- Japan

- /

- Entertainment

- /

- TSE:7458

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism marked by the Federal Reserve's recent rate cuts and ongoing political uncertainties, investors are keenly observing the impacts on major indices. Amidst these fluctuations, dividend stocks remain an attractive option for those seeking stability and income in their portfolios. A good dividend stock typically offers a reliable yield and has strong fundamentals that can withstand market volatility, making them particularly appealing in today's economic climate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.52% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.02% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.72% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1958 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

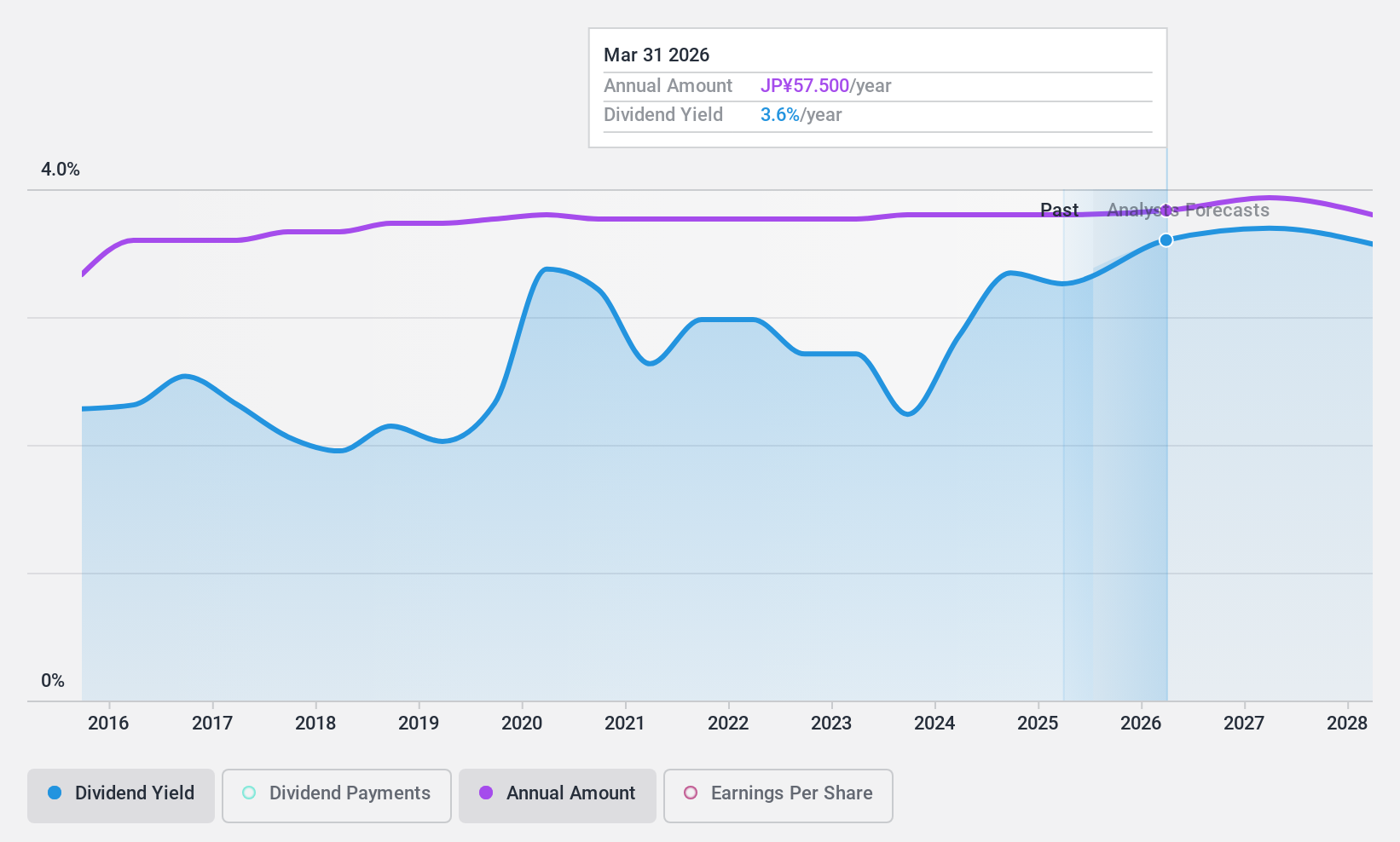

Daiichikosho (TSE:7458)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daiichikosho Co., Ltd. specializes in the sale and rental of commercial karaoke systems in Japan, with a market cap of ¥195.99 billion.

Operations: Daiichikosho Co., Ltd.'s revenue is primarily derived from its Commercial Karaoke segment, which generates ¥61.39 billion, and its Karaoke and Restaurant Business, contributing ¥65.87 billion, with additional income from Music Soft amounting to ¥6.34 billion.

Dividend Yield: 3.1%

Daiichikosho offers a stable dividend history with consistent payments over the past decade, but its 3.05% yield is below the top tier in Japan. Despite a low payout ratio of 38.9%, dividends are not covered by free cash flow, raising sustainability concerns. Recent buybacks totaling ¥4 billion may indicate management's confidence, yet earnings are forecast to decline by 3.3% annually over three years, potentially impacting future dividends and financial health.

- Click here to discover the nuances of Daiichikosho with our detailed analytical dividend report.

- Our valuation report unveils the possibility Daiichikosho's shares may be trading at a discount.

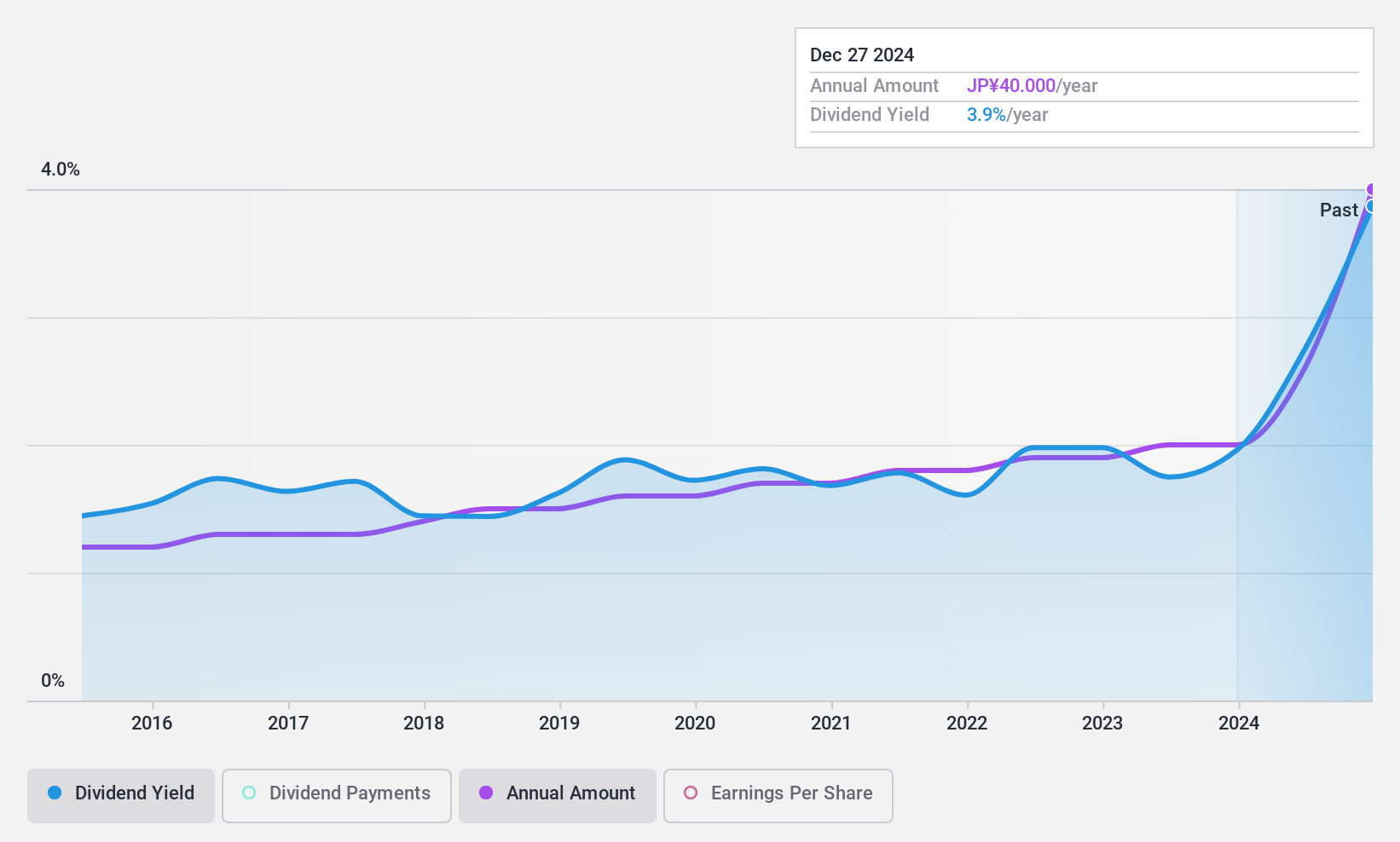

Shizuoka Gas (TSE:9543)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Shizuoka Gas Co., Ltd. produces, supplies, and sells city gas in Japan with a market cap of ¥77.82 billion.

Operations: Shizuoka Gas Co., Ltd. generates revenue through the production, supply, and sale of city gas in Japan.

Dividend Yield: 3.9%

Shizuoka Gas has maintained stable and reliable dividend payments over the past decade, with a current yield of 3.87%, placing it in the top 25% of Japanese dividend payers. The company's dividends are well-covered by earnings, reflected in a low payout ratio of 28.9%, and supported by cash flows with a cash payout ratio of 52%. Recent guidance revised profit expectations to ¥6.82 billion for year-end 2024, indicating potential stability in future dividends despite lower profit margins compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Shizuoka Gas.

- Our expertly prepared valuation report Shizuoka Gas implies its share price may be lower than expected.

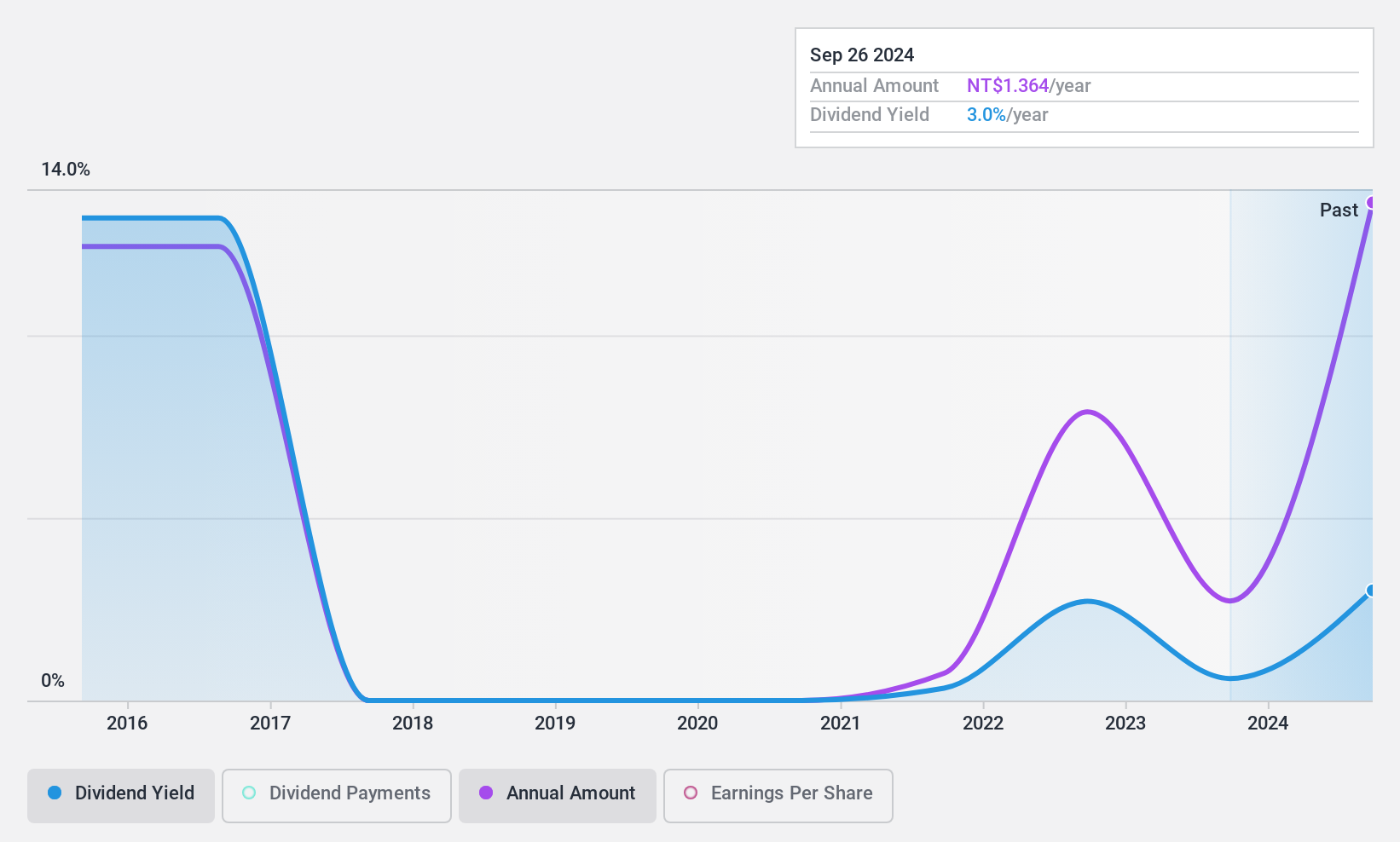

Run Long Construction (TWSE:1808)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Run Long Construction Co., Ltd. is involved in the construction, sale, and leasing of residential and commercial buildings in Taiwan, with a market cap of NT$37.85 billion.

Operations: Run Long Construction Co., Ltd. generates revenue primarily from its Construction Division, contributing NT$4.47 billion, and its Construction Industry Department, which adds NT$14.75 billion.

Dividend Yield: 3.6%

Run Long Construction's dividend yield of 3.57% is below the top 25% in Taiwan, and its payments have been volatile over the past decade. However, dividends are well-covered by earnings and cash flows with payout ratios of 35.2% and 36.8%, respectively. Recent financial performance shows significant declines in revenue and net income, raising concerns about future dividend sustainability despite low payout ratios. The resignation of an independent director may also impact governance stability.

- Click to explore a detailed breakdown of our findings in Run Long Construction's dividend report.

- Our valuation report here indicates Run Long Construction may be overvalued.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1955 more companies for you to explore.Click here to unveil our expertly curated list of 1958 Top Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7458

Daiichikosho

Engages in the sale and rental of commercial karaoke systems in Japan.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives