- Taiwan

- /

- Entertainment

- /

- TPEX:3293

3 Growth Companies With High Insider Ownership Growing Earnings Up To 84%

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, with U.S. stocks adjusting to potential policy shifts and interest rate expectations, investors are keenly observing how these changes might impact corporate earnings across various sectors. In this environment, growth companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those closest to the business in its future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Global Tax Free (KOSDAQ:A204620) | 19.9% | 78.4% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

Underneath we present a selection of stocks filtered out by our screen.

SungEel HiTech (KOSDAQ:A365340)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SungEel HiTech Co., Ltd. is a South Korean company specializing in secondary battery recycling, with a market cap of approximately ₩543.15 billion.

Operations: The company generates revenue primarily from its secondary battery raw material manufacturing segment, amounting to approximately ₩196.64 billion.

Insider Ownership: 38%

Earnings Growth Forecast: 78.7% p.a.

SungEel HiTech is expected to experience significant revenue growth, with forecasts indicating a 35.5% annual increase, outpacing the South Korean market's average. Earnings are projected to grow by 78.74% per year, and the company is anticipated to become profitable within three years, surpassing average market growth rates. However, its return on equity is forecasted to remain low at 4.9%, and operating cash flow does not adequately cover debt obligations.

- Delve into the full analysis future growth report here for a deeper understanding of SungEel HiTech.

- Our valuation report here indicates SungEel HiTech may be overvalued.

Zhejiang Zhongxin Fluoride MaterialsLtd (SZSE:002915)

Simply Wall St Growth Rating: ★★★★★☆

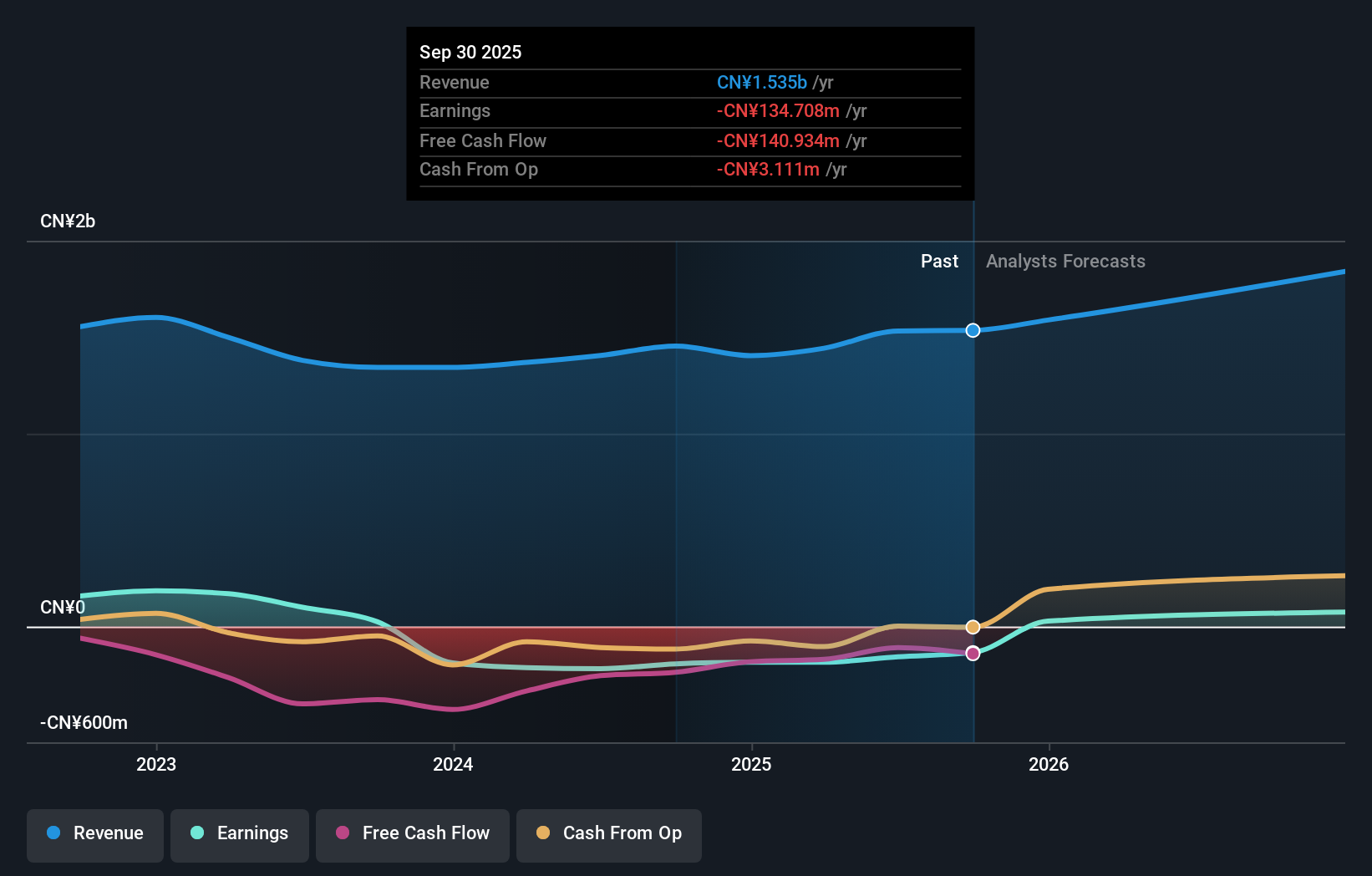

Overview: Zhejiang Zhongxin Fluoride Materials Co., Ltd engages in the research, development, production, and sale of fluorine fine chemicals in China with a market capitalization of CN¥4.05 billion.

Operations: The company generates revenue from the research, development, production, and sale of fluorine fine chemicals within China.

Insider Ownership: 20.7%

Earnings Growth Forecast: 84.8% p.a.

Zhejiang Zhongxin Fluoride Materials Ltd is poised for strong growth, with revenue expected to increase by 30.8% annually, outpacing the Chinese market's average. Earnings are projected to grow significantly at 84.75% per year, with profitability anticipated within three years. However, the company's return on equity is forecasted to be modest at 11.5%, and its debt coverage by operating cash flow remains inadequate. Recent earnings showed a net loss of CNY 42.99 million despite increased sales of CNY 1 billion.

- Click here and access our complete growth analysis report to understand the dynamics of Zhejiang Zhongxin Fluoride MaterialsLtd.

- Our comprehensive valuation report raises the possibility that Zhejiang Zhongxin Fluoride MaterialsLtd is priced higher than what may be justified by its financials.

International Games SystemLtd (TPEX:3293)

Simply Wall St Growth Rating: ★★★★★☆

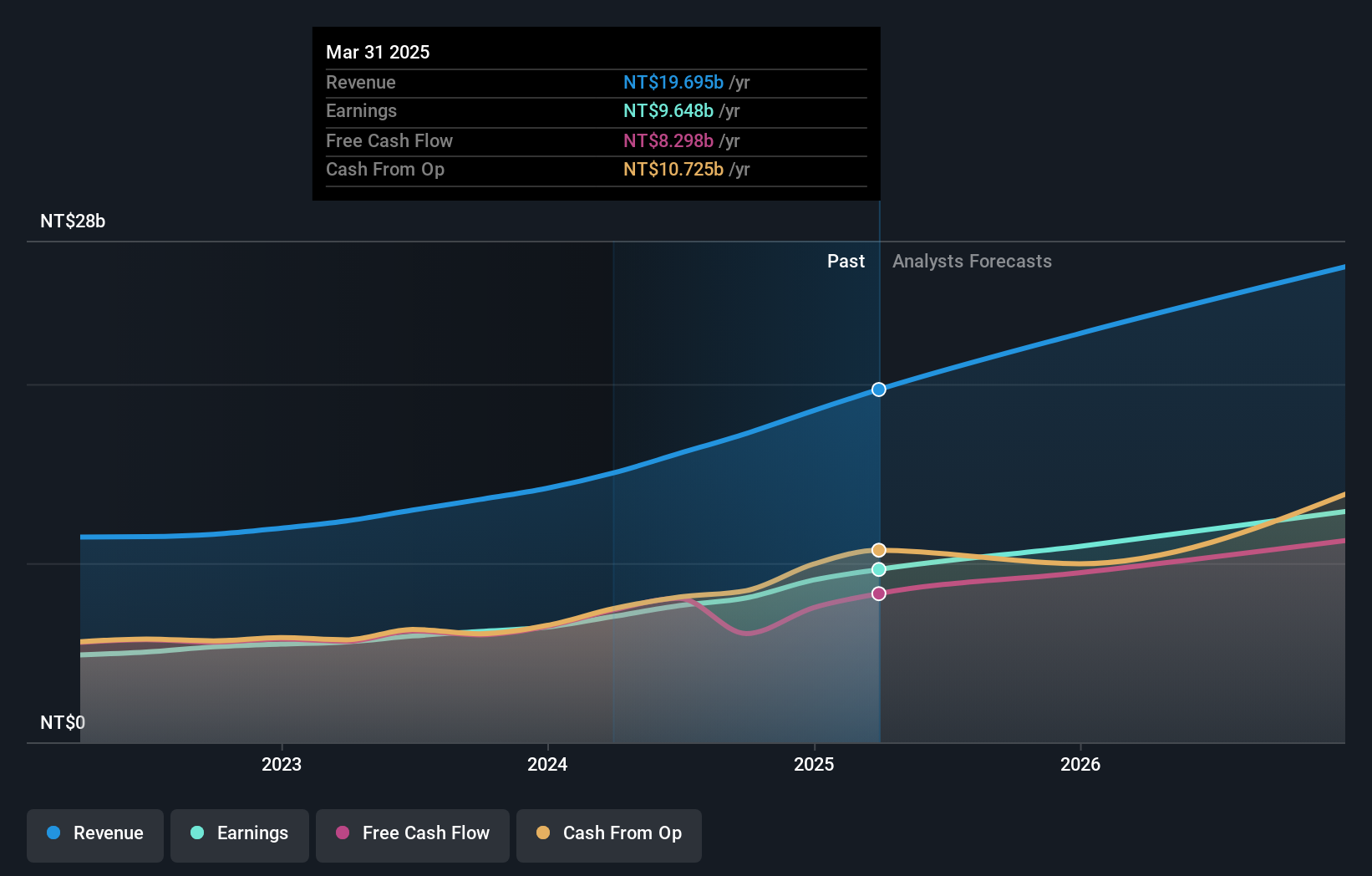

Overview: International Games System Co., Ltd. engages in the planning, design, research, development, manufacturing, marketing, servicing, and licensing of arcade, online, and mobile games primarily in Taiwan, the United Kingdom, and China with a market cap of NT$268.56 billion.

Operations: The company's revenue segments include arcade, online, and mobile games primarily across Taiwan, the United Kingdom, and China.

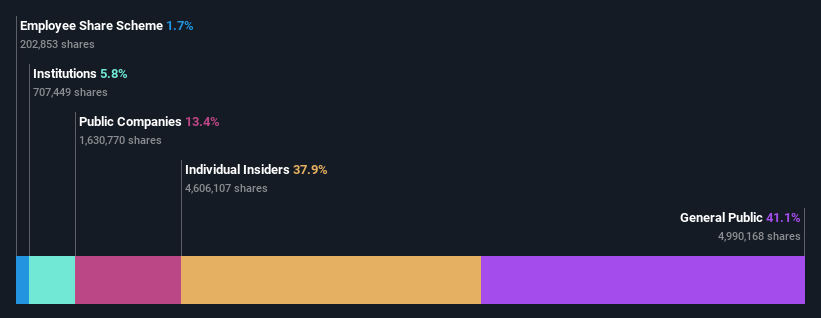

Insider Ownership: 13.6%

Earnings Growth Forecast: 21.2% p.a.

International Games System Ltd. demonstrates robust growth potential, with earnings projected to grow 21.21% annually, surpassing the TW market average of 19.5%. Revenue is also expected to increase by 20.9% per year, outpacing the market's 12.6% growth rate. Recent earnings reports reveal strong performance with third-quarter sales of TWD 4.70 billion and net income of TWD 2.17 billion, reflecting significant year-over-year improvements in both metrics and earnings per share figures.

- Navigate through the intricacies of International Games SystemLtd with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, International Games SystemLtd's share price might be too optimistic.

Next Steps

- Navigate through the entire inventory of 1535 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3293

International Games SystemLtd

Plans, designs, researches, develops, manufactures, markets, services, and licenses arcade, online, and mobile games principally in Taiwan, the United Kingdom, and China.

Flawless balance sheet with high growth potential and pays a dividend.