- Taiwan

- /

- Tech Hardware

- /

- TWSE:2451

Undiscovered Gems In Asia With Promising Potential April 2025

Reviewed by Simply Wall St

As global trade tensions intensify, Asian markets are navigating a complex landscape with significant implications for small-cap stocks. Despite the challenging environment, characterized by escalating tariffs and fluctuating consumer sentiment, there remain opportunities to uncover stocks with potential for growth. Identifying such gems often involves looking at companies that demonstrate resilience and adaptability in uncertain economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NOROO PAINT & COATINGS | 10.55% | 4.93% | 13.28% | ★★★★★★ |

| Ohashi Technica | NA | 4.58% | -14.04% | ★★★★★★ |

| Taisun Enterprise | 0.14% | 7.43% | 19.72% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Saison Technology | NA | 0.96% | -11.65% | ★★★★★★ |

| S.A.S. Dragon Holdings | 77.35% | 3.64% | 7.13% | ★★★★★☆ |

| Gallant Precision Machining | 47.82% | -1.17% | 4.66% | ★★★★★☆ |

| Uniplus Electronics | 27.23% | 44.40% | 74.50% | ★★★★★☆ |

| Bank of Iwate | 119.19% | 1.75% | 7.64% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 38.63% | 65.41% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Acter Group (TPEX:5536)

Simply Wall St Value Rating: ★★★★★☆

Overview: Acter Group Corporation Limited offers engineering services across Taiwan, Mainland China, and other Asian countries with a market capitalization of NT$42.68 billion.

Operations: Acter Group generates revenue primarily from engineering services in Taiwan (NT$14.99 billion), Mainland China (NT$12.68 billion), and other Asian countries (NT$3.36 billion). The company's operations result in a market capitalization of NT$42.68 billion, with adjustments and eliminations amounting to -NT$0.77 billion impacting the overall revenue figures.

Acter Group, a nimble player in the construction industry, has demonstrated impressive growth with earnings surging 42% over the past year, outpacing the industry's 9%. The company reported sales of TWD 29.72 billion for 2024, up from TWD 24.59 billion previously. Its price-to-earnings ratio stands at a favorable 16x compared to the Taiwan market's average of nearly 18x. With revenue expected to grow annually by about 12%, Acter seems poised for continued expansion. Notably, it declared cash dividends totaling TWD 1.24 billion for late 2024, reflecting robust financial health and shareholder returns.

- Take a closer look at Acter Group's potential here in our health report.

Evaluate Acter Group's historical performance by accessing our past performance report.

Transcend Information (TWSE:2451)

Simply Wall St Value Rating: ★★★★★★

Overview: Transcend Information, Inc. is involved in the manufacturing, processing, and selling of computer software and hardware, peripheral equipment, and other computer components across Taiwan and globally with a market cap of NT$41.65 billion.

Operations: Revenue from computer peripherals amounts to NT$10.08 billion, highlighting a significant segment of the company's income.

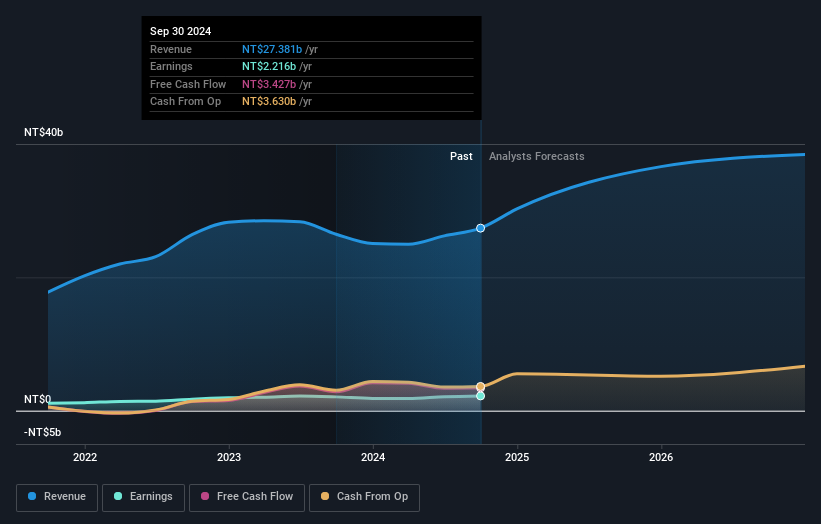

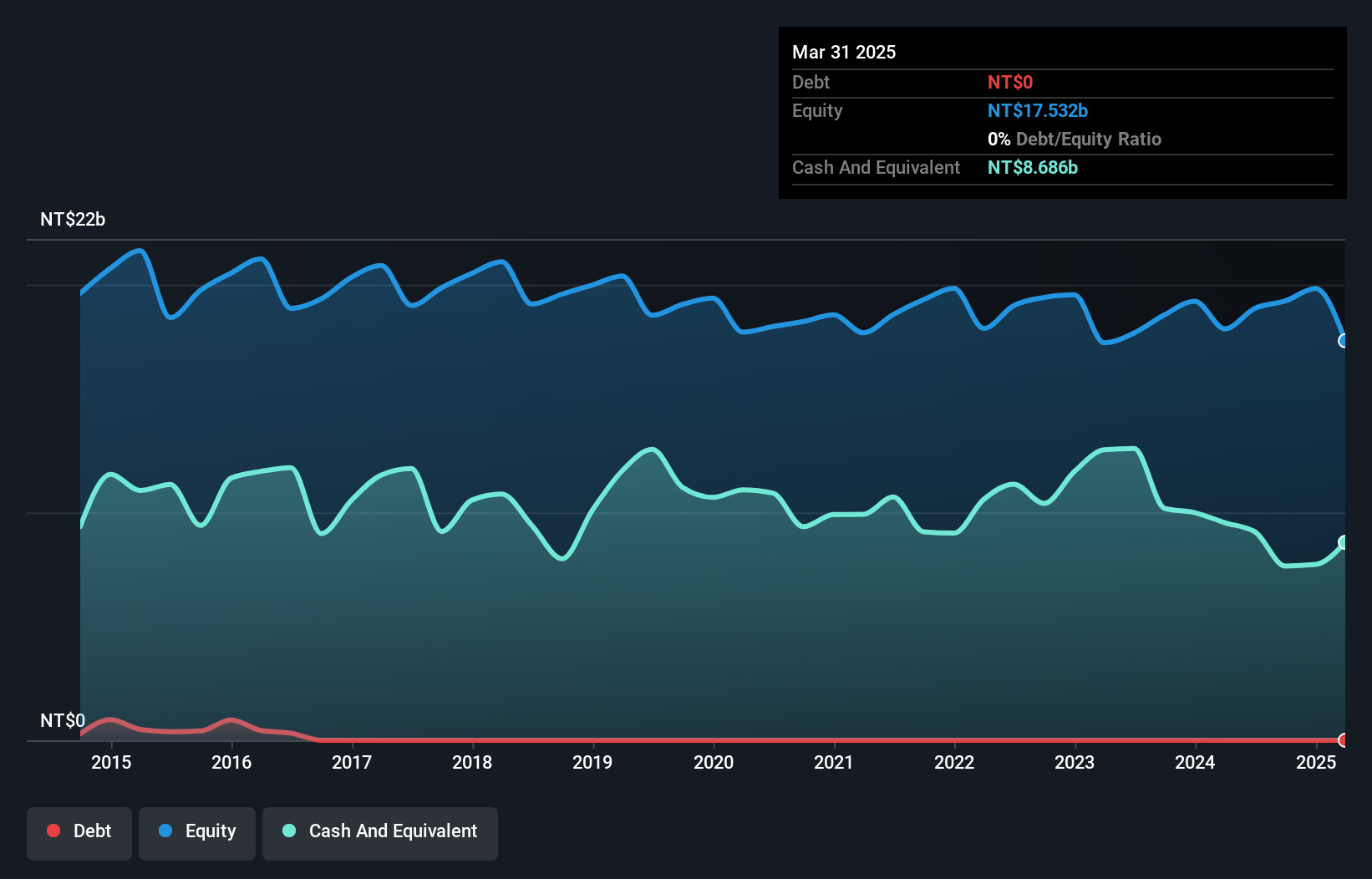

Transcend Information, a tech company with no debt, has demonstrated steady financial health over the past five years. Its earnings have grown 7.8% annually, though last year's growth of 16.6% slightly trailed the tech industry's 17.1%. The firm reported TWD 10 billion in sales for 2024, down from TWD 10.5 billion in the prior year; however, net income rose to TWD 2.31 billion from TWD 1.98 billion previously, reflecting improved profitability with basic earnings per share at TWD 5.39 up from TWD 4.63 last year and a proposed dividend distribution totaling over TWD 2.62 billion highlights shareholder returns focus amidst evolving market conditions.

- Get an in-depth perspective on Transcend Information's performance by reading our health report here.

Gain insights into Transcend Information's past trends and performance with our Past report.

FuSheng Precision (TWSE:6670)

Simply Wall St Value Rating: ★★★★★★

Overview: FuSheng Precision Co., Ltd. operates in the golf and sports equipment sectors across Japan, the United States, and internationally, with a market cap of NT$43.32 billion.

Operations: FuSheng Precision generates revenue primarily from its Golf Division, contributing NT$24.43 billion, and its Sports Assembly Division, adding NT$2.60 billion.

FuSheng Precision has shown impressive financial performance with earnings growing 57.9% over the past year, outpacing the Leisure industry’s 23.6%. The company reported sales of TWD 28.37 billion, up from TWD 24.38 billion last year, and net income rose to TWD 3.80 billion from TWD 2.40 billion previously. Basic earnings per share jumped to TWD 28.17 from TWD 18.18 a year ago, reflecting strong operational efficiency and profitability improvements likely driven by effective cost management and strategic initiatives in their operations or product offerings that could have bolstered revenue streams significantly over this period.

- Click here and access our complete health analysis report to understand the dynamics of FuSheng Precision.

Understand FuSheng Precision's track record by examining our Past report.

Seize The Opportunity

- Explore the 2628 names from our Asian Undiscovered Gems With Strong Fundamentals screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Transcend Information, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Transcend Information might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2451

Transcend Information

Engages in manufacturing, processing, and selling computer software and hardware, peripheral equipment, and other computer components in Taiwan, rest of Asia, the United States, Europe, and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives