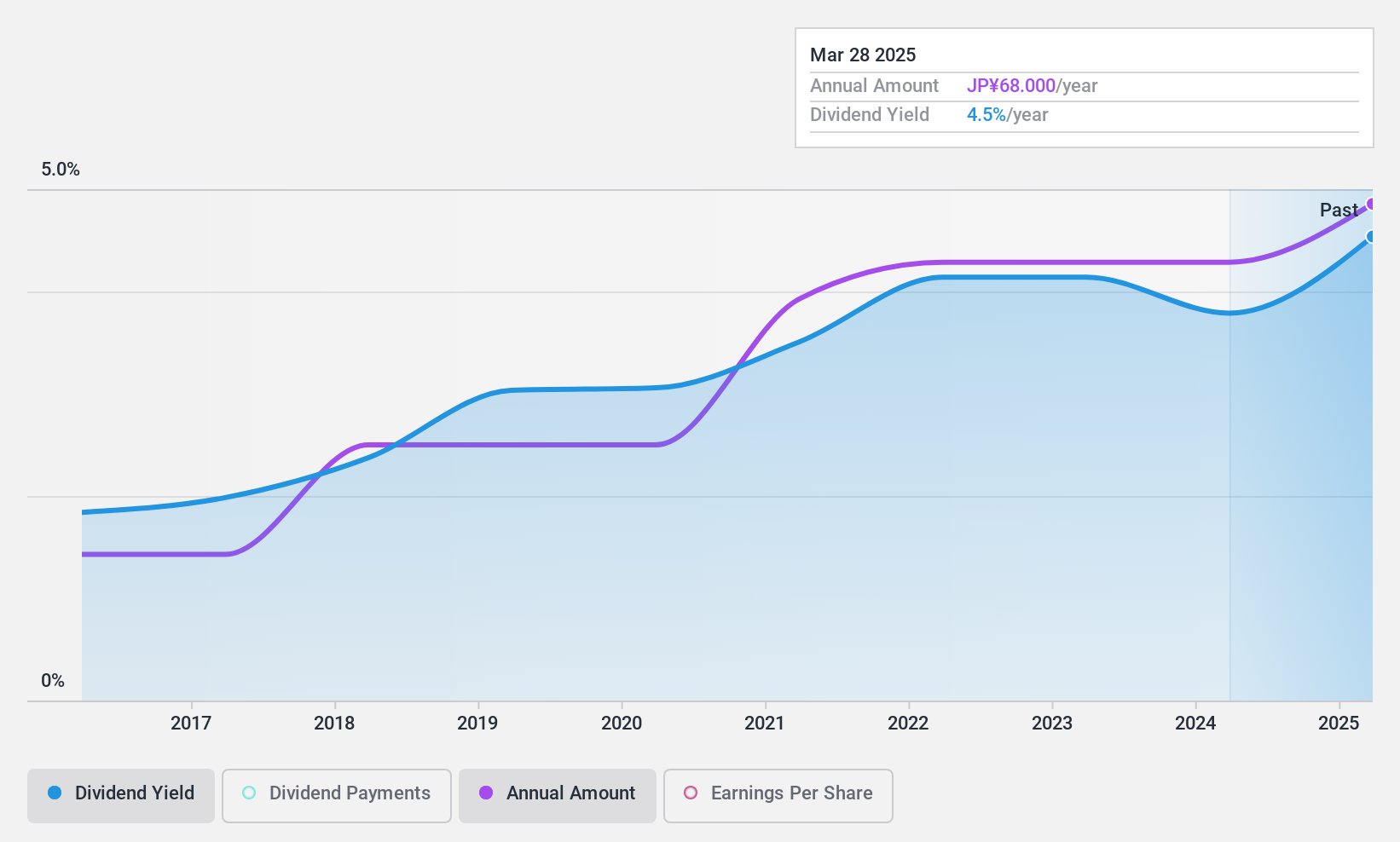

SPARX Group (TSE:8739)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SPARX Group Co., Ltd. is a publicly owned asset management holding company with a market cap of ¥60.74 billion.

Operations: SPARX Group Co., Ltd. generates revenue of ¥17.28 billion from its Investment Trust and Investment Advisory Business segment.

Dividend Yield: 4.3%

SPARX Group's dividends are well-supported by earnings and cash flows, with a payout ratio of 48% and a cash payout ratio of 52.8%. The company offers an attractive dividend yield of 4.31%, placing it in the top quarter among Japanese dividend payers. Dividends have been stable and growing over the past decade. Additionally, SPARX has recently completed a share buyback program to enhance shareholder returns, repurchasing shares worth ¥292.69 million.

- Get an in-depth perspective on SPARX Group's performance by reading our dividend report here.

- According our valuation report, there's an indication that SPARX Group's share price might be on the cheaper side.

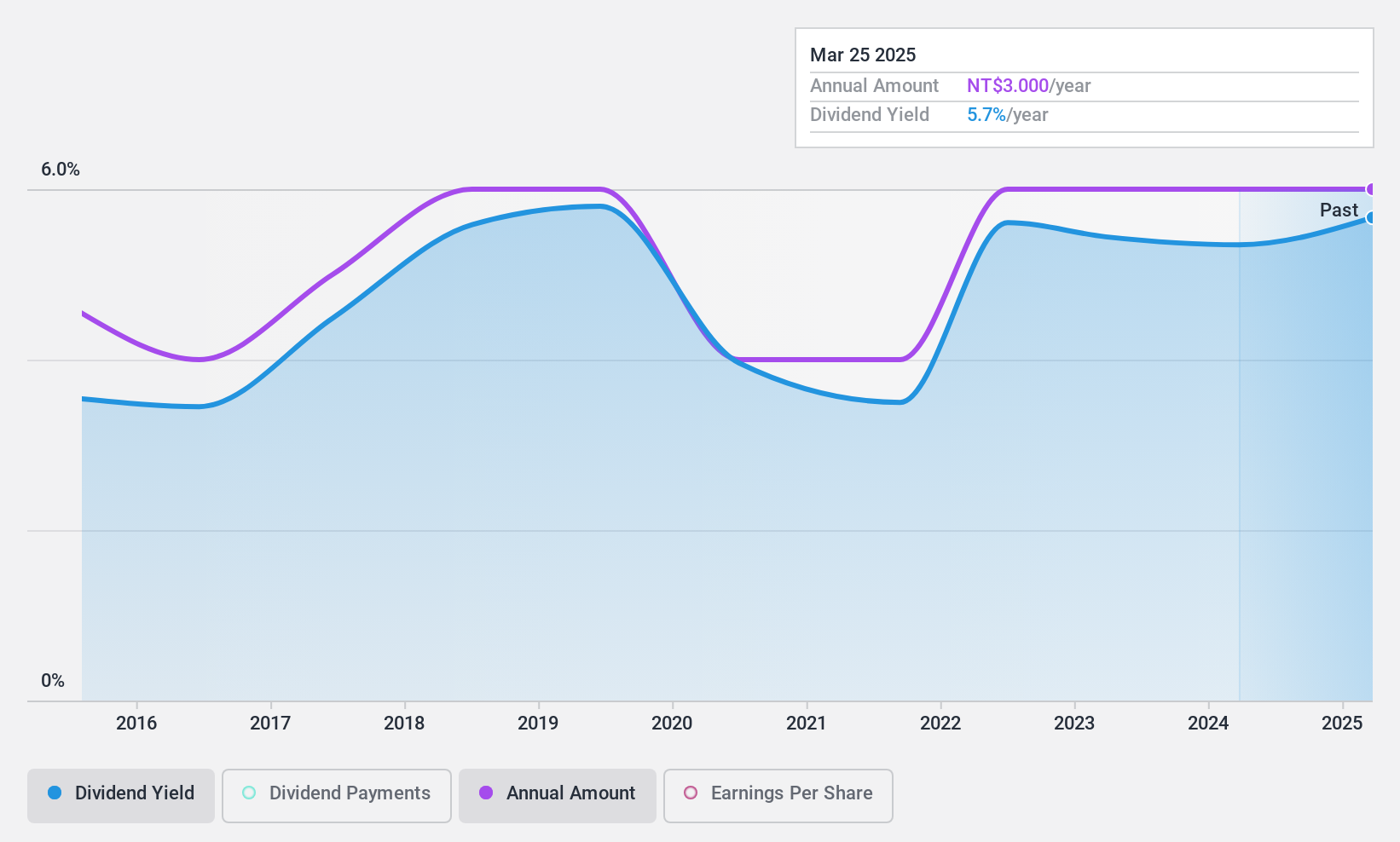

San Shing Fastech (TWSE:5007)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: San Shing Fastech Corp. is involved in the manufacturing, processing, marketing, and exporting of bolts, nuts, steel wires, and related machinery and tools across the United States, Germany, Taiwan, and other international markets with a market cap of NT$16.22 billion.

Operations: San Shing Fastech Corp.'s revenue segments include NT$6.08 billion from the Fastening Department and NT$992.73 million from the Machine Model Department.

Dividend Yield: 5.4%

San Shing Fastech's dividend yield of 5.41% ranks in the top 25% of Taiwan's market, although payments have been volatile over the past decade. The payout ratio is 80.9%, indicating coverage by earnings, but the high cash payout ratio of 156.2% suggests insufficient free cash flow support. Recent earnings reports show increased sales and net income for the first nine months of 2024, with a slight decline in quarterly net income year-over-year.

- Click here and access our complete dividend analysis report to understand the dynamics of San Shing Fastech.

- In light of our recent valuation report, it seems possible that San Shing Fastech is trading beyond its estimated value.

Key Takeaways

- Navigate through the entire inventory of 1952 Top Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:116

Chow Sang Sang Holdings International

An investment holding company, manufactures and retails jewellery in the Mainland China, Hong Kong, Macau, and Taiwan.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives