- Taiwan

- /

- Construction

- /

- TWSE:2404

United Integrated Services Co., Ltd. (TWSE:2404) Soars 27% But It's A Story Of Risk Vs Reward

United Integrated Services Co., Ltd. (TWSE:2404) shareholders have had their patience rewarded with a 27% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 73% in the last year.

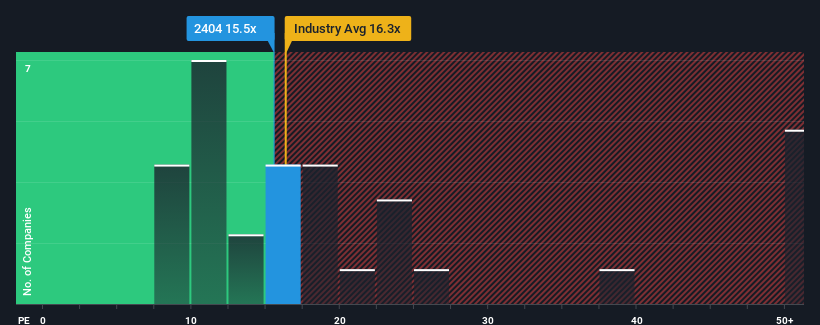

Although its price has surged higher, United Integrated Services' price-to-earnings (or "P/E") ratio of 15.5x might still make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 21x and even P/E's above 37x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

The earnings growth achieved at United Integrated Services over the last year would be more than acceptable for most companies. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for United Integrated Services

Does Growth Match The Low P/E?

United Integrated Services' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. Pleasingly, EPS has also lifted 84% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 24% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised earnings results.

With this information, we find it odd that United Integrated Services is trading at a P/E lower than the market. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift United Integrated Services' P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that United Integrated Services currently trades on a lower than expected P/E since its recent three-year growth is in line with the wider market forecast. When we see average earnings with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about this 1 warning sign we've spotted with United Integrated Services.

You might be able to find a better investment than United Integrated Services. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2404

United Integrated Services

Provides engineering construction services in Taiwan, Mainland China, Singapore, the United states, and Japan.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives