As global markets experience a rebound, driven by easing core U.S. inflation and strong bank earnings, small-cap stocks are gaining attention with the S&P MidCap 400 and Russell 2000 indices showing notable weekly gains. In this dynamic environment, identifying promising stocks often involves looking for companies with solid fundamentals that can thrive amid economic shifts and sector-specific trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| L&K Engineering | 14.36% | 37.26% | 54.49% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Sesoda | 71.33% | 11.54% | 15.53% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Great China Metal Ind | 0.32% | 2.69% | -3.41% | ★★★★★★ |

| China Electric Mfg | 13.74% | -13.57% | -32.70% | ★★★★★★ |

| ASRock Rack Incorporation | NA | 45.76% | 269.05% | ★★★★★★ |

| Savior Lifetec | NA | -7.74% | -0.77% | ★★★★★★ |

| Firich Enterprises | 34.24% | -2.31% | 25.41% | ★★★★★☆ |

| Systex | 31.75% | 12.06% | -1.88% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Value Rating: ★★★★★☆

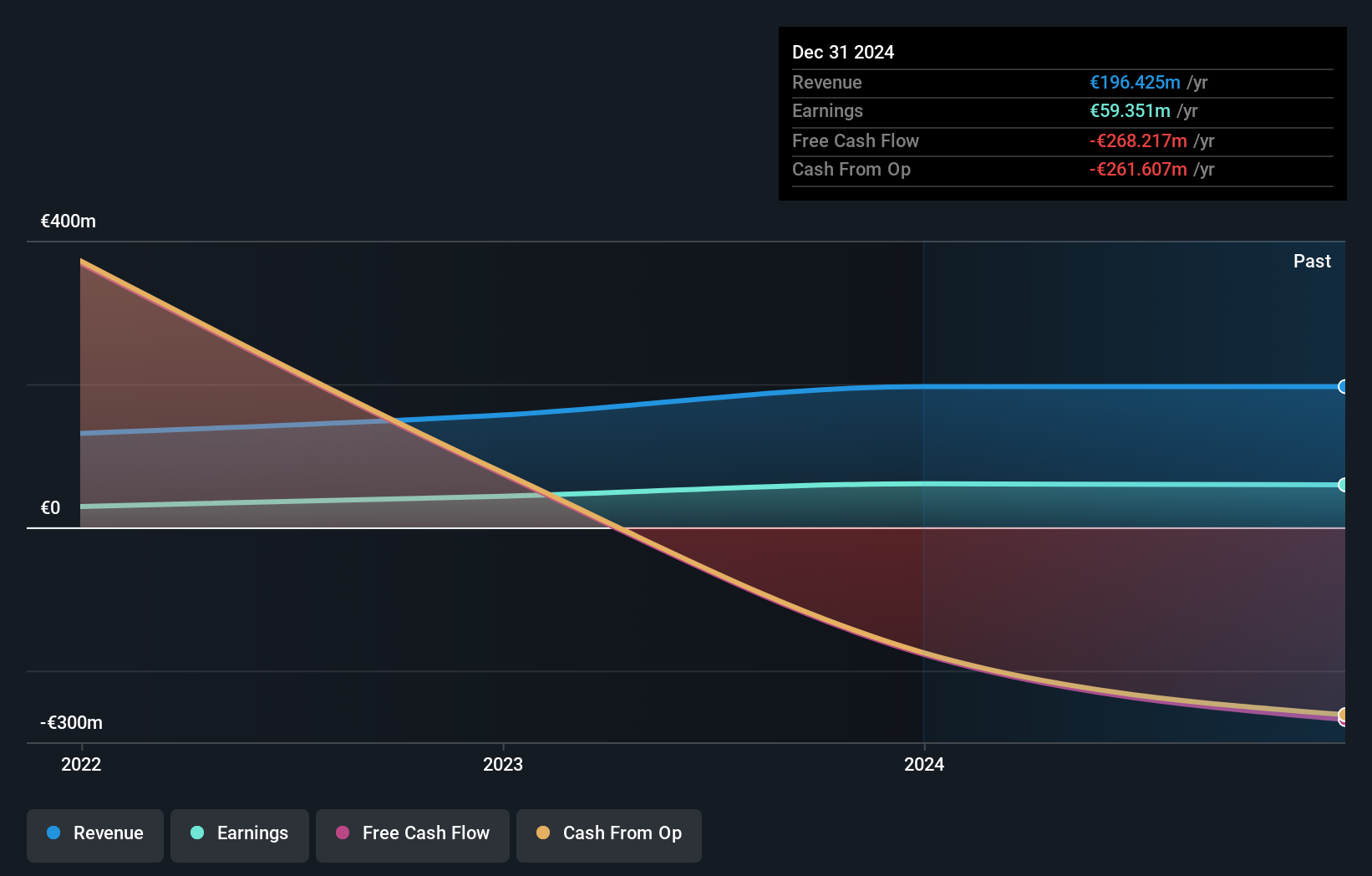

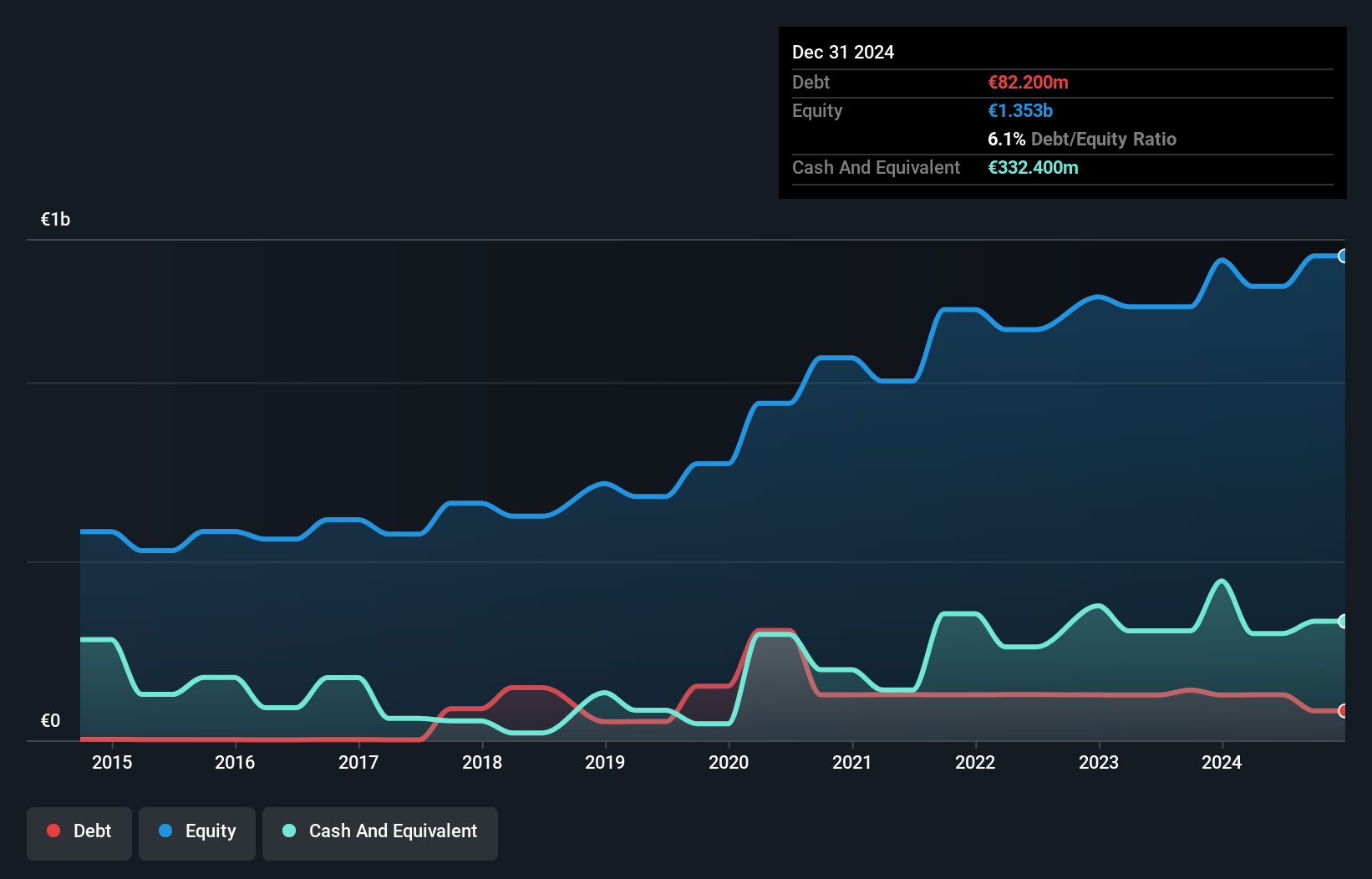

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, offers banking and financial solutions to private investors, businesses, institutions, and professionals in Monaco and internationally, with a market cap of €670.41 million.

Operations: CFM Indosuez Wealth Management generates revenue primarily from its wealth management services, amounting to €196.38 million. The company's financial performance is reflected in its market capitalization of €670.41 million.

CFM Indosuez Wealth Management, with total assets of €7.7 billion and equity of €404.3 million, stands out in the banking sector due to its impressive earnings growth of 40.1% over the past year, surpassing the industry average of 5.3%. This growth is supported by a strong financial foundation, with total deposits at €6.2 billion and loans amounting to €3.2 billion. The company maintains an appropriate level of bad loans at 0.8%, complemented by a low allowance for bad loans at 34%. Its price-to-earnings ratio is attractively positioned at 11x compared to the French market's 14x, indicating potential value for investors seeking opportunities in smaller financial entities with robust performance metrics and primarily low-risk funding sources comprising 85% customer deposits.

Métropole Télévision (ENXTPA:MMT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Métropole Télévision S.A. offers a variety of programs, products, and services across different media platforms with a market capitalization of approximately €1.54 billion.

Operations: Métropole Télévision generates revenue primarily from Television (€1.07 billion) and Radio (€161.90 million), with additional income from Production and Audiovisual Rights (€166.40 million).

Métropole Télévision, a nimble player in the media space, has shown some intriguing financial dynamics. The debt to equity ratio climbed from 7.7% to 10% over five years, indicating a slight shift in capital structure. Despite this, the company is profitable and doesn't face cash runway issues. It trades at a substantial 53% below its estimated fair value compared to peers and industry standards, suggesting potential undervaluation. However, earnings growth of 23% last year lagged behind the broader media industry's pace of 31%, with forecasts predicting an average annual decline of around 11% over three years.

- Click to explore a detailed breakdown of our findings in Métropole Télévision's health report.

Evaluate Métropole Télévision's historical performance by accessing our past performance report.

G-SHANK Enterprise (TWSE:2476)

Simply Wall St Value Rating: ★★★★★★

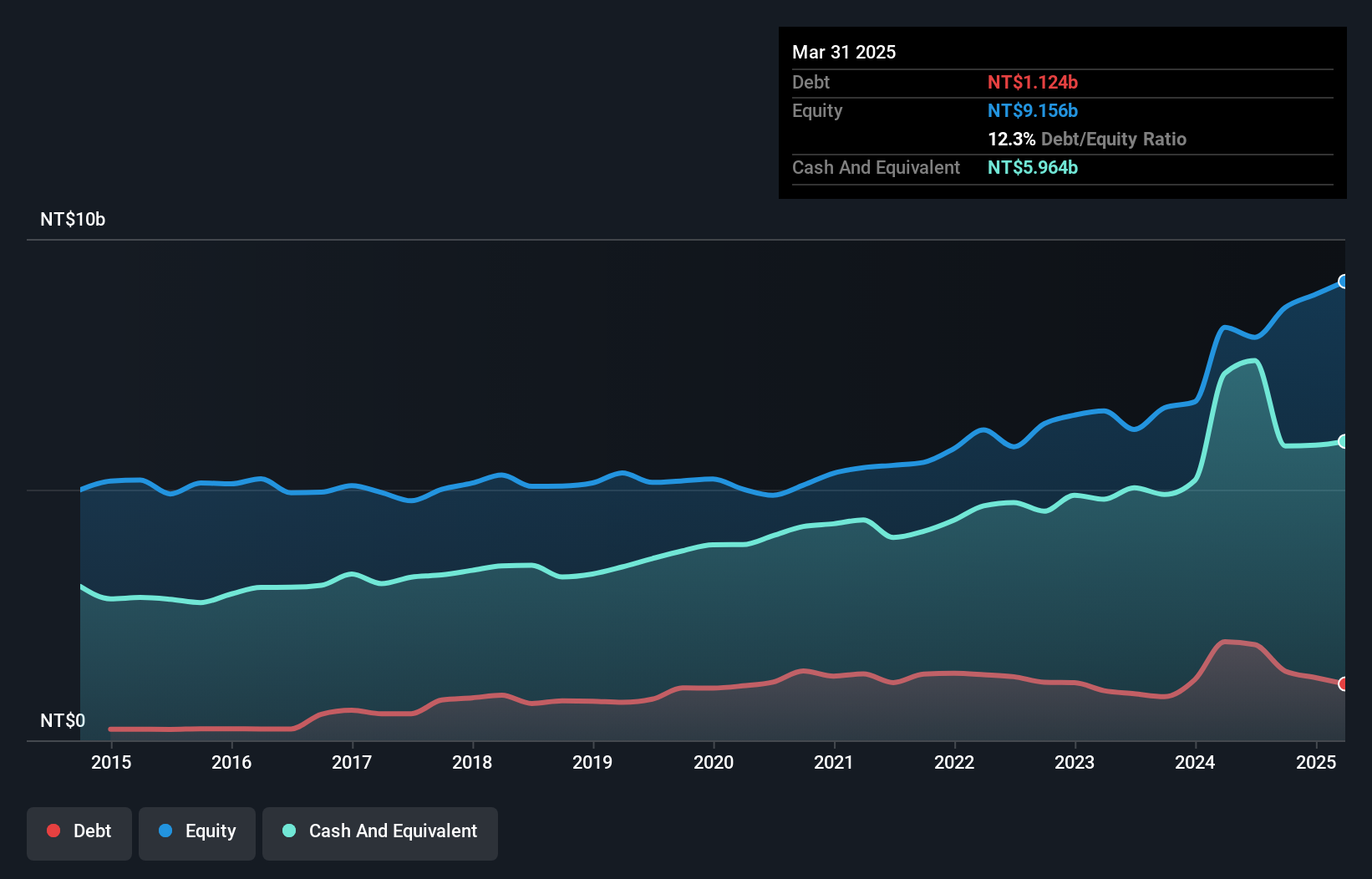

Overview: G-SHANK Enterprise Co., Ltd. is an investment holding company involved in the production and sales of molds, stamping parts, fixtures and tools, automatic machines and electrical appliances, and mechanical components with a market cap of NT$17.75 billion.

Operations: The primary revenue stream for G-SHANK Enterprise is from stamping parts, generating NT$6.37 billion. The company's market cap stands at NT$17.75 billion.

G-SHANK Enterprise, a notable player in the machinery sector, has demonstrated impressive growth with earnings rising by 37.6% over the past year, outpacing industry peers. The company's price-to-earnings ratio of 18.8x remains favorable compared to the TW market's 20.5x, suggesting potential value for investors. G-SHANK's debt-to-equity ratio improved from 20.2% to 16% over five years, indicating prudent financial management. Recent sales figures show robust performance; November's revenue hit TWD 558 million against last year's TWD 494 million and year-to-date sales reached TWD 6 billion versus TWD 5 billion previously, reflecting solid operational momentum.

Taking Advantage

- Click here to access our complete index of 4649 Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MLCFM

CFM Indosuez Wealth Management

Engages in the provision of banking and financial solutions in Monaco and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)