- Taiwan

- /

- Electrical

- /

- TWSE:6412

Undiscovered Gems on None to Watch This November 2024

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, small-cap stocks have experienced a mixed performance, with indices like the Russell 2000 reflecting a notable decline. Amidst this backdrop of fluctuating market sentiment and economic indicators, discerning investors may find opportunities in lesser-known stocks that exhibit strong fundamentals and potential for growth. Identifying such undiscovered gems often involves looking beyond current volatility to assess long-term value propositions that align with evolving market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | NA | 13.11% | 9.95% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Value Rating: ★★★★★★

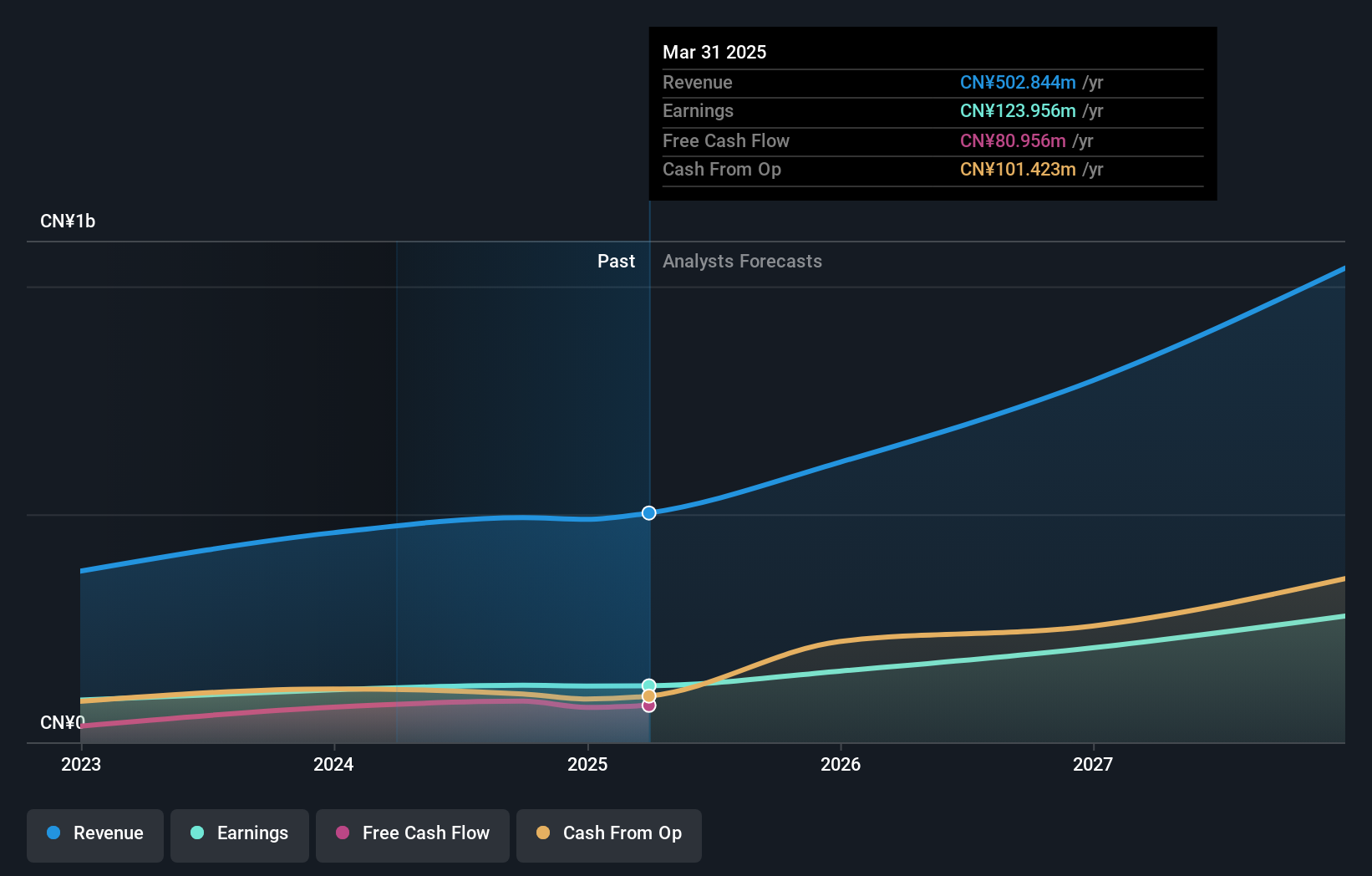

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. operates in the agricultural technology sector with a market capitalization of CN¥7.41 billion.

Operations: The company generates revenue primarily from its agricultural technology solutions. It incurs costs related to production and development, impacting its overall profitability. The net profit margin shows variability across reporting periods, indicating fluctuations in cost management and revenue efficiency.

Zhejiang Top Cloud-agri Technology, a small-cap player in the electronic industry, has been gaining traction with its recent IPO raising CNY 309.14 million. The company reported sales of CNY 335.51 million for the nine months ending September 2024, up from CNY 302.3 million the previous year, while net income rose to CNY 76.6 million from CNY 66.7 million. Basic earnings per share increased to CNY 1.2 from last year's CNY 1.04, indicating robust performance despite high illiquidity in shares and no debt burden since reducing a previous debt-to-equity ratio of 5:1 five years ago.

Daikoku Denki (TSE:6430)

Simply Wall St Value Rating: ★★★★★★

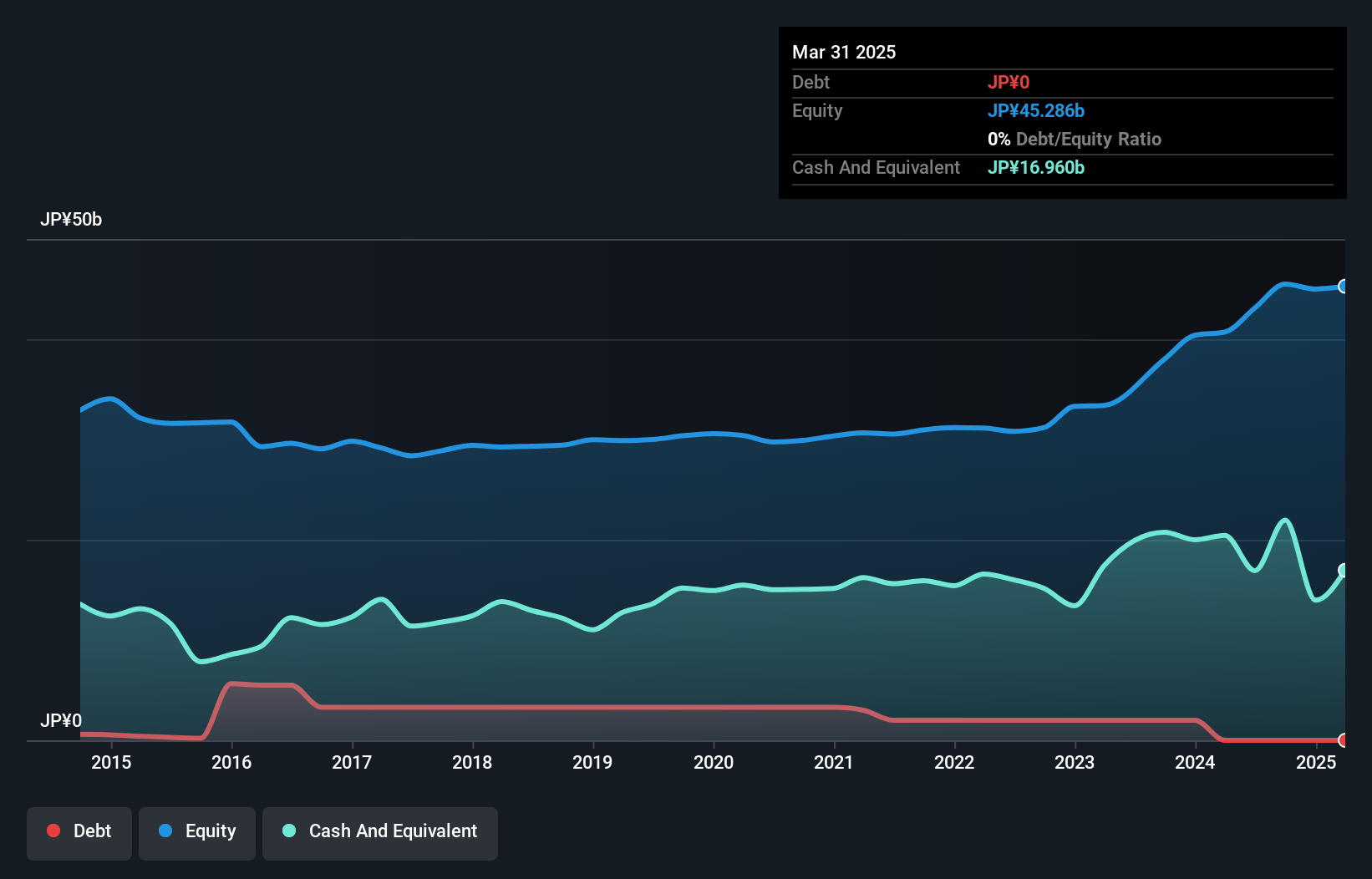

Overview: Daikoku Denki Co., Ltd. focuses on the development, production, and sale of computer and information system equipment for pachinko halls in Japan, with a market cap of ¥50.60 billion.

Operations: Daikoku Denki generates revenue primarily through the sale of computer and information system equipment tailored for pachinko halls in Japan. The company's financial performance is reflected in its market capitalization of ¥50.60 billion.

Daikoku Denki seems to be flying under the radar with its impressive financial health and growth trajectory. Trading at 63% below its estimated fair value, it offers a compelling valuation for investors. Over the past year, earnings have surged by 17%, outpacing the Leisure industry’s growth rate of 7%. This company stands debt-free now, a significant improvement from five years ago when its debt-to-equity ratio was 11%. With high-quality earnings and positive free cash flow, Daikoku Denki is poised for potential future success in its sector.

- Take a closer look at Daikoku Denki's potential here in our health report.

Understand Daikoku Denki's track record by examining our Past report.

Chicony Power Technology (TWSE:6412)

Simply Wall St Value Rating: ★★★★★★

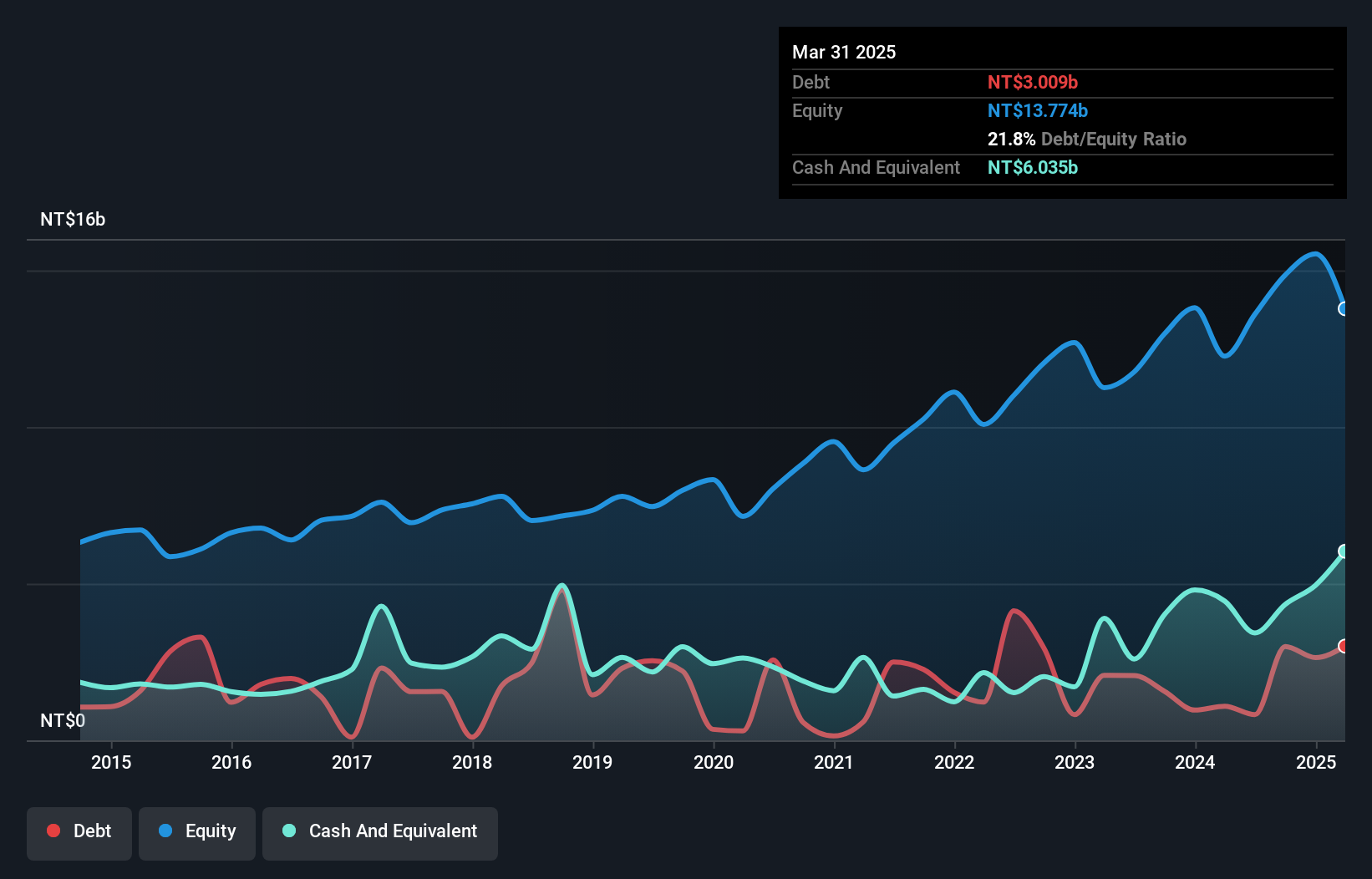

Overview: Chicony Power Technology Co., Ltd. is a Taiwanese company that develops, manufactures, and sells switching power supplies, electronic components, LED lighting modules, and smart building solutions with a market capitalization of NT$47.69 billion.

Operations: Chicony Power Technology generates revenue primarily from its operations in Asia and domestic markets, with NT$31.32 billion and NT$35.12 billion respectively. The company’s net profit margin is a key financial metric to consider when evaluating its performance.

Chicony Power Technology, a nimble player in the power solutions sector, showcases promising financial health with its earnings growing by 13% over the past year, outpacing the Electrical industry's 6.1%. The company reported TWD 10.36 billion in Q3 sales, up from TWD 9.74 billion last year, although net income dipped slightly to TWD 886.99 million from TWD 941.58 million. Its debt-to-equity ratio improved significantly over five years from 27.7% to 20.2%, and it trades at a favorable price-to-earnings ratio of 14x compared to the TW market's average of 21x, indicating good relative value and potential growth prospects ahead.

Key Takeaways

- Get an in-depth perspective on all 4627 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6412

Chicony Power Technology

Develops, manufactures, and sells switching power supplies, electronic components and LED lighting modules, and smart building solutions in Taiwan.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives