- Switzerland

- /

- Life Sciences

- /

- SWX:SKAN

Uncovering Hidden Potential With These 3 Small Cap Gems

Reviewed by Simply Wall St

As global markets navigate through heightened inflation and economic uncertainties, small-cap stocks have been trailing behind their larger counterparts, with the Russell 2000 Index underperforming the S&P 500. Despite this lag, these conditions can create opportunities for discerning investors to uncover hidden potential in lesser-known small-cap companies that may be poised for growth.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| NSIA Banque Société Anonyme | 10.33% | 13.42% | 31.75% | ★★★★★☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

SKAN Group (SWX:SKAN)

Simply Wall St Value Rating: ★★★★★☆

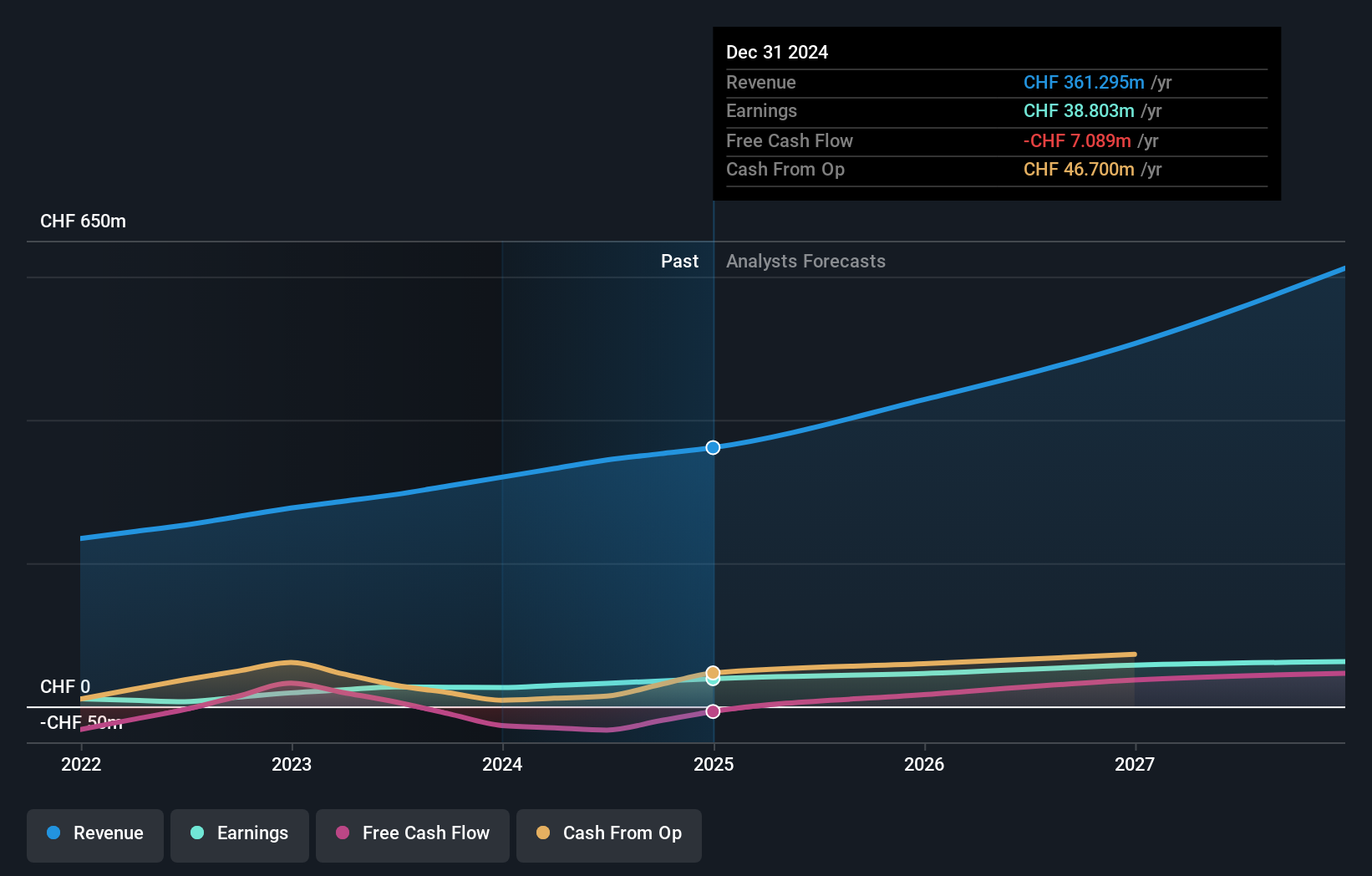

Overview: SKAN Group AG, with a market cap of CHF 1.76 billion, operates internationally by providing isolators, cleanroom devices, and decontamination processes for the pharmaceutical and chemical industries across Asia, Europe, the Americas, and other regions.

Operations: SKAN Group generates revenue primarily through its Equipment & Solutions segment, which accounts for CHF 254.17 million, and its Services & Consumables segment, contributing CHF 89.84 million.

SKAN Group, a smaller player in the Life Sciences sector, has been making waves with its impressive 17.9% earnings growth over the past year, outpacing the industry's 6.3%. The company is trading at 11.3% below its estimated fair value and boasts more cash than total debt, indicating financial stability despite a rise in its debt to equity ratio from 0% to 3.5% over five years. SKAN's recent participation in key industry events like the Sanofi Global Vaccines Summit highlights its proactive engagement within the sector as it projects net sales of CHF 360 million for 2024, up from CHF 320 million in 2023.

- Navigate through the intricacies of SKAN Group with our comprehensive health report here.

Gain insights into SKAN Group's historical performance by reviewing our past performance report.

HalowsLtd (TSE:2742)

Simply Wall St Value Rating: ★★★★★☆

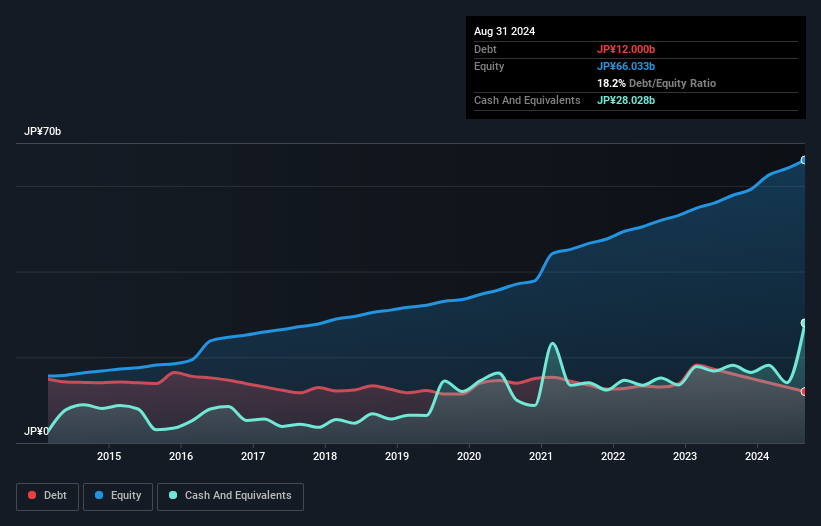

Overview: Halows Co., Ltd. operates a network of supermarket stores across several regions in Japan, including Hiroshima and Okayama, with a market cap of ¥83.82 billion.

Operations: The company generates revenue primarily through its supermarket operations across multiple regions in Japan. It has a market capitalization of ¥83.82 billion.

HalowsLtd shines with its robust financial health, having more cash than total debt, indicating a solid balance sheet. The company's high-quality earnings and profitability ensure that cash runway isn't a concern. Over the past year, earnings surged by 32%, outpacing the Consumer Retailing industry's 10% growth rate. Trading at 80% below fair value estimates suggests potential undervaluation in the market. Additionally, HalowsLtd's debt to equity ratio improved significantly from 34% to 16% over five years, reflecting prudent financial management. These factors collectively highlight HalowsLtd as an intriguing player within its sector with promising prospects ahead.

- Click here and access our complete health analysis report to understand the dynamics of HalowsLtd.

Gain insights into HalowsLtd's past trends and performance with our Past report.

C Sun Mfg (TWSE:2467)

Simply Wall St Value Rating: ★★★★★★

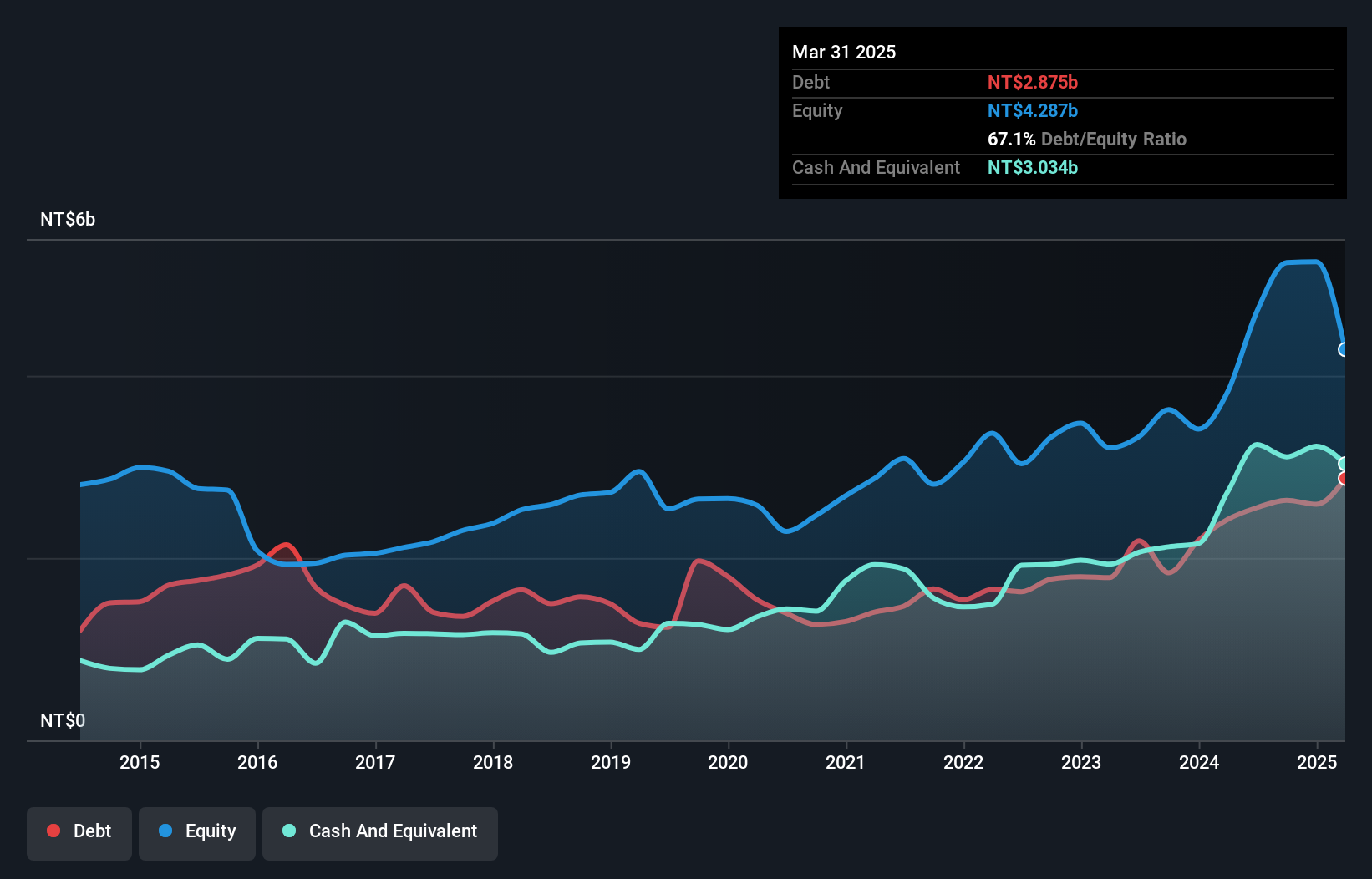

Overview: C Sun Mfg Ltd., along with its subsidiaries, supplies diverse processing equipment across Taiwan, China, and international markets, with a market capitalization of NT$27.44 billion.

Operations: C Sun Mfg Ltd. generates revenue primarily through its subsidiaries, with Zhisheng Industry contributing NT$2.46 billion and Suzhou Top Creation Machines Co Ltd. adding NT$1.44 billion to the total revenue streams.

C Sun Mfg, a smaller player in the machinery sector, has been making waves with its impressive 23.5% earnings growth over the past year, outpacing the industry's 14.6%. The company boasts high-quality earnings and maintains a healthy financial position with more cash than total debt, which underscores its robust balance sheet. Over five years, it reduced its debt-to-equity ratio from 74.4% to 50.2%, reflecting prudent financial management. Additionally, C Sun's recent share buyback of 803,000 shares for TWD 184.63 million signals confidence in its future prospects as it continues to generate positive free cash flow and forecasts suggest earnings could grow by an impressive rate of over 47% annually.

Key Takeaways

- Reveal the 4714 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SKAN Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SKAN

SKAN Group

Provides isolators, cleanroom devices, and decontamination processes for pharmaceutical and chemical industries in Europe, the Americas, Asia, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives