- Taiwan

- /

- Semiconductors

- /

- TWSE:6515

Three Elite Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

In a week marked by cautious commentary from the Federal Reserve and political uncertainty in the U.S., global markets have experienced notable volatility, with major indices seeing declines amid concerns over interest rate paths and economic stability. As investors navigate these turbulent waters, companies with strong growth potential and significant insider ownership may offer a compelling proposition, as high insider stakes can often indicate confidence in a company's long-term prospects despite broader market challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Medley (TSE:4480) | 34% | 31.7% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

Let's explore several standout options from the results in the screener.

Xi'an Manareco New MaterialsLtd (SHSE:688550)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xi'an Manareco New Materials Co., Ltd specializes in the production and sale of liquid crystal materials, OLED materials, and drug intermediates, with a market cap of CN¥5.41 billion.

Operations: The company's revenue primarily comes from its specialty chemicals segment, totaling CN¥1.37 billion.

Insider Ownership: 13%

Xi'an Manareco New Materials Ltd demonstrates strong growth potential with its revenue forecast to rise by 23.9% annually, surpassing the broader CN market's 13.7%. Earnings are expected to grow significantly at 25.04% per year, although slightly below the market average of 25.5%. Recent earnings showed a substantial increase in net income to CNY 185.3 million. Despite trading at a significant discount to estimated fair value, insider trading activity has been minimal recently, and dividends remain unstable.

- Take a closer look at Xi'an Manareco New MaterialsLtd's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of Xi'an Manareco New MaterialsLtd shares in the market.

China Railway Prefabricated Construction (SZSE:300374)

Simply Wall St Growth Rating: ★★★★★☆

Overview: China Railway Prefabricated Construction Co., Ltd. operates in the construction industry, focusing on prefabricated building solutions, with a market cap of CN¥4.74 billion.

Operations: Unfortunately, the provided Business operations text does not include specific revenue segment information for China Railway Prefabricated Construction Co., Ltd.

Insider Ownership: 24.9%

China Railway Prefabricated Construction shows promising growth potential, with revenue expected to increase by 23.3% annually, outpacing the broader CN market's 13.7%. The company is projected to become profitable within three years, indicating above-average market growth in profitability. Recent earnings revealed a reduction in net loss to CNY 66.89 million from CNY 85.69 million a year ago, although share price volatility remains high over the past three months and insider trading activity is minimal.

- Navigate through the intricacies of China Railway Prefabricated Construction with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that China Railway Prefabricated Construction is priced higher than what may be justified by its financials.

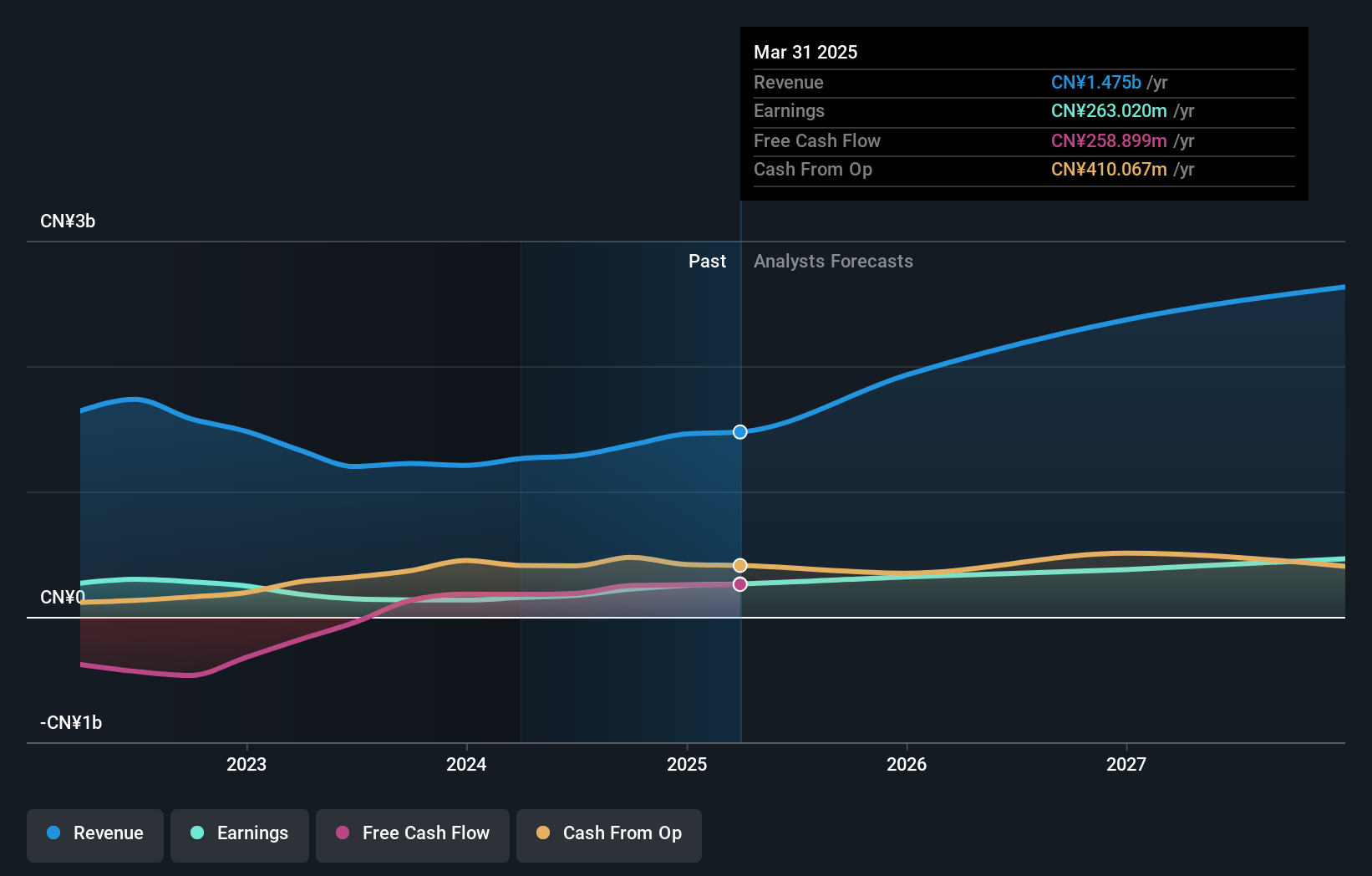

WinWay Technology (TWSE:6515)

Simply Wall St Growth Rating: ★★★★★★

Overview: WinWay Technology Co., Ltd. designs, processes, and sells optoelectronic product test fixtures and integrated circuit test interfaces across various regions including Taiwan, the Americas, China, Asia, Europe, and Canada with a market cap of NT$37.47 billion.

Operations: The company's revenue primarily comes from the manufacture and sales of photoelectric product testing tools, amounting to NT$4.93 billion.

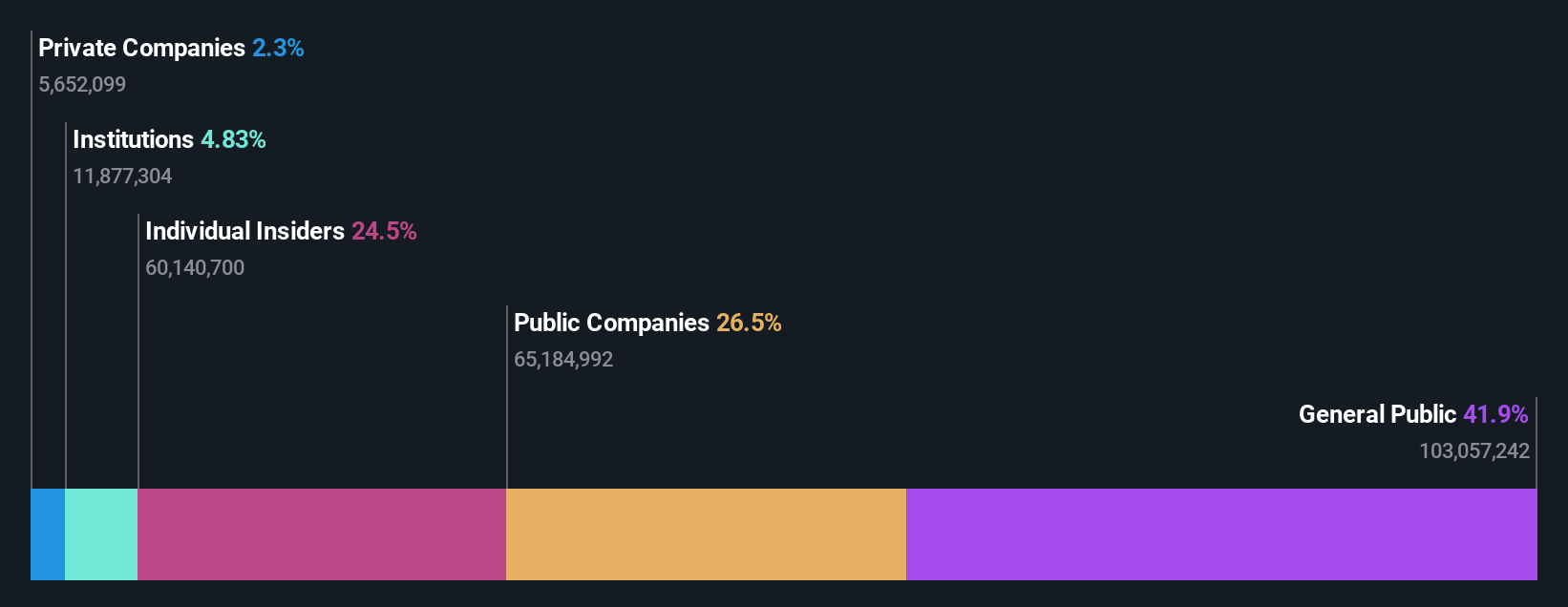

Insider Ownership: 22.7%

WinWay Technology is poised for significant growth, with earnings projected to rise by 28.15% annually, surpassing the TW market's growth rate. Recent financial results show a substantial increase in net income and sales compared to the previous year, indicating robust performance. Despite high share price volatility, WinWay trades significantly below its estimated fair value. The company is expanding its presence in Southeast Asia with a new Malaysian subsidiary, enhancing regional services and engineering capabilities.

- Click here to discover the nuances of WinWay Technology with our detailed analytical future growth report.

- According our valuation report, there's an indication that WinWay Technology's share price might be on the cheaper side.

Key Takeaways

- Click here to access our complete index of 1514 Fast Growing Companies With High Insider Ownership.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if WinWay Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6515

WinWay Technology

Designs, processes, and sells optoelectronic product test fixtures, integrated circuit test interfaces, and fixtures and their components in Taiwan, the Americas, China, Asia, Europe, and Canada.

Exceptional growth potential with excellent balance sheet.