- Taiwan

- /

- Electrical

- /

- TWSE:1612

3 Top Dividend Stocks Offering Up To 7.8% Yield

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets experienced notable volatility, with major indexes like the Nasdaq Composite and S&P MidCap 400 reaching highs before retreating. Amid these fluctuations, investors often turn to dividend stocks for their potential to provide stable income streams even when market conditions are uncertain. In this context, a good dividend stock is typically characterized by a strong track record of consistent payouts and the ability to maintain or grow dividends despite economic headwinds.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.87% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.92% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.69% | ★★★★★★ |

| Globeride (TSE:7990) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.16% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.39% | ★★★★★★ |

| Innotech (TSE:9880) | 4.75% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.11% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

Click here to see the full list of 1928 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

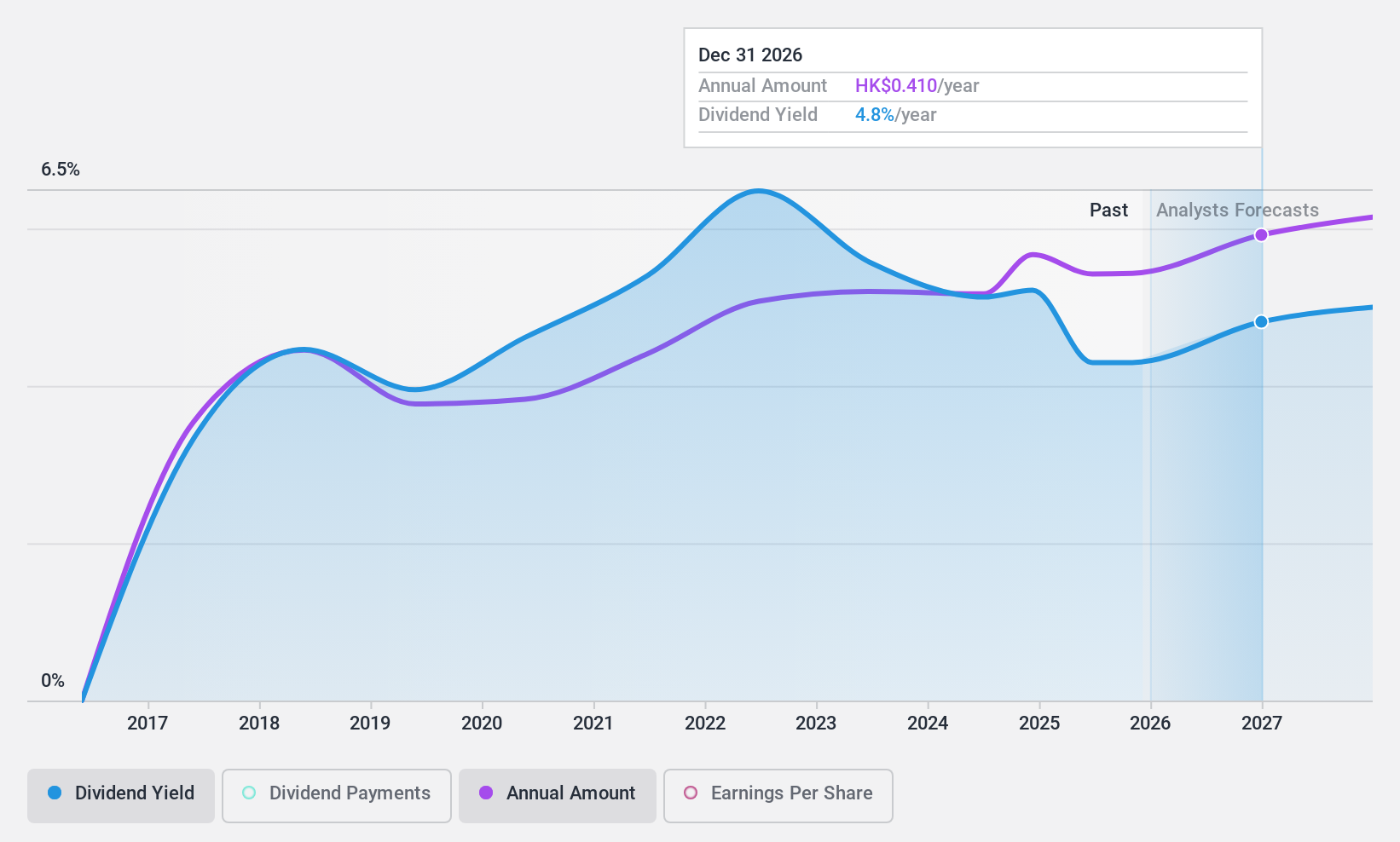

China CITIC Bank (SEHK:998)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China CITIC Bank Corporation Limited offers a range of banking products and services both in the People’s Republic of China and internationally, with a market cap of HK$364.53 billion.

Operations: China CITIC Bank Corporation Limited generates its revenue through various segments, including corporate banking (CN¥125.67 billion), personal banking (CN¥85.34 billion), and treasury business (CN¥47.89 billion).

Dividend Yield: 7.8%

China CITIC Bank's dividend payments, though currently covered by earnings with a 41.8% payout ratio, have been unreliable and volatile over the past decade. Despite this instability, the bank announced an interim dividend of RMB 1.847 per 10 shares for H1 2024. Recent earnings show slight growth in net income to CNY 51.83 billion for the nine months ending September 2024, suggesting some resilience in its financial performance amidst fluctuating dividends.

- Click to explore a detailed breakdown of our findings in China CITIC Bank's dividend report.

- Our expertly prepared valuation report China CITIC Bank implies its share price may be lower than expected.

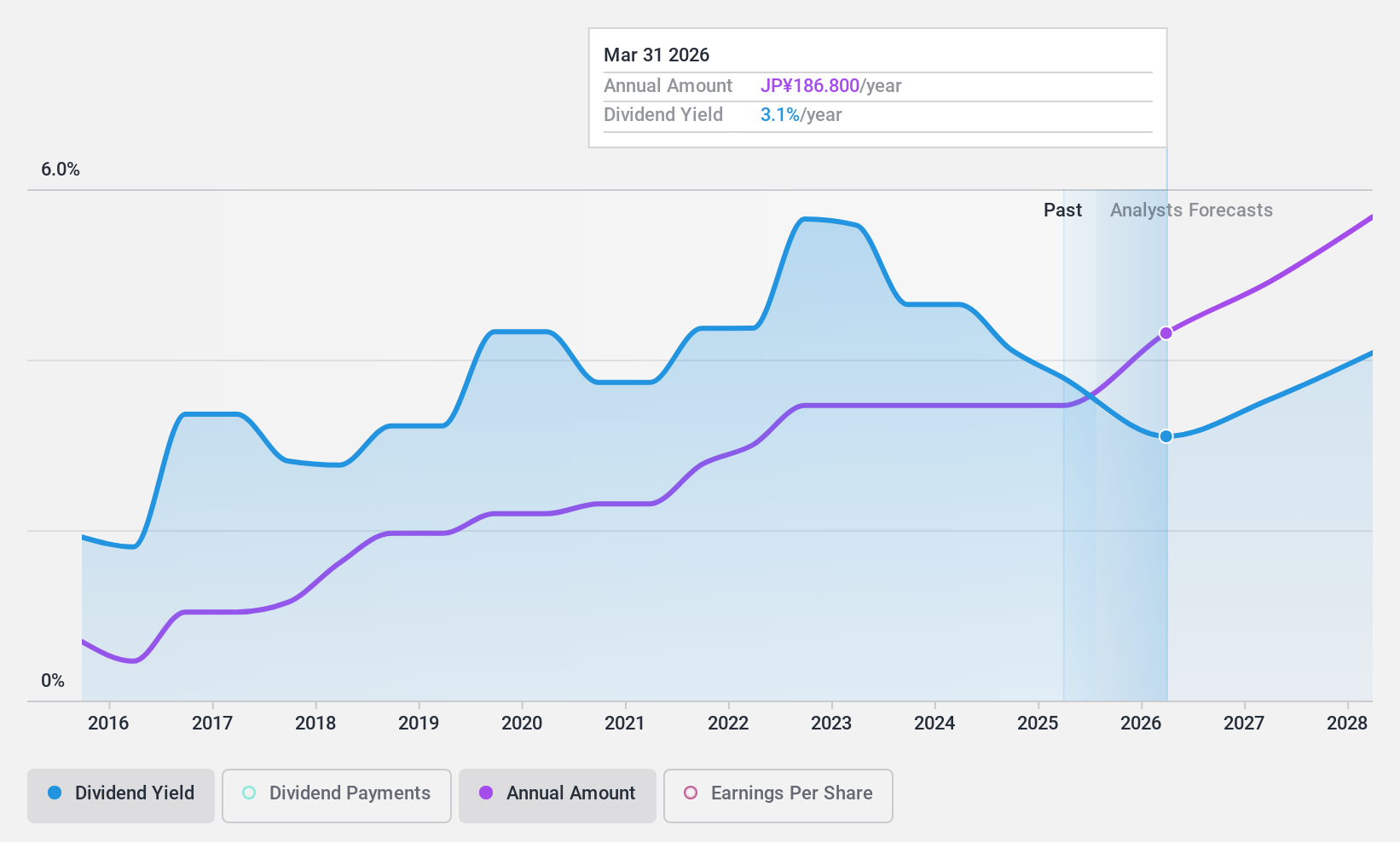

SBI Holdings (TSE:8473)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SBI Holdings, Inc. operates in the online securities and investment sectors with a market capitalization of ¥1.09 trillion.

Operations: SBI Holdings, Inc. generates revenue through its Finance Service Segment (¥1.06 billion), Investment Segment (¥88.58 million), Crypto Asset Business (¥68.93 million), Next Generation Business (¥26.45 million), and Asset Management Business (¥31.97 million).

Dividend Yield: 4.2%

SBI Holdings' dividend payments have been volatile and unreliable over the past decade, but its current payout ratio of 50.5% suggests dividends are covered by earnings. The cash payout ratio is low at 3.8%, indicating strong cash flow coverage. Recent strategic moves, such as launching an ETF focused on Saudi equities and expanding into AI semiconductors, demonstrate growth initiatives that could impact future financial stability and dividend sustainability positively.

- Delve into the full analysis dividend report here for a deeper understanding of SBI Holdings.

- The analysis detailed in our SBI Holdings valuation report hints at an deflated share price compared to its estimated value.

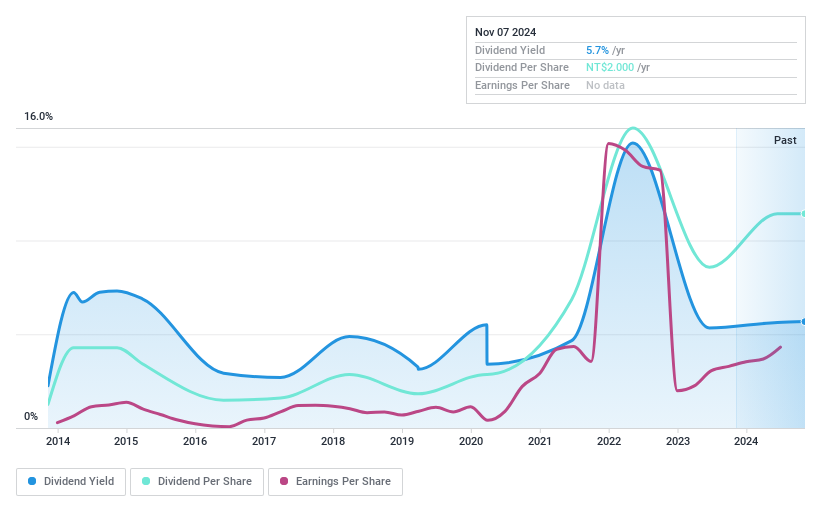

Hong Tai Electric Industrial (TWSE:1612)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hong Tai Electric Industrial Co., Ltd. engages in the manufacturing, processing, and sale of wires and cables, communication products and accessories, as well as copper foil substrates, with a market cap of NT$11.14 billion.

Operations: Hong Tai Electric Industrial Co., Ltd.'s revenue primarily comes from the manufacturing, processing, and sales of electric wires and cables, communication products, and accessories, totaling NT$6.62 billion.

Dividend Yield: 5.7%

Hong Tai Electric Industrial's dividend yield of 5.67% ranks in the top 25% of Taiwan's market, but its dividends have been volatile and unreliable over the past decade. The payout ratio stands at 82.5%, indicating coverage by earnings, yet a high cash payout ratio of 113.3% suggests insufficient cash flow support. Despite recent earnings growth of 40.9%, sustainability concerns persist due to inadequate free cash flow coverage for dividends.

- Click here and access our complete dividend analysis report to understand the dynamics of Hong Tai Electric Industrial.

- The analysis detailed in our Hong Tai Electric Industrial valuation report hints at an inflated share price compared to its estimated value.

Next Steps

- Explore the 1928 names from our Top Dividend Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Tai Electric Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1612

Hong Tai Electric Industrial

Manufactures, processes, and sells wires and cables, communication products and accessories, and copper foil substrates.

Flawless balance sheet with solid track record and pays a dividend.