- Taiwan

- /

- Electrical

- /

- TWSE:6115

Are Dividend Investors Getting More Than They Bargained For With I-Sheng Electric Wire & Cable Co., Ltd.'s (TPE:6115) Dividend?

Dividend paying stocks like I-Sheng Electric Wire & Cable Co., Ltd. (TPE:6115) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. If you are hoping to live on the income from dividends, it's important to be a lot more stringent with your investments than the average punter.

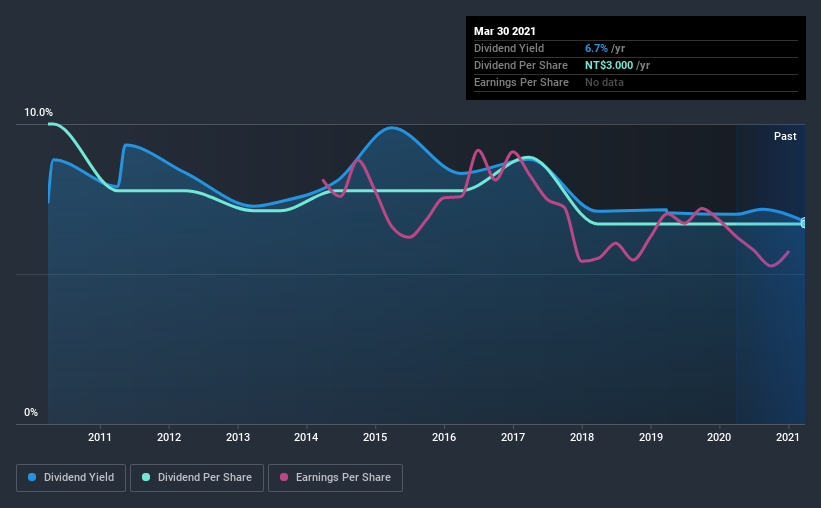

With I-Sheng Electric Wire & Cable yielding 6.7% and having paid a dividend for over 10 years, many investors likely find the company quite interesting. It would not be a surprise to discover that many investors buy it for the dividends. Before you buy any stock for its dividend however, you should always remember Warren Buffett's two rules: 1) Don't lose money, and 2) Remember rule #1. We'll run through some checks below to help with this.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. In the last year, I-Sheng Electric Wire & Cable paid out 116% of its profit as dividends. Unless there are extenuating circumstances, from the perspective of an investor who hopes to own the company for many years, a payout ratio of above 100% is definitely a concern.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. The company paid out 50% of its free cash flow, which is not bad per se, but does start to limit the amount of cash I-Sheng Electric Wire & Cable has available to meet other needs. It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and I-Sheng Electric Wire & Cable fortunately did generate enough cash to fund its dividend. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

With a strong net cash balance, I-Sheng Electric Wire & Cable investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on I-Sheng Electric Wire & Cable's financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. For the purpose of this article, we only scrutinise the last decade of I-Sheng Electric Wire & Cable's dividend payments. The dividend has been cut on at least one occasion historically. During the past 10-year period, the first annual payment was NT$4.5 in 2011, compared to NT$3.0 last year. This works out to be a decline of approximately 4.0% per year over that time. I-Sheng Electric Wire & Cable's dividend has been cut sharply at least once, so it hasn't fallen by 4.0% every year, but this is a decent approximation of the long term change.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. Over the past five years, it looks as though I-Sheng Electric Wire & Cable's EPS have declined at around 5.3% a year. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. We're not keen on the fact that I-Sheng Electric Wire & Cable paid out such a high percentage of its income, although its cashflow is in better shape. Earnings per share are down, and I-Sheng Electric Wire & Cable's dividend has been cut at least once in the past, which is disappointing. Using these criteria, I-Sheng Electric Wire & Cable looks quite suboptimal from a dividend investment perspective.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Case in point: We've spotted 2 warning signs for I-Sheng Electric Wire & Cable (of which 1 is concerning!) you should know about.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you’re looking to trade I-Sheng Electric Wire & Cable, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6115

I-Sheng Electric Wire & Cable

Manufactures, processes, and trades in power transmission lines, electronic signal lines, and network routes with connectors in Taiwan.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives