- Taiwan

- /

- Construction

- /

- TWSE:3703

Continental Holdings Corporation (TWSE:3703) Stock Catapults 36% Though Its Price And Business Still Lag The Market

Despite an already strong run, Continental Holdings Corporation (TWSE:3703) shares have been powering on, with a gain of 36% in the last thirty days. The last 30 days bring the annual gain to a very sharp 26%.

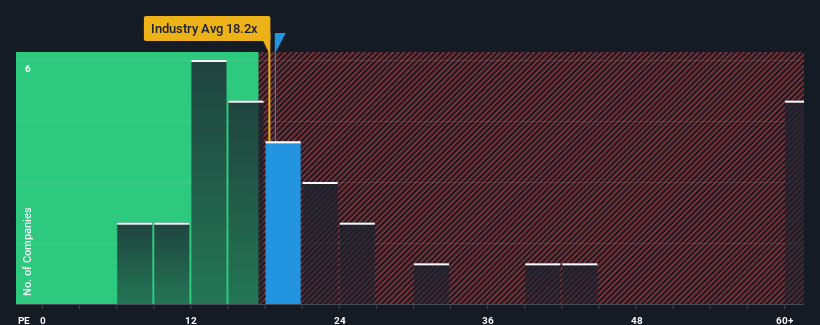

Even after such a large jump in price, Continental Holdings may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 18.7x, since almost half of all companies in Taiwan have P/E ratios greater than 24x and even P/E's higher than 41x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Continental Holdings' financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Continental Holdings

Is There Any Growth For Continental Holdings?

Continental Holdings' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 41%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 12% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Continental Holdings' P/E sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

The Key Takeaway

The latest share price surge wasn't enough to lift Continental Holdings' P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Continental Holdings revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 3 warning signs for Continental Holdings (2 are significant!) that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3703

Continental Holdings

Engages in civil and building construction, real estate development, environmental project development, and water treatment businesses in Taiwan and internationally.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives