As global markets show signs of resilience with U.S. indexes approaching record highs and broad-based gains across sectors, investors are keenly observing the economic landscape shaped by strong labor market data and stabilizing mortgage rates. In this context, identifying stocks that might be priced below their estimated value becomes crucial, as these opportunities can potentially offer a favorable entry point for investors looking to capitalize on market inefficiencies amidst ongoing geopolitical uncertainties and economic shifts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.44 | CN¥18.82 | 49.8% |

| HangzhouS MedTech (SHSE:688581) | CN¥62.11 | CN¥124.15 | 50% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.08 | US$99.93 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK172.40 | SEK344.27 | 49.9% |

| Insyde Software (TPEX:6231) | NT$463.00 | NT$923.49 | 49.9% |

| Power Root Berhad (KLSE:PWROOT) | MYR1.46 | MYR2.92 | 50% |

| EnomotoLtd (TSE:6928) | ¥1470.00 | ¥2936.12 | 49.9% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.86 | 49.9% |

| DUG Technology (ASX:DUG) | A$1.705 | A$3.40 | 49.8% |

| Audinate Group (ASX:AD8) | A$8.79 | A$17.54 | 49.9% |

Let's explore several standout options from the results in the screener.

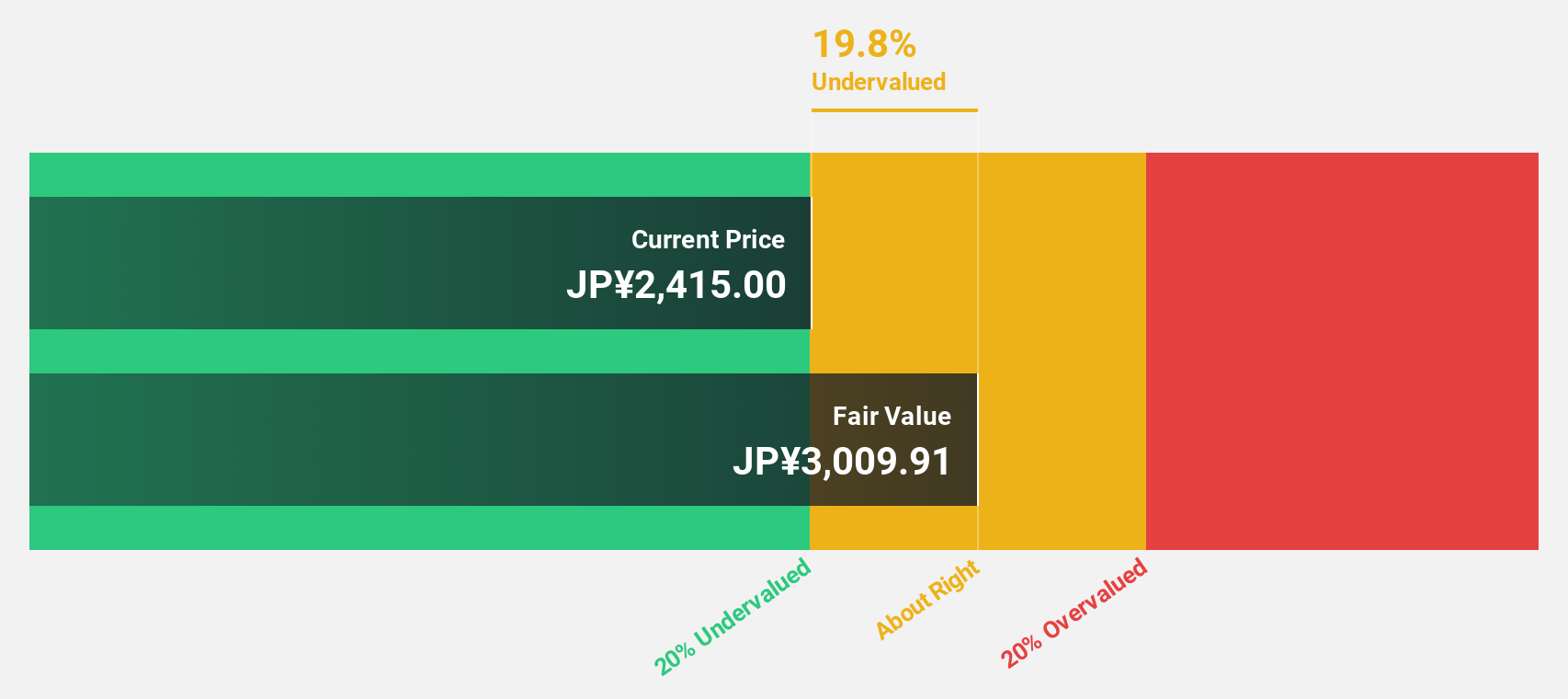

Shiseido Company (TSE:4911)

Overview: Shiseido Company, Limited is involved in the production and sale of cosmetics both in Japan and internationally, with a market cap of ¥1.15 trillion.

Operations: The company's revenue segments include the Japan Business at ¥281.33 billion, China Business at ¥247.68 billion, EMEA Business at ¥133.36 billion, Americas Business at ¥122.24 billion, Travel Retail Business at ¥110.26 billion, and Asia-Pacific Business at ¥77.51 billion.

Estimated Discount To Fair Value: 27.9%

Shiseido Company is trading significantly below its estimated fair value, suggesting it may be undervalued based on cash flows. Despite a low profit margin of 0.2%, earnings are forecast to grow significantly at 44.3% annually, outpacing the Japanese market's growth rate. However, the dividend yield of 2.09% is not well covered by earnings or free cash flows, and recent executive changes aim to enhance governance effectiveness as part of their strategic initiatives.

- Upon reviewing our latest growth report, Shiseido Company's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Shiseido Company.

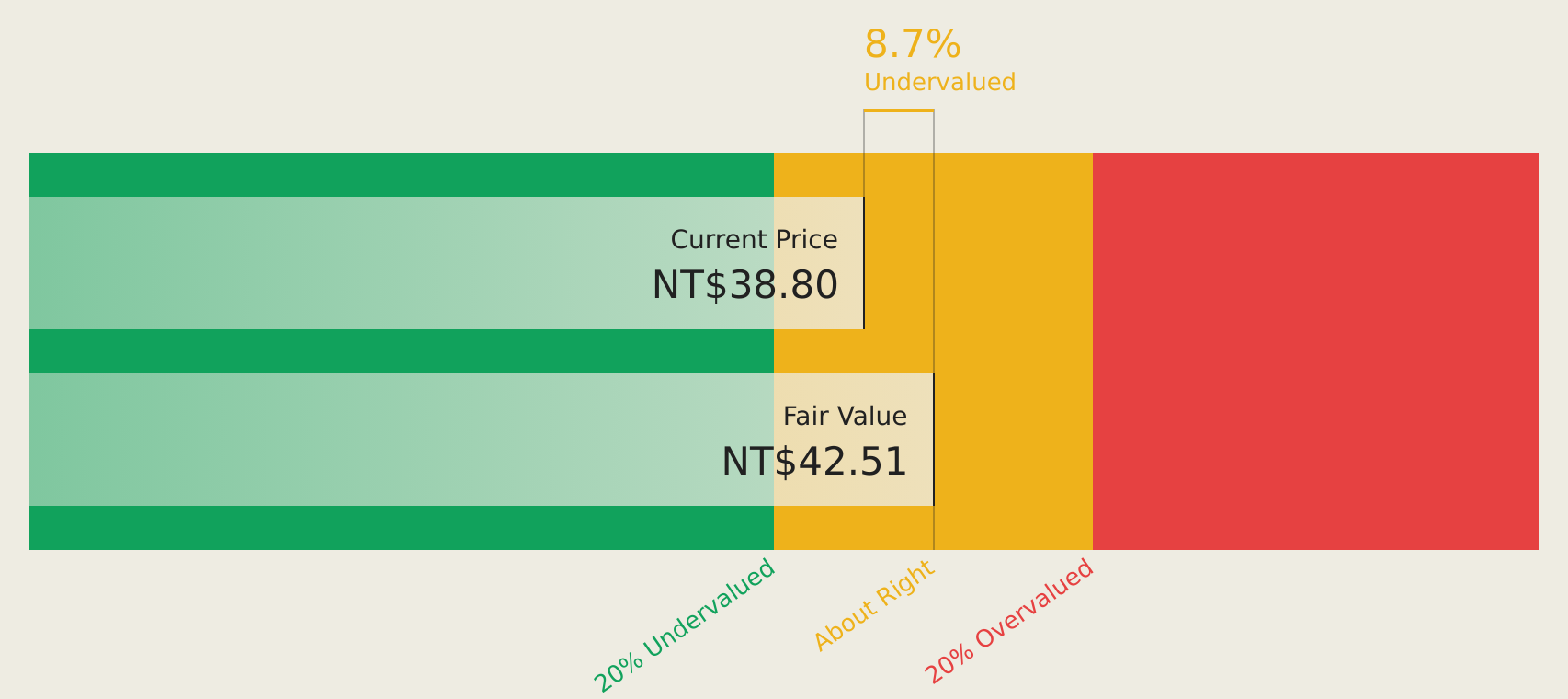

Shanghai Commercial & Savings Bank (TWSE:5876)

Overview: The Shanghai Commercial & Savings Bank, Ltd. operates as a financial institution providing banking services and has a market cap of NT$192.07 billion.

Operations: The bank generates revenue primarily through its banking segment, which amounts to NT$32.41 billion.

Estimated Discount To Fair Value: 15.7%

Shanghai Commercial & Savings Bank is trading at 15.7% below its estimated fair value, indicating potential undervaluation based on cash flows. Despite a decline in Q3 net income to TWD 4.75 billion, earnings are expected to grow significantly at 21.7% annually, surpassing the Taiwan market's growth rate. The bank offers a high dividend yield of 4.55%, though recent earnings per share have slightly decreased compared to last year’s figures.

- Our growth report here indicates Shanghai Commercial & Savings Bank may be poised for an improving outlook.

- Click here to discover the nuances of Shanghai Commercial & Savings Bank with our detailed financial health report.

adidas (XTRA:ADS)

Overview: adidas AG, along with its subsidiaries, is engaged in designing, developing, producing, and marketing athletic and sports lifestyle products across various regions including Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific, and Latin America; it has a market cap of approximately €39.42 billion.

Operations: The company's revenue segments include Greater China at €3.34 billion, Latin America at €2.44 billion, and North America at €4.95 billion.

Estimated Discount To Fair Value: 12.2%

adidas is trading 12.2% below its estimated fair value of €251.4, suggesting potential undervaluation based on cash flows. Recent Q3 results showed strong performance with net income rising to €443 million from €259 million a year ago, and earnings per share increasing significantly. While revenue growth is forecasted at 8.4% annually, slower than 20%, earnings are expected to grow significantly at 38.1% per year, outpacing the German market's growth rate.

- According our earnings growth report, there's an indication that adidas might be ready to expand.

- Click to explore a detailed breakdown of our findings in adidas' balance sheet health report.

Where To Now?

- Click through to start exploring the rest of the 917 Undervalued Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific, and Latin America.

High growth potential with excellent balance sheet.