Yulon Nissan Motor's (TWSE:2227) earnings have declined over three years, contributing to shareholders 44% loss

Many investors define successful investing as beating the market average over the long term. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Yulon Nissan Motor Co., Ltd (TWSE:2227) shareholders have had that experience, with the share price dropping 50% in three years, versus a market return of about 52%. And over the last year the share price fell 33%, so we doubt many shareholders are delighted. But it's up 7.3% in the last week.

Although the past week has been more reassuring for shareholders, they're still in the red over the last three years, so let's see if the underlying business has been responsible for the decline.

See our latest analysis for Yulon Nissan Motor

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

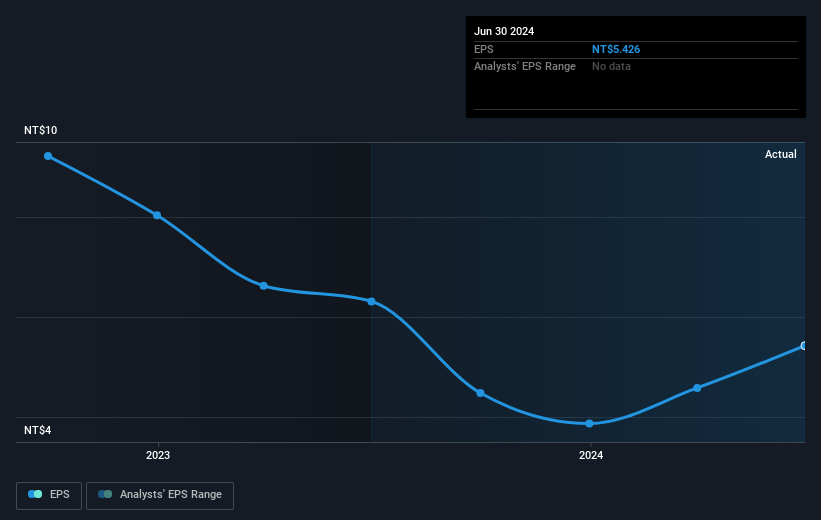

During the three years that the share price fell, Yulon Nissan Motor's earnings per share (EPS) dropped by 37% each year. This fall in the EPS is worse than the 21% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Yulon Nissan Motor the TSR over the last 3 years was -44%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in Yulon Nissan Motor had a tough year, with a total loss of 31% (including dividends), against a market gain of about 38%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Yulon Nissan Motor (of which 2 make us uncomfortable!) you should know about.

But note: Yulon Nissan Motor may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2227

Yulon Nissan Motor

Engages in the research, development, and sale of vehicles in Taiwan and internationally.

Flawless balance sheet unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives