- Taiwan

- /

- Real Estate

- /

- TPEX:5508

Undiscovered Gems Including Yungshin Construction & DevelopmentLtd And 2 Promising Small Caps

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainties, U.S. stocks, particularly smaller-cap indexes, faced broad-based declines. Amid this backdrop of fluctuating market sentiment and economic indicators, investors are increasingly on the lookout for hidden opportunities that can weather such volatility. Identifying promising small-cap stocks often involves looking beyond immediate market trends to focus on companies with strong fundamentals and potential for growth even in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ABG Sundal Collier Holding | 18.07% | 0.55% | -4.76% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Yungshin Construction & DevelopmentLtd (TPEX:5508)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yungshin Construction & Development Co., Ltd. (TPEX:5508) is a company engaged in construction and development activities, with a market capitalization of NT$30.87 billion.

Operations: Yungshin Construction & Development generates revenue primarily from its home builders segment, which includes both residential and commercial projects, amounting to NT$12.55 billion.

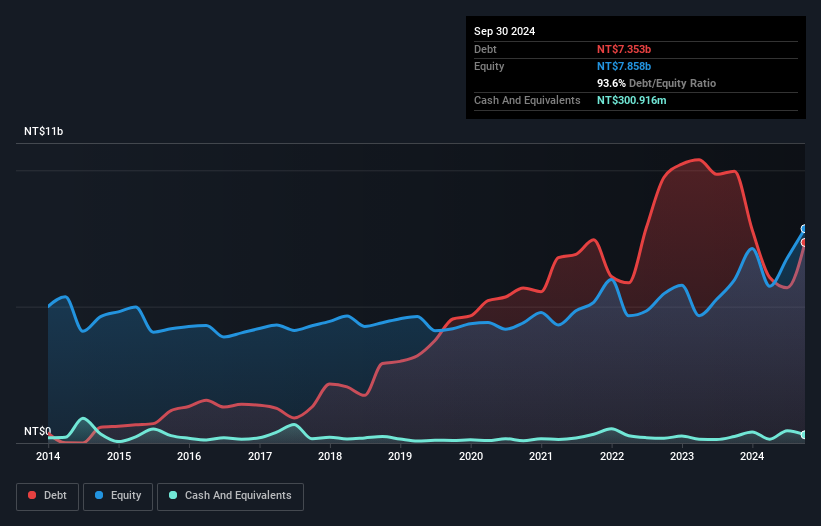

Yungshin Construction & Development, a small cap player in the real estate sector, has shown impressive growth with earnings surging by 129.4% over the past year, outpacing the industry average of 52%. The company's net debt to equity ratio stands at a high 89.7%, although it has improved from 108.6% over five years. Recent results highlight strong performance; third-quarter sales reached TWD 3 billion compared to TWD 2 billion last year, while net income increased to TWD 1 billion from TWD 715 million. Trading at nearly half its estimated fair value suggests potential for further appreciation.

Chiba Kogyo Bank (TSE:8337)

Simply Wall St Value Rating: ★★★★★☆

Overview: The Chiba Kogyo Bank, Ltd., along with its subsidiaries, offers a range of banking products and services in Japan and has a market capitalization of approximately ¥83.80 billion.

Operations: Chiba Kogyo Bank generates its revenue primarily from banking, which contributes ¥49.79 billion, followed by the leasing business at ¥8.08 billion, and the credit guarantee and credit card industry at ¥1.22 billion.

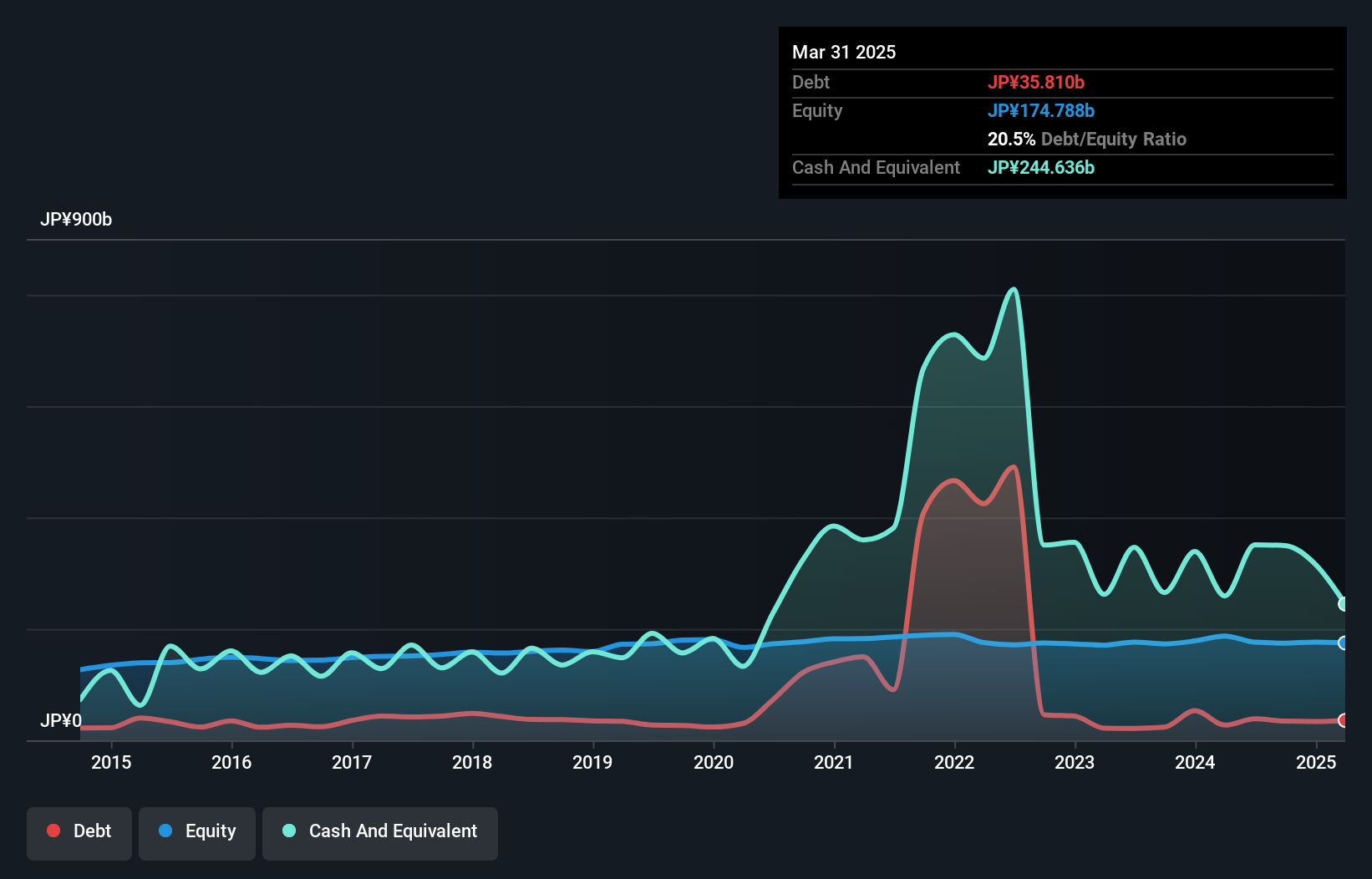

With total assets of ¥3,298.6 billion and total equity at ¥174.5 billion, Chiba Kogyo Bank operates with a robust foundation. Its deposits amount to ¥3,053.9 billion against loans of ¥2,390.3 billion; however, the bank's allowance for bad loans is insufficient at 1.8%. Despite this shortfall, it maintains primarily low-risk funding sources with 98% liabilities from customer deposits and trades at a compelling 23.7% below fair value estimates. Earnings have grown steadily by 18% annually over five years while recent guidance projects profits of ¥7 billion for March 2025 end year.

Run Long Construction (TWSE:1808)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Run Long Construction Co., Ltd. operates in the construction, sale, and leasing of residential and commercial buildings in Taiwan, with a market capitalization of approximately NT$37.85 billion.

Operations: The primary revenue stream for Run Long Construction comes from its Construction Industry Department, generating NT$14.75 billion. The company's net profit margin is not explicitly detailed in the provided data, but significant adjustments and eliminations amount to -NT$4.41 billion impact overall financials.

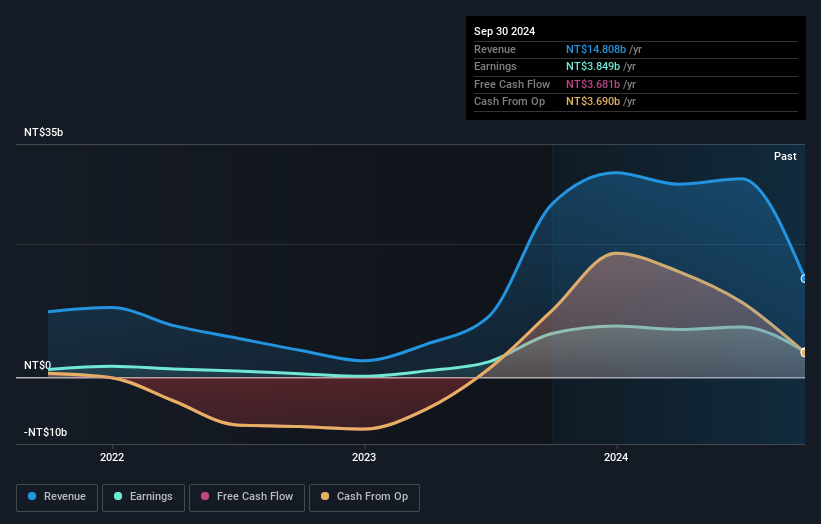

Run Long Construction, a relatively small player in the construction sector, has shown mixed financial signals recently. Despite high-quality past earnings and profitability, its net debt to equity ratio stands at 126.2%, which is considered high but has improved from 360.2% over five years. The company's price-to-earnings ratio of 9.8x suggests it might be undervalued compared to the broader TW market's 20.8x average. However, recent earnings reveal a significant drop with third-quarter sales at TWD 1,974 million against TWD 16,938 million last year and net income falling to TWD 443 million from TWD 4,148 million previously reported.

- Navigate through the intricacies of Run Long Construction with our comprehensive health report here.

Seize The Opportunity

- Discover the full array of 4621 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5508

Yungshin Construction & DevelopmentLtd

Yungshin Construction & Development Co.,Ltd.

Outstanding track record with excellent balance sheet and pays a dividend.