- Taiwan

- /

- Electrical

- /

- TWSE:6115

I-Sheng Electric Wire & Cable Co., Ltd.'s (TPE:6115) Has Performed Well But Fundamentals Look Varied: Is There A Clear Direction For The Stock?

I-Sheng Electric Wire & Cable's (TPE:6115) stock up by 1.7% over the past three months. Given that the stock prices usually follow long-term business performance, we wonder if the company's mixed financials could have any adverse effect on its current price price movement In this article, we decided to focus on I-Sheng Electric Wire & Cable's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for I-Sheng Electric Wire & Cable

How Is ROE Calculated?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for I-Sheng Electric Wire & Cable is:

9.8% = NT$445m ÷ NT$4.5b (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.10 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

I-Sheng Electric Wire & Cable's Earnings Growth And 9.8% ROE

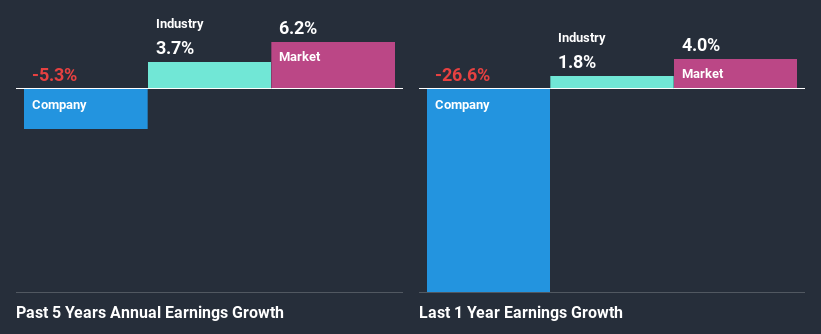

At first glance, I-Sheng Electric Wire & Cable seems to have a decent ROE. Especially when compared to the industry average of 7.9% the company's ROE looks pretty impressive. For this reason, I-Sheng Electric Wire & Cable's five year net income decline of 5.3% raises the question as to why the high ROE didn't translate into earnings growth. Based on this, we feel that there might be other reasons which haven't been discussed so far in this article that could be hampering the company's growth. These include low earnings retention or poor allocation of capital.

So, as a next step, we compared I-Sheng Electric Wire & Cable's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 3.7% in the same period.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about I-Sheng Electric Wire & Cable's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is I-Sheng Electric Wire & Cable Using Its Retained Earnings Effectively?

With a three-year median payout ratio as high as 111%,I-Sheng Electric Wire & Cable's shrinking earnings don't come as a surprise as the company is paying a dividend which is beyond its means. Paying a dividend beyond their means is usually not viable over the long term. Our risks dashboard should have the 3 risks we have identified for I-Sheng Electric Wire & Cable.

Moreover, I-Sheng Electric Wire & Cable has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth.

Conclusion

On the whole, we feel that the performance shown by I-Sheng Electric Wire & Cable can be open to many interpretations. While the company does have a high rate of return, its low earnings retention is probably what's hampering its earnings growth. So far, we've only made a quick discussion around the company's earnings growth. So it may be worth checking this free detailed graph of I-Sheng Electric Wire & Cable's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

If you decide to trade I-Sheng Electric Wire & Cable, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6115

I-Sheng Electric Wire & Cable

Manufactures, processes, and trades in power transmission lines, electronic signal lines, and network routes with connectors in Taiwan.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives