- Taiwan

- /

- Communications

- /

- TPEX:6245

3 Dividend Stocks To Consider With Up To 6% Yield

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding incoming U.S. administration policies and inflationary pressures have led to a mixed performance across major indices, with sectors like financials and energy seeing gains while healthcare faces challenges. Amidst this backdrop, dividend stocks can offer a measure of stability through regular income streams, making them an attractive option for investors looking to navigate volatile markets with potential yields of up to 6%.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.37% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.58% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.95% | ★★★★★★ |

Click here to see the full list of 1957 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Lanner Electronics (TPEX:6245)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lanner Electronics Inc., along with its subsidiaries, manufactures and sells Internet and communication equipment globally, including in the United States, Europe, China, Israel, and Canada; it has a market cap of NT$13.19 billion.

Operations: Lanner Electronics Inc. generates revenue through the manufacturing and sale of Internet and communication equipment across various regions, including the United States, Europe, China, Israel, Canada, and other international markets.

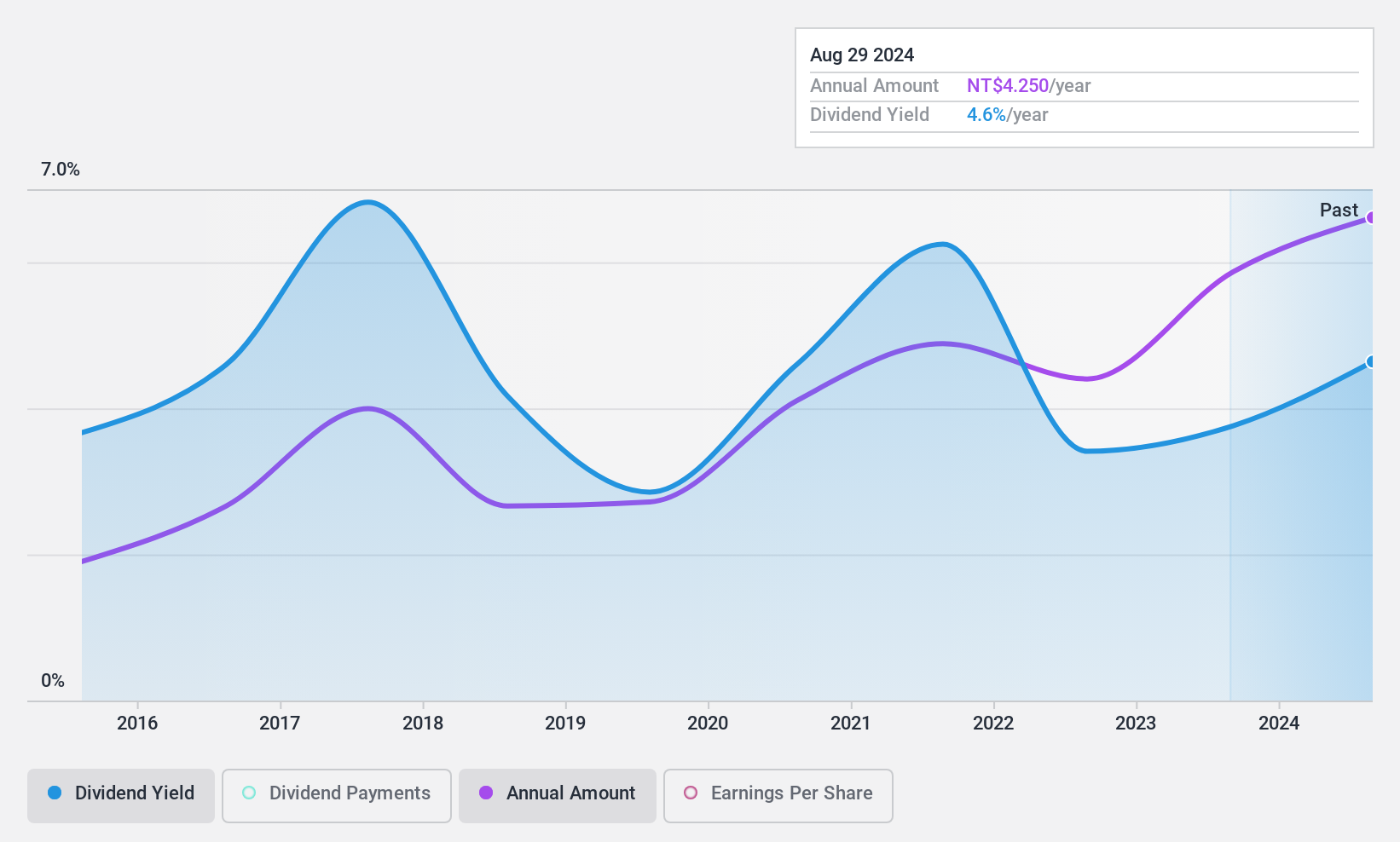

Dividend Yield: 4.6%

Lanner Electronics offers a dividend yield of 4.64%, placing it among the top 25% of dividend payers in Taiwan, but its dividends have been volatile and unreliable over the past decade. The company's payout ratio stands at 74.4%, indicating dividends are covered by earnings, yet high cash payout ratio (98.5%) suggests poor coverage by cash flows. Recent earnings showed stable sales growth but declining net income and diluted EPS, reflecting potential challenges in sustaining future payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of Lanner Electronics.

- Upon reviewing our latest valuation report, Lanner Electronics' share price might be too optimistic.

J Trust (TSE:8508)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: J Trust Co., Ltd. offers a range of financial services in Japan and has a market cap of ¥58.42 billion.

Operations: J Trust Co., Ltd.'s revenue is primarily derived from its South Korea and Mongolia Financial Business at ¥48.13 billion, Southeast Asia Financial Business at ¥44.03 billion, Japan Financial Business at ¥15.33 billion, Real Estate Business at ¥18.38 billion, and Investment Business at ¥55 million.

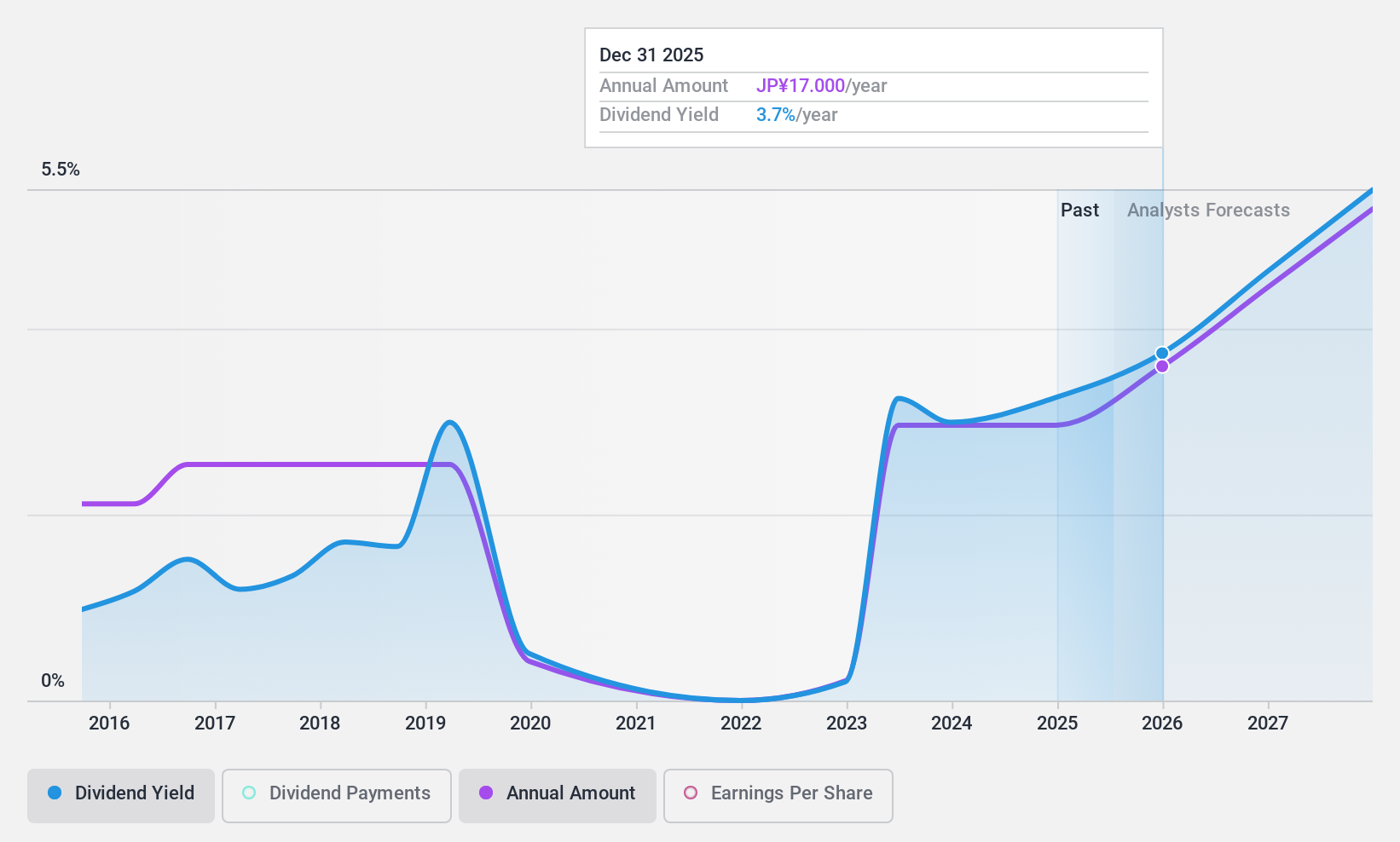

Dividend Yield: 3.2%

J Trust's dividend yield of 3.23% is below the top 25% in Japan, and its dividends have been volatile over the past decade. Despite this, a payout ratio of 53.4% indicates coverage by earnings, while a low cash payout ratio of 9.8% shows strong cash flow support. Recent buyback activity involved repurchasing shares worth ¥1,779.57 million, potentially enhancing shareholder value but not directly impacting dividend stability or growth prospects.

- Navigate through the intricacies of J Trust with our comprehensive dividend report here.

- Our valuation report unveils the possibility J Trust's shares may be trading at a premium.

King's Town Bank (TWSE:2809)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: King's Town Bank Co., Ltd., along with its subsidiaries, offers a range of banking products and services in Taiwan and has a market cap of NT$54.67 billion.

Operations: King's Town Bank Co., Ltd. generates revenue primarily from Branch Sales, amounting to NT$7.65 billion, and the Financial Market segment, contributing NT$1.94 billion.

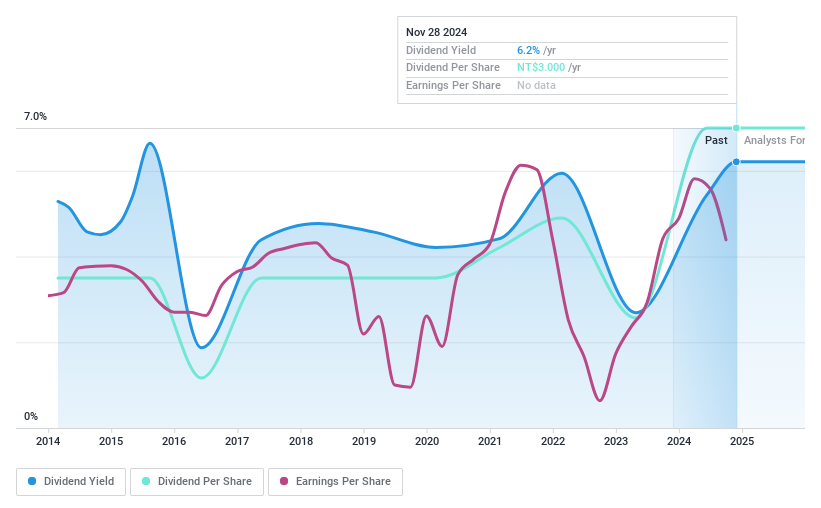

Dividend Yield: 6.1%

King's Town Bank's dividend yield of 6.08% ranks in the top 25% of Taiwan's market, yet its dividends have been volatile over the last decade, experiencing significant annual drops. Despite trading at a discount to estimated fair value and having a reasonable payout ratio of 59.8%, the bank's dividend track record remains unstable and unreliable. Recent earnings reports show decreasing net income, which could impact future dividend sustainability and growth potential.

- Click here to discover the nuances of King's Town Bank with our detailed analytical dividend report.

- The analysis detailed in our King's Town Bank valuation report hints at an deflated share price compared to its estimated value.

Taking Advantage

- Access the full spectrum of 1957 Top Dividend Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6245

Lanner Electronics

Manufactures and sells Internet and communication equipment in the United States, Europe, China, Israel, Canada, and internationally.

Flawless balance sheet average dividend payer.